- Home

- »

- Medical Devices

- »

-

Fertility Tourism Market Size & Share Report, 2022-2030GVR Report cover

![Fertility Tourism Market Size, Share & Trends Report]()

Fertility Tourism Market Size, Share & Trends Analysis Report By Age Group (18-24, 25-34, 34-44, 46-54), By Country (U.S., U.K., Spain, Czech Republic, Portugal, Thailand, India), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-969-7

- Number of Pages: 83

- Format: Electronic (PDF)

- Historical Range: 2016 - 2020

- Industry: Healthcare

Report Overview

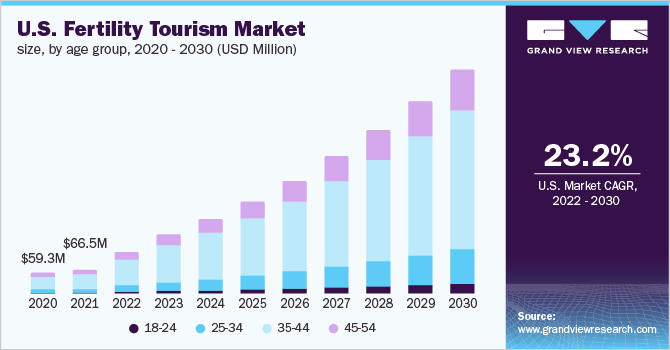

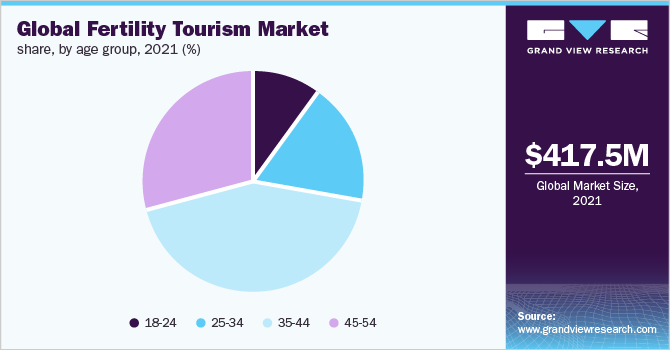

The global fertility tourism market was valued at USD 417.5 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 30.33% from 2022 to 2030. The market is expected to grow due to rising cases of infertility, an increasing trend of delayed pregnancy, and the rapid acceptance of medical tourism. In addition, advancements in assisted reproductive technologies coupled with cost savings and additional benefits to visitors such as improved healthcare, sophisticated devices, superior hospitality, and individualized care are propelling the market growth.

Rising reprotourism and the increasing cases of male and female infertility are the key factors driving the market growth. Infertility is one of the major health concerns faced by individuals globally. According to WHO, 8%-10% of couples globally suffer from infertility which is around 80 million couples worldwide. According to the American Pregnancy Association, male infertility accounts for 30% of infertility cases and contributes to around one-fifth of infertility cases. The average age of women and men getting married and having their first child is increasing. This trend has surged the number of women seeking treatment abroad.

The rising number and success rates of IVF procedures are fueling market growth. For instance, according to Human Fertilization and Embryology Authority (HFEA), the proportion of IVF cycles performed by patients over the age of 40 has more than doubled from 10% (689 cycles) in 1991 to 21% (14,761 cycles) in 2019. Countries such as Spain, U.K., Czech Republic, Turkey, and India have emerged as major destinations for IVF treatment. High IVF success rates are increasing preference for these countries in the international market. For instance, according to The National Association for Fertility Problems, Spain is a country where tourists prefer to have fertility procedures performed most frequently, accounting for almost 40% of fertility tourism in Europe.

Rising government and private investment in new clinics and fertility centers are contributing to the market expansion. For instance, in July 2022, Xytex Cryo International opened a new donor lab near Rutgers University in New Brunswick, NJ. Donors between 18 and 38 who meet Xytex donor guidelines can donate sperm there. Governments of countries such as Thailand and Malaysia are increasingly focusing on attracting foreign individuals by developing their healthcare infrastructure.

COVID-19 fertility tourism market impact: 17.0% decrease from 2019 to 2021

Pandemic Impact

Post COVID Outlook

The COVID-19 pandemic had a massive impact on the market, especially in the first half of 2020. The primary reasons for this drop were the imposition of travel restrictions and the global suspension of elective procedures.

The market is not expected to return to the pre-pandemic level till 2024. This is mainly due to foreigners avoiding traveling and the majority of countries closing their borders in 2021 as well.

According to the World Tourism Organization, (UNWTO), international tourism around the world declined by 22% in the first quarter of 2020, down 60% year-on-year, as the outbreak of COVID-19 affects international travel.

The opening of borders in 2022 and vaccination drives is likely to positively impact the market. For instance, the Malaysian government is reviving the industry with a few measures. Malaysia began receiving medical tourists from six nations in July 2021, including Japan, Australia, and Singapore.

Many countries prohibit fertility treatment for single mothers and gay & lesbian couples. Countries such as India, Turkey, Thailand, and Spain have certain restrictions on surrogacy. As, a result, such people travel outside to countries where the legal framework is favorable to becoming parents. For example, Spain allows access to assisted reproduction to single women, lesbians, bisexuals, and transgender people. The U.S. allows surrogacy and has well-established regulations for the same. Thus, many couples travel to U.S. and Spain for reproductive tourism.

Age Group Insights

The 35-44 segment dominated the market with a share of 42.6% in 2021. The high incidence of infertility in this age group is a key factor in the growth of the segment. The cost and anonymity of ART-assisted treatments are the main reasons for travel. Additionally, the availability of more donors offered by international clinics, as well as the success rates advertised contribute to the segment growth.

The risk of pregnancy complications increases with age. Miscarriage and chromosomal abnormalities are more common in fetuses after the age of 35. In addition, the risk of pregnancy complications such as gestational diabetes, placenta previa (the placenta covering part of or all of the cervix), cesarean section, and stillbirth is also higher among older women. Thus, many women between the age group 35 to 44 seek treatment abroad.

The 45-54 segment is set to witness significant growth during the forecast period. High spending capacity and world-class treatment facilities in developed countries are primary factors for the growth of the segment. Furthermore, the efficient and reliable regulatory frameworks in international countries, such as U.S. and U.K. are increasing the influx of patients in the age group 45-54 to these countries.

Country Insights

Turkey dominated the market with a share of 42.19% in 2021. The availability of world-class IVF treatment services at a lower cost than in the U.S. and other European countries is responsible for the growth of the market in Turkey. Furthermore, the country witnessed a high influx of medical visitors in 2021, which rendered a dominating position to Turkey. According to the Turkish Statistical Institute, the country reported an increase of 61% in the arrival of international patients in 2021.

The market in Spain is likely to witness a notable growth rate due to the increasing number of patients from other European countries, rapid developments in fertility tourism, and the rising number of international fertility clinics. Thailand is one of the popular destinations for medical tourism. Its popularity as a tourist destination is augmenting its market growth. The growing number of private institutions, improvements in the overall healthcare infrastructure, and lower treatment prices all contribute to the country’s growth in reproductive tourism.

In recent years, the number of Chinese couples traveling overseas for IVF treatment has increased. The abolition of the one-child policy in China resulted in many older couples traveling to Thailand and Malaysia for IVF treatment. Both the countries are focussing on attracting Chinese patients. To compete with world-class medical centers and hospitals across Asia & other regions, Malaysia is forging a niche in fertility treatments. The country’s fertility centers also claim success rates that are well ahead of the global average.

Key Companies & Market Share Insights

The market is fragmented, with considerable local and international participants. In addition to strategic international promotional endeavors, major players in the industry are pursuing strategic mergers, acquisitions, and collaborations aimed at improving access to consumers. For instance, in March 2021, INVO Bioscience Inc. announced the formation of a joint venture for an INVO-exclusive clinic in Alabama, United States, offering in vivo culture system (IVC) INVOcell to clients worldwide. Some of the prominent players in the global fertility tourism market include:

-

San Diego Fertility Center

-

IVF-Life

-

Barcelona IVF

-

Eva Fertility Clinics

-

The Surrey Park Clinic

-

Bumrungrad International Hospital

-

Assisted Reproduction and Gynecology Centre

-

Sincere IVF Center

-

Alpha IVF & Women’s Specialists

-

Genesis IVF

-

Manchester Fertility Services Ltd

-

Apollo Fertility

Fertility Tourism Market Report Scope

Report Attribute

Details

The market size value in 2022

USD 741.7 million

The revenue forecast in 2030

USD 6.2 billion

Growth rate

CAGR of 30.33% from 2022 to 2030

The base year for estimation

2021

Historical data

2016 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age Group, country

Country scope

Spain; U.K.; U.S.; Czech Republic; Portugal; Turkey; India; Thailand; Malaysia; South Korea

Key companies profiled

San Diego Fertility Center; IVF-Life; Barcelona IVF; Eva Fertility Clinics; The Surrey Park Clinic; Bumrungrad International Hospital; Assisted Reproduction and Gynecology Centre; Sincere IVF Center; Alpha IVF & Women’s Specialists; Genesis IVF; Manchester Fertility Services Ltd; Apollo Fertility

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fertility Tourism Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the global fertility tourism market based on age group and country:

-

Age group Outlook (Revenue, USD Million, 2016 - 2030)

-

18 - 24

-

25 - 34

-

34 - 44

-

46 - 54

-

-

Country Outlook (Revenue, USD Million, 2016 - 2030)

-

U.S.

-

U.K.

-

Spain

-

Czech Republic

-

Turkey

-

Portugal

-

India

-

South Korea

-

Thailand

-

Malaysia

-

Frequently Asked Questions About This Report

b. The global fertility tourism market size was estimated at USD 417.5 million in 2021 and is expected to reach USD 741.7 million in 2022.

b. The global fertility tourism market is expected to grow at a compound annual growth rate of 30.33% from 2022 to 2028 to reach USD 6.2 billion by 2028.

b. Turkey dominated the fertility tourism market with a share of 42.2% in 2021. The availability of world-class IVF treatment services at a lower cost than in the U.S. and other European countries is responsible for the growth of the market in Turkey.

b. Some key players operating in the fertility tourism market include San Diego Fertility Center; IVF-Life; Barcelona IVF; Eva Fertility Clinics; The Surrey Park Clinic; Bumrungrad International Hospital; Assisted Reproduction and Gynecology Centre; Sincere IVF Center; Alpha IVF & Women’s Specialists; Genesis IVF; Manchester Fertility Services Ltd; and Apollo Fertility.

b. Key factors that are driving the market growth include increasing cases of infertility among the population, favorable regulatory framework, lower cost, and high IVF success rates.

b. The 35-44 segment dominated the fertility tourism market owing to high incidence of infertility and high spending capacity among this particular age group.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."