- Home

- »

- Next Generation Technologies

- »

-

GCC Indoor Location-based Services Market Size, Industry Report 2025GVR Report cover

![GCC Indoor Location-based Services Market Report]()

GCC Indoor Location-based Services Market Analysis By Product, By Technology, By Application (Monitoring, Navigation, Proximity, Tracking), By End-Use, By Country, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-586-1

- Number of Pages: 138

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Technology

Industry Insights

The GCC Indoor Location-based Services Market size was valued at USD 46,171.2 thousand in 2016 and is expected to gain traction over the forecast period. The growing penetration of smartphones in the GCC region is a major factor that has contributed to the growth of the industry in this region. Moreover, the increasing usage of 3D platforms across various industries is expected to stimulate the demand for indoor location-based services (LBS) in this region.

The GCC region has a well-developed infrastructure with a large number of parks, skyscrapers, and state-of-the-art malls and campuses. Thus, it enables service providers to offer customers with location information and offers for stores, hotels, and shops through indoor LBS. The region experiences a large volume of tourists visiting countries such as Dubai and Saudi Arabia regularly for business and leisure. Thus, it fosters the usage of location-based services at airports, lounges, ATMs, and shopping malls to enable convenience to tourists. For instance, Dubai is the fourth largest tourist destination with the number of tourists estimated at 14.3 million in 2015. It provides extensive scope for the use of LBS for marketing and promotional services on a large scale.

Indoor LBS is mainly used for the tracking of assets and navigation to provide assistance and security. The involvement of government in the usage of monitoring devices for tracking public activities contributes toward the industry growth. Furthermore, the use of location-based services in retail applications for promotion purposes is further expected to stimulate industry growth over the forecast period.

The difficulty involved in providing real-time accuracy of information by industry participants poses a challenge to the indoor location-based services market. Technological proliferation has enabled industry vendors to make use of analytics and business intelligence to improve location accuracy, thereby increasing tracking efficiency.

Product Insights

Location-based advertising service dominated the product segment in 2016 and is anticipated to grow at a CAGR of 49.2% from 2017 to 2025. The services are mainly used to provide customers with updates regarding offers and benefits on various products. Moreover, advertising and marketing services are designed based on location-based service technologies.

Proximity beacons are expected to emerge as the fastest-growing segment as they are low in cost and can be easily installed. These beacons are used to deliver various promotional services and hyper-local advertising. They are a replacement for traditional signboards for customers who prefer accessing information through connected devices such as mobile phones and tablets.

Technology Insights

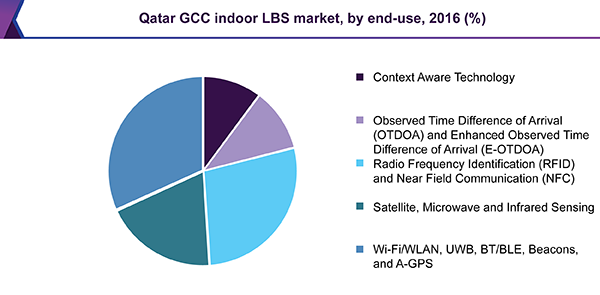

Wi-Fi/WLAN, UWB, BT/BLE, Beacons, and A-GPS dominates the application segment due to the increased penetration of internet broadband and Wi-Fi services in the region. Most of the countries have public Wi-Fi connections to provide customers with connectivity at all places. Along with connectivity, location-based marketing activities are also undertaken by various companies.

Radio Frequency Identification (RFID) and Near Field Communication (NFC) is the fastest-growing technological sub-segment in the GCC region owing to the increasing adoption of smartphones that has integrated RFID and QR code scanners to offer customers payment services, security clearances, and voice messaging services.

Application Insights

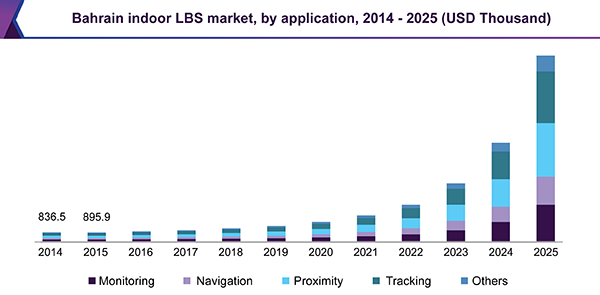

The tracking application is anticipated to witness remarkable growth and was valued at USD 15,818.4 thousand in 2016. Indoor LBS is majorly implemented for asset tracking and monitoring purposes. The development of infrastructure in the GCC region has increased the importance of tracking valuable products.

Proximity is expected to be the fastest-growing application segment, registering a CAGR of 52.8% over the forecast period. The increased growth is attributed to the use of location-based services for geo-targeting, which provides customers with the location information of the product. This enables effective marketing and customer engagement.

End-use Insights

The government is the largest end-use segment and was valued at USD 10,683.9 thousand in 2016. The sector uses indoor LBS on a large scale for security purposes and to provide information regarding public services through mobile applications in the GCC region.

On the other hand, retail is the fastest-growing end-use segment, registering a CAGR of 52.9% over the forecast period. The emergence of global brands entering the GCC region has led to an increased scope for the promotion of products and services that enable the use of LBS on an extensive scale.

Country Insights

Saudi Arabia holds the largest share among all other GCC countries due to the high GDP and huge involvement of the government toward digitalization. The government in this region has developed plans to provide internet connectivity across all areas of the country. Moreover, the adoption of smart devices in this country is higher as compared to other countries.

UAE is the fastest growing country owing to famous tourist destinations in cities such as Dubai, which enables large-scale retail companies to set up offices. Furthermore, the widespread infrastructure enables the usage of location-based services to a large extent for location and marketing purposes.

GCC Indoor Location-based Services Market Share Insights

Key players in the industry include Apple Inc., Cisco Systems Inc., GloPos, Google Inc., HERE, inside, IndoorAtlas Ltd., Micello, Inc., Microsoft Corp., Navizon Inc., Qualcomm Technologies Inc., Ruckus Wireless, Inc., Shopkick, Inc., Sprooki Pte Ltd., and YOOSE Pte. Ltd. among others.

OEM manufacturers provide a lucrative scope for industry growth as the demand is high for connected devices such as mobile phones, tablets, and wearable devices in this region. Industry participants are highly competitive as the solutions provided by these companies can be deployed across multiple platforms and different devices. As such, they are likely to acquire a major market share. Large companies focus on new product developments to retain industry share whereas small companies provide small-scale solutions such as software and updates.

Report Scope

Attribute

Details

The base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Thousand and CAGR from 2017 to 2025

Regional scope

GCC

Country scope

Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and UAE

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the GCC indoor location-based services market based on the product, technology, application, end-use, and region.

-

Product Scope (Revenue, USD Thousand; 2014 - 2025)

-

Analytics and Insights

-

Automotive Services

-

Campaign Management

-

Consumer Services

-

Enterprise Services

-

Location and Alerts

-

Location-based Advertising Services

-

Maps

-

Precision Geo-targeting

-

Proximity Beacons

-

Secure Transactions and Redemptions

-

-

Technology Security Scope (Revenue, USD Thousand; 2014 - 2025)

-

Context-Aware Technology

-

Observed Time Difference of Arrival (OTDOA) and Enhanced Observed Time Difference of Arrival (E-OTDOA)

-

Radio Frequency Identification (RFID) and Near Field Communication (NFC)

-

Satellite, Microwave and Infrared Sensing

-

Wi-Fi/WLAN, UWB, BT/BLE, Beacons, and A-GPS

-

-

Application Security Scope (Revenue, USD Thousand; 2014 - 2025)

-

Monitoring

-

Navigation

-

Proximity

-

Tracking

-

Others

-

-

End-use Scope (Revenue, USD Thousand; 2014 - 2025)

-

Aerospace & Defense

-

BFSI

-

IT & Telecommunication

-

Energy & Power

-

Government

-

Healthcare

-

Hospitality

-

Retail

-

Transportation & Logistics

-

Others

-

-

Country Scope (Revenue, USD Thousand; 2014 - 2025)

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

Saudi Arabia

-

UAE

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."