- Home

- »

- Biotechnology

- »

-

Gene Amplification Technologies Market Report, 2028GVR Report cover

![Gene Amplification Technologies Market Size, Share & Trends Report]()

Gene Amplification Technologies Market Size, Share & Trends Analysis Report By Technology, By Downstream Application, By Sample Type, By Product, By End Use, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-570-4

- Number of Pages: 185

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Healthcare

Report Overview

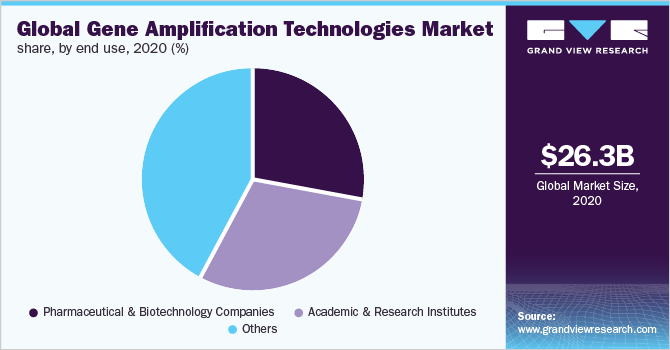

The global gene amplification technologies market size was valued at USD 26.28 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 2.0% from 2021 to 2028. The growing need for research and development in the field of molecular diagnostics, genomics, biological research, and genetic testing is a key factor fueling market growth. The constant development of numerous diagnostic tests based on various gene amplification methods for COVID-19 has further driven the market. A PCR-based diagnostic test is considered to be the gold standard approach for the detection of SARS-CoV-2 infection. Several product launches and technological advancements by the key players are expected to provide sensitive and rapid diagnosis of COVID-19 at POC settings.

The constantly expanding landscape of advanced DNA multiplication technologies is one of the key driving forces of the market. Owing to the technological advancements concerning loop-mediated amplification, substitutes and advanced technologies such as Nucleic Acid Sequence Based Amplification (NASBA), Rolling Circle Amplification (RCA), and Loop-Mediated Isothermal Amplification (LAMP) have been extensively studied.

These techniques are witnessing increased traction owing to their advantages such as no requirement of expensive thermal cyclers, rapid amplification kinetics, and easy multiplication from a single cell. These factors are expected to propel the usage of products offered in this market and thereby augment the organic revenue generation.

The applicability of gene amplification and vector engineering is increasing the demand for gene amplification assays. Moreover, the usage of gene amplification technologies for revolutionizing the diagnosis of inherited, infectious, and systemic diseases is anticipated to increase revenue growth in the sector.

Technology Insights

The Polymerase Chain Reaction (PCR)-based amplification segment accounted for the largest revenue share of over 85.0% in 2020. This can be attributed to the widespread use of PCR technology across various end-use applications. In addition, the large-scale application of PCR for COVID-19 detection has resulted in significant revenue generation by this technology.

However, several technological challenges associated with the use of PCR technology have spurred the development and usage of substitute technologies such as Loop-Mediated Isothermal Amplification (LAMP) and Multiple Displacement Amplification. The ongoing pandemic has repurposed the application of LAMP technology in molecular diagnostics. Several players are leveraging the advantages of LAMP to develop the COVID-19 detection tests.

Companies such as Eiken Chemical Co., Ltd. and HiberGene Diagnostics have developed new, innovative tests for detecting the SARS-CoV-2 virus, which is based on LAMP technology. For instance, in October 2020, researchers evaluated the feasibility of using dry reagents LAMP assay for COVID-19 detection. The study found the method to be highly sensitive and specific. The same study also stated that the LAMP-based COVID-19 detection could enable POC diagnosis in low-cost settings.

Downstream Application Insights

The hybridization segment captured the largest revenue share of over 30.0% in 2020. Several multiplication technologies are increasingly being used in the hybridization process. In October 2020, researchers from Thailand developed a new method that enabled co-hybridization and amplification of targeted DNA in a single reaction.

The new method - Probe-triggered, One-step, Simultaneous DNA Hybridization, and LAMP Integrated with LFD was found to be more sensitive and easy to perform as compared to other PCR and LAMP-LFD methods. Such advancements are expected to propel the segment growth throughout the forecast period.

The exome sequencing segment held the second-largest revenue share in 2020 as this method is a cost-effective alternative to whole-genome sequencing. It offers the ability to use sequencing and analysis resources more efficiently to the research community. It also enables an easier method for the discovery and validation of causative genes and common and rare variants.

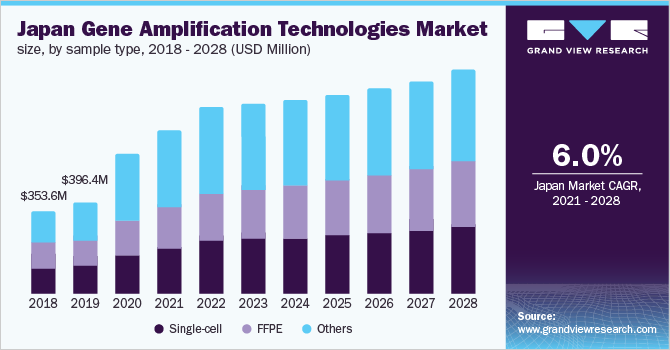

Sample Type Insights

In 2020, the others segment held the largest revenue share of over 45.0%. The single-cell segment accounted for the second-largest revenue share in 2020. This can be attributed to the wide availability of products for amplification using single-cell samples, coupled with the advantages offered by single-cell samples. These kits are available at low prices and are easy to use, thereby increasing their usage in the market.

The operating players such as QIAGEN NV, Merck KGaA (Sigma Aldrich), Cytiva, New England Biolabs, and Silicon Biosystemsfocus are focusing on the introduction of new products in this space to address the increasing demand for genomics studies. For instance, in October 2020, BioSkryb, Inc. launched ResolveDNA products for single-cell whole genome amplification.

Formalin-Fixed Paraffin-Embedded (FFPE) samples represent an extensive source of biomaterial for biomedical research, especially studying cancer pathogenesis. Almost 90% of the clinically used tissue samples are formalin-fixed. Researchers are showing much interest in analyzing gene expression in these clinically important samples.

Product Insights

The kits and reagents segment captured the largest revenue share of over 60.0% in 2020. The presence of a substantial number of companies offering various kits, media, and reagents, coupled with the growing demand for kits and reagents in molecular diagnostics and genomics research, is expected to fuel the segment growth throughout the forecast period.

The ongoing COVID-19 pandemic has supplemented the segment growth. Several operating players have launched reagents and kits designed for the SARS-CoV-2 detection. For instance, on 1st July 2021, BioGX was granted the EUA for its Xfree COVID-19 test by the U.S. FDA. This is a high-throughput, RT-PCR test kit. Thus, an increasing number of regulatory approvals are expected to foment the organic revenue growth of operating entities.

Owing to the widespread use of PCR-based amplification, a substantial number of companies offer PCR instruments. With the increasing application of gene amplification technologies, the market players are focusing on the introduction of new innovative products in this market space. For instance, hand-held PCR instruments have been developed to get rapid results. For instance, Franklin by Biomeme is a hand-held qPCR thermocycler that provides rapid results for Biomeme SARS-CoV-2 Real-Time RT-PCR Test.

End-use Insights

The others segment comprising clinics, hospitals, and diagnostic laboratories accounted for the largest revenue share of over 40.0% in 2020 due to the ongoing pandemic management. Hospital laboratories, clinics, and diagnostic centers prefer the PCR technique over others, thereby driving the market.

Furthermore, researchers from the University of Alberta and the University of Calgary are engaged in the development of point of care diagnostics based on isothermal amplification techniques for the detection of the COVID-19 virus. Such studies indicate the growing involvement of research and academic institutes in this market space.

The growing penetration of gene multiplication techniques in pharmaceutical and biotechnology companies has resulted in significant revenue generation by this segment. These companies are focusing on the development of molecular diagnostic tests based on amplification methods, thereby fueling the market growth. Moreover, expanding applications in drug discovery, food quality control, bioremediation, and others supplement the market growth.

Regional Insights

North America dominated the market with a revenue share of over 35.0% in 2020. Strong research and a commercial base for gene multiplication products, coupled with the presence of various genetic research programs in the region, are the major factors contributing to the growth of the North American market.

Furthermore, a significant number of companies that are engaged in the supply and commercialization of gene amplification solutions (instruments, kits, and reagents) are headquartered in the U.S. This factor also contributed to the high revenue generation of the region. For instance, in January 2021, Luna SARS-CoV-2 RT-qPCR Assay Kit was introduced by New England BioLabs, Inc. (Massachusetts, U.S.) for the detection of SARS-CoV-2 nucleic acid.

Asia Pacific is anticipated to witness the fastest growth throughout the forecast period owing to favorable government initiatives to develop healthcare infrastructure. Increased research activity in genomics and molecular diagnostics space and the easy availability of skilled manpower are some factors that have augmented the market growth in emerging economies, such as China and India. For instance, in April 2021, Chinese researchers developed an ultrasensitive and rapid ELISA test based on rolling circle amplification for the early diagnosis of various diseases.

Key Companies & Market Share Insights

The market is expected to witness remarkable growth in the coming years. The expanding product portfolio of operating players and an increasing number of technological collaborations between operating entities have intensified the market competition.

The operating entities are undertaking various strategic initiatives such as mergers & acquisitions, licensing, and partnering to enhance their market presence. In recent years, the market has witnessed notable mergers and acquisitions. For instance, in April 2021, Hologic acquired the Finnish-French molecular test maker - Mobidiag to cope up with the growing COVID-19 diagnostic demand. Some prominent players in the global gene amplification technologies market include:

-

QIAGEN

-

New England Biolabs

-

Illumina Inc.

-

Yikang Gene

-

Bio-Rad Laboratories

-

Silicon Biosystems

-

Merck KGaA

-

Promega Corporation

-

Takara Bio Inc.

-

Danaher Corporation

-

4basebio AG

-

LGC Group

-

Vazyme Biotech Co. Ltd.

-

MyBioSource

Gene Amplification Technologies Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 32.15 billion

Revenue forecast in 2028

USD 30.80 billion

Growth Rate

CAGR of 2.00% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment coverage

Technology, downstream application, sample type, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; Italy; France; Spain; China; India; Australia; Japan; Singapore; Brazil; Mexico; South Africa; Saudi Arabia

Companies profiled

QIAGEN; New England Biolabs; Illumina Inc.; Yikang Gene; Bio-Rad Laboratories; Silicon Biosystems; Merck KGaA; Promega Corporation; Takara Bio Inc.; Danaher Corporation; 4basebio AG; LGC Group; Vazyme Biotech Co. Ltd.; MyBioSource

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global gene amplification technologies market report on the basis of technology, downstream application, sample type, product, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2028)

-

PCR-based Amplification

-

Loop-mediated Isothermal Amplification

-

Nucleic Acid Sequence Based Amplification

-

Strand Displacement Amplification

-

Multiple Displacement Amplification

-

Rolling Circle Amplification

-

Ramification Amplification

-

Others

-

-

Downstream Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Whole Genome Amplification

-

Exome Sequencing

-

SNP Genotyping Arrays

-

Array CGH

-

Hybridization

-

Others

-

-

Sample Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Single Cell

-

FFPE

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Instruments

-

Kits & Reagents

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2028)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Japan

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global gene amplification technologies market size was estimated at USD 26.28 billion in 2020 and is expected to reach USD 32.15 billion in 2021.

b. The global gene amplification technologies market is expected to grow at a compound annual growth rate of 2.00% from 2021 to 2028 to reach USD 30.80 billion by 2028.

b. PCR-based Amplification segment dominated the gene amplification technologies market with a market share of 89.7% in 2020. This can be attributed to the widespread use of PCR technology across various end-use applications. In addition, the large-scale application of PCR for COVID-19 detection has resulted in significant revenue generation by this technology.

b. Some key players operating in the gene amplification technologies market include QIAGEN, New England Biolabs, Illumina Inc., Yikang Gene, Bio-Rad Laboratories, Silicon Biosystems, Merck KGaA, Promega Corporation, Takara Bio Inc., Danaher Corporation, 4basebio AG, LGC Group, Vazyme Biotech Co. Ltd, and MyBioSource.

b. Key factors that are driving the gene amplification technologies market growth include expanding R&D in the genomics and molecular diagnostics arena, the advent of high throughput technologies, growing acceptance of personalized medicines, and rising incidence of chronic diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."