- Home

- »

- Consumer F&B

- »

-

Flavored Water Market Size & Share Report, 2021-2028GVR Report cover

![Flavored Water Market Size, Share & Trends Report]()

Flavored Water Market Size, Share & Trends Analysis Report By Distribution Channel (Supermarkets & Hypermarkets, Online), By Product (Sparkling, Still), By Region (North America, APAC), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-260-0

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The global flavored water market size was valued at USD 13.50 billion in 2020 and is expected to witness a compound annual growth rate (CAGR) of 10.3% from 2021 to 2028. The increasing preference for flavored, healthy, and functional drinks has been boosting the growth of the market across the globe. Consumers are showing interest in exploring innovative beverages infused with fruits, herbs, other healthy ingredients. The market witnessed rapid growth during the COVID-19 pandemic due to the increased health concerns, which augmented the demand for flavored hydration products enriched with the benefits of minerals and vitamins, especially among health-conscious consumers with mid-to high-income levels.

Consumers, especially millennials and Gen Z, in the developed economies, such as the U.S., are spending more on flavored water. The trend of zero-calorie, zero-sugar, and low-carb content soft drinks is rising across the globe, which is also boosting the market growth. Citrus and berry flavors are gaining traction among consumers due to their refreshing tastes. The natural flavors are gaining traction due to their health benefits and refreshing tastes.

As a result, producers have been launching beverages with such flavors that help improve physical and mental health. Over the past few years, consumer preference is shifting from sugary carbonated soft drinks to healthy drinks. Moreover, the continuous introduction of new flavors, innovative packaging, and incorporation of functional ingredients have helped in shaping and boosting the global market. Companies are adding vitamins and minerals to their drinks to attract modern consumers.

With the growing awareness regarding sustainability and the environment among consumers, industry players are increasingly offering flavored waters in sustainable packaging. Several brands offer their drinks in aluminum cans to appeal to environmentally conscious consumers. Furthermore, consumers are looking for drinks that are sourced and produced sustainably. This trend has been creating growth opportunities for the market players.

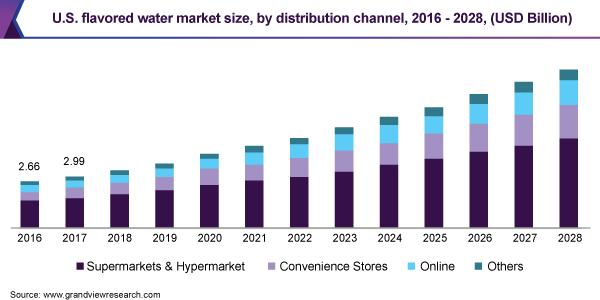

Distribution Channel Insights

The supermarkets & hypermarkets segment accounted for the largest revenue share of over 55% in 2020 and will grow further at a steady CAGR from 2021 to 2028. A large number of consumers prefer buying bottled water from supermarkets & hypermarkets due to the shopping experience. Services, such as home delivery and click & collect, at several supermarkets have also been attracting consumers. Walmart, Carrefour, Woolworths, Magnit, and Edeka are among the leading supermarket chains across the globe.

Convenience stores are also a prominent distribution channel for the market. With the growing number of convenience stores, product sales through this distribution channel have been rising significantly over the years. The online distribution channel segment is expected to register the fastest CAGR of more than 11% over the forecast period. The provision of competitive pricing and hassle-free home delivery are driving the growth of this sales channel. Furthermore, the high penetration of the Internet across the globe is expected to boost product sales via online platforms over the coming years.

The ongoing pandemic has fundamentally changed the shopping patterns of consumers. Nowadays, more and more customers are willing to buy their essentials, including water and coffee, through online platforms. The pandemic has resulted in the online portals becoming one of the most important distribution channels among manufacturers, distributors, retailers, and customers.

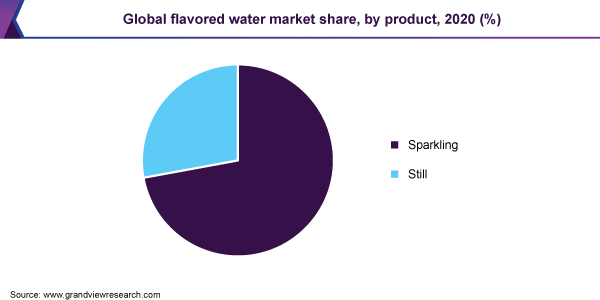

Product Insights

The sparkling product segment accounted for the highest revenue share of more than 72% in 2020 and is estimated to expand further at a steady CAGR from 2021 to 2028. The increase in demand for flavored bubbly and fizzy hydration products is projected to drive the segment growth. The sparkling variants are increasingly preferred owing to their taste, fizz, and health benefits. Several brands including Nestlé Pure Life offer a range of zero-calorie and zero-sweetener flavored products in different fruit flavors.

Key players are launching new products in the market in accordance with the changing demands from health-conscious consumers. For instance, in May 2019, National Beverage Corp. launched a new flavor, Hi-Biscus! under its LaCroix brand. The new sparkling water has no carbohydrates, sweeteners, or sodium, and has a unique flavor of the hibiscus flower. Such product launches are estimated to augment the segment growth over the forecast period.

However, the still product segment is expected to register the fastest CAGR during forecast years. The availability of a wide range of still water products that are enriched with minerals, antioxidants, vitamins, and caffeine is estimated to boost the segment growth in the years to come. Furthermore, the perception about sparkling drinks that they cause low bone mineral density and tooth decay has been encouraging many consumers to shift towards still alternatives.

The increasing availability of the still variants infused with various fruits, such as watermelon, blueberry, blackberry, lemon, mango, pomegranate, and mandarin orange, is boosting the consumption of the products. In May 2018, Just Goods, Inc. launched JUST Infused waters in lemon, tangerine, and apple cinnamon flavors.

Regional Insights

North America accounted for the largest revenue share of over 37% in 2020 and will expand further at a steady CAGR from 2021 to 2028 due to the rising product consumption as a healthy alternative to other carbonated drinks. Several popular brands, such as bubbly, AHA, Talking Rain, Nestlé Pure Life, Perrier, Schweppes, and LaCroix, offer a wide range of products in the region. Thus, the increased accessibility of the product has been boosting product adoption in the region.

Europe holds a significant share of the global market. Natural flavored and naturally carbonated waters with high levels of minerals make it more appealing to health-conscious consumers. The flavors added to the drinks are often obtained from natural fruit extracts. The product sales are strong in several countries, such as Germany, the U.K., Italy, Spain, and France, where the product is often served with meals in restaurants.

Asia Pacific is estimated to be the fastest-growing regional market from 2021 to 2028. Increasing consumer preference for the product, coupled with the expansion of quick-service and full-service restaurants, is likely to create a positive outlook for the market in the region. The rising consumer awareness about the benefits of following a healthy lifestyle has fueled the demand for healthy foods and beverages, which, in turn, will support the regional market growth.

Furthermore, the surge in disposable income of consumers has changed their food and beverage consumption patterns globally. Consumers are highly inclined toward the consumption of healthy foods and beverages and limiting the intake of sugary drinks that have adverse health effects. Many restaurants and bars have been serving the product, resulting in an optimistic outlook for the growth of flavored water over the forecast period.

Key Companies & Market Share Insights

The key players have been implementing various expansion strategies, such as mergers & acquisitions and new product launches, to strengthen their market share. For example, in February 2021, PepsiCo Inc. launched five new caffeinated sparkling waters under its Bubly brand. The company has expanded its line of caffeinated drinks with the addition of mango passion fruit, blood orange grapefruit, triple berry, blueberry pomegranate, and citrus cherry flavors. Some of the key players operating in the global flavored water market include:

-

Nestlé

-

Talking Rain

-

PepsiCo, Inc.

-

The Coca-Cola Company

-

Hint, Inc.

-

Spindrift

-

National Beverage Corp.

-

Sanpellegrino S.P.A.

-

KeurigDr Pepper, Inc.

-

Saratoga Spring Water Company

Flavored Water Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 14.71 billion

Revenue forecast in 2028

USD 29.56 billion

Growth rate

CAGR of 10.3% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; Japan; Brazil; South Africa

Key companies profiled

Nestlé; Talking Rain; PepsiCo, Inc.; The Coca-Cola Company; Hint, Inc.; Spindrift; National Beverage Corp.; Sanpellegrino S.P.A.; KeurigDr Pepper, Inc.; Saratoga Spring Water Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global flavored water market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Sparkling

-

Still

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Supermarkets & Hypermarket

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flavored water market size was estimated at USD 13.50 billion in 2020 and is expected to reach USD 14.71 billion in 2021.

b. The global flavored water market is expected to grow at a compound annual growth rate of 10.3% from 2021 to 2028 to reach USD 29.56 billion by 2028.

b. North America dominated the flavored water market with a share of 37% in 2020. This is attributed to the rising consumption of healthy alternatives to carbonated drinks.

b. Some key players in the flavored water market include Nestlé, Talking Rain, PepsiCo, Inc., The Coca-Cola Company, Hint Inc., Spindrift, National Beverage Corp., SANPELLEGRINO S.P.A, Keurig Dr Pepper Inc., and Saratoga Spring Water Company.

b. Key factors that are driving the flavored water market growth include increasing consumer preference for healthy alternatives to sugary soft drinks. Moreover, the rising preference for flavorful, healthy, and functional drinks among consumers is also driving the growth of this market.

b. The supermarkets & hypermarkets segment accounted for the largest revenue share of over 55% in 2020 and will grow further at a steady CAGR from 2021 to 2028 in the flavored water market.

b. The sparkling product segment accounted for the highest revenue share of more than 72% in 2020 and is estimated to expand further at a steady CAGR from 2021 to 2028 in the flavored water market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."