- Home

- »

- Organic Chemicals

- »

-

Fermentation Chemicals Market Size & Share Report, 2030GVR Report cover

![Fermentation Chemicals Market Size, Share & Trends Report]()

Fermentation Chemicals Market Size, Share & Trends Analysis Report By Product (Alcohol, Enzymes, Organic Acid), By Application (Industrial, Food & Beverages, Plastic & Fibers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-336-2

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Fermentation Chemicals Market Trends

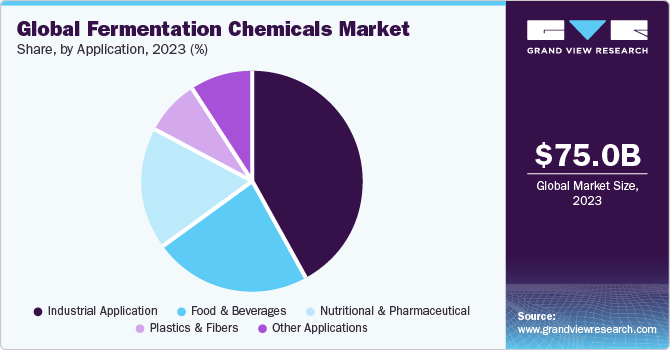

The global fermentation chemicals market size was estimated at USD 75.0 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2030. The growth is attributed to surging demand for bio-based feedstock especially in industrial biotechnology. The need for fermentation chemicals is further expected to increase due to the high demand for methanol and ethanol as well as to meet demands from different chemicals and industrial end-use applications. In addition, the rise over the foreseeable period will be significantly impacted by a similar, seemingly larger demand for various organic acids from fiber as well as plastic manufacturing makers.

In comparison to chemicals made from petroleum, fermentation chemicals are environment-friendly and less expensive. Owing to their ability to reduce the manufacturing time by accelerating reaction rates, these chemicals are predicted to see an increase in demand over the forecast period. They are primarily made from environmentally safe vegetable feedstocks like starch, sugar, and corn. In addition, when contrasted on a nominal scale index, the raw materials needed include sugar and starch, which are more affordable than petrochemicals.

Fermentation chemicals have been developed as a result of these above-mentioned factors. In order to reduce the level of reliance on petrochemicals, major chemical manufacturing companies have moved their attention to bio-based raw resources. The trend toward the creation of sustainable and biodegradable solvents is primarily driven by fluctuations in crude oil costs, as well as increased worries about carbon emissions and the degradability of petrochemical-based goods. These factors have created numerous growth opportunities in the near future.

The technique utilized to produce fermentation compounds is pricey and necessitates much research and development. In addition, the quality of the feedstocks is crucial for the synthesis of fermentation chemicals since high-quality feedstocks result in higher yields. This method is expensive and is still in the development phase for producing compounds from bio-based raw materials. Such factors are likely to restrain the growth opportunities of the product market in the coming years.

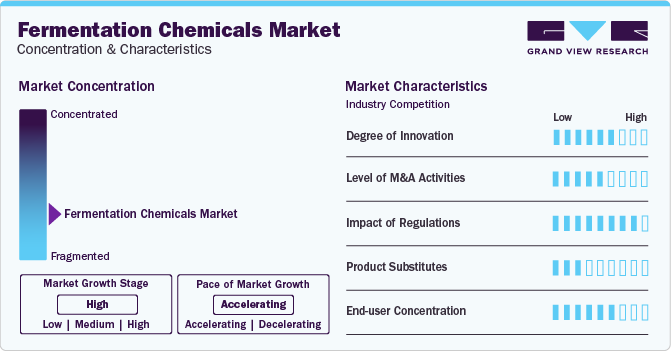

Market Concentration & Characteristics

The market is fragmented in nature, wherein leading players account for less than 20% of the market share. These key players have established their presence through extensive research and development, strong distribution networks, and strategic partnerships. Examples of major companies operating in this market include BASF SE; Cargill; Incorporated; Evonik Industries AG; DSM, and Novozymes.

Fermentation-derived ingredients, such as enzymes and flavors, are widely used to enhance the taste, texture, and nutritional value of food products. For instance, fermentation-derived enzymes are used in the production of cheese, bread, and alcoholic beverages, while fermentation-derived flavors are used in the formulation of various food products.

Increasing demand for sustainable and eco-friendly products. Consumers and industries are increasingly seeking alternatives to traditional chemical processes, leading to a growing interest in fermentation-based solutions. This demand is driving the development of new chemicals and applications in various industries, including food and beverages, pharmaceuticals, and plastics.

Regulations related to safety, quality, and environmental impact play a crucial role in shaping the market. For example, regulations promoting clean energy and reducing carbon emissions have led to the development of chemicals for biofuels and renewable energy sources. Compliance with these regulations is essential for companies operating in the market.

Product Insights

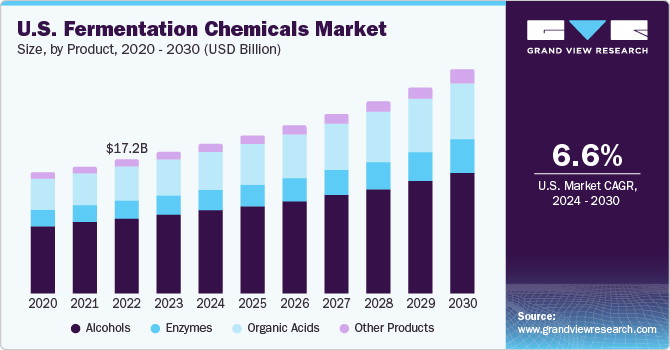

Alcohols dominated the market with a share of 56.0% in 2023. This is attributed to rising applications of the product in various end-use industries such as beverages, pharmaceuticals, and in industrial applications as a solvent. Carbohydrase, protease, lipases, cellulase, pectinase rennin, polymerases, nucleases, etc. are examples of enzymes. Proteins called enzymes serve as a catalyst in biological processes. Enzymes' primary purpose is to speed up reactions without changing their chemical makeup. They are extensively employed in industrial and chemical applications.

Acids having pKa values of 3 (carboxylic) or above are considered organic acids (phenolic). Itaconic acid, kojic acid, acetic acid, gluconic acid, 2-ketoglutaric acid, 5-ketoglutaric acid, -ketoglutaric acid, malic acid, propionic acid, fumaric acid, lactic acid, and citric acid are other categories for these. Modern technology has made it possible to produce organic acids on a large scale. Because they can stop bacteria from growing and extend a product's shelf life. Organic acids like fumaric acid, tartaric acid, and lactic acid are frequently employed as food preservatives.

Application Insights

Industrial applications dominated the market with a share of 41.6% in 2023.Its high share is attributable to increasing investments in biotechnology, R&D, and production from renewable raw materials. Formulation from lignocellulosic feedstock, however, has its own disadvantages, including low conversion and comparatively fewer applications of directly biosynthesized fermentation chemicals. This process necessitates the fermentation of carbohydrates.

Demand for food and drinks is anticipated to increase as the global population grows. This is expected to directly benefit the market. Dairy products like cheese, sour cream, yogurt, and kefir, food additives like flavors, alcoholic beverages like distilled spirits, beer, and wine, plant products like sauerkraut, bread, coffee, soy, sauce, and tofu, and fermented meat and fish, like salami and pepperoni, are among the food items that are traditionally produced through fermentation chemicals.

Globally expanding health concerns should be advantageous for the market for fermentation chemicals used in food and medicine. Fermentation techniques are used to create the majority of the goods used in the production of pharmaceuticals, including recombinant proteins. The fermentation of sugars obtained from yeast or bacteria also yields nutritional additions like vitamins and proteins.

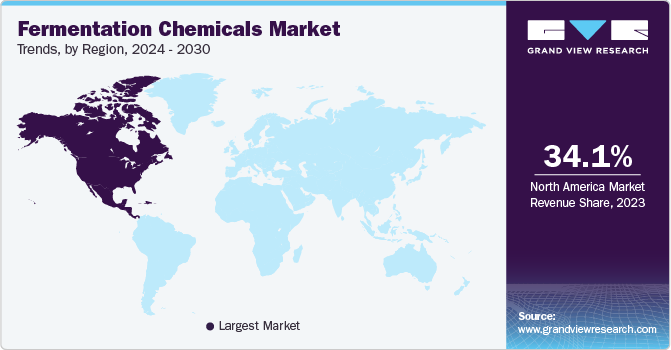

Regional Insights

North America dominated the market with a share of 34.1% in 2023. This is attributed to the rise in consumption of chemicals by numerous industries like pharmaceuticals, industrial, and food & beverages. In addition, the expanding pharmaceutical industry in countries such as the U.S., Mexico, and Canada is anticipated to surge the demand in North America.

Europe is run by major industrial economies such as the UK, Germany, France, Italy, and others. It is characterized by the presence of an increasing number of manufacturers and suppliers of food & beverage, cosmetics, and pharmaceutical products penetrating the regional ecosystem. The presence of major cosmetic manufacturing companies in the region is expected to drive the demand for fermentation chemicals.

Pharmaceutical, personal care & cosmetics, and food & beverage applications all have an impact on the demand for fermentation chemicals. The rising purchasing power parity, rising income levels, and expanding populations in nations like China and India have all contributed to the increased demand for the aforementioned goods. Additionally, a lot of industries are expected to see an increase in demand due to the quickly expanding number of food and beverage start-ups, particularly in India.

Key Fermentation Chemicals Company Insights

Due to the presence of numerous international corporations that are active in ongoing research and development, the market is quite competitive. Companies with a variety of products for each application market and their strong global brand presence, such as BASF SE, Novozymes, Cargill, Inc., and Evonik Industries AG, dominate the market. To maximize profit at the lowest possible investment, the bulk of these businesses have integrated their business activities throughout the value chain.

To obtain an advantage in the cutthroat market environment, international corporations are also concentrating on capacity increases, negotiating cooperation agreements with distributors, and implementing many other operational tactics.

Some of the key players operating in the market include:

-

BASF SE offers a wide range of fermentation chemicals, including enzymes, organic acids, and alcohol, catering to various industries such as food and beverages, pharmaceuticals, and plastics. BASF SE has collaborated with other companies to open precision fermentation facilities in Singapore, showcasing their commitment to expanding their presence in the market.

-

Evonik Industries AG offers a wide range of fermentation-based products, including enzymes, organic acids, and other specialty chemicals. Evonik Industries AG is known for its expertise in specialty chemicals and its commitment to sustainability.

AB Enzymes, Ajinomoto Co., Inc. and Ajinomoto Co., Inc. are some of the emerging market participants in the fermentation chemicals market.

-

AB Enzymes specializes in the production and supply of enzymes. The company offers a wide range of enzyme products used in various industries such as pharmaceuticals, food processing, and diagnostics. AB Enzymes utilizes different fermentation systems, including solid culture and submerged culture, to produce unique and diverse enzyme products.

-

Ajinomoto Co., Inc. is a global company that operates in various industries, including the production of fermentation chemicals. They offer a diverse range of products, including enzymes, organic acids, and other specialty chemicals. Ajinomoto's fermentation chemicals find applications in industries such as food and beverages, pharmaceuticals, and plastics.

Key Fermentation Chemicals Companies:

The following are the leading companies in the fermentation chemicals market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these fermentation chemicals companies are analyzed to map the supply network.

- BASF SE

- Novozymes

- DuPont Danisco

- DSM

- Amano Enzymes USA Co., Ltd.

- AB Enzymes

- Chr. Hansen Holding A/S

- Dow

- Evonik Industries AG

- Cargill, Incorporated

- Ajinomoto Co., Inc.

- ADM

Recent Developments

-

In October 2023, BASF SE announced the decision to build a new fermentation plant which would be employed to produce crop protection products in its Ludwigshafen site. The new facility will manufacture offering to improve the biological seed treatment and fungicide products.

-

In October 2023, ADM and Solugen announced that they will be producing plant based specialty chemicals including fermentation chemicals alongside the ADM’s corn-processing facility in Minnesota. The company plans to produce bio based building block molecules alongside specialty chemicals to cater to agriculture, cleaning, personal care and energy sectors.

Fermentation Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 79.28 billion

Revenue forecast in 2030

USD 120.89 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

BASF SE; Novozymes; DuPont Danisco; DSM; Amano Enzymes USA Co., Ltd.; AB Enzymes; Chr. Hansen Holding A/S; Dow; Evonik Industries AG; Cargill; Incorporated; Ajinomoto Co., Inc.; ADM

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Fermentation Chemicals Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fermentation chemicals market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Alcohols

-

Enzymes

-

Organic Acids

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial Application

-

Food & Beverages

-

Nutritional And Pharmaceutical

-

Plastics And Fibers

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

- Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fermentation chemicals market size was estimated at USD 75.0 billion in 2023 and is expected to reach USD 79.28 billion in 2024.

b. The global fermentation chemicals market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 120.89 billion by 2030

b. North America dominated the fermentation chemicals market with a share of 34.1% in 2023. This is attributable to expanding pharmaceutical industry in countries such as Mexico and the U.S. is expected to surge the demand for fermentation chemicals.

b. Some of the key players in the fermentation chemicals market include Novozymes, DSM, Dupont Danisco, Chr. Hansen Holding A/S, Evonik Industries AG

b. The factors driving the fermentation chemicals market include eco-friendly nature of the products and high growth in the end-use industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."