- Home

- »

- Biotechnology

- »

-

Gene Expression Market Size, Share & Trends Report, 2030GVR Report cover

![Gene Expression Market Size, Share & Trends Report]()

Gene Expression Market Size, Share & Trends Analysis Report By Product (DNA Chip/Microarray, Kits & Reagents), By Technique (Promoter Analysis, RNA Exp.), By Capacity, By Process, By Application, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-576-2

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

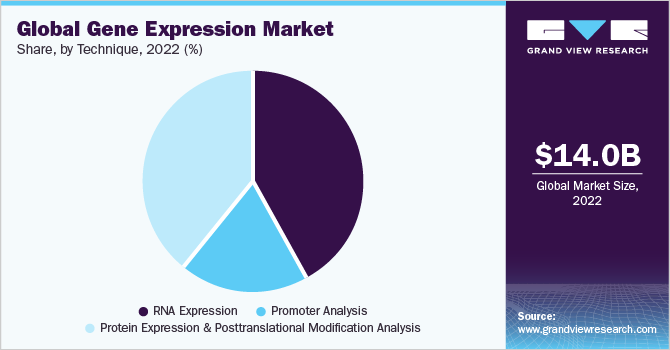

The global gene expression market size was valued at USD 14 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. The key factors driving the market include advancements in genomics, the increasing demand for personalized medicine, and the growing prevalence of chronic diseases such as cardiovascular diseases, cancer, and neurological disorders. For instance, cancer involves altered gene expression, with the activation or silencing of several proteins significantly affecting cellular activity.In particular, the activation or silencing of genes can drastically alter the overall cellular activity. Therefore, it is essential to activate and increase the expression of specific genes that are not typically expressed in a particular cell.

Gene expression profiling is a method of simultaneously monitoring the activity (or expression) of thousands of genes in order to offer a comprehensive picture of cellular function. For instance, these profiles can indicate which cells are actively dividing or the way the cells react to a specific treatment. Many of these procedures simultaneously measure the entire genome, or all the genes in a particular cell.Expression profiling experiments often involve measuring the relative amount of mRNA expressed in two or more experimental conditions. This is because variable levels of a particular mRNA sequence indicate a modified requirement for the protein that the mRNA codes for, either indicating a pathological situation or a homeostatic response.

Gene expression has emerged as one of the key technologies used in various applications, such as drug discovery and development procedures, clinical diagnostics, biotechnology, microbiology, and others. This method is used more often throughout different stages of the drug discovery process. The development of new methods has been accelerated up by limitations on the use of current technology and the expanding range of applications for the expression of genes expression research.

Western blotting, northern blotting, enzyme-linked immunosorbent assays, PCR technology with an emphasis on quantitative PCR, differential protein display, and DNA sequencing and hybridization arrays technology with a focus on macro arrays and microarrays in facilitating gene expression are a few examples of technological advancements for gene expression.

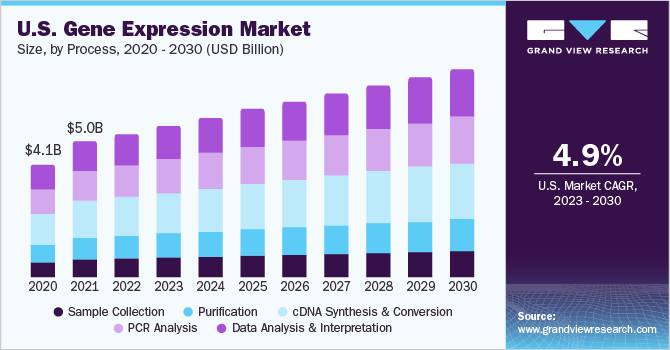

Process Insights

CDNA synthesis & conversion accounted for the largest revenue share of 27.1% in 2022, primarily due to the wide range of available kits that cater to diverse research needs, including optimal reaction temperature, the number of reactions, and sample size. Furthermore, the continuous launch of new cDNA synthesis and library preparation kits is expected to drive the growth of this segment.

Data analysis & interpretation is anticipated to register the fastest CAGR growth of 5.7% during the forecast period. This growth can be attributed to significant investments in cancer-related research and the increasing demand for advanced interpretation software for cancer gene expression studies. Various approaches and algorithms are being developed to study gene expression in complex diseases like cancer. For example, projective clustering techniques and ensemble techniques are reported to be used for the integration of cancer gene expression data.

Product Insights

Kits & Reagents accounted for the largest revenue share of 74.2% in 2022. The large share of the segment is attributed to the presence of a high number of companies offering different types of kits & reagents for gene expression. For instance, Agilent Technologies, Inc. offers an extensive range of gene expression microarray kits & reagents. Furthermore, the introduction of advanced products designed for specific applications drives the segment growth.

DNA Chips are anticipated to register the fastest CAGR growth of 5.3% during the forecast period. DNA microarrays are microscope slides with thousands of tiny dots printed in specific locations; every location has a recognized DNA sequence or gene. These slides are often referred to as DNA or gene chips. These chips are frequently used in the analysis of gene expression profiles to detect diseases, biomarkers, and therapeutic responses in the fields of molecular biology, biomedical research, and genomics.

Capacity Insights

High-plex dominated the gene expression market and accounted for the largest revenue share of 64.5% in 2022.It typically involves analyzing a significant number of gene targets, approximately thousands of genes. The high-plex technology in gene expression analysis includes RNA sequencing and microarrays. Furthermore, high-plex analysis reduces hands-on time when compared to qPCR and other conventional technologies. The technique is also highly accurate and simple as it eliminates the requirement of upfront probe validation. The development of spatially resolved, multiplexed digital characterization systems further enhances the segment's growth.

The low- to mid- plex segment, on the other hand, is anticipated to register a lucrative CAGR of 4.5% in the market during the forecast period of 2023 to 2030. Low mid plex measurements involve analyzing a limited number of genes, often in the range of 5-500 targets. These low to mid-plex methods are cost-effective and relatively easy to perform. Researchers use low to mid-plex techniques for hypothesis-driven research, focused studies, or more general exploratory analysis.

Application Insights

The drug discovery & development segment dominated the market and accounted for the largest revenue share of 42.2% in 2022. Gene-expression profiling has evolved into an effective tool for drug discovery for pharmaceutical companies. The effectiveness, toxicity, and other properties of pharmaceuticals are determined by monitoring the activity of a cell's genes in reaction to the drugs. The cost of conventional profiling techniques can reach millions of dollars, making them frequently ineffective.

The clinical diagnostics is anticipated to register the fastest CAGR of 6.1% from 2023 to 2030. This is a due to the increasing use of gene expression analysis and profiling for the rapid and accurate diagnosis of genetic disorders, understanding disease pathology, and monitoring disease progression and response to therapies. Additionally, by examining gene expression patterns, medical personnel can acquire essential details about the molecular causes of diseases, aiding in early detection, precise diagnosis, and the identification of biomarkers.

Technique Insight

The RNA expression accounted for the largest revenue share of 41.7% in 2022. RNA-sequencing (RNA-seq) is a high-throughput sequencing (HTS) technique that analyzes cDNA transcripts. It is a relatively new technology that has been widely used in clinical studies. In a Differential Gene Expression (DGE) analysis, RNA-seq is most commonly utilized to compare the expression levels of genes and/or transcripts between two or more conditions (i.e., comparison groups). In cancer research, DGE has been essential in assessing biological function, pathogenesis, and biomarker discovery.

On the other hand, Promoter analysis is anticipated to register the fastest CAGR growth of 5.3% during the forecast period. It plays a crucial role in understanding gene expression regulation and identifying the key factors that govern gene activity. Promoter identification is the first step in the computational study that results in the prediction of regulatory factors. Due to relatively high gene density in relation to genome size, this is a relatively simple problem in lower eukaryotes. The application of promoter analysis techniques in various fields includes drug discovery, advancing genetic diseases, and diagnostic development.

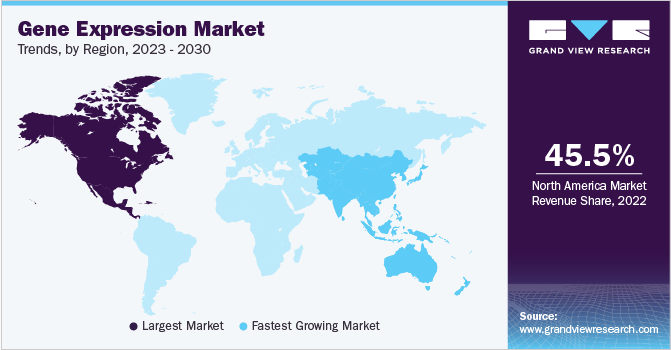

Regional Insight

North America dominated the market and accounted for the largest revenue share of 45.5% in 2022. Rising funding and increasing research & development efforts, especially in the U.S., are responsible for the growth of the gene expression market.In addition, other factors responsible for market growth include rising importance of gene expression studies, government initiatives, and the availability of financing for NGS research.

Asia Pacific is anticipated to register the fastest CAGR of 6.9% during the forecast period in the market owing to the increasing Investments in R&D, presence of large population base in countries such as India and China that provides personalized and research healthcare. Key companies provide various services and products related to gene expression analysis, RNA sequencing, and expression microarrays. Furthermore, Japan is a significant market for gene expression analysis. The country's strong academic institutions, advanced research infrastructure, and well-established biotech sector are driving the market growth.

Key Companies & Market Share Insights

Major players operating across the market are focused on the adoption of strategic initiatives such as mergers, partnerships, acquisitions, etc. For instance, in September 2022, Illumina, Inc. the global leader in DNA sequencing and array-based technologies launched NovaSeq, new production-scale sequencers expand the boundaries that is feasible in genomic medicine by enabling faster, more potent, and more environmentally friendly sequencing. Utilizing ground-breaking new technology, NovaSeq X Plus can generate more than 20,000 whole genomes annually - 2.5 times the throughput of earlier sequencers - significantly boosting genomic discovery and clinical insights to comprehend disease and eventually alter patient lives.

Also in January 2023, QIAGEN Digital Insights (QDI), launched the QIAGEN CLC Genomics Workbench Premium, which addresses the issue of next-generation sequencing's data-analysis bottleneck. By integrating high analysis speed with the analysis and interpretation of the data from whole exome sequencing (WES), whole genome sequencing (WGS), and large panel sequencing, it is possible to address the bottleneck of the NGS data analysis. Some prominent players in the gene expression market are:

-

Catalent Inc.

-

QIAGEN

-

Quest Diagnostics, Inc.

-

F. Hoffmann-La Roche Ltd.

-

Illumina, Inc.

-

PerkinElmer, Inc.

-

Bio-Rad Laboratories

-

Thermo Fisher Scientific, Inc.

-

Agilent Technologies

-

GE Healthcare

-

Promega Corp.

-

Luminex Corp.

-

Takara Bio, Inc.

-

Danaher Corp.

Gene Expression Market Report Scope

Attribute

Details

Market size value in 2023

USD 14.8 billion

Revenue Forecast in 2030

USD 20.9 billion

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments Covered

Process, product, capacity, application, technique, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

QIAGEN; Quest Diagnostics, Inc.; F. Hoffmann-La Roche Ltd.; Illumina, Inc.; PerkinElmer, Inc.; Bio-Rad Laboratories; Thermo Fisher Scientific, Inc.; Agilent Technologies; GE Healthcare; Promega Corp.; Luminex Corp.; Takara Bio, Inc.; Danaher Corp.; ELITechGroup; AutoGenomics; Biocartis NV; IntegraGen; Interpace Biosciences, Inc.; Fluidigm Corp.

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gene Expression Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the gene expression market on the basis of process, product, capacity, application, technique, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Collection

-

Purification

-

cDNA synthesis & conversion

-

PCR Analysis

-

Data analysis & interpretation

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits & Reagents

-

DNA Chips

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Low- to Mid- Plex

-

High-Plex

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Development

-

Clinical Diagnostics

-

Biotech & Microbiology

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

RNA Expression

-

Promoter Analysis

-

Protein Expression & Posttranslational Modification Analysis

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gene expression market size was estimated at USD 14 billion in 2022 and is expected to reach USD 14.80 billion in 2023.

b. The global gene expression market is expected to grow at a compound annual growth rate of 5.09% from 2023 to 2030 to reach USD 20.9 billion by 2030.

b. Kits & reagents dominated the gene expression market with a share of 74.2% in 2022. This is attributable to the high penetration of kits and reagents in the space in terms of product availability, usage rate, and purchase frequency.

b. Some key players operating in the gene expression market include QIAGEN, Quest Diagnostics Incorporated, F. Hoffmann-La Roche Ltd, Illumina, Inc., Bio-Rad Laboratories, Thermo Fisher Scientific, Inc., Agilent Technologies, GE Healthcare, and TAKARA BIO INC.

b. Key factors that are driving the gene expression market growth include increasing interest of research entities in transcriptomic profiling coupled with technological advancements in genomic technologies in terms of accuracy, specificity, and outcome.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."