- Home

- »

- Medical Devices

- »

-

Foley Catheter Market Size, Share & Trends Report, 2030GVR Report cover

![Foley Catheter Market Size, Share & Trends Report]()

Foley Catheter Market Size, Share & Trends Analysis Report By Product Type (2-way, 3-way, 4-way), By Material (Silicone, Latex), By Indication (Urinary Incontinence, Enlarged Prostate Gland/BPH), By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-009-3

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global foley catheter market size was valued at USD 1.64 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.81% from 2023 to 2030. The growth of the foley catheters industry is due to the increasing prevalence of urological disorders such as urinary tract infections (UTIs), kidney and ureteral stones, rising preference for minimally invasive surgeries coupled with the rising geriatric population in the Asia Pacific region, especially in countries such as Japan, India, and China. The forecast period will see potential opportunities for market participants as a result of the pandemic's short-term impact on the foley catheters industry. The short-term impact of the pandemic on the market for foley catheters is caused by a number of factors, including the need to reduce the number of beds available for urological patients to dedicate beds and staff to the new COVID-19 wards, the need to prevent hospital contamination from infecting elective patients, and the fact that 30% of the remaining urology medical staff were completely dedicated to managing the infected patients on the newly established COVID-19 ward.

According to the African Journal of Urology in 2021, all types of elective urological procedures have decreased significantly. In particular, ureteroscopic lithotripsy, percutaneous nephrolithotomy, transurethral resection of the prostate, urethroplasty, and renal transplant had the highest cut-down. For instance, according to early urologic recommendations issued in April 2021, from weeks 8-9 to weeks 11-13, the trend for 2020 urologic activity dropped steadily (Average weekly %age changes range -41 % to -29.9 %; p 0.001). Additionally, as per the same source mentioned above, one-third of uro-oncologic procedures may have been postponed. As a result, due to the outbreak of the COVID-19 pandemic in 2020, sales of foley catheters dropped dramatically.

However, in phase 2 of the pandemic, the market is expected to grow and rebound over the forecast period, most governments around the world have begun to ease lockdown restrictions and recommence some elective surgeries. Key players intend to expand their enterprises regionally, build new warehouses in new places, and run their operations through multiple channels in the worst-affected areas.

For instance, in February 2020, Integer Holdings Corporation announced that it has finalized the acquisition of Inomec, establishing its presence in Israel. With the acquisition, Integer will be able to develop a regional R&D and sales center, as well as add critical catheter design, clinical, and pilot production skills to its extensive portfolio, enhancing its position as a preferred partner for new medical solutions.

Additionally, sourcing from additional partners, rerouting logistics, and air freight delivery are among the strategies companies are employing to deal with supply chain interruptions. These characteristics are projected to create lucrative market growth prospects.

The increasing prevalence of kidney stone disease, cystitis, benign prostatic hyperplasia, and other urinary tract disorders are expected to drive the foley catheters industry during the forecast period. According Journal of Taibah University Medical Sciences in 2021, kidney stones are one of the most excruciating urological conditions. It has recently become extremely common worldwide (7-13 % in North America, 5-9% in Europe, and 1-5% in Asia). Kidney stones also increase the risk of chronic kidney disease by 60% and end-stage renal disease by 40%, which is predicted to drive market expansion in the near future.

Over the past decade, the demand for Minimally Invasive Surgeries (MIS) is increasing. According to The Mount Sinai Hospital, in 2021, novel diagnostic techniques and less invasive therapies for prostate, kidney, and bladder malignancies, as well as a wide range of urologic illnesses, are becoming more widely used. Furthermore, between 2019 and 2021, there was a 50% increase in the number of procedures for advanced bladder cancer, a 20% increase in procedure volume for the kidney cancer program, and a 34% increase in volume for the prostate cancer program, all of which are expected to boost foley catheters industry growth in the near future.

Research results published by manufacturers (Ethicon Endo-Surgery, Inc.) suggest that minimally invasive surgeries are rapidly replacing invasive surgeries owing to the factors such as higher patient satisfaction owing to lesser incision wounds, involve a relatively lesser number of hospital stays, and therefore are economically viable and involve a lesser number of postsurgical complications and lower mortality rates. Foley catheters are used in minimally invasive procedures, thus the rising demand for minimally invasive surgeries is expected to boost the market during the forecast period.

Along with the above factors, the global foley catheters industry continues to undergo consolidation due to the rising popularity of medical equipment and along with increased research collaboration and agreements between diverse manufacturers. For instance, in February 2021,the acquisition of an Israeli medical equipment firm by Olympus Corporation has been completed. Olympus increases its business line by delivering in-office treatment for benign prostatic hyperplasia (BPH), which is expected to boost market growth in the near future.

Technological advancements, coupled with product launches, to streamline the procedures and make them safer & more cost-effective, are among the key factors contributing to market growth. For instance, in December 2018, NanoVibronix, Inc., a New York-based medical device company, expanded its agreement with MDS Pharm Ltd. for the distribution of UroShield, an ultrasound-based product designed for the prevention of bacterial colonization on indwelling urinary catheters, in Israel. Thus, the foley catheters industry is expected to grow rapidly in the coming years.

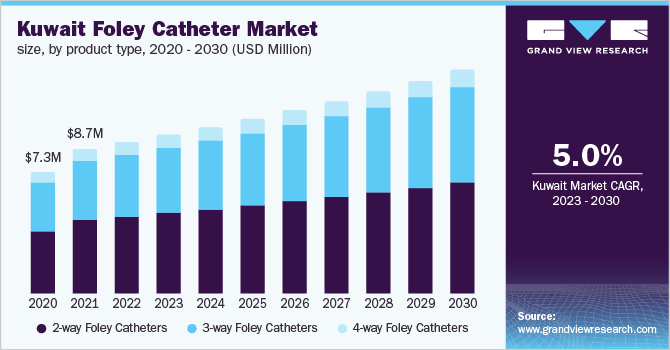

Product Type Insights

Based on product type, the 2-way foley catheters segment captured the largest market share with around 51.84% in 2022. The 2-way foley catheter is the most common type of indwelling catheter and it has two channels: one for passing urine and the other for inflating and deflating balloons. There are two connectors on 2-way foley catheters; one is used to drain urine from the bladder and the other to inflate the balloon. A pediatric version of the 2-way catheter is also available; it functions in the same way but has smaller dimensions to fit a child's smaller frame.

Moreover, strategic collaborations and new product launches are among the key strategies adopted by the key players to remain competitive which is expected to spur the segment growth. For instance, in November 2021the Flume Catheter Company Ltd. (TFCC) reported that the FDA has approved the company's plans to market the catheter ‘Flume’ across the country, which is anticipated to spur market expansion.

The 3-way foley catheters segment is expected to grow at the highest CAGR during the forecast period. The third channel on some three-way catheters allows for continuous bladder irrigation. When a prostate or bladder is bleeding and the bladder needs intermittent or continuous irrigation to clear debris or blood clots, this urinary catheter is frequently used.

Moreover, strategic collaborations and new product launches are among the key strategies adopted by the key players to remain competitive which is expected to spur the segment growth. For instance, In March 2019, Poiesis Medical, a manufacturer of urine drainage systems in Florida (U.S.), received an innovative technology contract from Vizient Inc., a Texas-based company, for its Duette dual balloon indwelling urinary catheters. These catheters are considered to reduce the incidence of Catheter-acquired Urinary Tract Infections (CAUTIs) by more than 80.0% in acute care settings, which is predicted to boost segment growth.

Material Insights

Based on material, the silicone foley catheters segment captured the largest market share with around 59.09% in 2022. These catheters have a lubricious covering that is permanently infused with silver ions. Ionic bonding keeps the silver in the hydrophilic coating, and it also has a unique surface modification technology that uses covalent bonding to keep it attached to the silicone surface. The silicone coating on the foley catheter provides a zone of resistance to bacteria around the catheter surface and inhibits microbial colonization on the device's surface, reducing the risk of catheter-related urinary tract infections, which is expected to fuel the segment's growth.

The main advantage of a silicone foley catheter is that it is effective for persons with sensitive skin and non-allergenic. While allergies to silicone can exist, they are much less common than allergies to latex. For those who experience pain during clean self-catheterization or intermittent, silicone may also be softer and so preferable. Due to its extreme smoothness and flexibility, silicone makes insertion simple and less painful for the urethra. They have less encrustation and are more tissue-friendly than latex. Furthermore, larger lumens are typically present in silicone catheters to enhance drainage.

The latex foley catheters segment is expected to grow at the highest CAGR during the forecast period. While latex catheters are made entirely of latex, they are otherwise identical to other catheters in design. Like silicone, latex is soft and flexible but also thermos-sensitive. This indicates that latex is more flexible because it can adjust to the temperature of its surroundings. Both Foley and intermittent catheters can be made of latex. People prefer using latex over other materials because of its thermos-sensitive characteristics. They are also flexible, which may help many people experience less discomfort during insertion.

Indication Insights

Based on the indication, the urinary incontinence segment dominated the market with around 35.80% of the revenue share. Urinary incontinence is a condition resulting in involuntary loss of control of the bladder. It has a significant impact on long-term care facilities and is one of the main reasons for the admission of elderly people to institutionalized care. Bladder incontinence is a result of various factors, such as changes in the urinary tract due to age, UTIs, and other indirect conditions such as diabetes, stroke, cancer, & mobility impairment.

According to the National Association for Continence, around 25 million people suffer from some form of incontinence in the U.S., with 75% to 80% of the female population. Urinary incontinence levies a financial burden on individuals and society. Growing awareness about incontinence, advancing technology, and rising adoption of these products for managing incontinence contribute to market growth.

The spinal cord injury segment is expected to grow at the highest CAGR during the forecast period. Spinal cord injury can affect the control of a patient over their bladder. This is a result of injury to nerves controlling the passage of signals from the bladder to the brain. Thus, nerves fail to relay the message for emptying of the bladder, which results in bladder dysfunction. Spinal shocks are another reason for incontinence and cause temporary loss of spinal cord reflexes. During spinal shocks, patients are catheterized because their bladder fails to drain urine. According to the National SCI Statistical Center's Data Sheet in 2020, there were about 17,810 new spinal cord injuries reported in the U.S. in 2020.

Additionally, spinal cord injury may result in bladder dysfunction, causing urinary incontinence, urinary retention, or frequent urination. There is an increase in the incidence of spinal cord injury due to various factors such as the growing geriatric population, which is prone to falls, and the rise in vehicular accidents & violence. Increasing cases of such injuries contribute to the growing demand for foley catheters

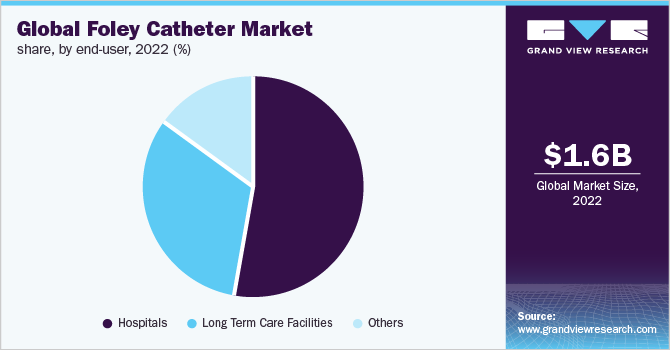

End-user Insights

The hospital segment dominated the market with a share of 53.14% in 2022. This segment's growth is mostly due to an increase in the number of patients suffering from various urological diseases, which has resulted in an increase in surgical treatments. Hospitals see a substantially higher inflow of patients for urological procedures or other treatments than other healthcare settings, owing to the simplicity of managing any emergencies that may develop during surgical procedures and the availability of a wide range of treatment alternatives. As a result, the hospital segment is likely to be driven by the aforementioned variables.

Long term care facilities segment is expected to grow at the highest CAGR during the forecast period. The lucrative expansion of this market is due to an increase in the adoption of minimally invasive surgeries, a high desire for outpatient surgeries, and the cost-effectiveness of long-term care facilities -based urology procedures. Lower postsurgical complications in minimally invasive urology surgery, on the other hand, are predicted to boost demand for long-term care facilities.

In comparison to hospitals, they provide patients with various benefits, including same-day release and faster procedure times. As a result of the factors discussed above, the long-term care facilities segment is expected to rise rapidly during the forecast period.

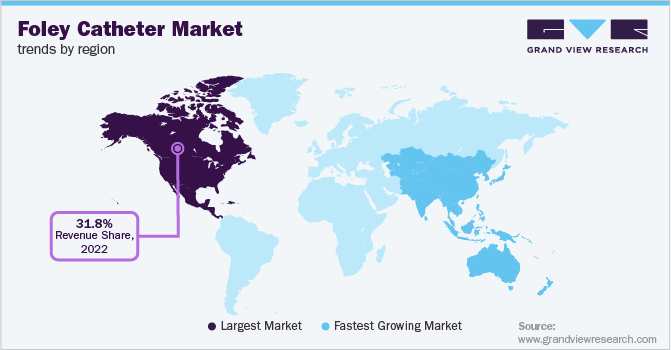

Regional Insights

North America dominated the foley catheters industry with the highest share of 31.83% in 2022. The increasing incidence of chronic kidney diseases (CKD) along with the rising aging population in developed economies is driving the demand for foley catheters for urological procedures. For instance, according to the Centers for Disease Control and Prevention in 2021, CKD is more common in those aged 65 and up (38%) than in those aged 18-44 years (6%), or 45-64 years (4%). Furthermore, CKD is significantly more common in women (14%) than in males (12%), which is predicted to boost the region's growth in the near future.

The U.S. dominated the market with the highest shares. This can be attributed due to the growing prevalence of urological disorders, the presence of a large number of urologists in the country, and the rising preference for minimally invasive surgeries. According to the American Urological Association (AUA) in 2020, the U.S. urologist population consists of a total of 13,352 practicing urologists, an increase of 2.4 % from 13,044 practicing urologists in 2019. Thus, this is expected to boost market growth.

Furthermore, the market growth in developed regions is primarily due to technological advancements in minimally invasive techniques. Rising price pressures and lower reimbursement are projected to stifle the overall increase in demand for these devices, particularly in developed regions such as Europe and North America. Furthermore, rising healthcare spending in the U.S. may encourage both new and old competitors to enter the market. According to the Centers for Medicaid and Medicare Services, healthcare spending in the U.S. would increase by 9.7% to USD 4.1 trillion in 2020, accounting for around 19.7% of GDP.

Asia Pacific is expected to register the fastest CAGR from 2023 to 2030. This can be attributed to the presence of a large population suffering from kidney diseases, improvement in medical facilities, and the availability of insurance policies. Moreover, the presence of a large patient pool and the growing need for technologically advanced & cost-efficient healthcare solutions are expected to present significant regional growth opportunities in the market. For instance, according to The Japan Times Ltd in September 2021, the number of people aged 65 and up in Japan had reached a new high of 36.4 million, resulting in hospitalization. The demand for foley catheters in the country is likely to increase as a result of this.

Key Companies & Market Share Insights

Global manufacturers are accelerating their production processes while also upgrading them by using cost-effective solutions in response to the surge in demand for foley catheters. For instance, in September 2021, Integer Holdings Corporation announced plans to expand its presence in Ireland, Galway, by building a new manufacturing plant and medical device invention in the Parkmore East neighborhood. This innovative facility is needed to fulfill the rising demand for regional development, manufacturing capabilities, and research, as well as delivery system capacity which is expected to drive market growth.

To maintain the surge in demand from diverse applications, leading businesses in the global market are enforcing higher product quality through mergers and acquisitions. For instance, in February 2019, Coloplast signed a 3-year agreement with Premier, Inc.-a U.S.-based healthcare improvement company-to sells its urology products. The general urological products include drainage systems, catheters, and other accessories. Some prominent players in the global foley catheter market include:

-

Sterimed Group.

-

Angiplast Pvt Ltd

-

HEMC (Hospital Equipment Manufacturing Company)

-

Cardinal Health

-

Advin Health Care

-

AdvaCare Pharma

-

Teleflex Incorporated

-

GWS Surgicals LLP

-

BACTIGUARD AB

-

Medtronic

-

Convatec Inc.

-

B. Braun

-

VOGT MEDICAL

-

Ribbel International Limited

-

C. R. Bard (BD)

-

Hollister Incorporated

-

Coloplast

Foley Catheter Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.73 billion

Revenue forecast in 2030

USD 2.57 billion

Growth Rate

CAGR of 5.81% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, material, indication, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway Japan; China; India; Australia; Thailand; South Korea;Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sterimed Group.; Angiplast Pvt Ltd; HEMC (Hospital Equipment Manufacturing Company); Cardinal Health; Advin Health Care; AdvaCare Pharma; Teleflex Incorporated; GWS Surgicals LLP; BACTIGUARD AB; Medtronic; Convatec Inc.

B. Braun; VOGT MEDICAL; Ribbel International Limited; C. R. Bard (BD); Hollister Incorporated; Coloplast

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foley Catheter Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global foley catheter market report based on product type, material, indication, end-user, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2-way Foley Catheters

-

3-way Foley Catheters

-

4-way Foley Catheters

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicone Foley Catheters

-

Latex Foley Catheters

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Urinary Incontinence

-

Enlarged Prostate Gland/BPH

-

Spinal Cord Injury

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Long Term Care Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global foley catheters market size was estimated at USD 1,646.15 million in 2022 and is expected to reach USD 1,737.81 million in 2023.

b. The global foley catheters market is expected to grow at a compound annual growth rate of 5.81% from 2023 to 2030 to reach USD 2,579.69 million by 2030.

b. North America dominated the foley catheters market in 2022 and is expected to witness a growth rate of 5.45% over the forecast period. This is due high prevalence of urological disorders such as prostate cancer, bladder cancer, and others along with technological advancements.

b. Prominent key players operating in the foley catheters market include Sterimed Group., Angiplast Pvt Ltd, HEMC (Hospital Equipment Manufacturing Company), Cardinal Health, Advin Health Care, AdvaCare Pharma, Teleflex Incorporated, GWS Surgicals LLP, BACTIGUARD AB, Medtronic, Convatec Inc., B. Braun, VOGT MEDICAL, Ribbel International Limited, C. R. Bard (BD), Hollister Incorporated, Coloplast & others.

b. Key factors that are driving the foley catheters market growth include a surge in the number of surgical procedures for urological diseases and increasing demand for minimally invasive surgeries. In addition, the rising geriatric population, and increasing various initiatives by major key market players such as acquisitions, mergers, product launches are anticipated to boost the market are further fuelling the growth of the foley catheters market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."