- Home

- »

- Plastics, Polymers & Resins

- »

-

Food Packaging Market Size & Share Analysis Report, 2030GVR Report cover

![Food Packaging Market Size, Share & Trends Report]()

Food Packaging Market Size, Share & Trends Analysis Report By Type (Rigid, Semi-rigid, Flexible), By Material (Paper, Plastic), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-365-2

- Number of Pages: 160

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Food Packaging Market Size & Trends

The global food packaging market size was valued at USD 362.9 billion in 2022, and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. The change in eating habits and the quickening pace of life has driven the demand for packaged food and is expected to significantly impact the food packaging industry. Moreover, the benefits offered by food packaging such as extended and stable shelf-life, high barrier properties, and safety, thereby boosted the food packaging industry's growth. Factors such as the use of high-performance materials and the availability of diverse material compositions in the market are expected to aid the growth of the food packaging industry.

Food packaging provides various key benefits such as the prevention of food contamination and improvement of food shelf-life along with heightened efficiency. These are expected to boost the food packaging industry's growth. Moreover, the shrinking household size, rising disposable income, and the increasing population are also expected to positively impact the market.

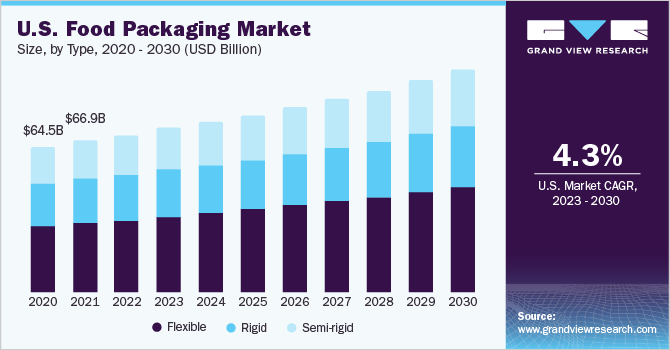

The growth of the industry in the U.S. is expected to be fueled by the rising popularity of single-serve packs and the growing urban population percentage leading to the growing consumption of packaged food. Industry growth. These factors are also supported by increasing infrastructural developments for the recycling of glass, metals, and plastics. However, concerns regarding wastage due to improper packaging may hamper growth.

The bargaining power of buyers in the food packaging industry is expected to remain high during the forecast period. The packaged food industry is characterized by the presence of a large number of buyers, which is expected to increase over the forecast period. In addition, buyers seek innovative and customized solutions for their products and exhibit high levels of price sensitivity. Furthermore, they often resort to material substitution.

The food packaging industry is highly regulated by government agencies such as the U.S. FDA and European Commission. These agencies impose stringent regulations regarding the use of materials for food packaging and types of food packaging. The food packaging industry is shifting toward including sustainable packing materials such as bio-based plastics which in turn is further expected to heighten industry growth.

Rising sales of retail products and a growing trend for online purchasing are expected to have a positive influence on the market. The busy lifestyle and the introduction of health-conscious new snack variants such as baked & low-fat by snack manufacturing companies are also increasing the consumption of snacks over traditional food. This, in turn, is further anticipated to drive demand for packaged food products, which is consequently estimated to boost market growth.

During the COVID-19 pandemic, the sales of online goods and services increased due to the shift from offline to online purchasing. This trend continued to grow post-normalization of operations. The introduction of a new type of online shopping experience with multiple touchpoints for consumers benefitted the sales of food packaging solutions used in the e-commerce industry, which in turn, is expected to contribute to the food packaging industry growth in the coming years.

Type Insights

Flexible-type packaging dominated the food packaging industry in 2022 and accounted for over 43.0% of the overall market share in terms of revenue. Flexible packaging is the fastest-growing segment owing to its ability to offer thin, light, and compact packaging solutions. A shift in demand from rigid to flexible packing solutions is expected to boost segment growth. Superior performance and convenience offered by retortable packaging are expected to exhibit the largest demand over the forecast period.

Rigid packaging is widely used owing to its properties such as a high barrier to oxygen, light, and moisture, preventing contamination of food. Rigid packaging has witnessed a growing demand from North America owing to the increasing consumer demand for packaged food offering nutritional value and convenience.

The demand for fresh food products such as fruits and vegetables, along with processed protein-rich fish and meat, is steadily growing in countries such as Canada, China, and India owing to health awareness among the masses. Rigid products are extensively utilized for the packaging of these products, contributing to segment growth.

Applications of semi-rigid packaging include dairy products, fresh sandwich packs, and bakery and confectionery products. Thus, increased consumption of milk and dairy products and bakery and confectionary products is expected to drive demand for semi-rigid packaging.

Material Insights

The plastics segment dominated the material segment and accounted for over 39.0% of the total market revenue in 2022. Plastic food packaging is expected to witness rapid growth owing to adoption by end users due to its lower prices. The rising usage of plastic films in secondary food packing is anticipated to have a positive influence on the industry. Superior properties offered by plastic packaging such as increased sealing capacity and high moisture barrier are presumed to drive demand.

Paper and paper-based materials accounted for over 33.0% of the total market revenue in 2022. The growth of this segment is driven by high product adoption in packaging as an alternative to non-biodegradable packing solutions. Innovations in design, ease of printability, and sustainability gives paper packaging a competitive advantage over plastic and metal packing solutions.

The stringent regulations governing packaging products are expected to pose several challenges. California, Delaware, Connecticut, Maine, Hawaii, New York, Vermont, and Oregon are among the states that have banned single-use plastic bags. This trend is expected to impact the growth of plastic materials in the North American market for food packaging over the forecast period.

Metal packaging is commonly used for applications such as canned food, fish, meat, and canned fruits. Growing demand for metal cans owing to the extended shelf-life of food products, tamper-proof packing, and nutrition preservation is predicted to boost industry growth. A rise in investments and technological and design innovations are expected to drive the growth of this segment.

Growing demand for glass packaging in food products on account of its non-corrosive nature is expected to bolster demand in the food packaging industry. In addition, recyclability, non-permeability, and chemical inertness make it a suitable material for direct food contact.

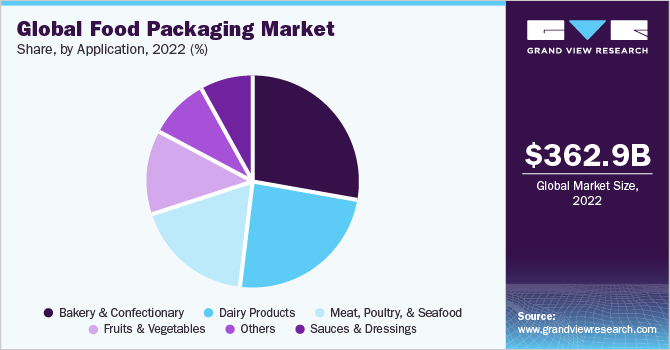

Application Insights

The bakery and confectionery product segment dominated the application segment and accounted for over 27.0% of the total market revenue in 2022. Bakery and confectionary products are generally packed with high moisture barrier packaging to extend their shelf life. Flexible packaging is widely used for the aforementioned applications owing to its advantages such as cost-effectiveness over tins and paper cartons, printability, and lightweight. The attractive packaging of confectionary products is expected to boost the growth of the industry.

The shrinking households have driven consumer inclination toward dairy products in smaller packs which are anticipated to further augment the flexible food packaging industry growth. The adoption of attractive packaging strategies by manufacturers is also likely to boost the growth of the dairy product segment. Moreover, rising demand for dairy products such as yogurt and ice cream is expected to augment segment growth.

The growing presence of vegans globally has increased the growth opportunities for companies that operate in the plant-based packaged food industry. The demand for ready-to-eat meals is expected to witness significant growth during the forecast period.

Rising health awareness is projected to drive demand for fruits and vegetables, and subsequently packaging solutions for the same. Additionally, rising consumer disposable income has led to a rise in demand for garden fresh products. Increasing consumer demand for environment-friendly packing solutions with low costs and ease of handling is expected to drive demand over the next few years.

In addition, the emergence of online meat and seafood marinated product-selling brands such as Licious, Angus Meats, and Wegmans Food Markets among others is expected to further drive the market growth. Moreover, government initiatives to promote healthy eating habits are expected to boost demand for sterilizable packaging of seafood, poultry, and meat which in turn can contribute to the market growth.

Regional Insights

Asia Pacific is estimated to become the largest market, followed by Europe and North America. The Asia Pacific region accounted for over 38.0% of the total market revenue in 2022. The food packaging industry is expected to be driven by rising per capita income, increasing population, and growing demand for packaged food in emerging economies such as India, Japan, and China.

China is the largest consumer owing to its large population and growing economy. The food packaging industry in China is expected to grow at a significant rate owing to its expanding middle class and its rising purchasing power. India is the fastest-growing market owing to the increasing usage of retail chains.

The thriving retail sector, coupled with the high consumption of packaged food by consumers, is expected to drive demand for packaging solutions in North America. In addition, the region benefits from the presence of a large number of manufacturers.

Despite the high saturation level, Europe is expected to exhibit a positive outlook over the forecast period. Europe’s single market policy allows free trade within the region and this is anticipated to encourage exports, consequently driving industry growth.

Key Companies & Market Share Insights

The market exhibits the presence of a large number of players, most of which operate through North America and Europe. Players are exhibiting immense interest in investing in Asia Pacific to expand their business. They operate through dedicated distribution networks and manufacturing locations across the globe.

To increase their market share and augment their revenues, companies offer extensive product customizations. They strive to replace existing materials with biodegradable ones to meet changing government standards. A large number of companies are integrated across the value chain and indulge in captive consumption of raw materials to reduce production costs.

In recent years several packaging technologies have been introduced in the global market due to continuous investments in research & development programs by leading packaging companies. Child-proof & elderly-friendly packaging, retort packaging, modified atmosphere packaging (MAP), and temperature-controlled packaging, are a few of the commonly used packaging technologies.

The value additions in the packaging offered by manufacturers have resulted in a significant expansion of the market size in terms of revenue and benefitted the companies in terms of profit margin. Most of the market players engage in acquiring other food packaging manufacturers to expand their market reach. For instance, on June 1, 2023, ALPLA UK acquired iTEC Packaging which specializes in manufacturing closures for dairy and other food & beverage sectors. Some prominent players in the global food packaging market include:

-

Amcor plc

-

Sealed Air

-

Sonoco Products Company

-

Berry Global, Inc.

-

WestRock Company

-

Mondi

-

Genpak LLC

-

Pactiv LLC

-

Chantler Packages

-

WINPAK LTD.

-

Alpha Packaging

-

BE Packaging

-

Cheer Pack North America

-

Evanesce Packaging Solutions Inc.

-

Pacmoore Products Inc.

-

Innovative Fiber

-

Emmerson Packaging

-

PakTech

-

Tradepak

-

ProAmpac

Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 380.8 billion

Revenue forecast in 2030

USD 562.3 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, trends

Segments Covered

Type, material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

Amcor plc; Sealed Air; Sonoco Products Company; Berry Global, Inc.; WestRock Company; Mondi; Genpak LLC; Pactiv LLC; Chantler Packages; WINPAK LTD; Alpha Packaging; CuBE Packaging; Cheer Pack North America; Evanesce Packaging Solutions Inc; Pacmoore Products Inc.; Innovative Fiber; Emmerson Packaging; PakTech; Tradepak; ProAmpac

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global food packaging market report based on type, material, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rigid

-

Semi-rigid

-

Flexible

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Paper & Paper-based Material

-

Plastics

-

Metal

-

Glass

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bakery & Confectionary

-

Dairy Products

-

Fruits & Vegetables

-

Meat, Poultry, & Seafood

-

Sauces & Dressings

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global food packaging market size was estimated at USD 362.9 billion in 2022 and is expected to reach USD 380.8 billion in 2023.

b. The global food packaging market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 562.3 billion by 2030.

b. Flexible packaging was the dominant type of segment, occupying over 43.0% share in 2022, and is expected to experience significant growth over the forecast period.

b. Some of the key players in the food packaging market are Amcor plc, Sealed Air, Sonoco Products Company, Berry Global, Inc., WestRock Company, Mondi, Genpak LLC, Pactiv LLC, Chantler Packages, WINPAK LTD, Alpha Packaging, CuBE Packaging, Cheer Pack North America, Evanesce Packaging Solutions Inc, Pacmoore Products Inc., Innovative Fiber, Emmerson Packaging, PakTech, and Tradepak.

b. The key factors that are driving food packaging include the high penetration of retail chains offering convenience food products, the busy lifestyle of consumers inclined toward ready-to-eat food and beverages, and the large number of food service chains offering food and beverages products according to changing needs of the customers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."