- Home

- »

- Next Generation Technologies

- »

-

Fintech As A Service Market Size And Share Report, 2030GVR Report cover

![Fintech As A Service Market Size, Share & Trends Report]()

Fintech As A Service Market Size, Share & Trends Analysis Report By Type (Payment, Fund Transfer, Loan), By Technology, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-956-8

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global fintech as a service market size was estimated at USD 266.56 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.5% from 2023 to 2030. One of the primary drivers is the increasing demand for seamless, user-friendly digital financial services among consumers and businesses. Traditional financial institutions are recognizing the need to enhance their offerings to meet evolving customer expectations, leading them to partner with Fintech-as-a-Service (FaaS) providers to integrate advanced technological solutions into their operations. Another key driver is the rise of open banking and APIs, which have revolutionized the way financial data is shared and accessed. FaaS providers leverage APIs to offer modular and customizable solutions that enable traditional financial institutions to quickly add new services or features without the need for extensive development efforts.

The cost-efficiency and scalability offered by FaaS models are also driving the growth of the market. Traditional financial institutions often grapple with expensive legacy systems to maintain and upgrade. Fintech As A Service providers offer cloud-based solutions that reduce infrastructure costs and allow institutions to scale their services as needed without physical infrastructure constraints. Moreover, regulatory changes and compliance requirements are also pushing the adoption of fintech as a service solution. Financial institutions face increasingly complex regulations that require robust risk management and reporting capabilities. Fintech providers offer solutions equipped with advanced compliance tools, enabling institutions to navigate regulatory challenges efficiently.

In addition, the growing trend of financial institutions shifting their focus from product-centric to customer-centric models is fueling the demand for fintech as a service solution. These solutions enable institutions to offer personalized experiences to their customers through data-driven insights, leading to improved customer engagement and loyalty. Furthermore, the global reach and interconnectedness of financial markets also contribute to the expansion of the fintech-as-a-service market. As businesses and individuals engage in cross-border transactions, there is a growing need for solutions that can facilitate international payments, foreign exchange, and regulatory compliance seamlessly.

The dynamic and innovation-centric nature of the financial sector serves as a major driving force behind the FaaS market. Fintech solution providers consistently introduce novel technologies like AI, blockchain, and data analytics, with the potential to reshape financial services and streamline operational effectiveness. This ongoing pursuit of innovation prompts financial institutions to collaborate with fintech providers to remain at the forefront and deliver state-of-the-art solutions to their clientele. This partnership ensures that financial organizations can remain competitive, embrace emerging trends, and provide cutting-edge services that cater to evolving customer demands.

A notable restraint in the fintech-as-a-service market lies in the complexity of integrating new technologies with existing legacy systems of financial institutions. This integration challenge can hinder the seamless adoption of fintech solutions, as it often requires substantial time and resources to ensure compatibility and smooth functioning. To overcome this hurdle, comprehensive planning, phased implementation strategies, and robust interoperability frameworks are essential. Collaborative efforts between fintech providers and financial institutions, coupled with rigorous testing and training programs, can help alleviate integration difficulties and ensure a successful transition to advanced fintech solutions.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic played a decisive role in driving the growth of the market over the projected period. The adoption of contactless payment methods and digitized financial services increased as people were confined to their homes. Consumers across the globe were adopting contactless payment methods as a safe mode of transaction. At the same time, several retail stores also adopted contactless payments as part of their efforts to ensure a safe and secure way of payment for customers. The increased adoption of digital fintech services such as digital wallets during the pandemic bodes well for the fintech platform as a service.

Type Insights

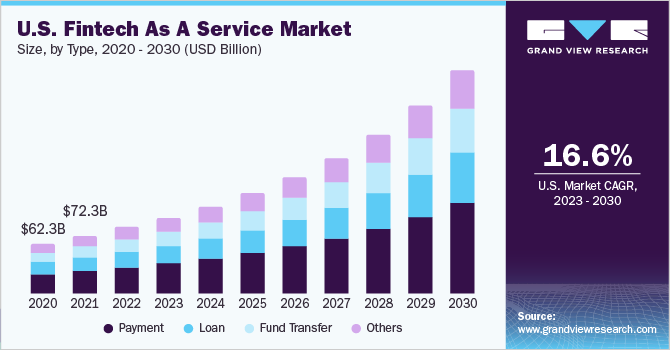

The payment segment dominated the market in 2022 and accounted for a revenue share of more than 40.0%. The dominance can be attributed to the fundamental shift in consumer preferences towards digital and cashless transactions. As consumers increasingly opt for convenient and efficient payment methods, fintech solutions are at the forefront of providing innovative payment technologies and platforms. This segment encompasses a wide range of services, from mobile wallets and peer-to-peer payments to contactless transactions and cross-border remittances, catering to diverse needs across individual consumers, businesses, and even governments.

The fund transfer segment is anticipated to witness significant growth over the forecast period. Fund transfer is mainly associated with transferring and receiving money using technology-based payment systems. The growing popularity of fund transfer apps worldwide is expected to trigger the demand thereby driving the growth of the segment. The efforts are being pursued by various fintech companies worldwide to develop fund transfer applications with modern user interfaces that ensure a better customer experience. These factors are fueling the segment's growth.

Technology Insights

The blockchain segment dominated the market in 2022 and accounted for more than 28.0% share of the global revenue. The increasing demand for blockchain technology is particularly rising among large enterprises. Several large enterprises are trying to adopt blockchain due to its greater transparency and automation benefits. Financial institutions are adopting blockchain technology for the enhanced security and efficiency it offers. With blockchain technology users can be sole owners of their wealth and only they can access their assets which provides added security to both financial institutions and end-users. The benefits offered by blockchain are expected to drive the segment's growth.

The artificial intelligence segment is expected to register the fastest growth over the forecast period. The rising adoption of AI among various companies due to improved decision-making, query resolution, less processing time, and better efficiency is driving the segment growth. Moreover, AI drives innovation among companies which results in customized, fast, and safer services with higher levels of customer satisfaction and global reach. Such enhancements being pursued by several companies to gain competitive advantage and strengthen their market position are expected to drive the growth of the segment.

Application Insights

The compliance and regulatory support segment dominated the market in 2022 and accounted for over 31.0% share of the global revenue. Several financial institutions worldwide are rolling out customer support within the app as part of the efforts to streamline their operations and enhance customer experience. Furthermore, rising incidents of fraud and money laundering across the globe are also forcing these companies to offer better customer support. Thereby, driving the segment growth over the forecast period.

The KYC verification segment is anticipated to grow at a promising CAGR of 18.0% over the forecast period. The increasing illegal activities and number of frauds are among the major factors that are expected to drive the growth of the segment. KYC is an important and regulatory aspect that validates the personal information provided by users to verify their credibility. Moreover, KYC also ensures that the business evaluates client’s financial situations and tracks their accounts for fraudulent transactions.

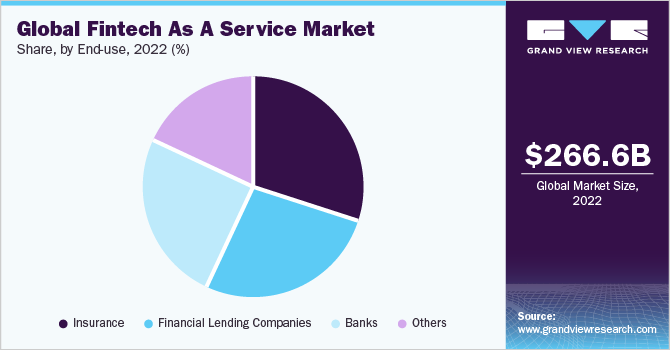

End-use Insights

The insurance segment dominated the market in 2022 and accounted for over 30.0% share of the global revenue. The dominance stems from the growing recognition of technology's potential to reshape and optimize the insurance industry. Fintech solutions within the insurance domain encompass a range of services, such as digital underwriting, claims processing, policy management, and risk assessment. These offerings leverage advanced data analytics, AI-driven algorithms, and automation to enhance the efficiency, accuracy, and customer experience in insurance operations. Fintech-as-a-service providers have become integral partners in this transformation as insurance providers seek ways to streamline processes, reduce costs, and personalize offerings.

The financial lending companies segment is expected to witness significant growth from 2023 to 2030. The rising consumer preference towards using financial instruments at convenience from their home is boosting the segment growth. In addition, tech-enabled platforms help financial institutions to offer services such as fixed deposits, lending, borrowing, and others. Moreover, the rising adoption of digital lending platforms bodes well for the growth of the market.

Regional Insights

North America dominated the fintech as a service market in 2022 and accounted for a revenue share of over 34.0%. The region boasts a robust ecosystem of tech innovation, established financial institutions, and a culture that embraces digital transformation. With Silicon Valley as a hub for fintech startups and major financial centers like New York City, North America has cultivated an environment conducive to fostering fintech innovation. Moreover, the region's large population, high digital adoption rates, and advanced technological infrastructure create a fertile ground for the growth of fintech-as-a-service offerings. Regulatory support and a well-developed financial services landscape further contribute to North America's leadership in this dynamic market.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growth of the regional market is attributed to rising awareness about the benefits of FaaS platforms in countries such as China, India, and Japan. Governments and venture capitalists are aggressively funding fintech firms to promote the use of digital services and fintech-as-a-service platforms. For instance, in 2022, funding in fintech companies in the Asia Pacific region raised USD 3.3 billion in the first quarter.

Key Companies & Market Share Insights

The fintech-as-a-service market can be described as a highly competitive market due to the existence of various dominant market players. Market players are seeking different strategies, including strategic partnerships, to improve their offerings. For instance, in March 2023, PayPugs, a fintech entity, and Muniy, a personal finance app, jointly forged an accord to unveil a global fintech-as-a-service solution. This dynamic solution empowers enterprises to effortlessly integrate financial services into their product lineup, amplifying convenience and adaptability for their customer base. The strategic alliance between PayPugs and Muniy constitutes a formidable force in the industry, catalyzing the uptake of fintech services throughout the UK and Europe. Market players are investing aggressively in research & development activities to enhance their product offerings. Some prominent players in the global fintech as a service market include:

-

PayPal Holdings, Inc.

-

Block, Inc.

-

Mastercard Incorporated

-

Envestnet, Inc.

-

Upstart Holdings, Inc.

-

Rapyd Financial Network Ltd.

-

Solid Financial Technologies, Inc.

-

Railsbank Technology Ltd.

-

Synctera Inc.

-

Braintree

Fintech As A Service Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 307.29 billion

Revenue forecast in 2030

USD 949.49 billion

Growth rate

CAGR of 17.5% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

PayPal Holdings, Inc.; Block, Inc.; Mastercard Incorporated; Envestnet, Inc.; Upstart Holdings, Inc.; Rapyd Financial Network Ltd.; Solid Financial Technologies, Inc.; Railsbank Technology Ltd.; Synctera Inc.; Braintree

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fintech As A Service Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the fintech as a service market report based on type, technology, application, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Payment

-

Fund Transfer

-

Loan

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

- API

-

Artificial Intelligence

-

RPA

-

Blockchain

-

Others

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

KYC Verification

-

Fraud Monitoring

-

Compliance & Regulatory Support

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Banks

-

Financial Lending Companies

-

Insurance

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fintech as a service market size was estimated at USD 266.56 billion in 2022 and is expected to reach USD 307.29 billion in 2023.

b. The global fintech as a service market is expected to grow at a compound annual growth rate of 17.5% from 2023 to 2030 to reach USD 949.49 billion by 2030.

b. North America dominated the fintech as a service market with a share of 34.40% in 2022. This is attributable to the shifting consumer preference toward digital financial services.

b. Some key players operating in the fintech as a service market include PayPal Holdings, Inc., Block, Inc., Mastercard Incorporated, Envestnet, Inc., Upstart Holdings, Inc., Rapyd Financial Network Ltd., Solid Financial Technologies, Inc., Railsbank Technology Ltd., Synctera Inc., Braintree

b. Key factors that are driving the fintech as a service market growth include technological advancements in the fintech sector and Increasing demands by venture capital companies in the fintech sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."