- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Ferro Manganese Market Size & Share Report, 2020-2027GVR Report cover

![Ferro Manganese Market Size, Share & Trends Report]()

Ferro Manganese Market Size, Share & Trends Analysis Report By Grade (High Carbon, Refined), By Application (Carbon Steel, Stainless Steel, Alloy Steel, Cast Iron), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-170-4

- Number of Pages: 115

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Advanced Materials

Report Overview

The global ferro manganese market size was valued at USD 14.2 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 4.0% from 2020 to 2027. The rising demand for the grade in stainless steel production is projected to aid market growth over the forecast period.

Demand for stainless steel from various industrial sectors observed steady growth over the past few years, which positively influenced the production dynamics. The use of ferro manganese to substitute nickel in stainless steel production has widely gained popularity around the globe. Thus, the market for ferro manganese is projected to be driven by a steady production of stainless steel over the forecast period.

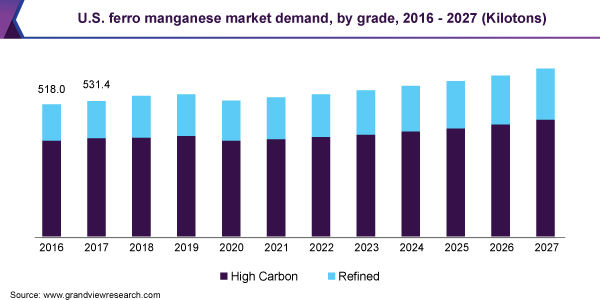

The U.S. is largely dependent on imports of ferro manganese and most of its commodity import takes place from South Africa, Australia, Norway, and South Korea. As per the stats released by the United States Geological Survey (USGS) in 2019, the overall import volume increased from nearly 229 kilotons in 2016 to approximately 427 kilotons in 2018. However, import volume declined in 2019 owing to the protectionist measures taken by the domestic federal government.

At the beginning of FY 2020, the dynamics of the domestic industry in the U.S. observed severe distress as the downstream demand from the steel industry started declining. As of July 2020, the domestic crude steel production decreased by nearly 29.4% year-on-year as compared to July 2019. The heightened volatility from the steel industry directly impacted the market growth during the first half of FY 2020.

Another key challenge for the market in the U.S. is the steel demand from key end-use sectors, such as construction and automotive. Automotive manufacturing has already been severely disrupted as major manufacturers of the country including Ford, General Motors, and Tesla halted their operations in March 2020.

Automotive operations resumed at full potential in July 2020. However, slumping sales of automotive vehicles are likely to cause immense strain on the production side of the business, thereby reflecting sluggish demand for steel grades. Until the steel demand revives, the demand for ferro manganese is projected to remain inactive in the U.S.

Grade Insights

The high carbon ferro manganese segment dominated the market and accounted for 70.2% share of the global volume in 2019. The supply side of this grade segment largely remained stable until 2018 and the global production volume reached nearly 4 million tons. However, by the second half of FY 2019, the supply curtailed owing to the stagnant demand from steel mills of China, which are among the primary consumers of the product. The demand reduced as the government of China initiated steel mills production restrictions for a cleaner sky in Beijing to celebrate the 70th founding anniversary on 1st October 2019.

The emergence of coronavirus at the beginning of FY 2020 directly impacted the operations of steel mills across the globe. Falling downstream demand for steel products from key industries, including construction and automotive, affected the price dynamics by the end of Q1 FY 2020. The demand slowdown, coupled with plunging prices, led to budget cuts by the key steel operators around the world.

In the current situation, the demand for high carbon grade is likely to increase, especially from Chinese mills, owing to its economical pricing as compared to its counterparts. Among the northern steel mills of China, many producers have reported a severe burden on their liquidity flow as the global demand for steel products continues to plunge. For instance, apparent consumption of steel across the globe is projected to reduce by nearly 6.4% as per the stats revealed by the World Steel Association.

Refined ferro manganese grade is projected to witness the highest growth over the forecast period. The current situation for the grade category looks dull due to the reduced demand from the steel industry. However, the situation is projected to rebound as the global economic system normalizes itself to these unprecedented times.

Application Insights

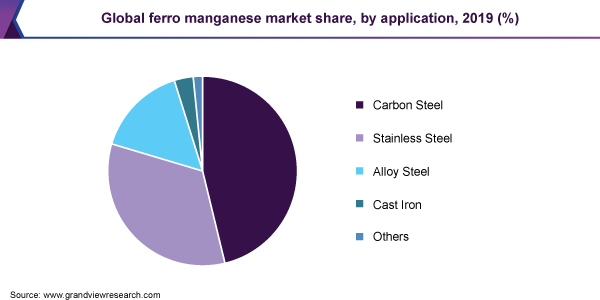

The carbon steel application segment led the market and accounted for more than 48.0% share of the global volume in 2019. The segment is projected to witness stagnant growth in the years to come owing to the falling downstream demand from the construction industry. The imposed lockdowns initiated across major economies of the globe pushed the construction output volume toward a negative trajectory over the first half of the FY 2020.

The stainless steel application segment is estimated to witness sturdy growth over the forecast period. The use of the commodity to substitute nickel in 200 series of stainless steel has gained wide prominence over the last few years. The stainless steel demand is projected to remain largely stable as compared to other steel types over the forecast period.

The cast iron application segment is estimated to witness the highest growth over the forecast period. The use of cast iron, especially in cookware of the hospitality industry, has gained wide popularity. Owing to the stable demand, the supply side of cast iron flourished, thereby positively augmenting the demand for ferro manganese.

Regional Insights

Asia Pacific dominated the market and accounted for over 51.0% share of the global revenue in 2019. China, which is the largest steel producer and consumer, is projected to remain a key market in the region over the forecast period. The emerging markets for ferro manganese in Asia Pacific are India, Vietnam, Malaysia, and Indonesia. These emerging markets, coupled with China, are projected to generate lucrative opportunities for the vendors of ferro manganese in the region.

However, the steel industry of Asia Pacific is projected to observe few production curtailments from Japan and South Korea over the coming years. JFE Corporation of Japan, which is among the prominent crude steel producers of the world, has already initiated the plans to reduce its production capacity by nearly 4 million tons. The strategy to reduce production capacity is largely due to the falling downstream demand for the commodity. These measures are projected to restrain market growth in Japan and South Korea.

Europe emerged as the second-largest regional market in 2019. The region is projected to witness stagnant growth in the future as the steel production capacity of the region continues to plummet and face heavy import challenges from China. The region is undergoing economical drought due to the turbulence created by the coronavirus pandemic. Many steel producers of the region have slowly reduced their operations as the automotive manufacturing plants halted their manufacturing operations by the beginning of Q2 in FY 2020.

North America is projected to exhibit a volume-based CAGR of 2.0% from 2020 to 2027. The region is undergoing severe economic disruptions, along with rising unemployment rates and increasing civil protest, especially in Mexico and the U.S. In addition, rising coronavirus cases in these countries are inflicting greater economic losses. These factors are projected to indirectly affect the market dynamics of the commodity.

The Middle East and Africa region is projected to witness slow growth as compared to its counterparts. The region’s steel industry is likely to witness immense pressure as the downstream demand from the construction sector takes a hit. The key construction markets of the region, including Gulf countries, are estimated to observe lower construction volume output in FY 2020. Moreover, plunging crude oil prices are anticipated to restrict investment opportunities in the Gulf region. These factors are likely to contribute to the restraining growth of the market in the region.

Key Companies & Market Share Insights

The industry participants are largely focused on devising strategies to tackle falling demand from the steel industry owing to the emergence of the COVID-19 pandemic. Many vendors across the European region reported a surge in demand in Q1 of FY 2020 due to the fear of disruption in supply. However, the scenario evolved as the lockdown measures came into place, with many steelmakers across the region reducing their production outputs. Owing to the reduced outputs, the pressure on ferro manganese vendors increased greatly, leading to a reduced margin and higher inventory.

Many vendors are diverting their attention toward Asia Pacific in an attempt to strengthen their position in the emerging markets, including Vietnam, Malaysia, and India. In addition, the steel industry of China is coming back to its normal level, which is projected to offer lucrative opportunities for the industry participants over the forecast period. Some of the prominent players in the ferromanganese market include:

-

Monet Group

-

Tata Steel

-

Gulf Manganese Corporation Limited

-

Vale

-

Eurasian Resources Group

-

Ferroglobe

-

China Minmetals Group Co., Ltd.

-

Eramet Group

-

South32

-

OM Holdings Ltd.

Ferro Manganese Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 13.7 billion

Revenue forecast in 2027

USD 19.4 billion

Growth Rate

CAGR of 4.0% from 2020 to 2027

Market demand in 2020

6,942.3 kilotons

Volume forecast in 2027

8,732.4 kilotons

Growth Rate

CAGR of 2.1% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; France; U.K.; China; India; Japan; Brazil

Key companies profiled

Monet Group; Tata Steel; Gulf Manganese Corporation Limited; Vale; Eurasian Resources Group; Ferroglobe

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global ferro manganese market report on the basis of grade, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

High Carbon Ferro Manganese

-

Refined Ferro Manganese

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Carbon Steel

-

Stainless Steel

-

Alloy Steel

-

Cast Iron

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global ferro manganese market size was estimated at USD 14,211.5 million in 2019 and is expected to reach USD 13,668.5 million in 2020.

b. The ferro manganese market is expected to grow at a compound annual growth rate of 4.0% from 2020 to 2027 to reach USD 19,438.2 million by 2027.

b. The high carbon grade segment dominated the ferro manganese market with a volume share of 70.2% in 2019, owing to its extensive use in the manufacturing of steel commodities.

b. Some of the key players operating in the ferro manganese market are Monet Group, Tata Steel, Gulf Manganese Corporation Limited, Vale, Eurasian Resources Group, Ferroglobe, China Minmetals Group Co., Ltd, Eramet Group, OM Holdings, and South32.

b. The key factors that are driving the ferro manganese market include growing grade demand from the stainless steel industry and the rising prominence of cast iron products in cookware.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."