- Home

- »

- Pharmaceuticals

- »

-

Genitourinary Drugs Market Size And Share Report, 2030GVR Report cover

![Genitourinary Drugs Market Size, Share & Trends Report]()

Genitourinary Drugs Market Size, Share & Trends Analysis Report By Indication (Prostate, Ovarian, Bladder, Cervical Cancer, UTI & STD), By Product (Hormonal Therapy, Gynecological), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-285-3

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

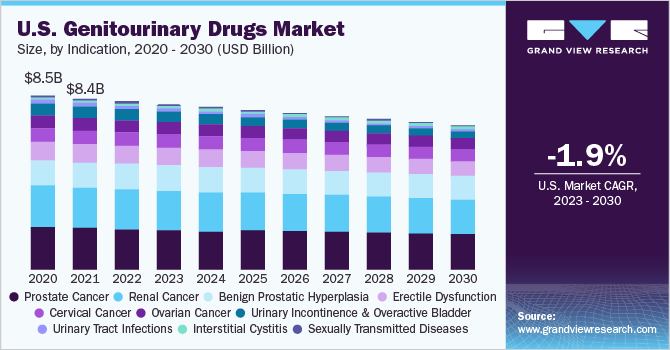

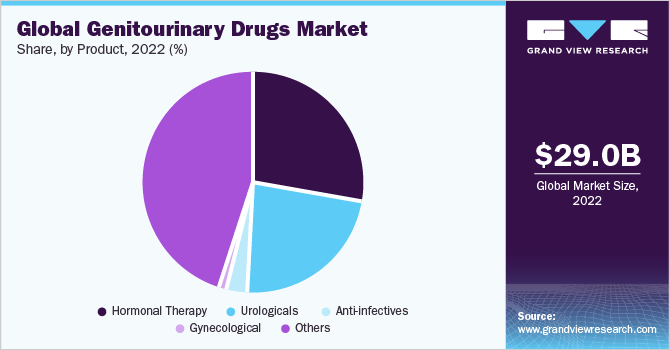

The global genitourinary drugs market size was estimated at USD 29.0 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 1.1% from 2023 to 2030. The growing prevalence of genitourinary disorders is one of the key factors expected to drive the growth of the market during the forecast period. As per a World Health Organization (WHO) report, in March 2022, 491 million individuals worldwide between the ages of 15 and 49 (13% of the population) get infected with herpes simplex virus (HSV)-2 infection each year.

As per an update by the Centers for Disease Control and Prevention (CDC), in 2021, there were 572 thousand new cases of genital herpes infections in the U.S. Women are more likely than males to get HSV-2. The high prevalence of this condition is anticipated to drive the market growth in the coming years.

In addition, the increasing number of pipeline drugs is expected to widen the scope for growth. For instance, in July 2021, AiCuris Anti-infective Cures AG announced the initiation of a clinical phase 3 trial with pritelivir for treating immunocompromised subjects with HSV. This is believed to be a consequence of collaborative research initiatives conducted by the major pharmaceutical companies consistently striving to strengthen their leadership position in the branded genitourinary drugs market space.

In another development, in June 2023, Novartis announced that it had entered into an agreement and would acquire Chinook Therapeutics, a clinical-stage biopharmaceutical organization. The agreed deal is in line with Novartis’s strategy to introduce medicines and expand its renal portfolio.

Indication Insights

Based on indication, the genitourinary drugs market is segmented into prostate cancer, ovarian cancer, bladder cancer, cervical cancer, renal cancer, erectile dysfunction, urinary tract infections, urinary incontinence & overactive bladder, sexually transmitted diseases, interstitial cystitis, hematuria, and benign prostatic hyperplasia. The prostate cancer segment held the largest revenue share of 28.3% in 2022. As per a report published by the American Society of Clinical Oncology (ASCO) in March 2023, 1,414,259 individuals were globally diagnosed with prostate cancer in 2020.

The growth can be attributed to the availability of a wide range of therapeutics, such as immunotherapy medication, radiopharmaceuticals, and anti-neoplastic agents, available to treat prostate cancer. Associated benefits, such as heightened survival chances, impeded disease progression, and limited adverse effects, are steadily increasing their uptake in the market.

For instance, in March 2022, Novartis announced the approval of Pluvicto, a treatment for adult patients with prostate-specific membrane antigen–positive metastatic castration-resistant prostate cancer (PSMA-positive mCRPC) and is metastatic and has spread in other body parts. It is expected to significantly improve survival rates of patients with limited treatment options

The interstitial cystitis segment is expected to grow at a lucrative CAGR of 8.4% over the forecast period. Interstitial cystitis is a common disease. In the U.S., the illness may affect between 1 million and 4 million males and between 3 million and 8 million women. Pentosan polysulfate sodium (Elmiron) is the only oral medication with FDA approval for treating the pain and discomfort caused by interstitial cystitis.

Product Insights

Based on product, the genitourinary drugs market is segmented into urological, hormonal therapy drugs, gynecological, anti-infectives, and others. The hormonal therapy segment held a significant market share in 2022 owing to the growing hormonal disorders and changing lifestyle habits.

The gynecological segment is expected to grow at the fastest CAGR of 5.6% over the forecast period. The product range for reproductive disorders in women is responsible for the growth of the gynecological products segment. The high need for therapeutics in this space is expected to create profitable opportunities for segment growth in the future. In addition, the high focus of government healthcare organizations on the enhancement of the reproductive health of women is anticipated to provide lucrative growth prospects.

Regional Insights

North America dominated the market with a revenue share of 37.0% in 2022. This can be attributed to the high prevalence of major genitourinary diseases, the presence of a strong healthcare system, and increased awareness among individuals. Prostate cancer which constitutes the larger share of all genitourinary cancer types is the second-most leading cause of all cancer-related deaths, which serves as a significant factor, contributing to the surging demand for therapeutics in this region. The American Cancer Society predicts that in 2023 there will be around 288,300 new cases and around 34,700 deaths from prostate cancer in the U.S.

Asia Pacific is expected to grow at the fastest CAGR of 4.8% over the forecast period. The sector’s growth is driven by high R&D investment by the global players and their consistent efforts to commercialize branded therapeutics at a relatively low price.

The urgent need to curb the high incidence rate of target disorders, rising disposable income that raises the probability of usage of branded drugs, and continual improvements in healthcare infrastructure are presumed to present the vertical with significant growth opportunities over the forecast period. The growth is also driven by the high R&D intensity and the growing awareness in emerging economies, such as China and India.

Key Companies & Market Share Insights

Key players are focusing on undertaking growth strategies, such as mergers and acquisitions, the development of existing devices, promotional events, and technological advancements. In April 2023, GSK plc presented positive outcomes from EAGLE-2 and EAGLE-3 clinical trials for gepotidacin. Positive phase III result shows the potential to be the first in class antibiotics administered orally for uncomplicated urinary tract infections (uUTI) in female adolescents and adults.

In March 2023, Pfizer Inc. announced that it has entered into a definitive merger agreement with Seagen Inc. Seagen Inc. is a biotechnology company discovering, developing & commercializing cancer medicines and is a pioneer in antibody-drug conjugate (ADC) technology. Together, both organizations aim to fast-track next-generation cancer breakthroughs and offer solutions to patients by combining the strengths & scale of Pfizer’s expertise & capabilities and Seagen’s ADC technology. Some prominent players in the global genitourinary drugs market include:

-

Abbott

-

Bristol-Myers Squibb Co.

-

Novartis AG

-

Genentech, Inc.

-

F. Hoffmann-La RocheLtd.

-

Ionis Pharmaceuticals, Inc.

-

Eli Lilly and Company

-

Merck & Co., Inc.

-

Pfizer, Inc.

-

AstraZeneca

-

GlaxoSmithKline

-

Teva Pharmaceutical Industries Ltd.

-

Bayer AG

-

Allergan

-

Antares Pharma

Genitourinary Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 29.39 billion

Revenue forecast in 2030

USD 31.75 billion

Growth rate

CAGR of 1.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Indication, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott; Bristol-Myers Squibb Co.; Novartis AG; Genentech, Inc.; F. Hoffmann-La Roche Ltd.; Ionis Pharmaceuticals, Inc.; Eli Lilly and Company; Merck & Co., Inc.; Pfizer, Inc.; AstraZeneca; GlaxoSmithKline; Teva Pharmaceutical Industries Ltd.; Bayer AG; Allergan; Antares Pharma

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Genitourinary Drugs Market Report Segmentation

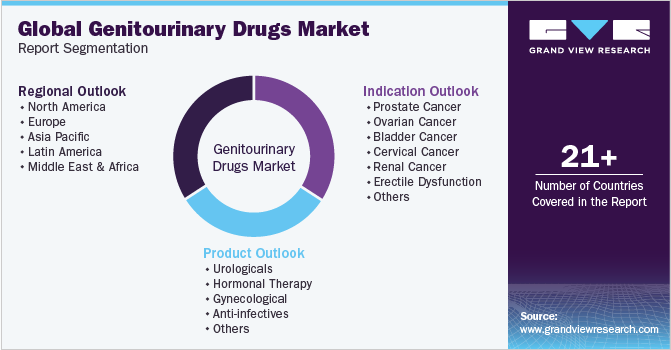

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global genitourinary drugs market report based on indication, product, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Prostate Cancer

-

Ovarian Cancer

-

Bladder Cancer

-

Cervical Cancer

-

Renal Cancer

-

Erectile Dysfunction

-

Urinary Tract Infections

-

Urinary Incontinence & Overactive Bladder

-

Sexually Transmitted Diseases

-

Interstitial Cystitis

-

Haematuria

-

Benign Prostatic Hyperplasia

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Urologicals

-

Hormonal Therapy

-

Gynecological

-

Anti-infectives

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global genitourinary drugs market size was estimated at USD 29.0 billion in 2022 and is expected to reach USD 29.39 billion in 2023.

b. The global genitourinary drugs market is expected to grow at a compound annual growth rate of 1.1% from 2023 to 2030 to reach USD 31.75 billion by 2030.

b. North America dominated the genitourinary drugs market with a share of 36.8% in 2022. This is attributable to rising healthcare awareness coupled with a high prevalence

b. Some key players operating in the genitourinary drugs market include Abbott, BMS, Novartis AG, H. Hoffmann-La Roche, Ltd., Pfizer, Inc., AstraZeneca, GSK, Teva Pharmaceuticals, Allergan, and Bayer AG

b. Key factors that are driving the genitourinary drugs market growth include the growing prevalence of genitourinary disorders, the increasing number of pipeline drugs, and collaborative research initiatives conducted by the major pharmaceutical companies

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."