- Home

- »

- Medical Devices

- »

-

Filter Needles Market Size, Share & Growth Report, 2030GVR Report cover

![Filter Needles Market Size, Share & Trends Report]()

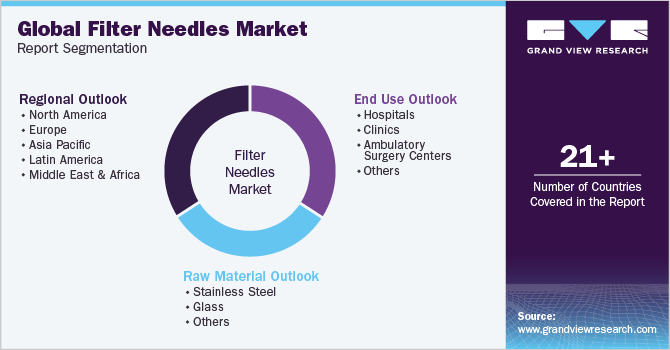

Filter Needles Market Size, Share & Trends Analysis Report By Raw Material (Stainless Steel, Glass, Others), By End-use (Hospital, Clinics, Ambulatory Surgery Centers, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-310-4

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global filter needles market size was valued at USD 1.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. The increasing number of road accidents, rising prevalence of diabetes, increasing geriatric population, and surgical processes are some of the major factors driving the market. Moreover, the increasing cases of accidents such as burns, road accidents, and trauma events globally are expected to drive the market. For instance, according to the World Health Organization (WHO) in March 2018, approximately 1,80,000 deaths occur globally annually due to burns. According to the same source, around 1 million people annually in India incur severe or moderate burns.

Furthermore, as per the Centers for Disease Control and Prevention (CDC), in January 2023, approximately 1.35 million people were killed in road accidents globally each year, accounting for almost 3,700 deaths per day. Middle or low-income countries are more affected by these incidents than high-income countries. As filter needles are used to drain out pus-filled wounds caused due to accidents, the rising number of accidents is expected to boost the demand for filter needles, leading to considerable market growth over the forecast period.

The increasing prevalence of diabetes (type I and type II) globally is expected to drive the market for filter needles. For instance, as per the International Diabetes Federation, in 2021, around 537 million adults aged 20 to 79 were living with diabetes. Moreover, according to the same source, this number is projected to grow to 643 million by 2023 and 783 million by 2045. Since prolonged diabetes is known for leading to diabetic foot ulcers, it is anticipated to lead to the growth of the market eventually.

Furthermore, the increasing geriatric population globally is also anticipated to propel the growth of the filter needles market as the geriatric population is prone to chronic diseases and chronic ulcers compared to other age groups. For instance, as per the World Population Prospects 2022, published by the Department of Economic and Social Affairs of the United Nations (UN), the share of the population aged 65 years or more was about 10% of the total population, which is likely to reach around 16% by the year 2050.

Globally, the number of surgeries is increasing, owing to which the incidence rate of surgical site infection is also anticipated to rise. According to the report published by the Health Research Educational Trust (HRET) in 2018, around 15.0 million surgeries are performed in the U.S. annually, and approximately 2.0% to 5.0% of patients develop surgical site infections. Filter needles drain pus and blood from the infected wounds and inject medication for proper healing of wounds. Such factors are expected to boost the growth of the market for filter needles over the forecast period.

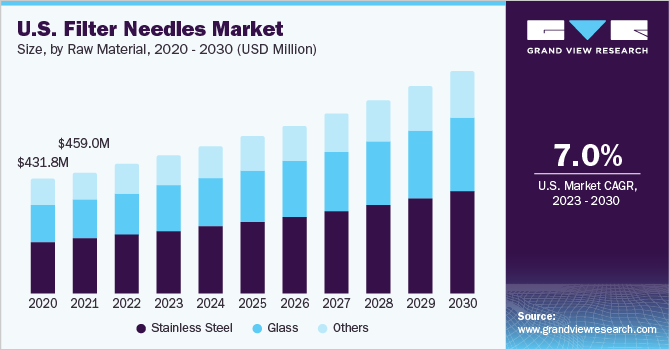

Raw Material Insights

The stainless-steel segment dominated the market and held the largest revenue share of 44.9% in 2022 and is expected to grow at the fastest CAGR of 7.8% over the forecast period, owing to the presence of a large number of key players offering this product and the corrosion resistance property of stainless steel, which makes it a suitable filter needle material. In addition, stainless steel is comparatively less expensive, making it more affordable. Moreover, the rising incidence of chronic wounds across the globe is also anticipated to boost segment growth. BD, Cardinal Health, and B. Braun SE are some companies offering this product.

The glass segment is anticipated to witness a CAGR of 7.5% over the forecast period. Several advantages of glass needles, such as low volume error, suitability for high precision work, and cost efficiency, are expected to drive the market. These advantages of glass needles make them suitable for use in fields like medical technology. However, some disadvantages are also associated with using a glass needle system, such as potential surface reactivity and breakage.

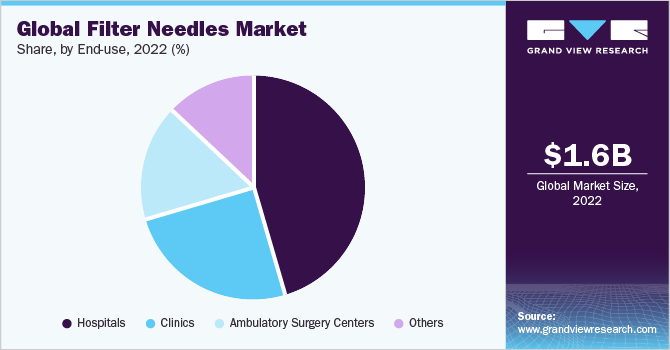

End Use Insights

The hospital segment held the largest revenue share of 45.4% in 2022, owing to the rising number of hospitalizations in countries across the globe. For instance, as per the report published by the Canadian Institute of Health Information (CIHI) in February 2023, total acute inpatient hospitalizations in Canada were about 2.7 million in the first year of the pandemic, 2020-2021, which rose to approximately 2.9 million in 2021-2022.

The ambulatory surgery centers segment is anticipated to witness the fastest CAGR of 8.2% over the forecast period. Ambulatory surgery centers are also known as outpatient surgery centers and are generally opted for by patients undergoing less complicated procedures and requiring a limited period of stay. Currently, the demand for minimally invasive procedures is also increasing across the globe owing to its several advantages, such as less scarring, less injury to tissues, high accuracy ratio, and shorter hospital stays, which in turn is anticipated to increase demand for ambulatory surgical centers’ surgical care and diagnostics.

Regional Insights

North America accounted for the largest revenue share of 35.3% in 2022. Several favorable reimbursement policies, developed healthcare infrastructure, increasing health awareness, and the presence of several key players in the market are anticipated to drive market growth. In addition, this region is governed by regulatory bodies such as the Food and Drug Administration (FDA), which have laws for the reimbursement of medical devices. For instance, in May 2021, the FDA recommended that healthcare providers stop using certain needles and syringes manufactured by Guangdong Haiou Medical Apparatus CO., LTD (HAIOU) until the FDA is done with their evaluation.

Asia Pacific is anticipated to witness the fastest CAGR of 8.2% over the forecast period. The presence of several local players in the region, increasing healthcare expenditure, and the presence of highly populated countries such as India and China are expected to boost market growth. Moreover, middle and low-income countries in the region are witnessing increasing incidents of accidents, such as burns and road accidents, which are expected to drive the market over the forecast period. For instance, according to the Ministry of Road Transport and Highways of Government of India (GOI), in the year 2021, a total number of 4,12,432 road accidents were reported claiming 1,53,972 lives as well as causing injuries to 3,84,448 people in the country.

Key Companies & Market Share Insights

Key companies are stressing research and development to develop technologically advanced products to gain a competitive edge. Market players are opting for mergers and acquisitions to increase their presence in the market. For instance, in July 2022, Sharps Technology Inc., an innovative medical device company, completely acquired Safeguard Medical's syringe manufacturing facility. This acquisition is expected to transform the company from R&D R&D-focused enterprise to revenue-generating commercial operations. Similarly, In January 2022, ICU Medical Inc. acquired Smiths Medical, a syringe, ambulatory infusion devices, and vital care product business from Smiths Group plc. This acquisition is expected to enhance competitiveness and expand the company's product portfolio. Some of the prominent players in the global filter needles market include:

-

BD

-

Cardinal Health

-

Myco Medical

-

Stryker

-

B.Braun SE

-

Sol-Millennium

-

Terumo Corporation

-

ICU Medical, Inc.

Filter Needles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.8 billion

Revenue forecast in 2030

USD 2.9 billion

Growth rate

CAGR of 7.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait;

Key companies profiled

BD; Cardinal Health; Myco Medical; Stryker; B. Braun SE; Sol-Millennium; Terumo Corporation; ICU Medical, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Filter Needles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global filter needles market report based on raw material, end use, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Glass

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgery Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global filter needles market size was estimated at USD 1.6 billion in 2022 and is expected to reach USD 1.7 billion in 2023.

b. The global filter needles market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 2.9 billion by 2030.

b. North America dominated the filter needles market with a share of 35.3% in 2022. This is attributable to rising several favorable reimbursement policies, the introduction of technologically advanced products, and the presence of several key players.

b. Some key players operating in the filter needles market include BD, Cardinal Health, Sentra Medical, Myco Medical, B.Braun Melsungen AG, and SOL-Millennium.

b. Key factors driving the filter needles market growth include the increasing number of road accidents, growing prevalence of chronic wounds, increase in geriatric population across the globe, and technological advancement.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."