- Home

- »

- Healthcare IT

- »

-

Fitness Platforms For Disabled Market Report, 2022-2030GVR Report cover

![Fitness Platforms For Disabled Market Size, Share & Trends Report]()

Fitness Platforms For Disabled Market Size, Share & Trends Analysis Report By Type (Exercise & Weight Loss, Diet & Nutrition, Activity Tracking), By Platform, By Device, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-915-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2016 - 2020

- Industry: Healthcare

Report Overview

The global fitness platforms for disabled market size was valued at USD 1.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 21.9% from 2022 to 2030. A transition from traditional studios and gyms to a virtual fitness trend among the general population and people with disabilities has been witnessed during the COVID-19 pandemic. This, in turn, has increased downloads and usage of fitness live streaming platforms. According to the World Economic Forum, in 2020, the global subscriptions of fitness and health platforms increased by 50.0% among the disabled group. This, in turn, increased the usage rate of fitness platforms.

Moreover, the growing trend of online fitness training among people with various disability types, including difficulties in hearing, vision, mobility, and many other functions, is driving the market.Increasing awareness regarding health and wellness among the disabled population is also driving the market.Moreover, the prevalence of disability is rising and is estimated to affect over 15.0% of the global population according to a report published by the WHO in 2020. Conflict and poverty are the two key factors responsible for high rates of disability in developing countries. The prevalence of disability is continuously increasing in the industrialized sectors with the aging population.

In 2019, as per an annual survey conducted by the U.S. Census Bureau under American Community Survey (ACS), nearly 12.8% of the U.S. population in 2019 is anticipated to be registered under people with disabilities. In addition, Europe constitutes about 39.0 million disabled people in 2019 as reported by CSR Europe, wherein Britain accounts for approximately 11.0 million disabled people. However, Saudi Arabia registered the lowest rates of disability prevalence globally, which is 8.0%. In addition, Asian countries are witnessing a high incidence of disability and account for the highest number of prevalent populations estimated above 135.0 million people with disability in 2019.

Additionally, the growing geriatric population has been one of the key reasons behind the increasing prevalence of disability. For instance, the aging U.S. population has led to an increase in the prevalence of people with disabilities. In 2016, the U.S. accounted for less than 1.0% of the population under 5 years with a disability. Likewise, for individuals aged 5 to 17 years, the prevalence rate for disability was valued at 5.6%. Moreover, for people aged 18 to 64 years, the prevalence rate was registered to be nearly 10.6%, and it is 35.2% in people aged 65 years and older. In addition, as per the CDC estimates, nearly 61.0 million adults in the U.S. had disabilities in 2021. This has pushed tech giants, such as Google, Apple, and Microsoft, to launch products and services that are more accessible to this target population.

Moreover, the high economic spending power of the disability community is responsible for the revenue growth in the market. The global disability purchasing market was valued at approximately USD 8.0 trillion in 2020, depicting that PWDs control a significant amount in spending. PWDs and their families, along with friends, represent nearly 73.0% of the consumers who are critical in making purchasing decisions. As per a report—A Hidden Market: The Purchasing Power of People With Disabilities—published by the American Institutes for Research (AIR), about 64.0 million people in the U.S. were registered with at least one disability, and nearly 35.0% of this population comprised people of working age, aged 16 to 65 years, who are earning income via direct employment or additional support and benefits.

COVID-19 fitness platforms for disabled market impact: an increase of 41.6% between 2019 and 2020

Pandemic Impact

Post COVID Outlook

The fitness platforms for disabled market increased by 41.6% from 2019 to 2020.

The market is estimated to witness a y-o-y growth of approximately 21.5% to 22.0% in the next 5 years.

The pandemic aided a significant increase in the awareness regarding fitness platforms, augmenting their usage. An increase in awareness regarding fitness and rehabilitation services has led to the rapid adoption of virtual fitness platforms among people with disabilities.

The COVID-19 pandemic has resulted in a transition of consumers from traditional gyms and fitness studios to virtual avenues. The growing trend of online training and home exercise among disabled target groups has led to an increase in the usage of live streaming fitness platforms.

Social distancing measures to slow down COVID-19 transmission have led to the closure of various fitness and rehabilitation centers, which has adversely affected disabled young adults and children, with many of them being unable to meet the physical activity needs for best physical health.

A negative impact on physical activity has been witnessed by people with physical disabilities during the pandemic, highlighting the need to support this demographic in greater ways. A number of public and private organizations have launched various live streaming fitness platforms to guide and aid target populations with important exercises and nutrition to support their physical and mental wellbeing.

The rapid adoption of live streaming platforms in the healthcare sector is one of the key factors driving the adoption of fitness platforms among the disabled population. A 2016 study published in Journal on Technology and Persons with Disabilities revealed that nearly 84.0% of disabled people use or own a smartphone, with 91.0% of users adopting a tablet. In addition, as per the GSMA’s Mobile Disability Gap Report 2020, it has been revealed that smartphones have embedded accessibility and compliant features, including voice command, screen-readers, and magnification, which makes it easier to use for people with hearing or visual disabilities.

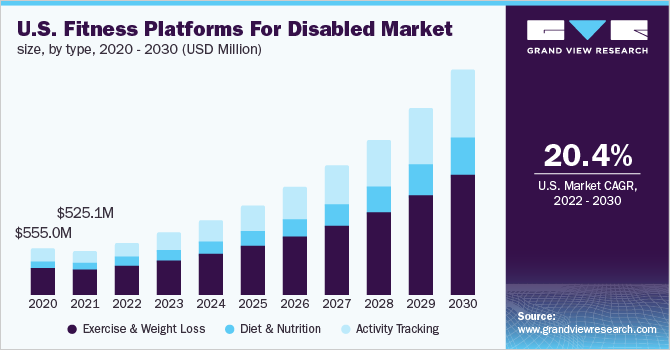

Type Insights

In 2021, the exercise and weight loss segment held the largest revenue share of over 50.0%. This growth can be attributed to the increasing number of companies focusing on introducing innovative platforms for weight loss and sticking to the daily workout routine among people with disabilities. The majority of the exercise and weight loss plans offered by these fitness platforms are personalized for users. These platforms supply customized recommendations on food consumption and physical activity, which aid in weight loss. The introduction of advanced technologies further aids the market growth. For instance, workout platforms are usually equipped with audio cues, video demos, and fitness tracking tools, which can help in supporting an exercise routine.

The activity tracking segment is expected to register the highest CAGR over the forecast period. This can be attributed to the high demand for wearable health and fitness tracking systems among people with disabilities and the launch of new activity tracking devices. Tracking health and fitness through apps and gadgets has become popular among people with disabilities in the past years, which is leading to an increase in the consumer pool. Users can access Do It Yourself (also termed as DIY) insights for diet and gain information about the impact of physical exercise on their health. With the increasing number of consumers, major technology companies have started investing in fitness technology. Android and Apple are the two main companies at the forefront of the fitness platforms domain. Both companies have their individual health platforms known as Google Fit and Apple Health, majorly for people in a wheelchair.

Platform Insights

In 2021, the iOS segment held the largest revenue share of over 50.0%. An increase in the adoption of iOS among target consumers is a major parameter contributing to the segment growth. Approximately, 26% of iPhone, iPod, and iPad users installed the iOS 14 updates within 5 days of its release in September 2020. Moreover, the increased usage of iOS devices is fueling the segment growth. Fitness apps available on the iOS platform are Apple Fitness+, Evolve 21, Kakana, Champion’s RX, and Kym NonStop.

The android segment is expected to expand at the fastest CAGR over the forecast period. This growth can be attributed to the high usage rate of Android smartphones among people with disabilities. The introduction of technological upgrades in android platforms has further aided their adoption. For instance, as per a statement released by Google, people with speech or any other physical disabilities are now capable of working their Android-based smartphones hands-free.

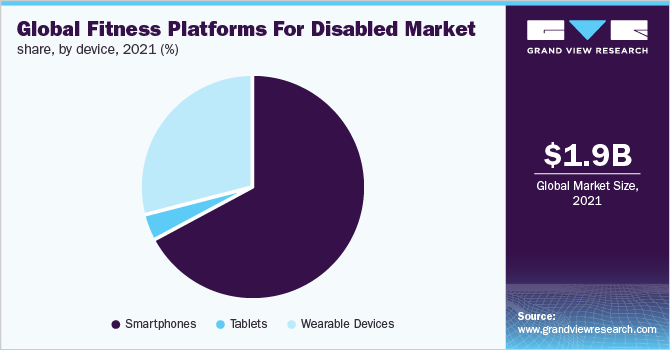

Device Insights

In 2021, the smartphones segment held the largest revenue share of over 65.0%. This can be attributed to an increase in the adoption of smartphones among U.S. consumers in the past few years. According to Pew Research Center, the U.S. population using smartphones has increased from 59% in 2014 to 81% in 2019. From 2015 to 2018, smartphone penetration has grown by 9% in the age group of 18 to 29 years and by 8% in the age group of 30 to 49 years. An increase in the adoption of smartphones is expected to proportionately scale up the use of fitness platforms. An increase in the penetration of smartphones worldwide, coupled with the growing awareness regarding fitness among the disabled population, is expected to drive the use of fitness platforms over the forecast period.

The wearable devices segment is expected to expand at the fastest CAGR over the forecast period. Wearable devices enable people with disabilities to easily perform daily tasks, such as browsing the web, sending emails, and using social media and fitness platforms for daily physical activities through voice-activation and gesture controls. Smartwatches are capable of performing a variety of functions, helping people with vision difficulty, hearing loss, and other physical impairments. For instance, the Apple watch provides VoiceOver, which enables users with vision difficulties to navigate the system. The Apple Watch also offers zoom features in their gadgets, which enables enlarging of the watch interface for people with limited vision.

Regional Insights

North America held the largest revenue share of over 30.0% in 2021. The growing awareness regarding fitness and daily health monitoring among the disabled has led to an increase in the adoption of fitness platforms in the region. Moreover, the market is primarily driven by the availability of next-generation internet connectivity and high smartphone penetration. In addition, rising awareness regarding the benefits of leading a healthy and active lifestyle among people with disabilities is driving the adoption of fitness platforms. According to the World Bank estimates in 2018, North America spends approximately 16.42% of its GDP on healthcare. The U.S. leads the North American market owing to the higher adoption of fitness platforms and mHealth platforms.

Asia Pacific is expected to expand at the fastest CAGR during the forecast period. Many countries in this region are adopting virtual fitness strategies to deliver exercise/workout plans for people with disabilities with better outcomes. During the COVID-19 pandemic, the region observed a significant increase in the downloading of fitness platforms. According to an article published in the World Economic Forum, health and fitness platform downloads increased by more than 150% in India. Moreover, in addition to fitness platforms, health and fitness app downloads also increased by 47% in Asia Pacific.

Key Companies & Market Share Insights

Key players are introducing live streaming fitness platforms to cater to the growing demand from People with Disabilities (PWD), which is projected to drive the market globally. In addition, virtual health firms and public sports organizations are launching solutions in fitness for the disabled sector. For instance, in September 2021, Move United, a community-based adaptive sports organization, announced the launch of Move United on Demand—a digital fitness platform that offers exercise and fitness routines for disabled communities. Some prominent players in the global fitness platforms for the disabled market include:

-

Apple, Inc.

-

Kakana

-

Champion’s Rx

-

Adaptive Yoga Live

-

Evolve21

-

Kym Nonstop

-

Exercise Buddy, LLC

-

Special Olympics

-

YouTube

-

Hulu, LLC

Fitness Platforms For Disabled Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.3 billion

Revenue forecast in 2030

USD 11.1 billion

Growth Rate

CAGR of 21.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2016 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type; platform; device; region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Apple, Inc.; Kakana; Adaptive Yoga LiveChampion’s Rx; Evolve21; Kym Nonstop; Exercise Buddy, LLC; Special Olympics; YouTube; Hulu, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global fitness platforms for disabled market report on the basis of type, platform, device, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Exercise & Weight Loss

-

Diet & Nutrition

-

Activity Tracking

-

-

Platform Outlook (Revenue, USD Million, 2016 - 2030)

-

Android

-

iOS

-

Others

-

-

Device Outlook (Revenue, USD Million, 2016 - 2030)

-

Smartphones

-

Tablets

-

Wearable Devices

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fitness platforms for disabled market size was estimated at USD 1.9 billion in 2021 and is expected to reach USD 2.3 billion in 2022.

b. The global fitness platforms for disabled market is expected to grow at a compound annual growth rate of 21.9% from 2022 to 2030 to reach USD 11.1 billion by 2030.

b. Key factors that are driving the fitness platforms for disabled market growth include increasing nationwide lockdowns and social distancing norms, leading to a transition from traditional studios & gyms to a virtual fitness trend among the general population as well as people with disabilities.

b. North America dominated the fitness platforms for disabled market with a share of 33.7% in 2021. This is attributable to growing awareness about fitness and daily health monitoring among the disabled which led to an increase in adoption of fitness platforms in the region.

b. Some key players operating in the fitness platforms for disabled market include Apple, Inc.; Kakana; Kakana; Champion’s Rx; Evolve21; Kym Nonstop; Exercise Buddy, LLC; Special Olympics; YouTube; and Hulu, LLC.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."