- Home

- »

- Automotive & Transportation

- »

-

Fuel Cell Vehicle Market Size, Share & Trends Report, 2030GVR Report cover

![Fuel Cell Vehicle Market Size, Share & Trends Report]()

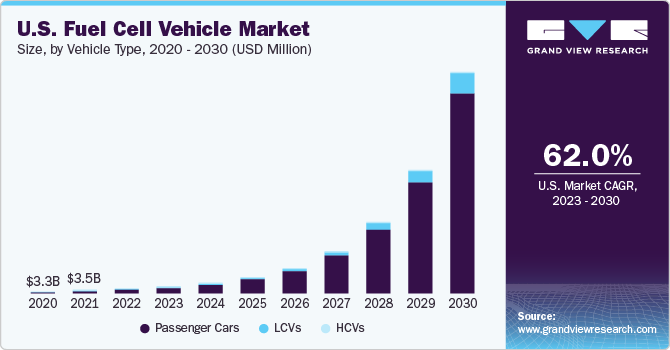

Fuel Cell Vehicle Market Size, Share & Trends Analysis Report By Vehicle type (Passenger Cars, LCVs, HCVs), By Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-705-6

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Fuel Cell Vehicle Market Size & Trends

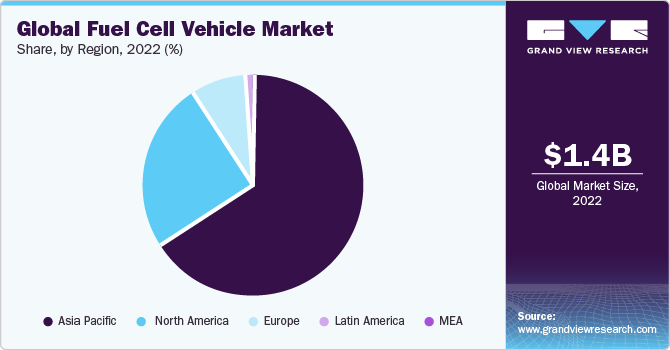

The global fuel cell vehicle market size was valued at USD 1.45 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 52.5% from 2023 to 2030. The surge in population has resulted in rising pollution levels and has shifted the trend toward clean fuels and green technology to curb carbon emissions effectively. It has had a favorable influence on FCV demand in recent years. The change from conventional fuel automobiles to environment-friendly vehicles has recently accelerated the demand for FCVs. Other factors, such as strict environmental laws, incentives and subsidies for clean fuels, and hazardous gas emissions from combustion engine vehicles, drive the market growth throughout the forecast period. Furthermore, the increasing awareness regarding vehicle emissions has led manufacturers to design alternate powertrains, increasing the market's development.

The outbreak of COVID-19 brought the whole ecosystem to a halt, prohibiting the development and sale of revolutionary automobiles worldwide. Fuel cell vehicles had to halt until the lockdowns were released before they could continue to prosper, impacting their manufacturing operations. As a result, manufacturing volumes for car production had to be adjusted, causing late final delivery and a decline in revenue.

The automotive industry is known for its heavy investments and requirement of constant funding to stay afloat. During the early months of the pandemic, this resulted in the stoppage of production and decreased demand, which had an adverse impact on manufacturers of fuel cell vehicles and automotive fuel cell producers. However, as the pandemic subsided, the cash flow for revenue and investment resumed. With the financial resources becoming stable, the production of automobiles started gaining pace. It prompted automotive fuel cell producers to resume research, development, and testing operations again, thereby positively impacting the market growth.

The fuel cell vehicle market is still in its early development and growth stages. Many technologies are in the testing stage, with a few automobiles from Toyota Motor Corporation, Honda Motor Corp., and Hyundai Motor Group running in some regions. European manufacturers such as BMW AG and Audi are developing fuel cell vehicles based on their earlier prototypes to launch in the later years. Many other companies are following BMW and Audi's footprints.

For instance, in May 2022, Renault manufactured the hydrogen fuel cell-powered SUV prototype. The SUV, Scenic Vision, was planned to be equipped with a 16kW fuel cell to help expand the car's driving range to 800 kilometers without charging. With a lightweight battery & other exceptional features, the company aimed to reduce the carbon footprint by 75% compared to traditional electric vehicle models. However, the French carmaker model will not be available before 2030 and 2032. The company will launch its fully electric version by 2024.

Hydrogen fuel cell vehicles are expanding their applications to heavy commercial vehicles to increase efficiency. For instance, a major global player in zero-emission hydrogen fuel cell-based commercial vehicles- Hyzon Motors Inc. announced the development of the hydrogen storage system technology, in July 2021, which can decrease the manufacturing cost and weight of the commercial vehicle. The new technology is yet to be patented and can potentially reduce the manufacturing component count by 75%, the weight of the system by 43%, and the system storage cost by 52%. This technology uses lightweight composite material for system metal print, based on a single rack system capable of storing five hydrogen cylinders simultaneously. The development of this onboard storage system technology is a collaboration between the European and U.S. divisions of Hyzon Motors Inc. These technological developments for reducing cost and carbon emissions are attempts to integrate hydrogen fuel cell technology as the primary power source for future vehicle production.

Fuel cell vehicles are expensive, and the cost of hydrogen (per kilo) in some places is high, restraining the market growth. Furthermore, the number of gasoline stations is restricted or inadequate in regions worldwide. The industry's progress is limited by a skeptical distribution network, fear of electric shock, and flammability owing to the chemical attribute of hydrogen fuel cells, which limit the market's growth. The manufacturing cost of hydrogen fuel cell vehicles is higher than that of conventional vehicles. The production cost and aftermarket services cost significantly increase the total ownership cost compared to that of a standard vehicle. Apart from that, it faces competition from battery electric vehicles and plug-in hybrid electric vehicles, which are becoming popular and are limiting the market's growth.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 66.3% in 2022. The proliferating sales of cars in countries such as South Korea and Japan are the primary factors for the growth of the passenger cars market in this region. Furthermore, Government initiatives in Japan for the usage of fuel cell vehicles and provision of support to consumers through subsidies for the purchase of the vehicles are driving the market growth in this region. For instance, in November 2021, China's Development and Reform Commission issued a directive to manufacture 5,000 hydrogen fuel cell automobiles by 2025 for port transportation, buses, and intercity logistics. Thus, such booming developments in clean energy within the automotive sector are anticipated to drive the fuel cell vehicle growth over the forecast period.

Europe is expected to expand at the fastest CAGR of 63.9% during the forecast period. Major players in the European regions are continuously pushing to integrate fuel cell systems and fuel cells in commercial and passenger vehicles. For instance, in May 2022, the European Daimler group announced plans to include electric and hydrogen fuel vehicles in their portfolio by 2030. Furthermore, the massive deployment of commercial vehicles in France for public and government usage is fueling the market growth.

Vehicle Type Insights

The passenger cars segment accounted for the largest revenue share of 84.7% in 2022 and is expected to expand at the fastest CAGR over the forecast period. The surge in the adoption of passenger cars in countries such as Japan and South Korea drives segment growth in the fuel-cell vehicle market. Depleting fossil fuel sources is driving the price of vehicle fuel. It prompts the government to look for sustainable, low-emission sources to power vehicles.

The LCV segment is expected to expand at a significant CAGR of 48.6% during the forecast period. Light commercial vehicles are instrumental vehicles used for supply chain purposes. Using a fuel cell instead of a battery converts electrochemical energy into torque and high efficiency. Thus, using fuel cells in long-distance travel vehicles such as LCVs is an ideal choice from a cost-saving and efficient travel perspective.

Key Companies & Market Share Insights

Companies highly invest in R&D for fuel cell vehicles. Several mergers and acquisitions, partnerships, and collaborations are expected to be some growth strategies the companies follow to expand their businesses. For instance, in February 2023, BMW launched the hydrogen-operated BMW iX5. The pilot fleet of the BMW iX5 was planned to be used worldwide by various target groups for demonstration and trial purposes. With the launch of the iX5 Hydrogen Pilot Fleet, BMW reaffirmed its dedication to exploring innovative options for sustainable and environmentally friendly transportation.

Recent Developments

-

In August 2022, Toyota announced a hydrogen fuel-cell truck joint venture with Isuzu and Hino Motors. These trucks were designed for the mass market and help address the challenges faced by the transportation industry and contribute to achieving a carbon-neutral society.

-

In July 2022, PowerCell, a Swedish company, partnered with ZeroAvia to develop and deliver 5,000 aviation-optimized (PEM) Proton Exchange Membrane fuel cell stacks between the years 2024 and 2028. As a part of the partnership, PowerCell established its presence in the UK and formed a production team alongside ZeroAvia's production facilities.

-

In March 2022, Toyota launched a green hydrogen-based advanced (FCEV) fuel cell electric vehicle, Toyota Mirai. Powered by a hydrogen fuel cell battery, this vehicle offers a range of up to 650 KM on a single charge.

Key Fuel Cell Vehicle Companies:

- Daimler AG

- Honda Motor Co., Ltd.

- Nikola Corporation

- TOYOTA MOTOR CORPORATION

- HYUNDAI MOTOR GROUP

- Ballard Power System Inc.

- AB Volvo

- General Motors

- BMW AG

- AUDI AG

Fuel Cell Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.92 billion

Revenue forecast in 2030

USD 36.89 billion

Growth rate

CAGR of 52.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Daimler AG; Honda Motors Co. Ltd.; Nikola Corporation; Toyota Motor Corporation; Hyundai Motor Group; Ballard Power Systems Inc.; Volvo AB; General Motors; BMW AG; Audi AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fuel Cell Vehicle Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fuel cell vehicle market report based on vehicle type and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

LCVs

-

HCVs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fuel cell vehicle market size was estimated at USD 1.45 billion in 2022 and is expected to reach USD 1.92 billion in 2023.

b. The global fuel cell vehicle market is expected to grow at a compound annual growth rate of 52.5% from 2023 to 2030 to reach USD 36.89 billion by 2030.

b. Asia Pacific has the highest CAGR of 66.3% in 2022. This is attributable to the increased development of fuel cell infrastructures such as hydrogen filling stations coupled with substantial investments made by the government in the development of fuel cells.

b. Some key players operating in the fuel cell vehicle market include Toyota Motor Corporation, Honda Motor Company, Ltd., and Hyundai Motor Company.

b. Key factors that are driving the fuel cell vehicle market growth include increasing concerns over alarming pollution levels and rising emphasis on the adoption of FCEVs due to their pollution-free properties.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."