- Home

- »

- Renewable Chemicals

- »

-

Furfuryl Alcohol Market Size & Share Report, 2021-2028GVR Report cover

![Furfuryl Alcohol Market Size, Share & Trends Report]()

Furfuryl Alcohol Market Size, Share & Trends Analysis Report By Application (Resins, Solvents, Corrosion Inhibitors), By End Use (Foundry, Agriculture, Food & Beverages), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-483-3

- Number of Pages: 109

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Specialty & Chemicals

Report Overview

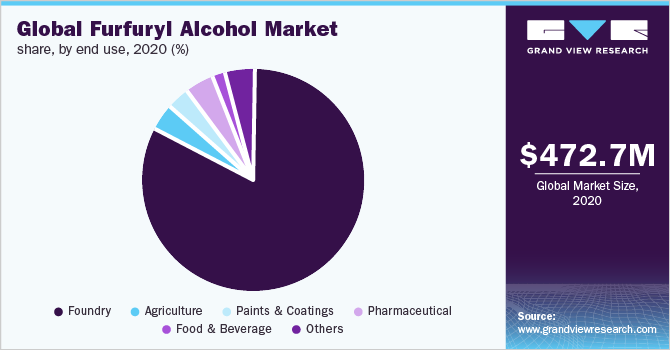

The global furfuryl alcohol market size was estimated at USD 472.7 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2021 to 2028. This is attributed to the increasing demand for furfuryl alcohol for the synthesis of furan resins and in the formulation of thermoset polymer matrix compounds, cement, adhesives, coatings, and casting resins.

Furfural, which is derived from sugarcane bagasse and corncobs, undergoes catalytic reduction to form furfuryl alcohol. It is an organic composite, comprising a furan substituted by a hydroxymethyl group. Its primary application is as a chemical intermediate in the production of several chemical products, including wetting agents, adhesives, and foundry resins.

The product is broadly utilized in resins and plastics applications. A surge in research and development activities in the area of rocket fuel is estimated to trigger the demand for furfuryl alcohol. The products also play an essential role in manufacturing in the foundry sector in the formulation of molds for metal casting. Consequently, the growing demand for furfuryl alcohol from various end-use industries across the globe is estimated to boost the growth of the market for furfuryl alcohol over the forecast period.

The metal casting sector is key to the underlying security and economic development of several nations across the globe. The foundries melt non-ferrous as well as ferrous alloys and dispense them into molds to profile them into finished goods by means of solidification. Furfural and its derivatives are utilized in the foundry sector for the formulation of molds for metal casting. Mounting production of metal castings is estimated to drive the growth of the foundry industry.

The growth of the foundry industry in India can be attributed to several government initiatives, including “Pradhan Mantri Kaushal Vikas Yojana (PMKVY)”, and “Make in India”, among others. Apart from these initiatives, the Government of India is easing certain FDI norms to endorse foreign investment. Additionally, a key demand for foundry products from several end-use industries, including railways, windmills, machine tools, power generation and distribution, mining, chemical industries, aerospace, domestic appliances, textile, and cement, among others, is estimated to drive the growth of the foundry industry.

Application Insights

The resins application segment dominated the market for furfuryl alcohol and accounted for the largest revenue share of more than 87.0% in 2020. This is attributed to the growing demand for furfuryl alcohol resins from the construction and automotive sectors. It is used as a critical component in furan foundry binders. The product is extensively used in the production of furan resins and foundry sand binders due to its unique properties.

Furfuryl alcohol is used as a solvent in petrochemical refining, chemical feedstock for 5-membered oxygen heterocycles, and for refining lubricating oils. In chemical feedstock for 5-membered oxygen heterocycles, it is used in the formulation of tetrahydrofuran, which is an essential industrial solvent. The surge in demand for low volatile organic compounds (VOC) and non-toxic solvents in agricultural formulations, petroleum refining, pharmaceuticals, paints and coatings, and several other end-use industries is anticipated to fuel the growth of the market for furfuryl alcohol over the forecast period.

Furfuryl alcohol is predominantly used in resinous mortars for joining corrosion-inhibitant bricks or tiles in the fabrication of storage tanks, reactors, floors, and fume stacks. It is used for corrosion-resistant mortars and cement and erosion-resilient fiber-reinforced plastics. Increasing awareness about the effectiveness of the product as a corrosion inhibitor coupled with its surging demand as an inhibitor in cement, grout, and mortar is expected to trigger market growth in the near future.

End-use Insights

The foundry end-use segment dominated the market for furfuryl alcohol and accounted for the largest revenue share of more than 82.0% in 2020. This is attributed to the surge in metal casting production. As furfuryl alcohol is derived from furfural, it is not an oil-based chemical, thus playing an important role in the formulation of foundry sand binders. It is extensively utilized to manufacture molds and cores for metal casting.

It is used in agricultural applications, especially in pesticide formulations, as a cosolvent for active ingredients such as gibberellic acid, mefenoxam, and propiconazole. It is also used as an adjuvant to support herbicides penetrating the leaf structure. In addition, the expanding agricultural sector along with the surge in farm production in countries such as China, India, Indonesia, Russia, France, and Germany are expected to fuel the demand for furfuryl alcohol in these economies over the forecast period.

The product is used in anti-corrosive paint applications and as a solvent in alkaline paint strippers. It is also used in the formulation of cleaning compounds and paint thinners. It is compatible with high-temperature applications, stable in highly basic formulations, and is water-miscible. It is broadly applied in paint and coating removers. Thus, the growth of the paints & coatings sector in countries that are among the top producers such as Germany, India, and Japan are anticipated to fuel the product demand.

Regional Insights

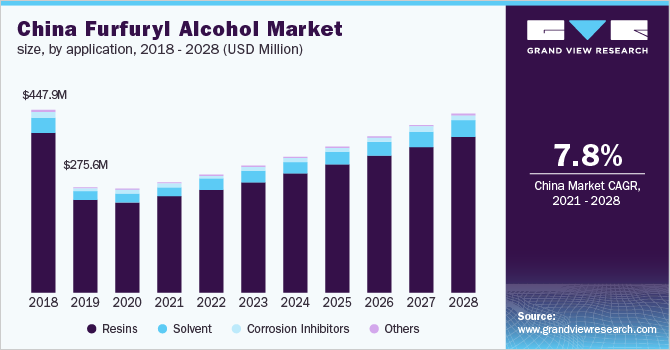

Asia Pacific dominated the market for furfuryl alcohol and accounted for the largest revenue share of more than 68.0% in 2020. This is attributed to the rising utilization of the product as a flavoring ingredient in various food products, including baked goods, beverages, candies, frozen dairy, gravies, meat products, and puddings. In China, furfural is majorly used to produce furfuryl alcohol. China is the leading manufacturer of furfuryl alcohol-producing over 80% of the worldwide production. The majority of the players in the country are engaged in the production of both furfural and furfuryl alcohol to gain a cost advantage.

Germany is one of the prominent contributors to the European food and beverage sector. About one-third of the food and beverage products manufactured in the country is exported. Consumers have contributed toward making Germany the largest retail sector for F&B in Europe. The growth of pesticide production and exports is estimated to drive the demand for furfuryl alcohol in Spain. It is also broadly used as an intermediate in the formulations of pesticides in the agricultural sector. Consequently, the rising need for herbicides, pesticides, and fertilizers in the country is estimated to drive the demand for furfuryl alcohol in the near future.

Key Companies & Market Share Insights

Market participants focus on third-party agreements with professional distributors and also sell distribution rights to these merchants in order to reach developed markets. Growing concerns regarding the toxicity of chemical-based products have created a significant demand for products derived from environment-friendly raw materials. Key players compete to gain market share by adopting various strategies such as setting up new manufacturing facilities and expansion in production capacity. Key manufacturers have in-house research and development laboratories for analysis of finished products, semi-finished products, and raw materials.

Manufacturers are inclined toward collaborations with key players, research institutes, and universities to obtain durable bio-based solutions. Companies are expected to focus on forward integration to reduce logistics & operational costs and acquire a higher market share. For instance, key players are engaged in the production of both furfural and furfuryl alcohol. Companies are focusing on mergers to acquire a larger market share. This helps them increase their client base as well as product portfolio. Some of the prominent players in the furfuryl alcohol market include:

-

ILLOVO SUGAR AFRICA (PTY) LTD.

-

Linzi Organic Chemical Inc. Ltd.

-

TransFurans Chemicals bvba

-

DalinYebo

-

Hebeichem

-

SilvateamS.p.a.

-

Shandong Crownchem Industries Co., Ltd.

-

Hongye Holdings Group Corp., Ltd.

-

Xian Welldon Trading Co., Ltd.

-

Furnova Polymers Ltd.

-

NC Nature Chemicals

Furfuryl Alcohol Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 503.7 million

Revenue forecast in 2028

USD 821.6 million

Growth Rate

CAGR of 7.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in tons, revenue in USD thousand, and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Belgium; China; India; Japan; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

ILLOVO SUGAR AFRICA (PTY) LTD.; Linzi Organic Chemical Inc. Ltd.; TransFurans Chemicals bvba; DalinYebo; Hebeichem; SilvateamS.p.a.; Shandong Crownchem Industries Co., Ltd.; Hongye Holdings Group Corp., Ltd.; Xian Welldon Trading Co., Ltd.; Furnova Polymers Ltd.; NC Nature Chemicals

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global furfuryl alcohol market report on the basis of application, end-use, and region:

-

Application Outlook (Volume: Tons; Revenue, USD Thousand, 2017 - 2028)

-

Resins

-

Solvent

-

Corrosion Inhibitors

-

Others

-

-

End-use Outlook (Volume: Tons; Revenue, USD Thousand, 2017 - 2028)

-

Foundry

-

Agriculture

-

Paints & Coatings

-

Pharmaceuticals

-

Food & Beverages

-

Others

-

-

Regional Outlook (Volume: Tons; Revenue, USD Thousand, 2017 - 2028)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global furfuryl alcohol market size was estimated at USD 472.7 million in 2020 and is expected to reach USD 503.7 million in 2021.

b. The global furfuryl alcohol market is expected to grow at a compound annual growth rate of 7.2% from 2021 to 2028 to reach USD 821.6 million by 2028.

b. The Asia Pacific dominated the furfuryl alcohol market with a share of 68.02% in 2020. This is attributable to the abundant production of raw materials in China along with increasing demand from the foundry industry.

b. Some key players operating in the furfuryl alcohol market include Teladoc; Doctor on Demand; iCliniq; IBM; Intel Corporation; Philips Healthcare; McKesson Corporation; AMD Telemedicine; GE Healthcare; CardioNet Inc.; 3m Health Information Systems; Medic4all; CirrusMD Inc.; Cisco; and American Telecare Inc.

b. Key factors that are driving the furfuryl alcohol market growth include growing demand for foundry binder resins, substantial production capacities in China, and increasing demand for bio-based chemicals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."