- Home

- »

- Next Generation Technologies

- »

-

Gas Sensor Market Size And Share Analysis Report, 2030GVR Report cover

![Gas Sensor Market Size, Share & Trends Report]()

Gas Sensor Market Size, Share & Trends Analysis Report By Product, By Type (Wired, Wireless), By Technology, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-083-5

- Number of Pages: 113

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Gas Sensor Market Size & Trends

The global gas sensor market size was valued at USD 2.90 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.5% from 2023 to 2030. The major factor driving the market is the development of miniaturization and wireless capabilities, coupled with the improvement in the communication technologies that enable their integration into various devices and machines to detect toxic gases at a safe distance. Gas sensors are used to constantly control and monitor the gas emissions from various industrial processes ranging from domestic and industrial. Additionally, the rising demand to control harmful emissions from critical industries also bodes well for the growth of the market.

Advances and innovations in technology are allowing gas sensor manufacturers to develop smart gas sensors. Various companies are also striking partnerships for enhancing automotive safety and addressing challenges associated with electric vehicle technology. For instance, In January 2023, Honeywell International Inc. announced the expansion of its partnership with a developer of Li-ion Tamer lithium-ion gas detection solutions named Nexceris. This alliance was aimed at offering advanced automotive sensing technology to help avoid situation leading to thermal runaway in batteries of electric vehicles. Additionally, gas sensors market includes various applications in industries and environments for detecting hazardous gases in workplaces, factories, and outdoor environments. Such technological developments bode well for the growth of the market.

Stringent government regulations to reduce the emissions from cars are expected to drive the demand for the gas sensor market over the forecast period. Rules and regulations are imposed by government bodies across the world on the emission of gas from cars. For instance, in April 2020, the Corporate Average Fuel Economy and greenhouse gas emission standards for passenger cars were amended by the National Highway Traffic Safety Administration and the EPA. Thus, the imposed limitation on gas emissions from vehicles creates demand for gas sensors as it decreases atmospheric pollution and increases fuel efficiency.

Numerous industries such as chemical, oil & gas, and power use gas sensors to detect the presence of various combustible and toxic gases. A huge number of gases such as carbon monoxide, carbon dioxide, hydrocarbons, and ammonia are released into the air by these industries. An excess number of emissions of these gases can adversely affect human health. Moreover, for power generation, methane is being used widely. Methane is a greenhouse gas that is highly inflammable and forms explosive mixes in the air if the methane leaks are not detected properly. Hence new sensor technologies are being developed, such as substance-specific electrochemical sensors and Non-dispersive Infrared (NDIR) sensors that are used to detect methane and other gases in industries.

The outbreak of the COVID-19 pandemic is expected to create growth opportunities for the market. The pandemic has affected the additional requirement of oxygen for hospitalized patients. This has propelled various hospitals to efficiently manage oxygen use through oxygen sensors. Oxygen sensors are widely used in hospitals to detect oxygen leaks and assist in protecting patients. Additionally, manufacturers have also developed sensors to meet the high demand from ventilator manufacturers. For instance, in March 2020, Sensirion developed a new flow sensor, SFM3019, to the market. This development was expected to meet the increasing demand from ventilator manufacturers. Moreover, portable gas sensors are also being used widely as they have the ability to detect the gases enhancing safety in various industrial environment, thereby contributing to the growth of the portable gas sensor market.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The gas sensor market can be characterized by a high degree of innovation with rapidly evolving technological advances. Technological advancements, such as improvements in the accuracy and better life span, are making gas sensors more effective and practical for the everyday use.

The gas sensor market is also characterized by a high level of product launches by the leading players. Various leading players are focusing on launching the gas sensors to provide better sensing solutions and strengthen their market position across the world.

Industries handling specific gases are subject to regulations that dictate the monitoring of these gases to prevent leaks and accidents. Gas sensors are required for continuous monitoring and to trigger alarms or shut down processes in case of hazardous conditions. Moreover, gas sensor providers involved in the production and sale of gas sensors for global markets may need to comply with international standards.

In the gas sensor market, while there are limited direct substitutes, alternative technologies such as gas analyzers, and replacement sensors can be employed to achieve similar outcomes in specific applications. However, these alternatives often lack the same level of performance and adaptability as advanced gas sensors solutions.

The gas sensor market is witnessing a surge in end-use concentration, driven by the growing awareness and concerns regarding air quality and industrial safety. The increasing deployment of gas sensors is evident across various applications, including industrial settings, residential spaces, commercial establishments, and environmental monitoring initiatives.

Product Insights

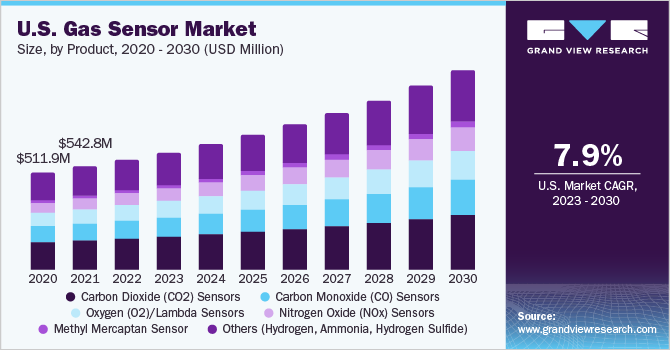

The carbon dioxide (CO2) sensors segment dominated the market in 2022 and accounted for a share of more than 31.0% of the global revenue. Carbon dioxide sensors are mainly used for monitoring indoor air quality in homes, office buildings, automotive, healthcare, and other applications. Numerous companies are focusing on developing MEMS-based carbon dioxide sensors for various applications. For instance, in January 2021, TDK Corporation introduced its TCE-11101, a miniaturized, low-power MEMS gas sensor platform for direct and accurate measurement of carbon dioxide in-home, healthcare, automotive, IoT, and other applications. Such initiatives bode well for the growth of the segment.

The carbon monoxide (CO) sensors segment is anticipated to register significant growth over the forecast period. Fatalities stemming from carbon monoxide poisoning are driving the need for carbon monoxide sensors. Government regulations to ensure safety in workplaces are increasing the growth of the carbon monoxide sensors market. For instance, in the U.S., carbon monoxide poisoning has prompted the government to deploy carbon monoxide detectors across various states in the U.S. As such, school buildings in the U.S. states, such as Connecticut, California, Maryland, Illinois, and Maine, are required to have carbon monoxide detectors.

Type Insights

The wired segment dominated the market in 2022 and accounted for a share of more than 55.0% of the global revenue. The wired gas sensors offer benefits, such as low maintenance, compact size, low cost, and higher accuracy. In many situations, wired sensors are among the most reliable systems as they directly link the sensor to the device receiving the input, making them suitable for use in mines, oil rigs, and nuclear power plants. Additionally, the increasing adoption of wired gas sensors in residential applications is a significant factor responsible for segment growth.

The benefits provided by wireless gas sensors, such as high scalability and flexibility, cost-effectiveness, and ease of portability, are expected to drive the growth of the segment. Wireless sensors can be used in a wide range of industries, including petrochemical, manufacturing, and oil & gas. In the oil & gas sector, these sensors provide continuous monitoring of gases remotely and can be operated from the base stations, thus reducing the chances of leakage and explosion of hazardous gases.

Technology Insights

The electrochemical segment dominated the market in 2022 and accounted for a share of more than 21.0% of the global revenue. The demand for electrochemical sensors is rising as these sensors consume lesser power, have intrinsically safer operations, and offer better specificity to the target gas. Electrochemical technology can detect toxic gas concentration with the oxidation of target gas in the electrode and provides efficient measurement of the resultant current. Such factors are expected to create more demand for electrochemical technology in gas sensors from the mining sector.

The infrared segment is anticipated to register the fastest growth over the forecast period. Infrared gas sensors detect various gases, including methane, carbon monoxide, and Volatile Organic Compounds (VOC) such as acetylene, benzene, butane, and others. These gas sensors are also used in monitoring oxygen levels in ventilators and ventilators. The growth of the segment can also be attributed to the rising levels of pollution across the globe.

End-use Insights

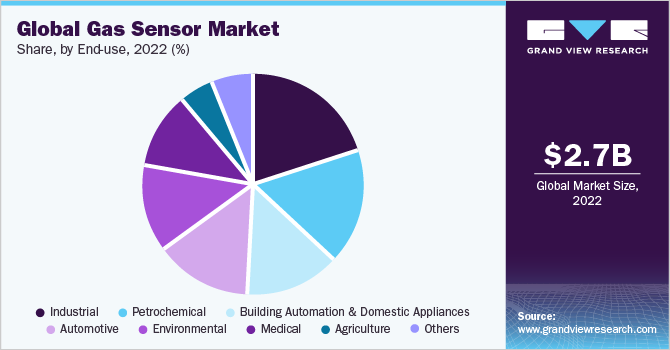

The industrial segment dominated the market in 2022 and accounted for a share of more than 19.0% of the global revenue. Industrial gas sensors are used to monitor and detect hazardous vapors and gases and trigger visual and audible alarms. Numerous gas sensor manufacturers are focusing on developing miniature industrial gas sensors. For instance, in October 2020, DD-Scientific, a sensor manufacturer, announced the launch of the newest range of high-performance industrial gas sensors that provides the same reliability and robustness as a bigger sensor in a miniature package. Additionally, in March 2022, Sensorix GmbH, a global manufacturer and supplier of electrochemical gas sensors, announced the launch of its sensor range namely, Sensorix AsH3 1, Sensorix SiH4 50, Sensorix PH3 1, Sensorix SeH2 5, Sensorix B2H6 1, Sensorix HCl 30, and Sensorix GeH4 5 for hydrogen chloride and hydrides, which are extremely used in the semiconductor manufacturing industry.

The petrochemicals segment is anticipated to register the fastest growth over the forecast period. The LPG and LNG industry verticals have been aggressively deploying gas sensors as these industry verticals require monitoring at every step of storage, production, and transportation of gas. While natural gas production has been growing worldwide, the emphasis on safety and security at the processing facilities has also been equally strengthening. The continued growth in natural gas products is expected to drive the growth of the segment.

Gas sensors are being integrated into IoT networks, enabling remote monitoring and control of gas concentrations in various settings. This trend is driven by the growing adoption of IoT technologies in various industries, including healthcare, automotive manufacturing, and environmental monitoring.

Regional Insights

Asia Pacific dominated the market in 2022 and accounted for a share of over 32.0% of the global revenue. Increasing awareness about the impact of air pollutants on human health across the countries in the Asia Pacific, such as India and China, is driving the demand for gas sensors for air quality monitoring. Continued urbanization in the region is also contributing to the rising demand for gas sensors. Moreover, the governments in the Asia Pacific regions are investing heavily in smart city projects, thus creating significant potential for smart sensor devices. Such factors bode well for the regional market growth. For instance, under the Union Budget 2021-22, the Smart City Mission in India has been granted a budget of Rs. 6,450 crore (USD 868 million) for the fiscal year 2021-22, which is an increase from the previous fiscal year’s (2020-21) allocation of Rs. 3,400 crore (USD 457 million).

Europe is expected to witness steady growth over the forecast period. Stringent norms related to the emissions of gases and the subsequent need for emissions monitoring are expected to drive the regional market's growth. In Europe, the safety requirements require all vehicle OEMs to include gas sensor technologies in their offers. As the rules to curb pollution levels are becoming more rigorous, the popularity of gas sensors in the automotive sector to decrease pollution is expected to increase over the coming years. In addition, several regional market players are developing advanced gas sensors, which is ultimately propelling the market’s growth. For instance, in March 2022, Gas Sensing Solutions, the U.K.-based company that specializes in LED-based NDIR infra-red gas sensors, introduced a line of methane gas sensors during the Sensor+Test 2022 event. These sensors are equipped with ultra-bright LEDs and internal architecture and deliver exceptional accuracy and minimal power usage.

Key Companies & Market Share Insights

The market is fragmented in nature. Market players are pursuing various strategies such as mergers & acquisitions, new product launches, and strategic partnerships, among others, for expanding their market presence. Market players are also investing aggressively in R&D for enhancing their product offerings. Benefits associated with wireless devices are prompting market players to mainly provide wireless gas sensors. Moreover, in recent years, players in gas sensor market in U.S. has witnessed notable trends indicating advancements in technology and a growing emphasis on environmental monitoring and safety. One significant trend is the integration of Internet of Things (IoT) capabilities into gas sensor systems, allowing real-time data collection and remote monitoring.

Vendors are also focusing on expanding their product offerings. For instance, in March 2023, Sensorix GmbH revealed its new range of sensors for toxic gases at Sensor + Test 2023. The showcase features the company’s variety of gas sensors that are highly prevalent in various industries. The company is addressing the worldwide demand for top-quality gas sensors and is presenting mechanical adaptations and customized solutions for gas detectors to meet customers' requirements, as well as sensors for exotic toxic gases.

In addition, in March 2021, Robert Bosch GmbH’s Bosch Sensortec announced the launch of the BME688 sensor, which combines humidity, gas, temperature, and barometric pressure sensing with Artificial Intelligence (AI). BME688 detects the presence of many gases, including VOCs, hydrogen, and carbon monoxide, in part per billion (ppb) range. Furthermore, in October 2022, Alphasense Inc. expanded its range of products with the launch of a series of photo-ionization detection (PID) sensors to deliver its customers with exceptional performance, and a broader choice of detection ranges.

Key Gas Sensor Companies:

- ABB Ltd.

- AlphaSense Inc.

- City Technology Ltd.

- Dynament

- Figaro Engineering Inc.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Siemens

- GfG Gas Detection UK Ltd.

- FLIR Systems, Inc.

Recent Developments

-

In December 2023, CO2 Meter.com, a Florida based company, launched CM-900,an industrial gas detector, to measure either Carbon Dioxide (CO2) or oxygen and provide protection for personnel working in proximity to hazardous gases. The newly released CM-900 detector boasts an industrially adaptive enclosure suitable for challenging conditions, including harsh and wash-down environments. Additionally, it incorporates audible and visual alarms that promptly notify individuals of unsafe conditions.

-

In April 2023, Figaro Engineering displayed its latest range of gas sensor products at the NFPA Conference trade show held in Las Vegas. The products include an electrochemical carbon monoxide sensor for unconditioned space; an ultra-low power battery operable methane sensor, TGS8410; and a highly sensitive hydrogen sensor, TGS2616

-

In February 2023, Figaro Engineering announced the launch of the NDIR CO2 sensor CDM7162, which is of a compact size with 8 mm thickness, and offers long-term reliability through a combination of a single-light-source dual-wavelength system with the company’s own signal processing technology. The application areas of the sensor include ventilation control and indoor air quality control

-

In September 2022, Sensorix announced the launch of its ‘Satellix’ gas sensor format, which has electrochemical sensors, along with pellistors for LEL monitoring. The product has been designed for detecting gases used in semiconductor processes

-

In April 2022, MEMBRAPOR launched the ETO/CA-10 sensor for ethylene oxide, which shows a highly reduced cross-sensitivity to carbon monoxide. The solution would allow for selective measurement of ethylene oxide concentrations in areas where traces of carbon monoxide are present

-

In April 2022, Alphasense & AMETEK MOCON unveiled the gas sensor center of excellence at their Essex manufacturing facility. This comes as part of the acquisition of Alphasense by AMETEK MOCON in November 2021 and will help accelerate the development of their gas safety and air quality sensor ranges, while also driving investment in R&D projects

Gas Sensor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.90 billion

Revenue forecast in 2030

USD 5.49 billion

Growth rate

CAGR of 9.5% from 2023 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in million units and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, type, technology, end-use

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

ABB Ltd.; AlphaSense Inc.; City Technology Ltd., Dynament; Figaro Engineering Inc.; Membrapor; Nemoto & Co. Ltd.; Robert Bosch LLC; Siemens; GfG Gas Detection UK Ltd.; FLIR Systems, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Sensor Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the gas sensor market report based on product, type, technology, end-use, and region.

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Oxygen (O2)/Lambda Sensors

-

Carbon Dioxide (CO2) Sensors

-

Carbon Monoxide (CO) Sensors

-

Nitrogen Oxide (NOx) Sensors

-

Methyl Mercaptan Sensor

-

Others (Hydrogen, Ammonia, Hydrogen Sulfide)

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Wireless

-

Wired

-

-

Technology Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Electrochemical

-

Semiconductor

-

Solid State/MOS

-

Photo-ionization Detector (PID)

-

Catalytic

-

Infrared (IR)

-

Others

-

-

End-use Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Medical

-

Building Automation & Domestic Appliances

-

Environmental

-

Petrochemical

-

Automotive

-

Industrial

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gas sensor market size was estimated at USD 2.69 billion in 2022 and is expected to reach USD 2.90 billion in 2023.

b. The global gas sensor market is expected to grow at a compound annual growth rate of 9.5% from 2023 to 2030 to reach USD 5.49 billion by 2030.

b. Asia Pacific dominated the gas sensor market with a share of 32.6% in 2022. Increasing awareness about the impact of air pollutants on human health across the countries in the Asia Pacific, such as India and China, is driving the demand for gas sensors for air quality monitoring.

b. Some key players operating in the gas sensor market include ABB Ltd.; AlphaSense Inc.; City Technology Ltd., Dynament; Figaro Engineering Inc.; Membrapor; Nemoto & Co. Ltd.; Robert Bosch LLC; Siemens; GfG Gas Detection UK Ltd.; FLIR Systems, Inc.

b. Key factors driving the gas sensor market growth include the increased extensive application of gas sensors in process and manufacturing industries for detecting various toxic, including hydrogen sulfide and nitrogen dioxide.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.4. Information Analysis

1.4.1. Market Formulation & Data Visualization

1.4.2. Data Validation & Publishing

1.5. Research Scope and Assumptions

1.6. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Outlook

3.2.2. Manufacturing & Technology Trends

3.3. Market Dynamics

3.3.1. Market Driver Impact Analysis

3.3.2. Market Restraint Impact Analysis

3.3.3. Market Opportunity Impact Analysis

3.4. Impact of COVID-19 Pandemic

3.5. Industry Analysis Tools

3.5.1. Porter’s Analysis

3.5.2. PESTEL Analysis

3.6. Pricing Analysis

Chapter 4. Gas Sensor Market: Product Estimates & Trend Analysis

4.1. Product Movement Analysis & Market Share, 2022 & 2030

4.2. Gas Sensor Market Estimates & Forecast, By Product

4.2.1. Oxygen (O2)/Lambda Sensors

4.2.2. Carbon Dioxide (CO2) Sensors

4.2.3. Carbon Monoxide (CO) Sensors

4.2.4. Nitrogen Oxide (NOx) Sensors

4.2.5. Methyl Mercaptan Sensor

4.2.6. Others (Hydrogen, Ammonia, Hydrogen Sulfide)

Chapter 5. Gas Sensor Market: Type Estimates & Trend Analysis

5.1. Type Movement Analysis & Market Share, 2022 & 2030

5.2. Gas Sensor Market Estimates & Forecast, By Type

5.2.1. Wired

5.2.2. Wireless

Chapter 6. Gas Sensor Market: Technology Estimates & Trend Analysis

6.1. Technology Movement Analysis & Market Share, 2022 & 2030

6.2. Gas Sensor Market Estimates & Forecast, By Technology

6.2.1. Electrochemical

6.2.2. Semiconductor

6.2.3. Solid State/MOS

6.2.4. Photo-Ionization Detector (PID)

6.2.5. Catalytic

6.2.6. Infrared (IR)

6.2.7. Others

Chapter 7. Gas Sensor Market: End-use Estimates & Trend Analysis

7.1. End-use Movement Analysis & Market Share, 2022 & 2030

7.2. Gas Sensor Market Estimates & Forecast, By End-use

7.2.1. Medical

7.2.2. Building Automation & Domestic Appliances

7.2.3. Environmental

7.2.4. Petrochemical

7.2.5. Automotive

7.2.6. Industrial

7.2.7. Agriculture

7.2.8. Others

Chapter 8. Gas Sensor Market: Regional Estimates & Trend Analysis

8.1. Gas Sensor Market: Regional Outlook

8.2. North America

8.2.1. North America gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. U.S. gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Canada gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.2.4. Mexico

8.2.4.1. Mexico gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.3.2. U.K.

8.3.2.1. U.K. gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.3.3. Germany

8.3.3.1. Germany gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.3.4. France

8.3.4.1. France gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.4.2. China

8.4.2.1. China gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.4.3. India

8.4.3.1. India gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.4.4. Japan

8.4.4.1. Japan gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.4.5. South Korea

8.4.5.1. South Korea gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.4.6. Australia

8.4.6.1. Australia gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.5. South America

8.5.1. South America gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Brazil gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.6. MEA

8.6.1. MEA gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.6.2. Kingdom of Saudi Arabia

8.6.2.1. Kingdom of Saudi Arabia gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.6.3. UAE

8.6.3.1. UAE gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

8.6.4. South Africa

8.6.4.1. South Africa gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company Categorization

9.2. Participant’s Overview

9.2.1. ABB. Ltd.

9.2.2. AlphaSense Inc.

9.2.3. City Technology Ltd.

9.2.4. Dynament

9.2.5. Figaro Engineering Inc.

9.2.6. Membrapor

9.2.7. Nemoto & Co. Ltd.

9.2.8. Robert Bosch LLC

9.2.9. Siemens

9.2.10. GfG Gas Detection UK Ltd.

9.2.11. FLIR Systems, Inc.

9.3. Financial Performance

9.4. Product Benchmarking

9.5. Company Market Positioning

9.6. Company Market Share Analysis, 2022

9.7. Company Heat Map Analysis

9.8. Strategy Mapping

9.8.1. Expansion

9.8.2. Collaborations

9.8.3. Mergers & Acquisitions

9.8.4. New Product Launches

9.8.5. Partnerships

9.8.6. Others

List of Tables

Table 1 Gas sensor market — Industry snapshot & key buying criteria, 2017 - 2030

Table 2 Global gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 3 Global gas sensor market, by region, 2017 - 2030 (USD Million)

Table 4 Global gas sensor market, by region, 2017 - 2030 (Million Units)

Table 5 Global gas sensor market, by product, 2017 - 2030 (USD Million)

Table 6 Global gas sensor market, by product, 2017 - 2030 (Million Units)

Table 7 Global gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 8 Global gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 9 Global gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 10 Vendor landscape

Table 11 Comparison between wired gas sensor and wireless gas sensor

Table 12 U.S natural gas volume delivered to customers (Million Cubic Feet), 2010 - 2015

Table 13 Gas Sensor Market — Application Analysis

Table 14 Gas Sensor Market — Key Distributors

Table 15 Oxygen (O2)/lambda gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 16 Oxygen (O2)/lambda gas sensor market, by region, 2017 - 2030 (USD Million)

Table 17 Oxygen (O2)/lambda gas sensor market, by region, 2017 - 2030 (Million Units)

Table 18 Carbon Dioxide (CO2) gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 19 Carbon Dioxide (CO2) gas sensor market, by region, 2017 - 2030 (USD Million)

Table 20 Carbon Dioxide (CO2) gas sensor market, by region, 2017 - 2030 (Million Units)

Table 21 Carbon Monoxide (CO) gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 22 Carbon Monoxide (CO) gas sensor market, by region, 2017 - 2030 (USD Million)

Table 23 Carbon Monoxide (CO) gas sensor market, by region, 2017 - 2030 (Million Units)

Table 24 Nitrogen Oxide (NOx) gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 25 Nitrogen Oxide (NOx) gas sensor market, by region, 2017 - 2030 (USD Million)

Table 26 Nitrogen Oxide (NOx) gas sensor market, by region, 2017 - 2030 (Million Units)

Table 27 Methyl mercaptan gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 28 Methyl mercaptan gas sensor market, by region, 2017 - 2030 (USD Million)

Table 29 Methyl mercaptan gas sensor market, by region, 2017 - 2030 (Million Units)

Table 30 Other gas sensors market, 2017 - 2030 (USD Million, Million Units)

Table 31 Other gas sensors market, by region, 2017 - 2030 (USD Million)

Table 32 Other gas sensors market, by region, 2017 - 2030 (Million Units)

Table 33 Electrochemical gas sensor market, 2017 - 2030 (USD Million)

Table 34 Electrochemical gas sensor market, by region, 2017 - 2030 (USD Million)

Table 35 Semiconductor gas sensor market, 2017 - 2030 (USD Million)

Table 36 Semiconductor gas sensor market, by region, 2017 - 2030 (USD Million)

Table 37 Solid state/MOS gas sensor market, 2017 - 2030 (USD Million)

Table 38 Solid state/MOS gas sensor market, by region, 2017 - 2030 (USD Million)

Table 39 Photo-Ionization Detector (PID) gas sensor market, 2017 - 2030 (USD Million)

Table 40 Photo-Ionization Detector (PID) gas sensor market, by region, 2017 - 2030 (USD Million)

Table 41 Catalytic gas sensor market, 2017 - 2030 (USD Million)

Table 42 Catalytic gas sensor market, by region, 2017 - 2030 (USD Million)

Table 43 Infrared gas sensor market, 2017 - 2030 (USD Million)

Table 44 Infrared gas sensor market, by region, 2017 - 2030 (USD Million)

Table 45 Other gas sensor technologies market, 2017 - 2030 (USD Million)

Table 46 Other gas sensor technologies market, by region, 2017 - 2030 (USD Million)

Table 47 Gas sensor market in medical end use, 2017 - 2030 (USD Million, Million Units)

Table 48 Gas sensor market in medical end use, by region, 2017 - 2030 (USD Million)

Table 49 Gas sensor market in medical end use, by region, 2017 - 2030 (Million Units)

Table 50 Gas sensor market in building automation & domestic appliances, 2017 - 2030 (USD Million, Million Units)

Table 51 Gas sensor market in building automation & domestic appliances, by region, 2017 - 2030 (USD Million)

Table 52 Gas sensor market in building automation & domestic appliances, by region, 2017 - 2030 (Million Units)

Table 53 Gas sensor market in environmental end use, 2017 - 2030 (USD Million, Million Units)

Table 54 Gas sensor market in environmental end use, by region, 2017 - 2030 (USD Million)

Table 55 Gas sensor market in environmental end use, by region, 2017 - 2030 (Million Units)

Table 56 Gas sensor market in petrochemical end use, 2017 - 2030 (USD Million, Million Units)

Table 57 Gas sensor market in petrochemical end use, by region, 2017 - 2030 (USD Million)

Table 58 Gas sensor market in petrochemical end use, by region, 2017 - 2030 (Million Units)

Table 59 Gas sensor market in automotive end use, 2017 - 2030 (USD Million, Million Units)

Table 60 Gas sensor market in automotive end use, by region, 2017 - 2030 (USD Million)

Table 61 Gas sensor market in automotive end use, by region, 2017 - 2030 (Million Units)

Table 62 Gas sensor market in industrial end use, 2017 - 2030 (USD Million, Million Units)

Table 63 Gas sensor market in industrial end use, by region, 2017 - 2030 (USD Million)

Table 64 Gas sensor market in industrial end use, by region, 2017 - 2030 (Million Units)

Table 65 Gas sensor market in agriculture end use, 2017 - 2030 (USD Million, Million Units)

Table 66 Gas sensor market in agriculture end use, by region, 2017 - 2030 (USD Million)

Table 67 Gas sensor market in agriculture end use, by region, 2017 - 2030 (Million Units)

Table 68 Gas sensor market in other end use, 2017 - 2030 (USD Million, Million Units)

Table 69 Gas sensor market in other end use, by region, 2017 - 2030 (USD Million)

Table 70 Gas sensor market in other end use, by region, 2017 - 2030 (Million Units)

Table 71 Oxygen (O2)/Lambda gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 72 Oxygen (O2)/Lambda gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 73 Oxygen (O2)/Lambda gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 74 Oxygen (O2)/Lambda gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 75 Carbon Dioxide (CO2) gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 76 Carbon Dioxide (CO2) gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 77 Carbon Dioxide (CO2) gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 78 Carbon Dioxide (CO2) gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 79 Carbon Monoxide (CO) gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 80 Carbon Monoxide (CO) gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 81 Carbon Monoxide (CO) gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 82 Carbon Monoxide (CO) gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 83 Nitrogen Oxide (NOx) gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 84 Nitrogen Oxide (NOx) gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 85 Nitrogen Oxide (NOx) gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 86 Nitrogen Oxide (NOx) gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 87 Methyl mercaptan gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 88 Methyl mercaptan gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 89 Methyl mercaptan gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 90 Methyl mercaptan gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 91 Other sensor market, 2017 - 2030 (USD Million, Million Units)

Table 92 Other sensor market, by technology, 2017 - 2030 (USD Million)

Table 93 Other sensor market, by end use, 2017 - 2030 (USD Million)

Table 94 Other sensor market, by end use, 2017 - 2030 (Million Units)

Table 95 Electrochemical gas sensor market, 2017 - 2030 (USD Million)

Table 96 Electrochemical gas sensor market, by product, 2017 - 2030 (USD Million)

Table 97 Electrochemical gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 98 Semiconductor gas sensor market, 2017 - 2030 (USD Million)

Table 99 Semiconductor gas sensor market, by product, 2017 - 2030 (USD Million)

Table 100 Semiconductor gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 101 Solid State/MOS gas sensor market, 2017 - 2030 (USD Million)

Table 102 Solid State/MOS gas sensor market, by product, 2017 - 2030 (USD Million)

Table 103 Solid State/MOS gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 104 PID gas sensor market, 2017 - 2030 (USD Million)

Table 105 PID gas sensor market, by product, 2017 - 2030 (USD Million)

Table 106 PID gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 107 Catalytic gas sensor market, 2017 - 2030 (USD Million)

Table 108 Catalytic gas sensor market, by product, 2017 - 2030 (USD Million)

Table 109 Catalytic gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 110 Infrared gas sensor market, 2017 - 2030 (USD Million)

Table 111 Infrared gas sensor market, by product, 2017 - 2030 (USD Million)

Table 112 Infrared gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 113 Other technology gas sensor market, 2017 - 2030 (USD Million)

Table 114 Other technology gas sensor market, by product, 2017 - 2030 (USD Million)

Table 115 Other technology gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 116 Gas sensor in medical end use, 2017 - 2030 (USD Million, Million Units)

Table 117 Gas sensor in medical end use, by product, 2017 - 2030 (USD Million)

Table 118 Gas sensor in medical end use, by product, 2017 - 2030 (Million Units)

Table 119 Gas sensor in medical end use, by technology, 2017 - 2030 (USD Million)

Table 120 Gas sensor in building automation & domestic appliances end use, 2017 - 2030 (USD Million, Million Units)

Table 121 Gas sensor in building automation & domestic appliances end use, by product, 2017 - 2030 (USD Million)

Table 122 Gas sensor in building automation & domestic appliances end use, by product, 2017 - 2030 (Million Units)

Table 123 Gas sensor in building automation & domestic appliances end use, by technology, 2017 - 2030 (USD Million)

Table 124 Gas sensor in environmental end use, 2017 - 2030 (USD Million, Million Units)

Table 125 Gas sensor in environmental end use, by product, 2017 - 2030 (USD Million)

Table 126 Gas sensor in environmental end use, by product, 2017 - 2030 (Million Units)

Table 127 Gas sensor in environmental end use, by technology, 2017 - 2030 (USD Million)

Table 128 Gas sensor in petrochemical end use, 2017 - 2030 (USD Million, Million Units)

Table 129 Gas sensor in petrochemical end use, by product, 2017 - 2030 (USD Million)

Table 130 Gas sensor in petrochemical end use, by product, 2017 - 2030 (Million Units)

Table 131 Gas sensor in petrochemical end use, by technology, 2017 - 2030 (USD Million)

Table 132 Gas sensor in automotive end use, 2017 - 2030 (USD Million, Million Units)

Table 133 Gas sensor in automotive end use, by product, 2017 - 2030 (USD Million)

Table 134 Gas sensor in automotive end use, by product, 2017 - 2030 (Million Units)

Table 135 Gas sensor in automotive end use, by technology, 2017 - 2030 (USD Million)

Table 136 Gas sensor in industrial end use, 2017 - 2030 (USD Million, Million Units)

Table 137 Gas sensor in industrial end use, by product, 2017 - 2030 (USD Million)

Table 138 Gas sensor in industrial end use, by product, 2017 - 2030 (Million Units)

Table 139 Gas sensor in industrial end use, by technology, 2017 - 2030 (USD Million)

Table 140 Gas sensor in agriculture end use, 2017 - 2030 (USD Million, Million Units)

Table 141 Gas sensor in agriculture end use, by product, 2017 - 2030 (USD Million)

Table 142 Gas sensor in agriculture end use, by product, 2017 - 2030 (Million Units)

Table 143 Gas sensor in agriculture end use, by technology, 2017 - 2030 (USD Million)

Table 144 Other gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 145 Other gas sensor market, by product, 2017 - 2030 (USD Million)

Table 146 Other gas sensor market, by product, 2017 - 2030 (Million Units)

Table 147 Other gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 148 North America gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 149 North America gas sensor market, by product, 2017 - 2030 (USD Million)

Table 150 North America gas sensor market, by product, 2017 - 2030 (Million Units)

Table 151 North America gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 152 North America gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 153 North America gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 154 U.S gas sensor market, 2017 - 2030 (USD Million)

Table 155 U.S gas sensor market, by product, 2017 - 2030 (USD Million)

Table 156 U.S gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 157 U.S gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 158 Canada gas sensor market, 2017 - 2030 (USD Million)

Table 159 Canada gas sensor market, by product, 2017 - 2030 (USD Million)

Table 160 Canada gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 161 Canada gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 162 Mexico gas sensor market, 2017 - 2030 (USD Million)

Table 163 Mexico gas sensor market, by product, 2017 - 2030 (USD Million)

Table 164 Mexico gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 165 Mexico gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 166 Europe gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 167 Europe gas sensor market, by product, 2017 - 2030 (USD Million)

Table 168 Europe gas sensor market, by product, 2017 - 2030 (Million Units)

Table 169 Europe gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 170 Europe gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 171 Europe gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 172 U.K gas sensor market, 2017 - 2030 (USD Million)

Table 173 U.K gas sensor market, by product, 2017 - 2030 (USD Million)

Table 174 U.K gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 175 U.K gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 176 Germany gas sensor market, 2017 - 2030 (USD Million)

Table 177 Germany gas sensor market, by product, 2017 - 2030 (USD Million)

Table 178 Germany gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 179 Germany gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 180 Asia Pacific gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 181 Asia Pacific gas sensor market, by product, 2017 - 2030 (USD Million)

Table 182 Asia Pacific gas sensor market, by product, 2017 - 2030 (Million Units)

Table 183 Asia Pacific gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 184 Asia Pacific gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 185 Asia Pacific gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 186 China gas sensor market, 2017 - 2030 (USD Million)

Table 187 China gas sensor market, by product, 2017 - 2030 (USD Million)

Table 188 China gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 189 China gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 190 India gas sensor market, 2017 - 2030 (USD Million)

Table 191 India gas sensor market, by product, 2017 - 2030 (USD Million)

Table 192 India gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 193 India gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 194 Japan gas sensor market, 2017 - 2030 (USD Million)

Table 195 Japan gas sensor market, by product, 2017 - 2030 (USD Million)

Table 196 Japan gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 197 Japan gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 198 South America gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 199 South America gas sensor market, by product, 2017 - 2030 (USD Million)

Table 200 South America gas sensor market, by product, 2017 - 2030 (Million Units)

Table 201 South America gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 202 South America gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 203 South America gas sensor market, by end use, 2017 - 2030 (Million Units)

Table 204 Brazil gas sensor market, 2017 - 2030 (USD Million)

Table 205 Brazil gas sensor market, by product, 2017 - 2030 (USD Million)

Table 206 Brazil gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 207 Brazil gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 208 MEA gas sensor market, 2017 - 2030 (USD Million, Million Units)

Table 209 MEA gas sensor market, by product, 2017 - 2030 (USD Million)

Table 210 MEA gas sensor market, by product, 2017 - 2030 (Million Units)

Table 211 MEA gas sensor market, by technology, 2017 - 2030 (USD Million)

Table 212 MEA gas sensor market, by end use, 2017 - 2030 (USD Million)

Table 213 MEA gas sensor market, by end use, 2017 - 2030 (Million Units)

List of Figures

Fig. 1 Gas Sensor Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Valudation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot

Fig. 8 Competitive Landscape Snapshot

Fig. 9 Parent Market Value, 2022 (USD Billion)

Fig. 10 Gas Sensor Market - Industry Value Chain Analysis

Fig. 11 Gas Sensor Market Dynamics

Fig. 12 Gas Sensor Market: PORTER’s Analysis

Fig. 13 Gas Sensor Market: PESTEL Analysis

Fig. 14 Gas Sensor Market, by Product: Key Takeaways

Fig. 15 Gas Sensor Market, by Product: Market Share, 2022 & 2030

Fig. 16 Gas sensor market estimates & forecasts, by oxygen (O2)/lambda sensors, 2017 - 2030 (USD Million)

Fig. 17 Gas sensor market estimates & forecasts, by carbon dioxide (CO2) sensors, 2017 - 2030 (USD Million)

Fig. 18 Gas sensor market estimates & forecasts, by carbon monoxide (CO) sensors, 2017 - 2030 (USD Million)

Fig. 19 Gas sensor market estimates & forecasts, by nitrogen oxide (NOx) sensors, 2017 - 2030 (USD Million)

Fig. 20 Gas sensor market estimates & forecasts, by methyl mercaptan sensor, 2017 - 2030 (USD Million)

Fig. 21 Gas sensor market estimates & forecasts, by others (hydrogen, ammonia, hydrogen sulfide), 2017 - 2030 (USD Million)

Fig. 22 Gas Sensor Market, by Type: Key Takeaways

Fig. 23 Gas Sensor Market, by Type: Market Share, 2022 & 2030

Fig. 24 Gas sensor market estimates & forecasts, by wired, 2017 - 2030 (USD Million)

Fig. 25 Gas sensor market estimates & forecasts, by wireless, 2017 - 2030 (USD Million)

Fig. 26 Gas Sensor Market, by Technology: Key Takeaways

Fig. 27 Gas Sensor Market, by Technology: Market Share, 2022 & 2030

Fig. 28 Gas sensor market estimates & forecasts, by electrochemical, 2017 - 2030 (USD Million)

Fig. 29 Gas sensor market estimates & forecasts, by semiconductor, 2017 - 2030 (USD Million)

Fig. 30 Gas sensor market estimates & forecasts, by solid state/MOS, 2017 - 2030 (USD Million)

Fig. 31 Gas sensor market estimates & forecasts, by photo-ionization detector (PID), 2017 - 2030 (USD Million)

Fig. 32 Gas sensor market estimates & forecasts, by catalytic, 2017 - 2030 (USD Million)

Fig. 33 Gas sensor market estimates & forecasts, by infrared (IR), 2017 - 2030 (USD Million)

Fig. 34 Gas sensor market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 35 Gas Sensor Market, by End-use: Key Takeaways

Fig. 36 Gas Sensor Market, by End-use: Market Share, 2022 & 2030

Fig. 37 Gas sensor market estimates & forecasts, by medical, 2017 - 2030 (USD Million)

Fig. 38 Gas sensor market estimates & forecasts, by building automation & domestic appliances, 2017 - 2030 (USD Million)

Fig. 39 Gas sensor market estimates & forecasts, by environmental, 2017 - 2030 (USD Million)

Fig. 40 Gas sensor market estimates & forecasts, by petrochemical, 2017 - 2030 (USD Million)

Fig. 41 Gas sensor market estimates & forecasts, by automotive, 2017 - 2030 (USD Million)

Fig. 42 Gas sensor market estimates & forecasts, by industrial, 2017 - 2030 (USD Million)

Fig. 43 Gas sensor market estimates & forecasts, by agriculture, 2017 - 2030 (USD Million)

Fig. 44 Gas sensor market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 45 Gas sensor market revenue, by region, 2022 & 2030 (USD Million)

Fig. 46 Regional marketplace: Key Takeways

Fig. 47 North America gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 48 U.S gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 49 Canada gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 50 Mexico gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 51 Europe gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 52 U.K gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 53 Germany gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 54 France gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 55 Asia Pacific Gas Sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 56 China gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 57 India gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 58 Japan gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 59 South Korea gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 60 Australia gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 61 South America gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 62 Brazil gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 63 MEA gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 64 Kingdom of Saudi Arabia gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 65 UAE gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 66 South Africa gas sensor market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 67 Key Company Categorization

Fig. 68 Company Market Positioning

Fig. 69 Company Market Share Analysis, 2022

Fig. 70 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket segmentation

- Gas Sensor Product Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Gas Sensor Type Outlook (Revenue, USD Million, 2017 - 2030)

- Wired

- Wireless

- Gas Sensor Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Gas Sensor End-use Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- Gas Sensor Regional Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

- North America

- North America Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- North America Gas Sensor Market, by Type

- Wired

- Wireless

- North America Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- North America Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- U.S.

- U.S. Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- U.S. Gas Sensor Market, by Type

- Wired

- Wireless

- U.S. Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- U.S. Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- U.S. Gas Sensor Market, by Product

- Canada

- Canada Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Canada Gas Sensor Market, by Type

- Wired

- Wireless

- Canada Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Canada Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- Canada Gas Sensor Market, by Product

- Mexico

- Mexico Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Mexico Gas Sensor Market, by Type

- Wired

- Wireless

- Mexico Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Mexico Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- Mexico Gas Sensor Market, by Product

- North America Gas Sensor Market, by Product

- Europe

- Europe Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Europe Gas Sensor Market, by Type

- Wired

- Wireless

- Europe Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Europe Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- Germany

- Germany Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Germany Gas Sensor Market, by Type

- Wired

- Wireless

- Germany Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Germany Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- Germany Gas Sensor Market, by Product

- U.K.

- U.K. Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- U.K. Gas Sensor Market, by Type

- Wired

- Wireless

- U.K. Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- U.K. Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- U.K. Gas Sensor Market, by Product

- France

- France Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- France Gas Sensor Market, by Type

- Wired

- Wireless

- France Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- France Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- France Gas Sensor Market, by Product

- Asia Pacific

- Asia Pacific Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Asia Pacific Gas Sensor Market, by Type

- Wired

- Wireless

- Asia Pacific Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Asia Pacific Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- China

- China Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- China Gas Sensor Market, by Type

- Wired

- Wireless

- China Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- China Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- India

- India Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- India Gas Sensor Market, by Type

- Wired

- Wireless

- India Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- India Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- India Gas Sensor Market, by Product

- Japan

- Japan Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Japan Gas Sensor Market, by Type

- Wired

- Wireless

- Japan Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Japan Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- Japan Gas Sensor Market, by Product

- South Korea

- South Korea Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- South Korea Gas Sensor Market, by Type

- Wired

- Wireless

- South Korea Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- South Korea Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- South Korea Gas Sensor Market, by Product

- Australia

- Australia Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Australia Gas Sensor Market, by Type

- Wired

- Wireless

- Australia Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Australia Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- Australia Gas Sensor Market, by Product

- Asia Pacific Gas Sensor Market, by Product

- South America

- South America Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- South America Gas Sensor Market, by Type

- Wired

- Wireless

- South America Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- South America Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- Brazil

- Brazil Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Brazil Gas Sensor Market, by Product

- Brazil Gas Sensor Market, by Type

- Wired

- Wireless

- Brazil Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Brazil Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- South America Gas Sensor Market, by Product

- MEA

- MEA Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- MEA Gas Sensor Market, by Type

- Wired

- Wireless

- MEA Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- MEA Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- Kingdom of Saudi Arabia

- Kingdom of Saudi Arabia Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- Kingdom of Saudi Arabia Gas Sensor Market, by Type

- Wired

- Wireless

- Kingdom of Saudi Arabia Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- Kingdom of Saudi Arabia Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- UAE

- UAE Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- UAE Gas Sensor Market, by Type

- Wired

- Wireless

- UAE Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- UAE Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- UAE Gas Sensor Market, by Product

- South Africa

- South Africa Gas Sensor Market, by Product

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

- South Africa Gas Sensor Market, by Type

- Wired

- Wireless

- South Africa Gas Sensor Market, by Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-Ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

- South Africa Gas Sensor Market, by End-use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

- South Africa Gas Sensor Market, by Product

- MEA Gas Sensor Market, by Product

- North America

Gas Sensor Market Dynamics

Drivers: Occupational Health And Safety Regulations

Industrial processes often involve the use of combustible and toxic gases like Hydrogen Sulfide (H2S) and Nitrogen Dioxide (NO2), posing significant risks to nearby workers. Continuous monitoring of these gases is crucial to prevent accidents. The demand for gas sensors, which ensure occupational health and safety, is increasing across various sectors, including manufacturing and processing industries. Regulations in North America and Europe regarding gas sensor usage are expected to positively influence the market. These devices effectively monitor gas leakages, safeguarding workers in hazardous environments. Agencies like the U.S.'s Occupational Safety and Health Administration (OSHA) and the UK’s Health and Safety at Work Act (HSWA) endorse gas sensor usage at workplaces. Industries like oil & gas, utilities, and manufacturing emit large amounts of toxic gases such as hydrogen sulfide, ammonia, and sulfur dioxide, exposing nearby workers to potential respiratory diseases. Hydrogen sulfide, a toxic gas found in oil and natural gas deposits, can cause irritation to the eyes, nose, throat, and lungs, and can even be fatal. A 2018 United Nations report revealed that around 2.8 million workers are affected annually due to exposure to toxic gases. Hence, continuous monitoring of these gases is essential for occupational safety in industries like oil & gas, mining, chemicals, and manufacturing.

Drivers: Increasing Use Of Wireless And Smart Gas Sensor Technology

The global market is anticipated to benefit from the growing use of wireless gas sensors. These sensors, capable of detecting target gas concentrations and transmitting corresponding signals, are particularly useful in remote areas. Their demand is expected to remain high due to their ability to identify toxic or flammable gases in dangerous environments. Wireless sensors offer several advantages, including cost-effectiveness, the capacity to form a sensor network, and easy installation. They can be integrated into portable devices like tablets and smartphones, enhancing performance in harsh conditions. Many companies are focusing on wireless technology to reap substantial benefits, such as real-time data transfer with the Internet of Things and improved resource utilization with less complexity. This trend is expected to continue, further driving the adoption of wireless gas sensors.

Restrains: Technical Issues And Hash Environments Hamper The Average Life Span Of A Sensor

Technical challenges associated with gas sensors, such as their inability to detect gases at certain temperature levels, pose a hurdle for market growth. Gas sensors made from metal oxides are vulnerable to harsh conditions like high temperatures and humidity. In humid conditions, the interaction between water molecules and surface oxygen reduces the baseline resistance of the sensor, decreasing its sensitivity. Moreover, gas sensors based on metal oxide semiconductor technology consume more power than those based on electrochemical technology. They are also susceptible to cross-sensitivity issues. For example, carbon monoxide sensors react to both carbon monoxide and hydrogen, which can lead to inflated carbon monoxide concentration readings in applications with high hydrogen levels. Gas sensors operating above 1000°C face challenges such as selectivity and thermal stability. The sensor’s mounting style can also cause detection problems. Sensors designed to detect a specific metal should not be mounted on that metal without a gap between the sensing face and the mounting metal, as incorrect mounting can result in false readings.

What Does This Report Include?

This section will provide insights into the contents included in this gas sensor market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Gas sensor market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Gas sensor market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the gas sensor market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for gas sensor market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of gas sensor market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Gas Sensor Market Categorization:

The gas sensor market was categorized into five segments, namely product (Oxygen /Lambda Sensors, Carbon Dioxide Sensors, Carbon Monoxide Sensors , Nitrogen Oxide Sensors, Methyl Mercaptan Sensor), type (Wireless, Wired), technology (Electrochemical, Semiconductor, Solid State/MOS, Photo-ionization Detector, Catalytic, Infrared) end-use (Medical, Building Automation & Domestic Appliances, Environmental, Petrochemical, Automotive, Industrial, Agriculture), and regions (North America, Europe, Asia Pacific, South America, Middle East & Africa).

Segment Market Methodology:

The gas sensor market was segmented into product, type, technology, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-