- Home

- »

- Biotechnology

- »

-

Filter Integrity Test Market Size, Share & Growth Report 2030GVR Report cover

![Filter Integrity Test Market Size, Share & Trends Report]()

Filter Integrity Test Market Size, Share & Trends Analysis Report By Test Method (Forward Flow (Diffusion) Test, Bubble Point Test, Pressure Hold Test), By Mode (Automated, Manual), By Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-127-6

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Filter Integrity Test Market Size & Trends

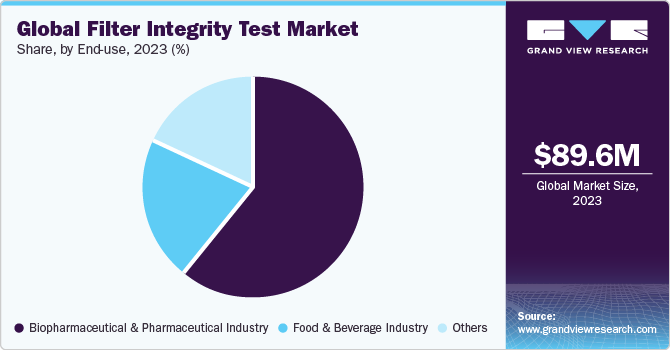

The global filter integrity test market size was estimated at USD 89.64 million in 2023 and is projected to grow at a CAGR of 5.15% from 2024 to 2030. The growth is attributed to the rising demand for biopharmaceuticals. According to an Endeavor Business Media, LLC. article published in August 2023, Biologics, which are a major component of the biopharmaceuticals market, are in high demand worldwide. This demand is driven by the potential of biologics to treat diseases with high unmet medical needs. However, there are capacity issues, particularly in the monoclonal antibody (mAb) space, where the demand for production scalability is growing. Presence of stringent safety regulatory guidelines and growing awareness of product purity and stability requirements across several industries are some other factors expected to propel market growth. Moreover, higher spending on R&D activities is further propelling growth.

According to a Pharmaceutical Development Association (PDA) article published in 2022, the introduction of a formal integrity test for sterile filters prior to use is a significant step in ensuring the safety and efficacy of pharmaceutical products. This draft emphasizes the necessity of validating the integrity of sterilized filter assemblies prior to application, especially in situations where processing could potentially cause damage or compromise integrity. Immediate online testing following filter usage, utilizing methods such as diffusive flow, water intrusion, bubble point, or pressure hold tests, is mandated.

In cases of smaller batch sizes where online testing may not be viable, an alternative approach is proposed, provided that a formal risk assessment is conducted, and compliance ensured. It is imperative to thoroughly document integrity testing methods, including acceptance criteria, failure investigation protocols, and justified conditions for retesting filter integrity. The results of integrity tests, including failures and subsequent retests, must be accurately recorded in batch records. Regulatory guidelines emphasize the key role of integrity testing in upholding the sterility and integrity of filters employed in the production of sterile pharmaceutical products.

Growing awareness concerning product purity and stability requirements across several industries boosts the growth of the market. Several companies are focusing on sustainability which is expected to drive the market growth in near future. Nestle is among one of the companies focusing on sustainability. They prioritize creating a healthier future for both humans and the planet by focusing on reducing their environmental footprint. This involves implementing practices like regenerative agriculture and striving to achieve a Net Zero carbon footprint. Nestlé's sustainability efforts are in line with a larger industry movement towards guaranteeing product purity and stability by responsibly sourcing materials and improving manufacturing practices.

Higher spending in R&D Activities is boosting the growth of the filter integrity test market. According to an NCBI article published in August 2021, in many industries such as pharmaceuticals, nutraceuticals, and food and beverage processing, large-scale bioprocessing is fundamental. Traditional control methods, which focus on factors like product yields and productivity, are used in about 90% of these processes.

However, as biopharmaceutical and nutraceutical production methods become more advanced, including the use of genetically modified organisms (GMOs) and complex downstream processing, traditional control systems are showing limitations. There's now a growing need for more effective advanced process control as research complexity increases and processes become more digitized. This involves finding better ways to monitor and regulate bioprocesses to improve both the quality and quantity of products. The discussion around industrial automation and different commercial control strategies has become critical in this perspective.

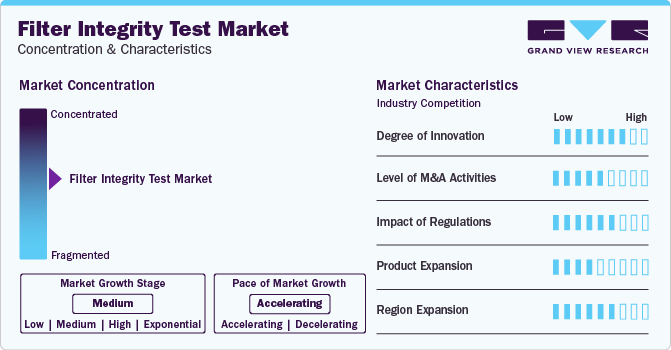

Market Concentration & Characteristics

The degree of innovation is high in the market characterized by a growing level of research and development. Innovations include the development of advanced testing techniques, such as diffusive flow, water intrusion, bubble point, and pressure hold tests, to ensure the integrity of sterile filters. Additionally, there's a focus on integrating automation and digital technologies for real-time monitoring and control, enhancing the efficiency and reliability of the testing process.

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in November 2023, Industrial Physics, a top provider of packaging, product, and material test and inspection solutions, announced its acquisition by investment funds managed by KKR from Union Park Capital (UPC). With a century of expertise, Industrial Physics is renowned globally for its testing and inspection equipment tailored for manufacturers, production lines, and laboratories.

Regulations significantly impact the filter integrity test market by setting stringent standards for product safety and quality assurance. Compliance with regulatory requirements ensures that filter integrity testing methods meet industry standards, safeguarding the integrity and purity of pharmaceutical and biotechnology products.

Tests are limited due to the specialized nature of ensuring the integrity and purity of pharmaceutical and biotech products. However, some alternative methods may include visual inspection, microbial challenge testing, and surrogate testing methods.

The market involves expanding operations and presence into new geographical areas to serve a wider customer base. This may include setting up distribution channels, establishing partnerships with local companies, and obtaining regulatory approvals to enter new markets.

Test Method Insights

The bubble point test segment led the market and accounted for 31.53 % of the global revenue in 2023. It is anticipated to grow at a significant CAGR over the forecast period. The bubble point test helps verify that the filters can withstand the pressure required for the pharmaceutical manufacturing process without causing any leakage or contamination, thereby protecting the product's quality and safety. For instance, the bubble point test is a critical procedure in the biotechnology industry, where filters are utilized to separate and purify biological substances. In biopharmaceutical production, this test ensures that filters maintain the necessary pressure levels during sterilization and filtration without compromising product sterility and purity.

The forward flow (diffusion) test segment is anticipated to grow at a moderate CAGR over the forecast period. When designing and developing new filtration products or systems, incorporating diffusion flow testing becomes an integral part of quality assurance. According to a Brother Filtration article published in 2024, diffusion flow testing ensures that the filtration system meets performance expectations and industry standards from the early stages of development. This method is crucial in the pharmaceutical industry, where the safety and efficacy of drugs are paramount. As part of routine maintenance procedures, especially in critical industries like pharmaceuticals and water treatment, diffusion flow testing is employed to monitor the ongoing performance of filtration systems. This proactive approach helps identify any potential issues before they escalate, ensuring the reliability and efficiency of filtration processes.

End-use Insights

The biopharmaceutical & pharmaceutical industry led the market with a revenue share of 60.87% in 2023. Primarily due to stringent quality standards and regulatory requirements governing pharmaceutical manufacturing processes. Ensuring the integrity of filters is paramount for maintaining the purity and safety of pharmaceutical products, especially in sterile filtration processes. Regulatory guidelines mandate rigorous integrity testing methods to comply with standards and ensure product sterility. Continuous advancements in biopharmaceutical production techniques underscore the critical need for reliable filter integrity testing solutions to meet evolving industry demands.

The food & beverage segment is projected to witness a significant growth rate over the forecast period. Filters play a key role in eliminating impurities and contaminants from beverages and food products, ensuring consumer safety and satisfaction. Maintaining filter integrity is imperative to prevent contamination and preserve product freshness and taste. With increasing consumer awareness and regulatory scrutiny surrounding food safety, the food and beverage industry places a significant emphasis on stringent quality control measures, driving the adoption of filter integrity testing solutions to safeguard product integrity throughout the production process.

Mode Insights

The automated segment led the market in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. The pressure decay test serves as a growth driver due to its simplicity, cost-effectiveness, and efficiency in ensuring filter integrity for less critical applications, making it accessible without extensive equipment or specialized knowledge. The process involves applying a specified pressure to the filters after they are installed and flushed, then closing the air feed valve. After a defined time interval, the pressure is noted, and the pressure decay (initial pressure minus final pressure) is calculated. This test relies on the diffusional flow allowed at a defined pressure below the bubble point, and the allowable pressure decay is calculated accordingly. It's a quick and cost-effective way to ensure filter integrity without the need for extensive equipment or specialized knowledge.

The manual segment is anticipated to grow at a significant CAGR from 2024 to 2030. The manual bubble point test ensures filters meet manufacturer specifications, providing a reliable method to verify filter integrity, remove particles, and ensure suitability for use, thus enhancing product quality and safety. This test is typically performed before installation into the system but can also be done after installation with proper plumbing. The filter(s) are installed into a housing, fully wet out with the required fluid, and connected to an upstream air source. The downstream line is directed into a vessel containing water where bubbles can be observed. The upstream pressure slowly increases until a steady stream of bubbles is noted in the downstream vessel. This method is a manual way to verify the filter's ability to remove particles and ensure it is undamaged and suitable for use.

Type Insights

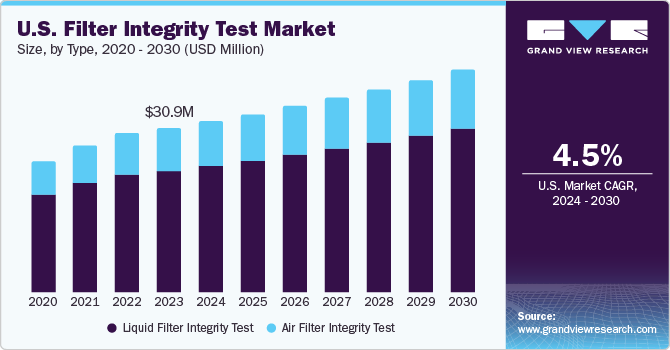

The liquid filter integrity test led the market in 2023 and is expected to grow at a CAGR of 5.0% over the forecast period. High penetration of the forward flow (diffusion) test and bubble point test has led to the segment's predominant position in the market.These tests are crucial for evaluating the integrity and efficiency of filters used in liquid filtration systems across industries. Their rising adoption highlights the importance of ensuring effective removal of contaminants and upholding product quality and safety standards, cementing the dominance of liquid filter integrity testing in the market.

The air filter integrity test segment is projected to witness a significant CAGR over the forecast period. Rising adoption of hydrophobic membrane filters for gas filtration. Furthermore, the widespread utilization of automated test instruments like Integritest Exacta and Sartocheck 3 is expected to contribute significantly to revenue generation within this segment. These instruments offer multiple options for water-based testing of hydrophobic filters, further enhancing their appeal and adoption in the market. Additionally, advancements in air filtration technology and increasing emphasis on maintaining clean and safe indoor air quality are likely to fuel the growth of the air filter integrity test segment over the forecast period.

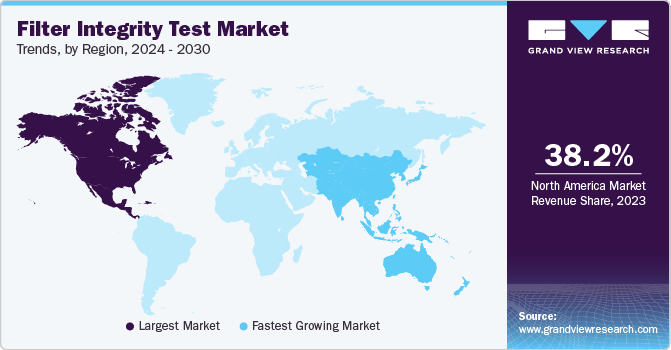

Regional Insights

The North America filter integrity test market accounted for a revenue share of 38.22% in 2023 owing to factors such as stringent regulatory requirements and quality standards in industries like pharmaceuticals, biotechnology, and food and beverage necessitate robust filter integrity testing procedures. The region's advanced healthcare infrastructure and pharmaceutical manufacturing capabilities contribute to the demand for high-quality filter integrity tests to ensure product safety and efficacy. Additionally, technological advancements and innovations in filtration technologies further propel market growth in North America.

U.S. Filter Integrity Test Market Trends

The filter integrity test market in the U.S. is expected to grow over the forecast period, due to frequent approvals and novel diagnostics launches aided with the increasing R&D investments.According to a Pharmaceutical Research and Manufacturers of America article published in July 2022, PhRMA member companies made a groundbreaking investment of $102.3 billion in Research and Development (R&D) solely in 2021. This figure represents the highest level of R&D investment ever recorded, as indicated by the 2022 PhRMA member annual survey. Additionally, the survey reveals a notable trend: approximately one-fifth of the revenue generated by these companies in 2021 was allocated towards R&D efforts.

Europe Filter Integrity Test Market Trends

The Europe filter integrity test market is identified as a lucrative region. The growth of the regional market can be attributed to an increasing awareness among European consumers and manufacturers about the importance of maintaining product purity and safety drives the demand for effective filter integrity testing measures. Additionally, technological advancements and collaborations between industry players and research institutions further propel market growth in the region.

The filter integrity test market in the UK is expected to grow over the forecast period, due to the presence of well-established healthcare infrastructure, high disposable income and growing demand for effective filter integrity testing measures.

The France filter integrity test market is expected to grow over the forecast period, driven by the strong research and development capabilities, coupled with collaborations between industry players and academic institutions, contribute to the innovation and advancement of filter integrity testing methods.

The filter integrity test market in Germany is expected to grow over the forecast period, due to the advancement in automated systems. For instance, Integritest 4 series automated filter integrity test instrument, by Merck Millipore, features an intuitive touch screen and user interface that streamlines the accelerated testing capability and test process.

Asia Pacific Filter Integrity Test Market Trends

The Asia Pacific market for filter integrity test is anticipated to witness the fastest growth over the forecast period. Presence of large target population, competitive landscape with local players, and developing healthcare is anticipated to provide high growth potential in the region. The competitive landscape in APAC is evolving rapidly, with a surge in local players. These players are contributing to the market growth through product launches, collaborations, acquisitions, mergers, and expansions. For instance, in December 2021, Pall Corporation, in association with Express Pharma, introduced its new Palltronic Flowstar V filter integrity test instrument in India. Such developments are anticipated to fuel market growth over the forecast period.

The filter integrity test market in China is expected to grow over the forecast period. The growing focus on improving healthcare R&D aided with development of novel technologies is anticipated to fuel the market growth in China.

The Japan filter integrity test market is expected to grow over the forecast period, due to the presence of collaborations between industry players and academic institutions in Japan drive innovation and the development of cutting-edge filtration solutions.

Latin America Filter Integrity Test Market Trends

The filter integrity test market in Latin America was identified as a lucrative industry. Pharmaceutical and biotechnology sectors with increasing regulatory standards, drive the need for robust filtration processes and integrity testing. The region's economic growth and rising healthcare expenditures further contribute to the demand for quality assurance measures in manufacturing and processing industries.

The filter integrity test market in Brazil is expected to grow over the forecast period due to the regulatory compliance requirements aided with the expansion of pharmaceutical manufacturing.

Middle East & Africa Filter Integrity Test Market Trends

The MEA filter integrity test market was identified as a lucrative industry. The growth of the regional market is driven by the regulatory compliance requirements and focus on product quality and safety, aided with improvements in healthcare infrastructure.

The filter integrity test market in Saudi Arabia is expected to grow over the forecast period, owing to the expansion of healthcare infrastructure and government support and initiatives.

Key Filter Integrity Test Company Insights

Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced Mode and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Surway Filter, Analytical Technologies Limited, and Pentair Ltd. are some of the emerging market participants in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Filter Integrity Test Companies:

The following are the leading companies in the filter integrity test market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Sartorius AG

- Parker Hannifin Corp

- PALL Corporation

- Donaldson Company, Inc.

- Pentair Ltd.

- 3M

- Meissner Filtration Products, Inc.

- Beijing Neuronbc Laboratories Co., Ltd.

- Surway Filter

- Analytical Technologies Limited

- Thermo Fisher Scientific, Inc.

Recent Developments

-

In November 2023, STEMart, a U.S.-based company specializing in medical device development, unveiled its latest offering: Filter Testing Services. Geared towards pharmaceutical and medical device manufacturers, these services assist in verifying filter performance during the manufacturing process, ensuring product safety and efficacy.

-

In August 2023, Eurofins Scientific (EUFI.PA), a player in bioanalytical testing, has acquired EAG Laboratories. EAG is recognized globally for its analytical testing and consulting services across various industries.

-

In March 2023, The Almac Group has invested an (USD 86.65 million) £80 million to construct new manufacturing, production, and diagnostic laboratory facilities at its Global Headquarters in Craigavon, Northern Ireland.

Filter Integrity Test Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 93.88 million

Revenue forecast in 2030

USD 126.88 million

Growth rate

CAGR of 5.15% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test method, mode, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Merck KGaA; Sartorius AG; Parker Hannifin Corp; PALL Corporation; Donaldson Company, Inc.; Pentair Ltd.; 3M; Meissner Filtration Products, Inc.; Beijing Neuronbc Laboratories Co., Ltd.; Surway Filter; Analytical Technologies Limited; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Filter Integrity Test Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global filter integrity test market report based on test method, mode, type, end-use, and region:

-

Test Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Forward Flow (Diffusion) Test

-

Bubble Point Test

-

Pressure Hold Test

-

Water Intrusion Test

-

Others

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated

-

Manual

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Filter Integrity Test

-

Air Filter Integrity Test

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Pharmaceutical Industry

-

Food & Beverage Industry

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rising demand for biopharmaceuticals, presence of stringent safety regulatory guidelines, growing awareness with respect to product purity and stability requirements across several industries, and multiple benefits associated with filter integrity testing.

b. The global filter integrity test market size was estimated at USD 89.64 million in 2023 and is expected to reach USD 93.88 million in 2024.

b. The global filter integrity test market is expected to grow at a compound annual growth rate of 5.15% from 2024 to 2030 to reach USD 126.88 million by 2030.

b. Some of the filter integrity test market opportunities include a rise in emerging opportunities in untapped regions and continuous growth of automated filter integrity tests.

b. Some key players operating in the filter integrity test market include Merck KGaA; Sartorius AG; Parker Hannifin Corp; PALL Corporation; Donaldson Company, Inc.; Pentair Ltd.; 3M; Meissner Filtration Products, Inc.; Beijing Neuronbc Laboratories Co., Ltd.; Surway Filter; Analytical Technologies Limited; Thermo Fisher Scientific, Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."