- Home

- »

- Advanced Interior Materials

- »

-

GCC Metal Forging Market Size, Industry Report, 2019-2025GVR Report cover

![GCC Metal Forging Market Size, Share & Trends Report]()

GCC Metal Forging Market Size, Share & Trends Analysis Report By Process (Open Die, Closed Die), By Application (Ball Valve, Wellhead Equipment, Turbine), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-857-2

- Number of Pages: 77

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Advanced Materials

Report Overview

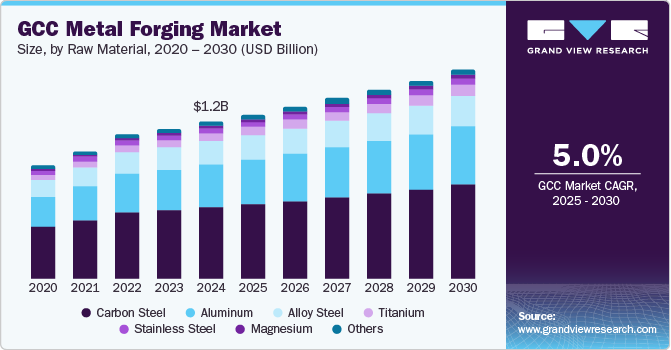

The GCC metal forging market size was estimated at USD 1.08 billion in 2018 and is anticipated to expand at a compounded annual growth rate (CAGR) of 2.1% from 2019 to 2025. Increasing focus on infrastructure development particularly in Asia Pacific countries is projected to drive product consumption in the forthcoming years.

Increasing activities in the GCC oil and gas industry is estimated to be the key driver for market growth. The demand for forged metal components such as ball valves, wellhead equipment, electric motors, turbines, and pumps from the oil and gas industry are predicted to grow at a stable pace over the forecast period.

Saudi Arabia has 18% of global petroleum reserves. The oil and gas sector in the country contributes to over 50% of the GDP. In 2017, the country generated around USD 231.48 billion in revenue through exports; out of which USD 159.74 billion came from the petroleum sector alone. The country requires different types of oil and gas machinery and equipment for the sustainability of the sector. As a result, the demand for forged parts in these equipment and machinery is expected to grow over the forecast period.

Pumps and ball valves application segments were the major contributors to Saudi Arabia forging demand in 2018 and accounted for volume shares of 27.1% and 20.0%, respectively. Pumps are integral components in oil drilling rigs as they help transfer fluids from one place to another.

Various pumps such as centrifugal, positive displacement, and diaphragm have witnessed high demand in the oil and gas sector. The demand for forged components in pumps on account of increasing exploration and production activities in the oil and gas sector is expected to increase over the forecast period.

GCC Metal Forging Market Trends

Increasing oil & gas activities in GCC is anticipated to boost market growth. Metal forged components are used in end-use industries such as automotive & transportation, oil & gas, and aerospace & defense. As compared to other end-use industries, oil & gas industry is a principal component of the GCC countries’ economy. Thus, the growth of oil & gas industry in the region is expected to drive the metal forging market.

The future outlook of oil & gas industry remains strong owing to the steady investments from the national oil & gas companies in the region. In December 2017, Saudi Arabian Oil Co., a public natural gas and petroleum company in Saudi Arabia, announced plan to invest USD 414 billion in various projects for the expansion of the company’s production capacity in next ten years.

The automotive industry is anticipated to be an important driver for the metal forging market. The trend is expected to continue over the coming years, which is in turn anticipated to positively influence the market growth in the region.

For instance, in September 2018, WMOTORS, a manufacturer of luxury sports car, has decided to move its manufacturing facility to UAE from Italy. The company will start the production of its limited series Fenyr SuperSport and electric vehicles from this facility. The construction is expected to get completed by 2022. Thus, these investments are projected to benefit the automotive industry in the region, thereby augmenting the demand for metal forged products.

However, GCC forging sector is facing competition from casting industry, where forged products are now being replaced by cast products. The substitution is projected to increase with the advancement in casting technology. Many forged components such as transmission parts and crankshafts are now manufactured using casting due to improvement in technology and low cost associated with it.

Furthermore, the forging industry is capital-intensive as it requires large space and produces large & heavy products, large machine tools, and other heavy equipment. Moreover, skilled labor is required, and this adds to the input cost. These reasons are anticipated to restrict the demand growth of metal forging in the region.

Process Insights

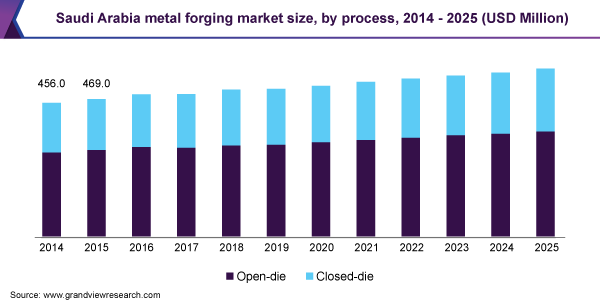

Open die process accounted for a volume share of more than 51.0% in 2018 in GCC metal forging market. This process is also called as open forging. In this process, the billet is placed between “hammer” or “stamp” dies. The material is altered through a series of continuous hammering and stamping movements until the desired dimensions are obtained.

Metal products manufactured using open die forging often need machining with the help of CNC or other advanced machines to achieve desired dimensions. Custom shapes can also be manufactured using open die forging. Primary products manufactured using open die forging process in the GCC region include wellhead equipment, electric motors, turbines, ball valves, pumps, blowout preventers, and gas compressors.

In terms of revenue, the closed die process is projected to expand at CAGR of 2.0% from 2019 to 2025. This process utilizes high pressure to compress the piece of metal into an enclosed die impression of required shapes. In this process, a medium-frequency induction heating furnace is utilized to heat the metal for pressing it into the enclosed dies. This process requires precision machined dies. As a result, forged components require little or no machining due to its high accuracy throughout the forging process.

Application Insights

Pumps was the largest application segment with a revenue share of more than 26.0% in 2018. Pumps are extensively used in oil and gas and chemical industries to transmit fluids. Impulse, positive displacement, gravity, velocity, steam, and valve-less are the major types of pumps that are currently used in the oil and gas industry. Out of the aforementioned pumps, positive displacement pumps are commonly used in the oil and gas industry as they offer consistent flow irrespective of the pressure.

The surging oil and gas activities in the GCC region are projected to benefit the demand in wellhead equipment applications. The outlook for oil and gas production in the Middle East remains optimistic owing to stable investments by the government oil and gas companies in the region. A significant boost in drilling activities in the region is predicted to provide a lucrative platform for forged wellhead equipment.

Ball valves are used for a variety of upstream and downstream applications in oil and gas, petrochemical, chemical, process, and energy industries. Ball valves are used to control the flow of substances from one opening to the next. They are used for pressure and flow control of slurries, corrosive fluids, normal gases, and liquids. They are predominantly used in oil and gas industry but also find applications in manufacturing as well as chemical storage sectors respectively.

Regional Insights

The GCC region is expected to witness 2.1% CAGR, in terms of revenue, across the forecast period. The increase in demand for forged components in end-use industries, namely, construction, industrial machinery, and oil & gas is anticipated to drive demand. Growth in construction activity, the development of the automotive aftermarket industry, and secured feedstock due to locally produced aluminum and steel, are anticipated to boost the metal forging market.

Saudi Arabia dominated the GCC metal forging market and accounted for the largest revenue share of 45.9% in 2018. The growing demand for forged parts in the country is attributed to the rising production in the oil & gas industry. For instance, the country generated USD 159.74 billion from petroleum exports in 2017. The requirement for machinery and equipment is anticipated to boost the demand for forged parts over the forecast period.

As per the U.S.-UAE Business Council, the UAE ranks seventh for proven oil reserves of 97.8 billion barrels. Moreover, between 2009 and 2016, the country’s crude oil and natural gas production rose by 28%. Production from the UAE’s oil & gas sector is increasing at a constant rate, which is anticipated to play a vital role in driving the demand for forged parts.

Furthermore, the UAE is characterized by the presence of several local and multinational oil & gas companies, which use forged components such as ball valves, pumps, and turbines among others. Some of the key local players in oil & gas sector include the Emirates National Oil Company, RAK Gas, Sharjah National Oil Company, and the Abu Dhabi National Oil Company. The existence of key players in the sector is projected to boost the demand for metal forged components in the country.

Key Companies & Market Share Insights

There are a small number of players present in the market compared to other regions such as Asia, North America, and Europe. End-use industries depend on imports of forged components. This provides opportunity for new entrants in the market. Thus, with the development of end-use industries, the establishment of new production facilities is expected over the long term in GCC countries.

Some of the prominent players in the GCC metal forging market include:

-

SPSV

-

Precision Forging Factory

-

Steel Forgings Gulf

-

ALKAFAA

-

FTV Proclad (U.A.E.) L.L.C.

-

Doosan Heavy Industries & Construction

-

MFc Group

-

El Nasr Company

GCC Metal Forging Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.11 Billion

Revenue forecast in 2025

USD 1.26 Billion

Growth Rate

CAGR of 2.1% from 2019 to 2025

Base year for estimation

2018

Actual estimates/Historic data

2014 - 2017

Forecast period

2019 - 2025

Quantitative Units

Volume in kilotons, revenue in USD million & CAGR from 2019 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Process, application, region

Country scope

Saudi Arabia; UAE; Qatar; Oman; Kuwait; Bahrain; Egypt; Iraq

Key companies profiled

SPSV; Precision Forging Factory; Steel Forgings Gulf; ALKAFAA; FTV Proclad (U.A.E.) L.L.C.; Doosan Heavy Industries & Construction; MFc Group; El Nasr Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the GCC metal forging market report based on process, application and region:

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Open Die

-

Closed Die

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Ball Valves

-

Wellhead Equipment

-

Electric Motor

-

Turbine

-

Pump

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

GCC

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

Kuwait

-

Bahrain

-

Egypt

-

Iraq

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."