- Home

- »

- Power Generation & Storage

- »

-

Fuel Cell Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Fuel Cell Market Size, Share & Trends Report]()

Fuel Cell Market Size, Share & Trends Analysis Report By Product (PEMFC, MCFC, PAFC, SOFC, AFC, MFC), By Components, By Fuel, By Size, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-087-3

- Number of Pages: 95

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Energy & Power

Fuel Cell Market Size & Trends

The global fuel cell market size was estimated at USD 7.35 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 27.1% from 2024 to 2030. Increasing demand for unconventional energy sources is one of the key factors driving the growth. Growing private-public partnerships and reduced environmental impact are expected to propel the demand. Governments across the globe are anticipated to supplement the developments by offering support in different forms, including funding R&D activities and funding suitable financing programs. Building a robust regulatory framework is vital as government enterprises need to provide an environment that is favorable for investment.

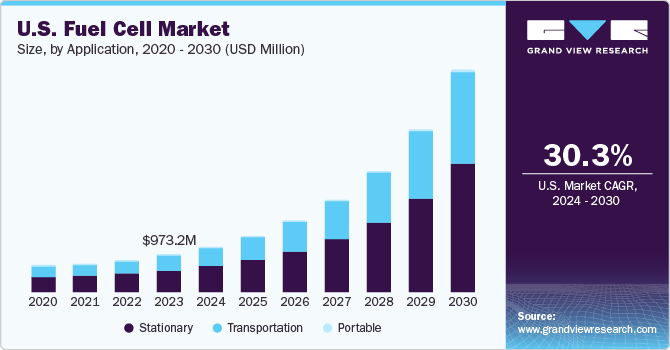

Most of the U.S. states, such as California and New York, have set mandates to limit the carbon emissions from commercial and industrial end users in the country. This has resulted in end users opting for clean energy technologies to comply with the mandate and limit their carbon footprint. Bloom Energy, one of the major fuel cell vendors in the U.S., provides its bloom energy servers for power generation application to aid commercial and industrial end users limit their carbon footprint.

For instance, in September 2023, FuelCell Energy, Inc. and Toyota Motor North America announced the completion of Tri-gen system at Toyota's Port of Long Beach operations. Tri-gen is an example of FuelCell Energy's ability to scale hydrogen-powered fuel cell technology. Such innovative ideas is expected to foster the demand of fuel cell market over forecast period.

Fuel cell market is a rapidly growing sector with a wide range of potential opportunities. The technology is constantly improving, with new materials and designs leading to increased efficiency and performance. This is making fuel cells more attractive for a wider range of applications. Transportation sector is one of the largest markets for fuel cells. Fuel cell electric vehicle (FCEVs) offer several advantages over battery-electric vehicles (BEVs), such as longer range and faster refueling times. As the cost of FCEVs comes down and the hydrogen infrastructure grows, the market for fuel cell vehicles is expected to boom. Companies operating in the market continuously launch new products in order to pace up with the growing fuel cell technology. For instance, in January 2024, Nikola Corporation launched 42 and wholesaled 35 Class 8 Nikola hydrogen-powered fuel cell electric vehicles (FCEVs) under HYLA brand for U.S. and Canada customers. The trucks are featured to run with a range of 500 miles with an estimated fueling time as low as 20 minutes.

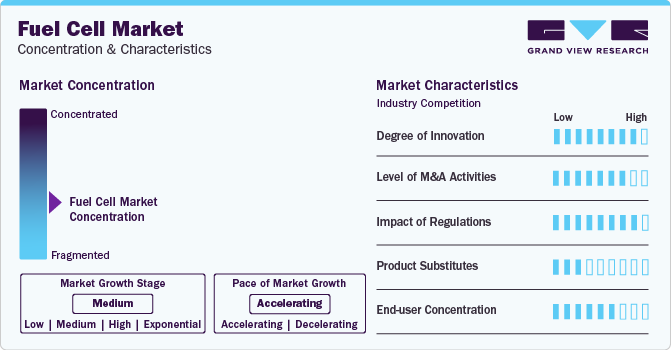

Market Characteristics

Market is a dynamic and competitive space with established players and innovative newcomers vying for dominance. Also, the industry is facing fierce competition from established players in various sectors. Leading companies like Ballard Power Systems, Plug Power, Bloom Energy, and FuelCell Energy have been in the industry for years, boasting extensive experience and established customer bases. They often specialize in specific applications, like Ballard in FCEVs and Bloom in stationary power. Startups and smaller companies are entering the fray with innovative technologies and disruptive business models. Companies such as Google and Amazon are exploring fuel cell applications in data centers and other sectors, leveraging their expertise in the industry.

Supportive government policies, such as subsidies and tax breaks, can incentivize fuel cell adoption and accelerate market growth. Also, raising public awareness about the benefits of fuel cells, such as clean energy and zero emissions, can drive demand and market expansion.

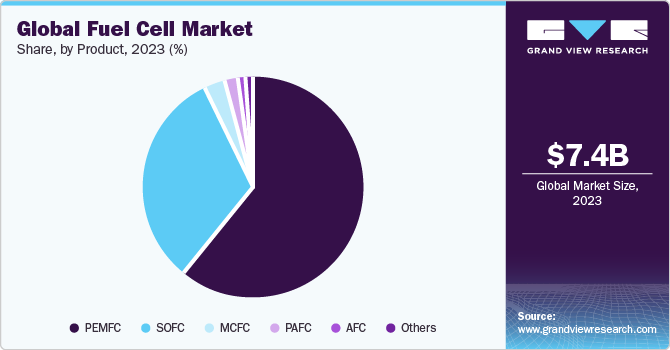

Product Insights

Proton exchange membrane fuel cell (PEMFC) accounted for more than 60.0% of the global market in terms of revenue in 2023. PEMFC is widely used in applications such as forklifts, automobiles, telecommunications, primary systems, and backup power systems. Versatility is a major factor slated to bolster their demand in the forecast period.

PEMFC requires pure hydrogen, oxygen, and water for its working. It operates at a comparatively lower temperature of around 80°C, making it eligible for quick start and less prone to wearing of system components. As a result, PEMFC is more durable than other product types. In addition, it provides advantages such as low weight and volume as compared with other available fuel cell types.

In the U.S., the Department of Energy (DOE) has provided funding for fuel cell development through programs such as Fuel Cell Technologies Office (FCTO) and Solid Oxide Fuel Cell (SOFC) program. Solid oxide fuel cell (SOFC) is expected to be the fastest-growing product segment over the forecast year. All the components in SOFC are solid, so the need for electrolyte loss is negated. Their ability to operate at high temperatures minimizes the need for costly catalysts, including ruthenium.

Components Insights

Based on Components, the fuel cell market has been segmented into stack and balance of plant. In 2023, the stack segment accounted for the largest share of more than 60.0% in the global fuel cell market. The fuel stack is the heart of a fuel cell system, responsible for the electrochemical conversion of fuel into electricity. Its complexity and high-value materials make it the most expensive component, contributing significantly to the total cost. Also, currently, there are fewer players in the fuel stack market compared to other components like balance of plant (BOP). This concentrated market leads to higher prices for stacks.

The balance-of-plant segment include components such as air compressors, power conditioners, thermal management system, and control systems. The BOP segment plays a vital role in ensuring efficient and reliable operation of fuel cell systems. It is expected to grow at a higher pace over the forecast period.

Fuel Insights

The hydrocarbon segment accounted for the largest share of over 90.0% in 2023, owing to extensive infrastructure for production, transportation, and storage of hydrocarbons is already in place, making them readily available and affordable. Solid Oxide Fuel Cells, Molten Carbonate Fuel Cells, and Direct Hydrocarbon Fuel Cells offer promising potential for using hydrocarbons. Hydrocarbon as a fuel type are utilized in combined heat and power systems and portable power for remote locations.

Hydrogen is gaining significant traction as a clean energy alternative, fueled by concerns about climate change and government policies promoting decarbonization. The segment is expected to achieve the fastest growth rate among all fuel types due to increasing investments in hydrogen production, storage, and infrastructure. Also, growing adoption in fuel cell vehicles, stationary power generation, and industrial applications is expected to augment the market growth.

Size Insights

On the basis of size, the fuel cell market is categorized into small-scale and large-scale. The large-scale holds a share of about 70.0% in 2023 of the global fuel cell market. They typically generate electricity above 100 kW, catering to applications like stationary power generation, heavy-duty transportation, and industrial. Also, vendors operating in the segment launch innovative products to scale up their presence in the market. For instance, in November 2023, Kohler Energy unveiled a 100kW hydrogen fuel cell power system suitable for off-highway equipment and standby and prime power applications for residential and industrial solutions.

Small-scale fuel cells generate electricity below 100 kW and are used in applications such as portable devices such as powering smartphones, residential backup power systems, and material handling equipment. The small-scale fuel cells are expected to maintain steady growth due to ongoing miniaturization and cost reduction. For instance, in October 2023, Toyota Industries developed 50 kW fuel cell module to be installed in lift trucks, agricultural machinery, and construction equipment, among others.

Application Insights

Stationary fuel cells dominated the global market in terms of revenue, accounting for a market share of more than 69.0% in 2023, owing to the increasing demand for fuel cells from distributed generation facilities and backup power applications. Furthermore, fuel cells are increasingly utilized in combined heat & power applications. Versatile factors and high efficiency enable the stationary segment to maintain a leading position.

Transportation is expected to be the fastest-growing segment due to the rising demand for fuel cell-powered forklifts and increasing research and development activities in mature economies of Europe. Portable fuel cells have applications such as personal electronics, portable products, laptops, mobile phones, APUs, and consumer products. Furthermore, the market is expected to grow owing to increased R&D activities in developed and developing countries to produce hydrogen-powered hybrid vehicles.

End-use Insights

Based on End-use, the fuel cell market has been segmented into transportation, commercial & Industrial, residential, data center, military & defense, and utilities & government. The transportation segment led the market and accounted for over 48.0% of the global revenue share in 2023. Growing adoption of fuel cell electric vehicles (FCEVs), particularly in heavy-duty trucks and buses is a key driver for the market growth. Also, government investments in hydrogen infrastructure to build a robust hydrogen fueling network is crucial for widespread FCEV adoption.

The commercial & industrial is expected to be the fastest growing market over the forecast period. Commercial and industrial end-users include hospitals, hotels, shopping malls, office spaces, sports center, and others. All these buildings utilize SOFC and PEMFC for standby applications. For instance, in February 2023, Weichai Power and technology partner Ceres launched stationary solid oxide fuel cell in China. The fuel cell has achieved cumulative operation of more than 30,000 hours. Also, the system can start and stop up to four times during the generation process with an efficiency rate of about 60%.

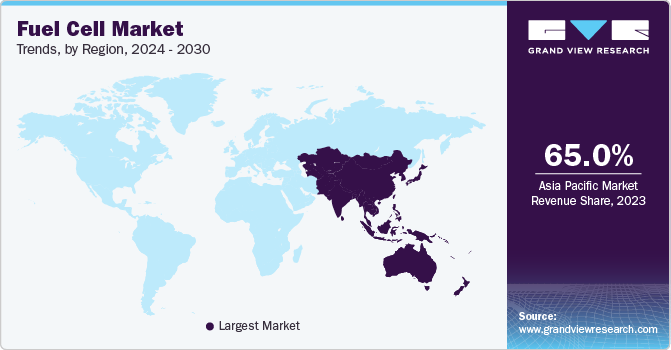

Regional Insights

Asia Pacific held a significant revenue share of more than 65% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The growth of the fuel cell market in the Asia Pacific region has been boosted by strategies and policies that encourage fuel cell systems for transportation applications in China, India, South Korea, and Japan. Japan is the primary market in the region that deals in fuel cells, followed by South Korea. Owing to the significant demand for combined heat and power systems in Japan and other countries in this region, the market for fuel cells is slated to register a robust growth rate.

Japan Fuel Cell Market

The fuel cell market in Japan has developed at a tremendous rate and is growing at a significant rate compared to the rest of the world on account of strong government support and strategic market focus. It was the world’s first country to commercialize residential fuel cell systems in 2009. The country is considering hydrogen energy a sustainable option for its economy as it is primarily dependent (approximately 96%) on imported energy sources.

India Fuel Cell Market

The fuel cell market in India is on the rise, driven by growing concerns about clean energy and government initiatives aiming to reduce carbon emissions. While still in its nascent stages, it holds significant potential for various applications across several sectors. The Indian government has introduced several policies and incentives to promote the development and adoption of fuel cell technologies. These include subsidies, research grants, and favorable tariff structures.

The success of fuel cell technology in Japan is the primary result of a collaboration between institutes, industries, end users, and the government. The government programs such as ENE-FARM have played a major role in enhancing the product adoption and driving the fuel cell market in the country. Furthermore, the program provides a subsidy to end users and has also set a trajectory for companies to enhance operational efficiency of their systems as well as to take steps to reduce product costs eventually.

North America accounted for a significant market share in 2023. This is owing to the supportive legislation present in the North American region that aims to reduce carbon emissions, as well as the availability of financing for fuel cell R&D initiatives.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In November 2023, Honda in association with General Motors displayed a prototype of its next-generation hydrogen fuel cell system at European Hydrogen Week in Brussels. The company is planning to expand its portfolio in fuel cell technology.

-

In December 2023, General Motors and Komatsu announced to develop a hydrogen fuel cell power module for the Japanese construction machinery maker's 930E electric drive mining truck.

-

In January 2023, Cochin Shipyard Limited initiated research activities for the development of a hydrogen-fueled electric vessel based on low-temperature proton exchange membrane technology.

-

In January 2023, Advent Technologies collaborated with Alfa laval to explore the application of high-temperature proton exchange membrane fuel cells in marine applications.

Key Fuel Cell Companies:

- Ballard Power Systems

- Bloom Energy

- Ceres Power Holdings PLC

- Doosan Fuel Cell America, Inc.

- FuelCell Energy, Inc

- Hydrogenics Corporation

- Nedstack Fuel Cell Technology B.V.

- Nuvera Fuel Cells LLC

- Plug Power, Inc.

- SFC Energy AG

Fuel Cell Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.77 billion

Revenue forecast in 2030

USD 36.98 billion

Growth rate

CAGR of 27.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in units, capacity in mw, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume forecast, Capacity Forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, components, fuel, size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Taiwan; Australia; Brazil; Argentina; Saudi Arabia ; UAE ; South Africa

Key companies profiled

FuelCell Energy, Inc.; Ballard Power Systems; Hydrogenics Corporation; SFC Energy AG; Nedstack Fuel Cell Technology B.V.; Bloom Energy; Doosan Fuel Cell America, Inc.; Ceres Power Holdings PLC; Plug Power, Inc.; Nuvera Fuel Cells LLC; Aisin Corporation; Kyocera Corporation; Mitsubishi Heavy Industries; Adaptive Energy; Ztek Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fuel Cell Market Report Segmentation

This report forecasts revenue, capacity, and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fuel cell market report based on product, components, fuel, size, application, and end-use, and region:

-

Product Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

-

PEMFC

-

PAFC

-

SOFC

-

MCFC

-

AFC

-

Others

-

-

Components Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

-

Stack

- Balance of Plant

-

-

Fuel Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

-

Hydrogen

-

Ammonia

-

Methanol

-

Ethanol

- Hydrocarbon

-

-

Size Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

-

Small-scale

-

Large-scale

-

-

Application Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Transportation

-

Portable

-

-

End-use Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial & Industrial

-

Transportation

-

Data Centers

-

Military & Defense

- Utilities & Government

-

-

Regional Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Taiwan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fuel cell market size was estimated at USD 6.3 billion in 2022 and is expected to reach USD 7.35 billion in 2023.

b. The global fuel cell market is expected to grow at a compound annual growth rate of 19.9% from 2023 to 2030 to reach USD 26.1 billion by 2030.

b. Proton exchange membrane fuel cell (PEMFC) was the dominant product segment in 2022 in terms of units.

b. Some of the key players operating in this industry include Fuel Cell Energy, Inc., Ballard Power Systems, SFC Energy AG, Nedstack Fuel Cell Technology B.V., Bloom Energy, Doosan Fuel Cell America, Inc., Ceres Power Holdings Plc, Plug Power, Inc., Nuvera Fuel Cells, LLC

b. Increasing demand for unconventional sources of energy is one of the key factors driving the fuel cell market growth.

Table of Contents

Chapter 1. Fuel Cell Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Fuel Cell Market: Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Fuel Cell Market: Variables, Trends & Scope

3.1. Global Fuel Cell Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Outlook

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. Fuel Cell Market: Product Outlook Estimates & Forecasts

4.1. Fuel Cell Market: Product Movement Analysis, 2023 & 2030

4.2. Proton Exchange Membrane Fuel Cell (PEMFC)

4.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

4.3. Molten Carbonate Fuel Cell (MCFC)

4.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

4.4. Phosphoric Acid Fuel Cell (PAFC)

4.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

4.5. Solid Oxide Fuel Cell (SOFC)

4.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

4.6. Alkaline Fuel cells (AFC)

4.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

4.7. Others

4.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

Chapter 5. Fuel Cell Market: Components Outlook Estimates & Forecasts

5.1. Fuel Cell Market: Components Movement Analysis, 2023 & 2030

5.2. Stack

5.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

5.3. Balance of Plant

5.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

Chapter 6. Fuel Cell Market: Fuel Outlook Estimates & Forecasts

6.1. Fuel Cell Market: Fuel Movement Analysis, 2023 & 2030

6.2. Hydrogen

6.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

6.3. Ammonia

6.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

6.4. Methanol

6.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

6.5. Ethanol

6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

6.6. Hydrocarbon

6.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

Chapter 7. Fuel Cell Market: Size Outlook Estimates & Forecasts

7.1. Fuel Cell Market: Size Movement Analysis, 2023 & 2030

7.2. Small-scale

7.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

7.3. Large-scale

7.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

Chapter 8. Fuel Cell Market: Application Outlook Estimates & Forecasts

8.1. Fuel Cell Market: Application Movement Analysis, 2023 & 2030

8.2. Stationary

8.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

8.3. Portable

8.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

8.4. Transportation

8.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (MW) (Units)

Chapter 9. Fuel Cell Market: End-use Outlook Estimates & Forecasts

9.1. Fuel Cell Market: End-use Movement Analysis, 2023 & 2030

9.2. Residential

9.2.1. Market estimates and forecast, 2018 - 2030, (USD Million)

9.3. Commercial & Industrial

9.3.1. Market estimates and forecast, 2018 - 2030, (USD Million)

9.4. Transportation

9.4.1. Market estimates and forecast, 2018 - 2030, (USD Million)

9.5. Data Centers

9.5.1. Market estimates and forecast, 2018 - 2030, (USD Million)

9.6. Military & Defense

9.6.1. Market estimates and forecast, 2018 - 2030, (USD Million)

9.7. Utilities & Government

9.7.1. Market estimates and forecast, 2018 - 2030, (USD Million)

Chapter 10. Fuel Cell Market Regional Outlook Estimates & Forecasts

10.1. Regional Snapshot

10.2. Fuel Cell Market: Regional Movement Analysis, 2023 & 2030

10.3. North America

10.3.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.3.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.3.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.3.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.3.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.3.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.3.7. U.S.

10.3.7.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.3.7.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.3.7.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.3.7.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.3.7.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.3.7.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.3.8. Canada

10.3.8.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.3.8.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.3.8.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.3.8.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.3.8.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.3.8.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.3.9. Mexico

10.3.9.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.3.9.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.3.9.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.3.9.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.3.9.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.3.9.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.4. Europe

10.4.1.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.4.1.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.4.1.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.4.1.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.4.1.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.4.1.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.4.2. Germany

10.4.2.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.4.2.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.4.2.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.4.2.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.4.2.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.4.2.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.4.3. France

10.4.3.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.4.3.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.4.3.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.4.3.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.4.3.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.4.3.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.4.4. UK

10.4.4.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.4.4.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.4.4.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.4.4.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.4.4.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.4.4.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.4.5. Italy

10.4.5.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.4.5.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.4.5.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.4.5.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.4.5.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.4.5.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.4.6. Spain

10.4.6.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.4.6.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.4.6.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.4.6.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.4.6.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.4.6.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.5. Asia Pacific

10.5.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.5.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.5.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.5.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.5.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.5.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.5.7. China

10.5.7.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.5.7.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.5.7.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.5.7.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.5.7.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.5.7.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.5.8. South Korea

10.5.8.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.5.8.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.5.8.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.5.3.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.5.8.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.5.8.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.5.9. Japan

10.5.9.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.5.9.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.5.9.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.5.9.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.5.9.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.5.9.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.5.10. India

10.5.10.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.5.10.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.5.10.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.5.10.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.5.105.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.5.10.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.5.11. Taiwan

10.5.11.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.5.116.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.5.11.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.5.116.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.5.116.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.5.11.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.5.12. Australia

10.5.12.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.5.12.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.5.12.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.5.12.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.5.12.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.5.12.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.6. Central & South America

10.6.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.6.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.6.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.6.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.6.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.6.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.6.7. Brazil

10.6.7.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.6.7.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.6.7.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.6.72.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.6.72.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.6.7.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.6.8. Argentina

10.6.8.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.6.8.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.6.3.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.6.8.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.6.8.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.6.83.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.7. Middle East & Africa

10.7.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.7.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.7.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.7.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.7.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.7.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.7.7. Saudi Arabia

10.7.7.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.7.7.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.7.7.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.7.7.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.7.7.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.7.7.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.7.8. UAE

10.7.8.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.7.8.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.7.8.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.7.8.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.7.8.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.7.8.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

10.7.9. South Africa

10.7.9.1. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (MW) (Units)

10.7.9.2. Market estimates and forecast, by components, 2018 - 2030 (USD Million) (MW) (Units)

10.7.9.3. Market estimates and forecast, by fuel, 2018 - 2030 (USD Million) (MW) (Units)

10.7.9.4. Market estimates and forecast, by size, 2018 - 2030 (USD Million) (MW) (Units)

10.7.9.5. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (MW) (Units)

10.7.9.6. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (MW) (Units)

Chapter 11. Competitive Landscape

11.1. Recent Developments & Impact Analysis, By Key Market Participants

11.2. Company Categorization

11.3. Company Ranking

11.4. Heat Map Analysis

11.5. Company Market Share Analysis, 2023

11.6. Market Strategies

11.7. Vendor Landscape

11.7.1. List of raw material supplier, key manufacturers, and distributors

11.7.2. List of prospective end-users

11.8. Strategy Mapping

11.9. Company Profiles/Listing

11.9.1. FuelCell Energy, Inc.

11.9.1.1. Company Overview

11.9.1.2. Financial Performance

11.9.1.3. Product Benchmarking

11.9.2. Ballard Power Systems

11.9.2.1. Company Overview

11.9.2.2. Financial Performance

11.9.2.3. Product Benchmarking

11.9.3. Hydrogenics Corporation

11.9.3.1. Company Overview

11.9.3.2. Financial Performance

11.9.3.3. Product Benchmarking

11.9.4. SFC Energy AG

11.9.4.1. Company Overview

11.9.4.2. Financial Performance

11.9.4.3. Product Benchmarking

11.9.5. Nedstack Fuel Cell Technology B.V.

11.9.5.1. Company Overview

11.9.5.2. Financial Performance

11.9.5.3. Product Benchmarking

11.9.6. Bloom Energy

11.9.6.1. Company Overview

11.9.6.2. Financial Performance

11.9.6.3. Product Benchmarking

11.9.7. Doosan Fuel Cell America, Inc.

11.9.7.1. Company Overview

11.9.7.2. Financial Performance

11.9.7.3. Product Benchmarking

11.9.8. Ceres Power Holdings PLC

11.9.8.1. Company Overview

11.9.8.2. Financial Performance

11.9.8.3. Product Benchmarking

11.9.9. Plug Power, Inc.

11.9.9.1. Company Overview

11.9.9.2. Financial Performance

11.9.9.3. Product Benchmarking

11.9.10. Nuvera Fuel Cells LLC

11.9.10.1. Company Overview

11.9.10.2. Financial Performance

11.9.10.3. Product Benchmarking

11.9.11. Aisin Corporation

11.9.11.1. Company Overview

11.9.11.2. Financial Performance

11.9.11.3. Product Benchmarking

11.9.12. Kyocera Corporation

11.9.12.1. Company Overview

11.9.12.2. Financial Performance

11.9.12.3. Product Benchmarking

11.9.13. Mitsubishi Heavy Industries

11.9.13.1. Company Overview

11.9.13.2. Financial Performance

11.9.13.3. Product Benchmarking

11.9.14. Adaptive Energy

11.9.14.1. Company Overview

11.9.14.2. Financial Performance

11.9.14.3. Product Benchmarking

11.9.15. Ztek Corporation

11.9.15.1. Company Overview

11.9.15.2. Financial Performance

11.9.15.3. Product Benchmarking

List of Tables

Table 1. Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 2. Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 3. Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 4. Fuel Cell market estimates and forecasts by product, 2018 - 2030 (USD Million)

Table 5. Fuel Cell market estimates and forecasts by product, 2018 - 2030 (MW)

Table 6. Fuel Cell market estimates and forecasts by product, 2018 - 2030 (Units)

Table 7. Fuel Cell market estimates and forecasts in PEMFC, 2018 - 2030 (USD Million)

Table 8. Fuel Cell market estimates and forecasts in PEMFC, 2018 - 2030 (MW)

Table 9. Fuel Cell market estimates and forecasts in PEMFC, 2018 - 2030 (Units)

Table 10. Fuel Cell market estimates and forecasts in PAFC, 2018 - 2030 (USD Million)

Table 11. Fuel Cell market estimates and forecasts in PAFC, 2018 - 2030 (MW)

Table 12. Fuel Cell market estimates and forecasts in PAFC, 2018 - 2030 (Units)

Table 13. Fuel Cell market estimates and forecasts in SOFC, 2018 - 2030 (USD Million)

Table 14. Fuel Cell market estimates and forecasts in SOFC, 2018 - 2030 (MW)

Table 15. Fuel Cell market estimates and forecasts in SOFC, 2018 - 2030 (Units)

Table 16. Fuel Cell market estimates and forecasts in MCFC, 2018 - 2030 (USD Million)

Table 17. Fuel Cell market estimates and forecasts in MCFC, 2018 - 2030 (MW)

Table 18. Fuel Cell market estimates and forecasts in MCFC, 2018 - 2030 (Units)

Table 19. Fuel Cell market estimates and forecasts in AFC, 2018 - 2030 (USD Million)

Table 20. Fuel Cell market estimates and forecasts in AFC, 2018 - 2030 (MW)

Table 21. Fuel Cell market estimates and forecasts in AFC, 2018 - 2030 (Units)

Table 22. Fuel Cell market estimates and forecasts in Others, 2018 - 2030 (USD Million)

Table 23. Fuel Cell market estimates and forecasts in Others, 2018 - 2030 (MW)

Table 24. Fuel Cell market estimates and forecasts in Others, 2018 - 2030 (Units)

Table 25. Fuel Cell market estimates and forecasts by components, 2018 - 2030 (USD Million)

Table 26. Fuel Cell market estimates and forecasts by components, 2018 - 2030 (MW)

Table 27. Fuel Cell market estimates and forecasts by components, 2018 - 2030 (Units)

Table 28. Fuel Cell market estimates and forecasts in Stack, 2018 - 2030 (USD Million)

Table 29. Fuel Cell market estimates and forecasts in Stack, 2018 - 2030 (MW)

Table 30. Fuel Cell market estimates and forecasts in Stack, 2018 - 2030 (Units)

Table 31. Fuel Cell market estimates and forecasts in Balance of Plant, 2018 - 2030 (USD Million)

Table 32. Fuel Cell market estimates and forecasts in Balance of Plant, 2018 - 2030 (MW)

Table 33. Fuel Cell market estimates and forecasts in Balance of Plant, 2018 - 2030 (Units)

Table 34. Fuel Cell market estimates and forecasts by fuel, 2018 - 2030 (USD Million)

Table 35. Fuel Cell market estimates and forecasts by fuel, 2018 - 2030 (MW)

Table 36. Fuel Cell market estimates and forecasts by fuel, 2018 - 2030 (Units)

Table 37. Fuel Cell market estimates and forecasts in Hydrogen, 2018 - 2030 (USD Million)

Table 38. Fuel Cell market estimates and forecasts in Hydrogen, 2018 - 2030 (MW)

Table 39. Fuel Cell market estimates and forecasts in Hydrogen, 2018 - 2030 (Units)

Table 40. Fuel Cell market estimates and forecasts in Ammonia, 2018 - 2030 (USD Million)

Table 41. Fuel Cell market estimates and forecasts in Ammonia, 2018 - 2030 (MW)

Table 42. Fuel Cell market estimates and forecasts in Ammonia, 2018 - 2030 (Units)

Table 43. Fuel Cell market estimates and forecasts in Methanol, 2018 - 2030 (USD Million)

Table 44. Fuel Cell market estimates and forecasts in Methanol, 2018 - 2030 (MW)

Table 45. Fuel Cell market estimates and forecasts in Methanol, 2018 - 2030 (Units)

Table 46. Fuel Cell market estimates and forecasts in Ethanol, 2018 - 2030 (USD Million)

Table 47. Fuel Cell market estimates and forecasts in Ethanol, 2018 - 2030 (MW)

Table 48. Fuel Cell market estimates and forecasts in Ethanol, 2018 - 2030 (Units)

Table 49. Fuel Cell market estimates and forecasts in Hydrocarbon, 2018 - 2030 (USD Million)

Table 50. Fuel Cell market estimates and forecasts in Hydrocarbon, 2018 - 2030 (MW)

Table 51. Fuel Cell market estimates and forecasts in Hydrocarbon, 2018 - 2030 (Units)

Table 52. Fuel Cell market estimates and forecasts by size, 2018 - 2030 (USD Million)

Table 53. Fuel Cell market estimates and forecasts by size, 2018 - 2030 (MW)

Table 54. Fuel Cell market estimates and forecasts by size, 2018 - 2030 (Units)

Table 55. Fuel Cell market estimates and forecasts in Small-scale, 2018 - 2030 (USD Million)

Table 56. Fuel Cell market estimates and forecasts in Small-scale, 2018 - 2030 (MW)

Table 57. Fuel Cell market estimates and forecasts in Small-scale, 2018 - 2030 (Units)

Table 58. Fuel Cell market estimates and forecasts in Large-scale, 2018 - 2030 (USD Million)

Table 59. Fuel Cell market estimates and forecasts in Large-scale, 2018 - 2030 (MW)

Table 60. Fuel Cell market estimates and forecasts in Large-scale, 2018 - 2030 (Units)

Table 61.

Table 62. Fuel Cell market estimates and forecasts by application, 2018 - 2030 (USD Million)

Table 63. Fuel Cell market estimates and forecasts by application, 2018 - 2030 (MW)

Table 64. Fuel Cell market estimates and forecasts by application, 2018 - 2030 (Units)

Table 65. Fuel Cell market estimates and forecasts in Stationary, 2018 - 2030 (USD Million)

Table 66. Fuel Cell market estimates and forecasts in Stationary, 2018 - 2030 (MW)

Table 67. Fuel Cell market estimates and forecasts in Stationary, 2018 - 2030 (Units)

Table 68. Fuel Cell market estimates and forecasts in Transportation, 2018 - 2030 (USD Million)

Table 69. Fuel Cell market estimates and forecasts in Transportation, 2018 - 2030 (MW)

Table 70. Fuel Cell market estimates and forecasts in Transportation, 2018 - 2030 (Units)

Table 71. Fuel Cell market estimates and forecasts in Portable, 2018 - 2030 (USD Million)

Table 72. Fuel Cell market estimates and forecasts in Portable, 2018 - 2030 (MW)

Table 73. Fuel Cell market estimates and forecasts in Portable, 2018 - 2030 (Units)

Table 74. Fuel Cell market estimates and forecasts by end-use, 2018 - 2030 (USD Million)

Table 75. Fuel Cell market estimates and forecasts by end-use, 2018 - 2030 (MW)

Table 76. Fuel Cell market estimates and forecasts by end-use, 2018 - 2030 (Units)

Table 77. Fuel Cell market estimates and forecasts in Residential, 2018 - 2030 (USD Million)

Table 78. Fuel Cell market estimates and forecasts in Residential, 2018 - 2030 (MW)

Table 79. Fuel Cell market estimates and forecasts in Residential, 2018 - 2030 (Units)

Table 80. Fuel Cell market estimates and forecasts in Commercial & Industrial, 2018 - 2030 (USD Million)

Table 81. Fuel Cell market estimates and forecasts in Commercial & Industrial, 2018 - 2030 (MW)

Table 82. Fuel Cell market estimates and forecasts in Commercial & Industrial, 2018 - 2030 (Units)

Table 83. Fuel Cell market estimates and forecasts in Transportation, 2018 - 2030 (USD Million)

Table 84. Fuel Cell market estimates and forecasts in Transportation, 2018 - 2030 (MW)

Table 85. Fuel Cell market estimates and forecasts in Transportation, 2018 - 2030 (Units)

Table 86. Fuel Cell market estimates and forecasts in Data Centers, 2018 - 2030 (USD Million)

Table 87. Fuel Cell market estimates and forecasts in Data Centers, 2018 - 2030 (MW)

Table 88. Fuel Cell market estimates and forecasts in Data Centers, 2018 - 2030 (Units)

Table 89. Fuel Cell market estimates and forecasts in Military & Defense, 2018 - 2030 (USD Million)

Table 90. Fuel Cell market estimates and forecasts in Military & Defense, 2018 - 2030 (MW)

Table 91. Fuel Cell market estimates and forecasts in Military & Defense, 2018 - 2030 (Units)

Table 92. Fuel Cell market estimates and forecasts in Utilities & Government, 2018 - 2030 (USD Million)

Table 93. Fuel Cell market estimates and forecasts in Utilities & Government, 2018 - 2030 (MW)

Table 94. Fuel Cell market estimates and forecasts in Utilities & Government, 2018 - 2030 (Units)

Table 95. North America Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 96. North America Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 97. North America Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 98. North America Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 99. North America Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 100. North America Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 101. North America Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 102. North America Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 103. North America Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 104. North America Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 105. North America Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 106. North America Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 107. North America Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 108. North America Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 109. North America Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 110. North America Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 111. North America Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 112. North America Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 113. North America Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 114. North America Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 115. North America Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 116. U.S. Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 117. U.S. Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 118. U.S. Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 119. U.S. Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 120. U.S. Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 121. U.S. Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 122. U.S. Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 123. U.S. Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 124. U.S. Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 125. U.S. Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 126. U.S. Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 127. U.S. Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 128. U.S. Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 129. U.S. Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 130. U.S. Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 131. U.S. Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 132. U.S. Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 133. U.S. Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 134. U.S. Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 135. U.S. Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 136. U.S. Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 137. Canada Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 138. Canada Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 139. Canada Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 140. Canada Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 141. Canada Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 142. Canada Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 143. Canada Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 144. Canada Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 145. Canada Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 146. Canada Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 147. Canada Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 148. Canada Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 149. Canada Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 150. Canada Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 151. Canada Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 152. Canada Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 153. Canada Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 154. Canada Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 155. Canada Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 156. Canada Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 157. Canada Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 158. Mexico Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 159. Mexico Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 160. Mexico Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 161. Mexico Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 162. Mexico Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 163. Mexico Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 164. Mexico Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 165. Mexico Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 166. Mexico Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 167. Mexico Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 168. Mexico Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 169. Mexico Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 170. Mexico Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 171. Mexico Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 172. Mexico Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 173. Mexico Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 174. Mexico Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 175. Mexico Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 176. Mexico Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 177. Mexico Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 178. Mexico Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 179. Europe Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 180. Europe Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 181. Europe Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 182. Europe Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 183. Europe Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 184. Europe Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 185. Europe Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 186. Europe Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 187. Europe Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 188. Europe Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 189. Europe Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 190. Europe Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 191. Europe Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 192. Europe Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 193. Europe Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 194. Europe Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 195. Europe Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 196. Europe Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 197. Europe Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 198. Europe Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 199. Europe Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 200. Germany Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 201. Germany Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 202. Germany Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 203. Germany Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 204. Germany Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 205. Germany Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 206. Germany Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 207. Germany Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 208. Germany Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 209. Germany Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 210. Germany Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 211. Germany Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 212. Germany Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 213. Germany Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 214. Germany Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 215. Germany Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 216. Germany Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 217. Germany Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 218. Germany Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 219. Germany Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 220. Germany Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 221. U.K. Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 222. U.K. Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 223. U.K. Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 224. U.K. Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 225. U.K. Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 226. U.K. Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 227. U.K. Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 228. U.K. Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 229. U.K. Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 230. U.K. Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 231. U.K. Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 232. U.K. Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 233. U.K. Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 234. U.K. Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 235. U.K. Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 236. U.K. Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 237. U.K. Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 238. U.K. Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 239. U.K. Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 240. U.K. Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 241. U.K. Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 242. France Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 243. France Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 244. France Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 245. France Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 246. France Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 247. France Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 248. France Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 249. France Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 250. France Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 251. France Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 252. France Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 253. France Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 254. France Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 255. France Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 256. France Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 257. France Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 258. France Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 259. France Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 260. France Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 261. France Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 262. France Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 263. Italy Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 264. Italy Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 265. Italy Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 266. Italy Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 267. Italy Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 268. Italy Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 269. Italy Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 270. Italy Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 271. Italy Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 272. Italy Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 273. Italy Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 274. Italy Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 275. Italy Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 276. Italy Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 277. Italy Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 278. Italy Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 279. Italy Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 280. Italy Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 281. Italy Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 282. Italy Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 283. Italy Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 284. Spain Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 285. Spain Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 286. Spain Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 287. Spain Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 288. Spain Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 289. Spain Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 290. Spain Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 291. Spain Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 292. Spain Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 293. Spain Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 294. Spain Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 295. Spain Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 296. Spain Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 297. Spain Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 298. Spain Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 299. Spain Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 300. Spain Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 301. Spain Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 302. Spain Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 303. Spain Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 304. Spain Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 305. Asia Pacific Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 306. Asia Pacific Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 307. Asia Pacific Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 308. Asia Pacific Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 309. Asia Pacific Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 310. Asia Pacific Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 311. Asia Pacific Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 312. Asia Pacific Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 313. Asia Pacific Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 314. Asia Pacific Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 315. Asia Pacific Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 316. Asia Pacific Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 317. Asia Pacific Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 318. Asia Pacific Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 319. Asia Pacific Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 320. Asia Pacific Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 321. Asia Pacific Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 322. Asia Pacific Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 323. Asia Pacific Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 324. Asia Pacific Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 325. Asia Pacific Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 326. China Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 327. China Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 328. China Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 329. China Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 330. China Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 331. China Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 332. China Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 333. China Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 334. China Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 335. China Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 336. China Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 337. China Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 338. China Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 339. China Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 340. China Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 341. China Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 342. China Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 343. China Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 344. China Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 345. China Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 346. China Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 347. India Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 348. India Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 349. India Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 350. India Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 351. India Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 352. India Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 353. India Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 354. India Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 355. India Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 356. India Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 357. India Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 358. India Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 359. India Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 360. India Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 361. India Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 362. India Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 363. India Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 364. India Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 365. India Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 366. India Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 367. India Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 368. Japan Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 369. Japan Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 370. Japan Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 371. Japan Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 372. Japan Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 373. Japan Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)

Table 374. Japan Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (USD Million)

Table 375. Japan Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (MW)

Table 376. Japan Fuel Cell market estimates and forecasts, by components, 2018 - 2030 (Units)

Table 377. Japan Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (USD Million)

Table 378. Japan Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (MW)

Table 379. Japan Fuel Cell market estimates and forecasts, by fuel, 2018 - 2030 (Units)

Table 380. Japan Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (USD Million)

Table 381. Japan Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (MW)

Table 382. Japan Fuel Cell market estimates and forecasts, by size, 2018 - 2030 (Units)

Table 383. Japan Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 384. Japan Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (MW)

Table 385. Japan Fuel Cell market estimates and forecasts, by application, 2018 - 2030 (Units)

Table 386. Japan Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 387. Japan Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (MW)

Table 388. Japan Fuel Cell market estimates and forecasts, by end-use, 2018 - 2030 (Units)

Table 389. South Korea Fuel Cell market estimates and forecasts, 2018 - 2030 (USD Million)

Table 390. South Korea Fuel Cell market estimates and forecasts, 2018 - 2030 (MW)

Table 391. South Korea Fuel Cell market estimates and forecasts, 2018 - 2030 (Units)

Table 392. South Korea Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 393. South Korea Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (MW)

Table 394. South Korea Fuel Cell market estimates and forecasts, by product, 2018 - 2030 (Units)