- Home

- »

- Consumer F&B

- »

-

Frozen Food Market Size, Share, And Growth Report, 2030GVR Report cover

![Frozen Food Market Size, Share & Trends Report]()

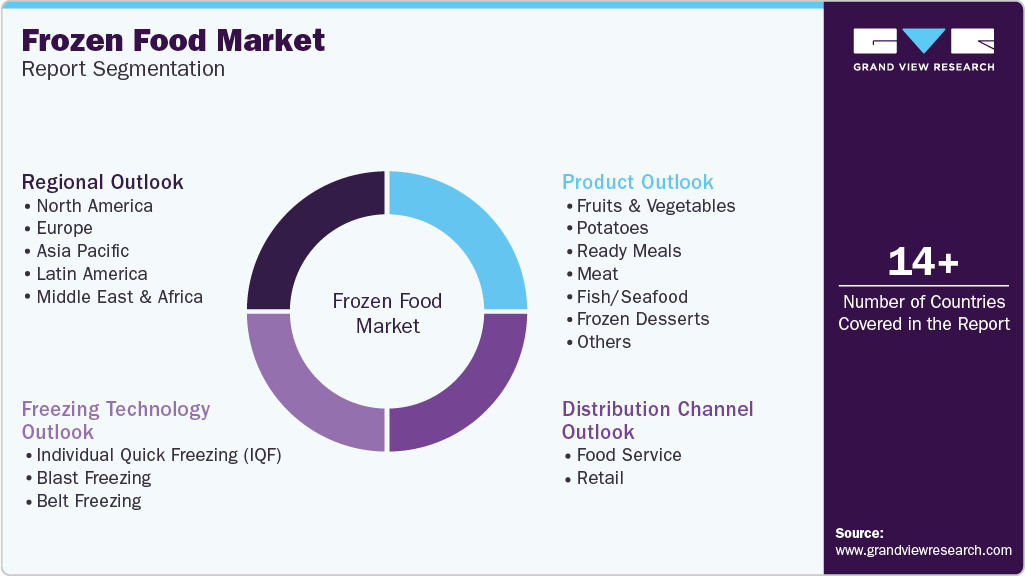

Frozen Food Market Size, Share & Trends Analysis Report By Product (Fruits & Vegetables, Potatoes, Ready Meals), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-280-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Consumer Goods

Frozen Food Market Size & Trends

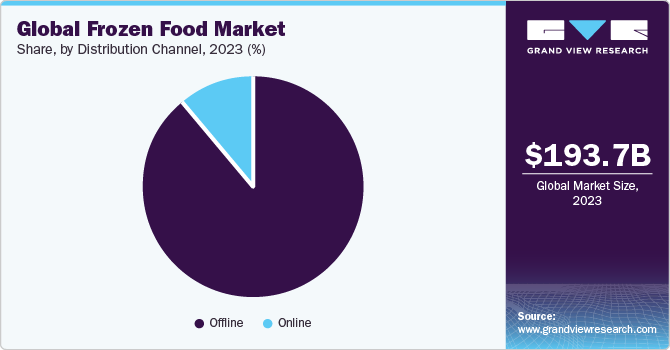

The global frozen food market size was valued at USD 193.74 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. Increasing popularity of shelf-stable foods among consumers on a global level is expected to boost industry growth over the next few years. According to an article published in Progressive Grocer in August 2021, popularity of these foods including breakfast meals rose by 10.9%, dinners/entrees was up by 4.9%. frozen meat, up 2.7% and processed chicken (up 10.4%). Moreover, the utilization of these products by numerous end-users, such as full-service restaurants, hotels & resorts, and quick service restaurants (QSRs), will support market growth.

Rising prevalence of gluten-free dietary lifestyles among consumers owing to various health benefits offered by these products will boost the market for gluten-free ready meals. For instance, in March 2022, Halo Top, an ice-cream brand from Wells Enterprises, Inc., launched a line of fruity frozen desserts with new sorbet pints. These products are available in three flavors including raspberry, mango, and strawberry. In addition, these products are made from real fruits, with less sugar & calories and are vegan-certified, and gluten-free. Rise in trend of healthy eating among buyers will further integrate well for the industry expansion.

The growing penetration on the online platforms is one of the major frozen market strategy of the companies. For instance, in March 2022, GoodPop frozen pops launched a United States Department of Agriculture (USDA) certified organic pops that are 100% fruit juice-based and made with no added sugar. The pops will be available in pack of six in three flavors, orange, cherry, and grape. These products will be available at GoodPop’s online shop across the U.S. beginning in April. Hence, initiatives like these will propel market growth in the coming years.

Increasing women employment rate has been witnessed globally in the recent years. According to U.S. Bureau of Labor Statistics April 2021, the employment rate was 68% for women in January 2020. Similarly, in China, the women employment rate was around 61.8% in 2020. With a rise in the number of employed women, it becomes significantly difficult for them to cook meals, which results in consuming frozen ready meals. All these factors collectively drive industry growth. Popular products in the segment include chicken pies, mini cottage pie, smoked haddock kedgeree, and broccoli & cheddar bake.

Moreover, the trend of stay-at-home across the globe during the COVID-19 pandemic shifted consumer preferences to ready-to-eat (RTE) food products as it can be stored for a longer duration. For instance, in October 2021, Amul, an Indian food retailer, expanded its frozen and RTE food offerings including foods, such as frozen potatoes, paneer, cheese parathas, and patties.

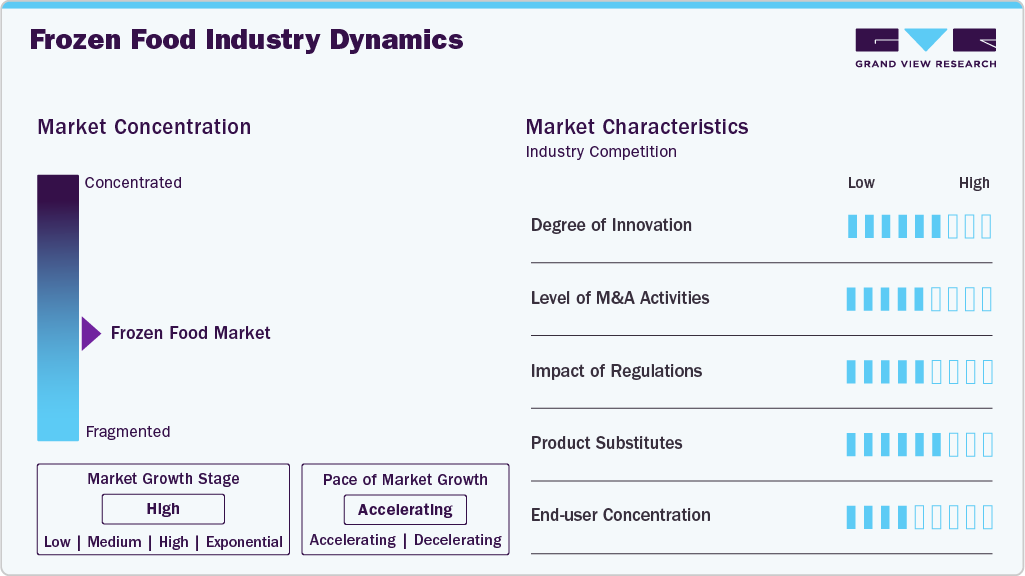

Market Concentration & Characteristics

The degree of innovation in this market has significantly increased in recent years, with companies introducing new products and enhancing existing offerings to meet evolving consumer demands. Innovations range from the development of healthier, organic, and natural frozen food options to the integration of advanced freezing technologies to preserve nutritional value and taste

The frozen food market has experienced a significant level of M&As, driven by the pursuit of expansion, diversification, and market consolidation. Large food corporations have sought to strengthen their positions and product portfolios through acquisitions of smaller, specialized companies, aiming to capitalize on emerging consumer trends and preferences

Regulations play a crucial role in shaping the market, influencing aspects, such as product safety, labeling requirements, and environmental sustainability. Stringent food safety regulations necessitate compliance with standards for handling, processing, and storage of frozen food products, ensuring consumer health and confidence. In addition, labeling regulations, including ingredient transparency and nutritional information, impact consumer perception and purchasing decisions

Product substitutes in this market include fresh produce, canned goods, and RTE meals. Fresh produce offers a natural alternative to frozen fruits and vegetables, positioned as a healthier, albeit shorter shelf-life option. Canned goods, such as soups and vegetables, provide convenient, long-lasting alternatives to frozen products. In addition, the RTE meal sector, encompassing fast food and meal kits, offers consumers immediate consumption options that compete with frozen dinners

Product Insights

The ready meals segment held the largest share of 42.9% in 2023 and is expected to maintain dominance over the forecast period on account of pre-dominant consumption of ready meals among working-class people around the globe. According to an article published in BioMed Central (BMC) February 2020, nearly 36% of the U.S. adults reported consumption of RTE meals. Furthermore, the segment is expected to witness growth on account of new product launches. For instance, in September 2021, China’s HEROTEIN launched sixteen RTE plant-based meat meals including various types of chicken and beef. The entire range is fully plant-based and will be distributed across China.

The fruits & vegetables segment is projected to register the fastest growth CAGR of 6.2% from 2024 to 2030. Owing to increasing prevalence of lifestyle diseases, consumers are shifting to these products as they do not need to be washed, peeled or chopped. Diseases, such as bloated stomach and diarrhea, are caused by eating infected or unclean food. In line with this, manufacturers are launching unique product variants, incorporating herbs and spices from local produce, to widen their portfolio and attract a large consumer base. For instance, in January 2021, Mother Dairy launched two new frozen vegetables under Safal brand including Drumsticks and Cut Okra.

Distribution Channel Insights

The offline segment held a revenue share of 89.2% in 2023. This channel includes supermarkets/hypermarkets, convenience stores, grocery stores, and local shops. Increasing number of these stores across various regionshave experienced surge in the distribution of frozen food in the market. According to an article published by Talking Retail, in April 2021, the sales of frozen food via grocery market, increased by 14.4% in value and 11.5% in volume in 2020. Moreover, easy access of such products in brick and mortar stores on a global level is expected to keep the momentum of the segment over the next few years.

The online distribution channel segment is anticipated to grow at a CAGR of 5.6% from 2024 to 2030. Promising growth exhibited by e-commerce platforms in emerging as well as developed countries, is compelling manufacturers to reorient their retail strategies in these countries. For instance, in April 2021, Amazon launched Aplenty, a private label food and snack brand with more than hundred products including frozen foods, pita chips, crackers, mini cookies, and condiments. These foods will be available online and in-store at Amazon Fresh, which will further increase product visibility among consumers.

Regional Insights

North America made the largest contribution in the global market with a share of 33.1% in 2023. Growing popularity of frozen foods among consumers in this region, especially among millennials, due to single serving options and ease of preparation is expected to drive the market growth. For instance, in October 2019, Bell & Evans launched a line of uncooked, frozen chicken meatballs. Flavors include parmesan breaded with mozzarella, buffalo seasoned and a traditional, savory chicken meatball. All three varieties are made from a blend of dark meat chicken and skin for full flavor and are uncooked and nitrogen chocked to lock in freshness and natural juices.

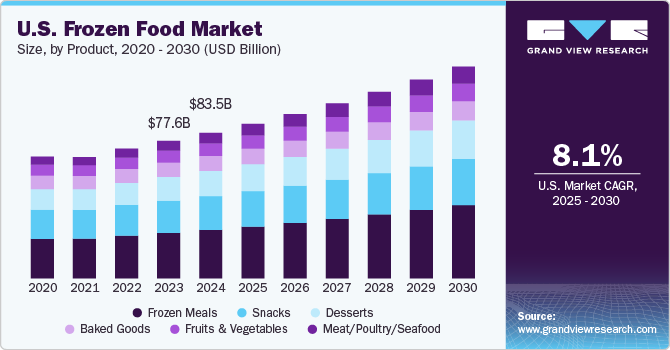

U.S. frozen food market

Frozen food market in the U.S. is projected to grow at a CAGR of 5.0% from 2024 to 2030. As a result of the increasing consumer focus on healthier eating habits, there is a demand for frozen foods that are perceived as nutritious, natural, and free from additives.

Canada frozen food market

The frozen food market in Canada is mainly driven due to the growing demand for frozen foods perceived as nutritious, natural, and free from additives, reflecting the increasing focus on healthier eating habits in Canada.

Furthermore, opening opportunities for developing country supplier in Brazil, Canada, and Mexico will surpass the market growth trend in the future. The Asia Pacific frozen food market is expected to register the fastest CAGR of 5.9% from 2024 to 2030. The increasing availability of frozen products that are high in protein, low in calories & fats, and which address specific dietary requirements, such as dairy-free, vegan, sugar-free, gluten-free, and plant-based products, will boost regional market growth. For instance, in June 2021, First pride, a food brand in Asia Pacific rolled out frozen bites, nuggets, and strips made with plants in Malaysia and other regional markets, which will increase the sales of these products. Frozen food market size in Bangladesh is notable owing to the shifting consumer lifestyles, characterized by busier schedules and increased urbanization.

Indian Frozen Food Market

The frozen food market in India is mainly driven due to the rapid urbanization and an increase in dual-income households have led to busier lifestyles, driving the demand for convenient and time-saving meal options, which frozen foods provide. India frozen food market analysis by segment include the products such as fruits & vegetables, potatoes, ready meals, meat, fish/seafood, and distribution channels.

Japan frozen food market

The frozen food market in Japan mainly driven by the evolving consumer preferences, increased health and nutrition awareness driving the demand for healthier frozen food options. Moreover, the frozen food market in Malaysia is experiencing the significant growth over the forecast period due to the convenience and time-saving nature of frozen foods in response to busy lifestyles.

The growth of the frozen food market in Indonesia can be attributed to the expansion of urban areas in the country, which has resulted in a higher demand for convenience foods, with frozen foods serving as quick and easy meal solutions for urban dwellers. The Vietnam frozen food market is mainly driven due to the presence of modern retail formats, such as supermarkets and hypermarkets, has made a wider variety of frozen food products more accessible.

The frozen food market in Europe is projected to grow at a CAGR of 5.2% over the forecast period owing toseveral key factors, including changing lifestyles that drive demand for convenient meal options, the introduction of healthier and more diverse frozen food products to cater to consumer preferences, sustainable practices within the industry

UK frozen food market

The growth of the frozen food market in the UK can be attributed to manufacturers' continual introduction of new and innovative frozen food products, including gourmet options and international cuisines, in response to changing consumer preferences.

The frozen food market in Saudi Arabia hold a notable share in the Middle East and Africa region driven by shifting consumer lifestyles, including an increase in dual-income households and a demand for convenient meal solutions.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of a large number of global players. Some of the key players in the industry are Unilever PLC; Nestlé S.A.; General Mills, Inc; Nomad Foods Ltd.; Tyson Foods Inc.; Conagra Brands Inc.; Wawona Frozen Foods; Bellisio Parent, LLC; The Kellogg Company; and The Kraft Heinz Company. The market players face intense competition, especially from the top manufacturers of this market as they have a large consumer base, strong brand recognition, and vast distribution networks. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead in the game.

-

In July 2023, Conagra Brands, Inc. revealed over 50 new products spanning their frozen, grocery, and snacks divisions. Within Conagra's frozen meal portfolio, there is a wide variety of flavors and price points available across their brands and entrees

-

In March 2021, Nomad Foods acquired Fortenova’s frozen food business. The deal for the divestment of the above mentioned business covers Ledo Plus, Ledo Citluk, Frikom and several smaller affiliated companies

-

In January 2021, Imperial Tobacco Company of India Limited (ITC) expanded its frozen snacks business three times during the COVID-19 pandemic with conglomerate adding 10 new products during the period

-

In June 2020, GOELD, a frozen food business by the Goel Group was launched. The brand offers fifteen products in four categories, including Indian breads, snacks, desserts, and vegan treats

Key Frozen Food Companies:

The following are the leading companies in the frozen food market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these frozen food companies are analyzed to map the supply network.

- Unilever PLC

- Nestlé S.A.

- General Mills, Inc.

- Nomad Foods Ltd.

- Tyson Foods Inc.

- Conagra Brands Inc.

- Wawona Frozen Foods

- Bellisio Parent, LLC

- The Kellogg Company

- The Kraft Heinz Company

Recent Developments

-

In July 2023, Conagra Brands, Inc. revealed over 50 new products spanning their frozen, grocery, and snacks divisions. Within Conagra's frozen meal portfolio, there is a wide variety of flavors and price points available across their brands and entrees

-

In March 2021, Nomad Foods acquired Fortenova’s frozen food business. The deal for the divestment of the above mentioned business covers Ledo Plus, Ledo Citluk, Frikom and several smaller affiliated companies

-

In January 2021, Imperial Tobacco Company of India Limited (ITC) expanded its frozen snacks business three times during the COVID-19 pandemic with conglomerate adding 10 new products during the period

-

In June 2020, GOELD, a frozen food business by the Goel Group was launched. The brand offers fifteen products in four categories, including Indian breads, snacks, desserts, and vegan treats

Frozen Food Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 203.12 billion

Revenue forecast in 2030

USD 278.47 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Actual

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, freezing technology, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, Italy, Spain, France, Russia, China, Japan, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Unilever PLC; Nestlé S.A.; General Mills, Inc; Nomad Foods Ltd.; Tyson Foods Inc.; Conagra Brands Inc.; Wawona Frozen Foods; Bellisio Parent, LLC; The Kellogg Company; and The Kraft Heinz Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Frozen Food Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global frozen food market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Fruits & Vegetables

-

Fruits

-

Berries

-

Tropical Fruits

-

Citrus Fruits

-

Grapes

-

Stone Fruits

-

Others

-

-

Vegetables

-

Peas

-

Broccoli

-

Cauliflower

-

Carrot

-

Bell Paper

-

Beans

-

Mushroom

-

Avocado

-

Corn

-

Others

-

-

-

Potatoes

-

Ready Meals

-

Meat

-

Fish/Seafood

-

Dairy Products

-

Bakery Products

-

Others

-

-

Freezing Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

Individual Quick Freezing (IQF)

-

Blast Freezing

-

Belt Freezing

-

-

Distribution channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Food Service

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

- Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global frozen food market size was estimated at USD 193.74 billion in 2023 and is expected to reach USD 203.12 billion in 2024

b. The frozen food market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 278.47 billion by 2030.

b. North America dominated the market for frozen food and accounted for a 33.1% share of the global revenue in 2023. Growing affinity towards frozen food among consumers specially millennials due to single serving options and ease in preparation is expected to drive the market in the forecast period.

b. Some of the key market players in the frozen food market are Unilever PLC; Nestlé S.A.; General Mills, Inc; Nomad Foods Ltd.; Tyson Foods Inc.; Conagra Brands Inc.; Wawona Frozen Foods; Bellisio Parent, LLC; The Kellogg Company; and The Kraft Heinz Company, and others

b. Key factors that are driving the market growth include growing importance of Ready-to-Eat (RTE) food products as a result of hectic lifestyles among working-class individuals and increasing popularity of shelf-stable foods among consumers on a global level

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."