- Home

- »

- Medical Devices

- »

-

Gastroretentive Drug Delivery Systems Market Report, 2028GVR Report cover

![Gastroretentive Drug Delivery Systems Market Size, Share & Trends Report]()

Gastroretentive Drug Delivery Systems Market Size, Share & Trends Analysis Report By Type (Tablets, Liquid, Capsule), By Dosage Form, By Distribution Channel, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-415-9

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global gastroretentive drug delivery systems market size was valued at USD 11.8 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2021 to 2028. Pharmaceutical companies are taking initiative with changing requirements and are constantly investing in developing gastroretentive drug delivery systems (DDSs) is the factor estimated to augment market growth. The rising disease burden throughout the world and proven efficacy of gastroretentive drug delivery systems in addressing several gastric-related disorders such as gastric ulcer, and peptic ulcer are anticipated to accelerate the overall market progression.

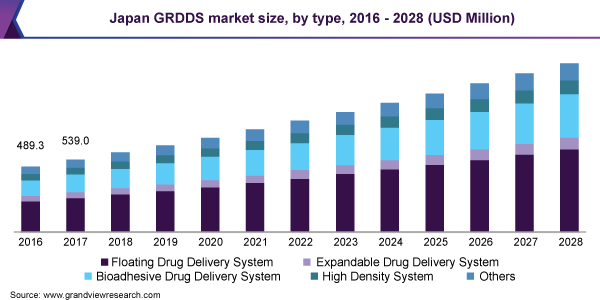

The market for gastroretentive drug delivery systems experienced a mild impact of the ongoing COVID-19 pandemic in some regions due to production restrictions during mid-2020. However, the restraining effect was negated with growing demand, online prescriptions, and e-pharmacy services. The market in Japan was unimpacted during the first wave of COVID-19 owing to its well-established healthcare infrastructure.

Helicobacter pylori infection is among the most common human infection globally. According to the article published by the University of Arizona, H.pylori infection is higher in developing countries than the developed countries. The incidence of new infections in developing countries is 3 to 10% of the population compared to 0.5% in developed economies. H. Pylori infection is among the known cause of gastroduodenal ulcer disease, gastritis, and gastric cancer. The prevention and management of the disorder can be achieved by enhancing mucosal protection and decreasing the level of gastric acidity. Gastroretentive drug delivery systems extend the gastric retention time, thereby aggregating the concentration of the drug at the application site, possibly reducing essential dosage and improving its bioavailability. The increasing prevalence of H. pylori infection globally is anticipated to boost the growth of the market for gastroretentive drug delivery systems.

Gastroretentive Drug Delivery (GRDD) technology has emerged as an efficient approach for the controlled delivery of various therapeutic molecules which enhances bioavailability. In current years, technological and scientific advancements are made in research and development activities of rate-controlled oral drug delivery methods by overcoming physiological difficulties, including unpredictable gastric emptying times and short gastric residence times. GRDDS has potential application to advance the oral delivery of drugs, for which extended retention in the upper GI tract can enhance their oral bioavailability as well as their therapeutic outcome.

Currently, technological and scientific advancements are undertaken for rate-controlled oral drug delivery systems by disabling physiological difficulties, including unpredictable gastric emptying times as well as short gastric residence times. Thus, to overcome such difficulties, the gastroretentive drug delivery system is designed for longer gastric retention time and will prolong the time within which drug absorption can occur, thereby surging its preference among patients.

Type Insights

The floating drug delivery systems segment accounted for the largest revenue share of 46.0% in 2020. Floating drug delivery systems is one of the important methods to attain gastric retention to gain adequate drug bioavailability. This system has less bulk density than gastric fluids and thus stays buoyant in the stomach without disturbing gastric emptying rate for a sustained period. The drug is released gradually at a preferred rate from this system. After drug release, the residual system is emptied from the stomach. This results in increased gastric retention time and offers improved control over fluctuation in plasma drug concentration, augmenting the segmental growth.

The bioadhesive drug delivery systems segment is expected to witness a healthy CAGR of 7.1% over the forecast period. Bioadhesive polymers are used in enhancing drug absorption and can adhere to the epithelial surface in the stomach. Thus, they improve the gastric retention prolongation, thereby increasing its adoption rate.

Distribution channel Insights

The hospital pharmacies segment dominated the market for gastroretentive drug delivery systems and captured the largest revenue share of 34.9% in 2020. Hospital pharmacies preserve the stock of products related to gastric disorders for in-patients and out-patients. Increased investments in healthcare infrastructure and rising consumer awareness in underdeveloped and developing countries are expected to fuel the segmental growth.

The online pharmacies segment is predicted to be the fastest-growing distribution channel segment and is expected to witness a CAGR of 7.7% over the forecast period. This growth can be accredited to convenience and user-friendly interfaces offered by online pharmacies in terms of prices, delivery, and access. In addition, these pharmacies offer several discounts on the purchase of a definite amount or offer bundle pricing for gastric-related products, securing market growth.

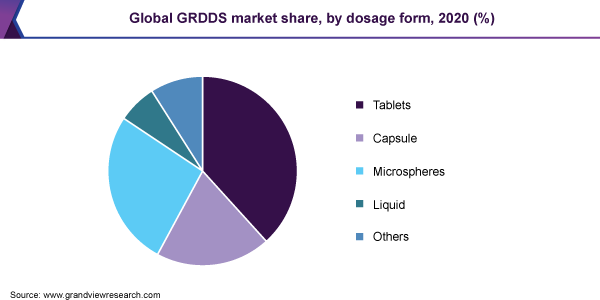

Dosage form insights

The tablets segment dominated the market for gastroretentive drug delivery systems and accounted for the largest revenue share of 38.5% in 2020. The increasing focus of manufacturers on developing gastroretentive tablets is expected to maintain a strong position in the market. Market players including Lupin are developing bioadhesive tablets of the brand name Xifaxan. The density of tablets is lower than the density of stomach fluid causing buoyancy in gastric fluid, thereby making it preferable among patients.

The capsule dosage form segment had a considerable revenue share in 2020. Various key players are manufacturing capsule-based gastroretentive products owing to their increased efficiency. Manufacturers such as Roche, Pfizer are producing controlled-release capsules and bilayer floating capsules respectively. Also, different geometrical forms of biodegradable polymer can be compressed and prepared within a capsule, creating a wide variety of dosage forms based on size, fostering the segmental expansion.

Regional Insights

North America dominated the gastroretentive drug delivery systems market and accounted for the largest revenue share of 41.2% in 2020. The high prevalence of gastric cancer, increasing R&D expenditure, and rising initiatives by market participants in developing advanced gastroretentive drug delivery systems in the U.S. and Canada contributed considerably to North America’s leading market share in 2020. Better adoption of improved gastroretentive drug delivery solutions and follow-up of advanced treatment methods in healthcare is expected to foster regional growth. The increasing occurrence of gastrointestinal disorders across the U.S. and Canada is anticipated to create demand for GRDDS, as they prolong drug retention time in the stomach.

The Asia Pacific region accounted for the significant revenue share in 2020. The market is expected to grow at the fastest rate of 6.8% in the region during the forecast period. The presence of a large patient pool is expected to drive the demand for these devices in the region. Rising spending on research and development activities in emerging countries such as Singapore and Japan is anticipated to fuel regional market growth. To meet the growing demand, global players are looking to launch technologically advanced products in the region.

In Europe, the market is expected to experience a significant growth rate of 27.2% during the forecast timeframe. Improved healthcare infrastructure services and a rising number of research activities in the healthcare sector are expected to contribute to the region’s market growth. Economic growth in countries such as Germany, France, and others is increasing health care expenditure through a rise in private health insurance and entry of international drug manufacturers and healthcare providers. Hence, the European GRDDS market is projected to witness considerable market share.

Key Companies & Market Share Insights

Product launch, strategic acquisitions, and innovation are major strategies adopted by the market players to retain their market share. Some of the prominent players in the gastroretentive drug delivery systems (DDSs) market include:

-

F. Hoffmann La Roche

-

Ranbaxy

-

GlaxoSmithKline

-

Pharmacia

-

Depomed

-

Alcon, Inc.

-

Lupin

-

Galanix

-

Sun Pharma

Gastroretentive Drug Delivery Systems Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 12.8 billion

Revenue forecast in 2028

USD 19.7 billion

Growth Rate

CAGR of 6.4% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, dosage form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; India; Japan; China; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

F. Hoffmann La Roche; Glaxo Smith Kline; Lupin; Pfizer; Sun Pharma; Ranbaxy; Depomed; Galanix; Pharmacia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global gastroretentive drug delivery systems market report on the basis of type, dosage form, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

High Density System

-

Expandable Drug Delivery System

-

Bioadhesive Drug Delivery System

-

Floating Drug Delivery System

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2016 - 2028)

-

Tablets

-

Liquid

-

Microspheres

-

Capsule

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Columbia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global GRDDS market size was estimated at USD 11.8 billion in 2020 and is expected to reach USD 12.8 billion in 2021.

b. The global GRDDS market is expected to grow at a compound annual growth rate of 6.4% from 2021 to 2028 to reach USD 19.7 billion by 2028.

b. The floating drug delivery systems segment accounted for the largest revenue share of 46.0% in 2020 in the GRDDS market. This system is one of the important methods to attain gastric retention to gain adequate drug bioavailability.

b. The hospital pharmacies distribution channel segment dominated the market for GRDDS and captured the largest revenue share of 34.9% in 2020.

b. The tablets segment dominated the GRDDS market and accounted for the largest revenue share of 38.5% in 2020.

b. Key factors that are driving the market growth include rising disease burden throughout the world and the proven efficacy of GRDDS in addressing several gastric-related disorders such as gastric ulcers, peptic ulcers, and others.

b. North America dominated the GRDDS market and accounted for the largest revenue share of 41.2% in 2020.

b. Some key players operating in the GRDDS market include Ranbaxy, F. Hoffmann La Roche, Pharmacia, GlaxoSmithKline, Lupin, Pfizer, Depomed, Galanix, Sun Pharma, and Alcon, Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."