- Home

- »

- Advanced Interior Materials

- »

-

Geosynthetics Market Size, Share & Growth Report, 2030GVR Report cover

![Geosynthetics Market Size, Share & Trends Report]()

Geosynthetics Market Size, Share & Trends Analysis Report By Product (Geotextiles, Geomembranes, Geogrids), By Region (North America, Europe, APAC, MEA), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-501-4

- Number of Pages: 145

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Geosynthetics Market Size & Trends

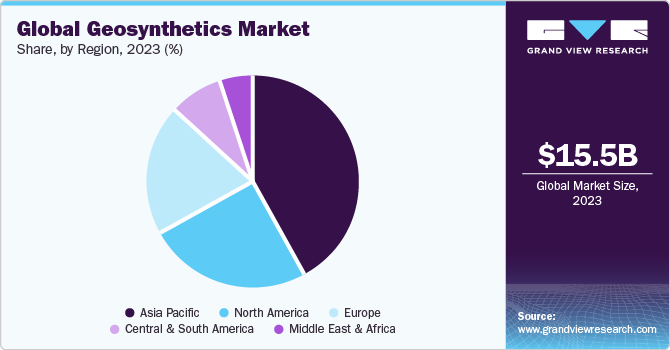

The global geosynthetics market size was estimated at USD 15.54 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2030. Rapid infrastructure development in emerging economies, such as India and Brazil, is anticipated to fuel market growth over the forecast period. Incorporation of geosynthetics entails sustainable development, a small volume of earthwork, low carbon footprint, and an increased rate of construction. The growth of the construction industry in Asia Pacific is expected to remain one of the key market drivers over the next seven years.

The spread of pandemic disease globally has negatively impacted construction industry in 2020, as numerous projects were halted due to an imposition of lockdown by the governing authorities to contain the spread of coronavirus. The players operating in the market observed lower demand for new office spaces, and other infrastructure owing to the supply chain barrier.

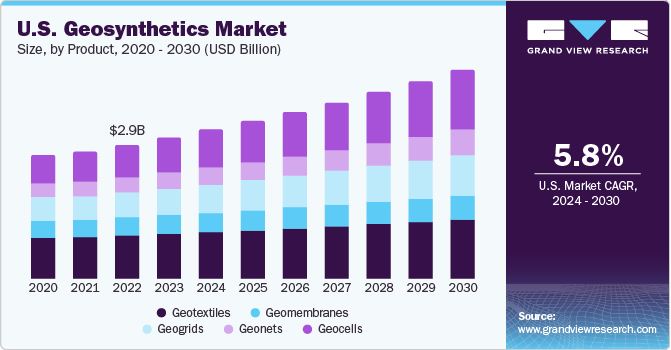

Availability of raw materials such as polypropylene on account of a high prevalence of petrochemical complexes of companies including Chevron Phillips, ExxonMobil, Shell, and BP encourages market players for increased production. These factors are anticipated to drive overall demand for geosynthetic products in the U.S. Furthermore, the U.S. EPA has authorized the application of geosynthetic products in landfills under the Resource Conservation and Recovery Act (RCRA). As a result, product market is likely to witness a positive impact in the U.S.

Geotextiles are used as lining systems in construction of ponds, streets, embankments, and pipelines. In addition, these products are also for the development of railway networks considering their ability to facilitate separation of soil layers from subsoil without hindering underground water circulation.

Geonets and geocells play a key role in promoting vegetative growth and providing shore protection, in turn, preventing soil erosion. Moreover, ongoing soil preservation projects in various economies, including South Africa, Spain, Canada, and India, are expected to drive the overall market growth.

Extreme outflow losses from canals have amplified drainage concerns. Geosynthetics are highly effective in controlling seepage problems in irrigation and other development projects. In addition, they are used in the design and construction of low embankment dams, channels, and slope protection and in controlling seepage losses from channels and reservoirs.

Market Concentration & Characteristics

The geosynthetics market growth stage is medium, and pace of growth is accelerating. The market is highly fragmented on account of the presence of a large number of manufacturers.These players compete on the basis of product quality, product range, geographies catered, strategic developments, operational capabilities, and pricing, which leads to high competition.

Geosynthetics market is characterized by a high degree of innovation as technologically advanced equipment are used for highly precise and accurate manufacturing as well as installation of geosynthetics. Majority of the equipment manufacturers are based in European region, wherein they develop application specific products such as extruders, beaming machines, looms & extruders, and pressing machinery.

Market is also characterized by a high level of merger and acquisition (M&A) activity by the players. The majority of the companies are engaged in mergers & acquisitions to increase their shares in the global market. For instance, in December 2023, Core & Main Inc. closed the acquisition of Granite Water Works Inc., a water, wastewater & storm drainage supplier in Minnesota, U.S.

Market is also subject to increasing regulatory scrutiny. Organizations such as Bureau of Indian Standards, U.S. Environmental Protection Agency, and European Union have set standards and directives for waste disposal, protection of environment, and test methods. For instance, BIS standards are mainly for test methods, jute & coir geotextiles, and PVC/HDPE geomembrane for waterproof lining.

High dependency of civil engineers on conventional raw materials such as bricks, cement, steel, etc. has led to high costs of material for its transportation. As a result, geosynthetics have gained importance over the aforementioned materials. The incorporation of new technologies in soil erosion and deployment of compacted clay liners are expected to reduce the application of geosynthetics. The threat of new substitutes is likely to be low to medium over the forecast period.

The market is marked by the presence of a large number of end-users, who use geosynthetics in applications such as construction, drainage, landfill, roads, and pavements. Growing demand for environment-friendly products has prompted the use of the products in the construction industry. End-users are expected to opt for backward integration to ensure access to products for captive consumption.

Product Insights

Geotextiles led the market in 2023 with a revenue share of more than 48.4%. The segment dominated the market on account of their better performance and functional advantages over other materials. The synthetic fibers used in manufacturing geotextiles are made up of polypropylene, polyethylene polyester, and polyamide. However, natural geotextiles are gaining importance for short-term use or as temporary reinforcement due to rising awareness regarding their eco-friendly benefits, thereby complementing market growth.

Geomembranes are estimated to expand at a CAGR of 5.2% in terms of revenue from 2024 to 2030 considering the rising awareness regarding the product’s application as floating covers for reservoirs to control evaporation, reduce Volatile Organic Compounds (VOCs) emission, and minimize demand for drainage and cleaning. Polyvinyl chloride (PVC)-based geomembranes are witnessing increasing application on account of their properties such as high degree of flexibility, excellent elongation percentage, and reduced expansion coefficient.

Geogrids are increasingly used in railway and road infrastructure development for reinforcement of structural bases over soft soils on account of their exceptional bearing capacity. Moreover, geogrids are used in retaining walls for reinforcement of railway abutments and bridges. Thus, these factors are expected to bolster market growth over the forecast period.

Geonets are incorporated as separation media in the collection of landfill leachates, foundation wall systems in drainage, road, and pavement drainage systems, and methane gas collection. Furthermore, increasing penetration of product in erosion control owing to its attributes of slowing down the surface runoff is likely to complement segment growth.

Regional Insights

Asia Pacific dominated the market in 2023 with a revenue share of 42.9%. The rising demand for oil reinforcement in foundation work of residential buildings in the emerging economies of China is expected to drive overall regional market. Geosynthetics market in India is also witnessing accelerated growth owing to rise in foreign direct investment in the construction sector.Several ongoing infrastructure projects supporting the geosynthetics industry are The Delhi-Mumbai Industrial Corridor (DMIC) worth USD 90.00 billion, a 9.2 km Chenani-Nashri Tunnel, a 9.15 km bridge linking Assam with Arunachal Pradesh, and Chenab Bridge, a 11.2 km the Banihal Rail Tunnel.

Europe accounted for a significant share owing to various construction directives, such as 89/106/EEC and M/107 European Union, which has mandated the application of geosynthetics for infrastructure projects. Furthermore, the German government imposed stringent regulations related to waste management practices in municipal and industrial sectors. Significant recovery of construction industry coupled with a rising penetration of geosynthetic products in this region is expected to drive the overall market growth.

Increasing infrastructural activities in the developing economies of Central and South America, including Brazil, are likely to boost the use of geosynthetics over the forecast period. Rising usage of geosynthetics in water management practices is expected to boost regional market growth. The regional market is also driven by flourishing offshore oil and gas sector in Argentina, Venezuela, and Brazil.

The Middle East and Africa are projected to be emerging markets for geosynthetics during the forecast period. Increasing civil and commercial construction activities in this region, including the construction of stadiums and hotels, are likely to impact the demand for composite building materials, including geosynthetics. However, countries such as Saudi Arabia and the United Arab Emirates (UAE) have witnessed stable economic growth owing to growing construction & infrastructure sector. This growth is expected to positively influence the market in this region over the forecast period.

Key Companies & Market Share Insights

Key industry participants are entering into strategic agreements with raw material suppliers and equipment manufacturers to maintain an uninterrupted supply. Factors such as the expansion of manufacturing capacities in the developing economies of the Asia Pacific and the Middle East offer a competitive edge to the geosynthetics manufacturers.

Key players in the market are entering into agreements with emerging players to expand their distribution capacities, thereby increasing their market reach. In addition, companies are likely to establish partnerships with e-commerce portals to ensure that buyers have timely access to geosynthetic products.

-

In September 2023, Titan Environmental Containment acquired Hewitt Geosynthetics, ageosynthetics company from Greater Toronto Area, Canada. Titan Environmental Containment provides high-quality geosynthetic solutions and specialized civil engineering construction services to extend the service life of critical infrastructure while conserving valuable natural resources. Under the terms of the agreement, Titan absorbed Hewitt's current client base in Canada and in the U.S.

-

In July 2023, India-based Hella Infra Market Pvt. Ltd. acquired Strata Geosynthetics. The acquisition was aimed to concentrate on growing the presence of Strata Geosynthetics’ core markets and expanding brand to new markets.

Key Geosynthetics Companies:

- GSE Holdings, Inc.

- Koninklijke Ten Cate N.V.

- Officine Maccaferri S.p.A.

- NAUE GmbH & Co. KG

- Propex Operating Company, LLC

- Low and Bonar PLC

- TENAX Group

- Fibertex Nonwovens A/S

- Global Synthetics

- AGRU America

- TYPAR

- HUESKER Group

- PRS Geo-Technologies

- Tensar International Corporation

- Solmax

Geosynthetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.52 billion

Revenue forecast in 2030

USD 24.60 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million square meters, revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; U.K.; Germany; Italy; Spain; China; India; Japan; New Zealand; Australia; Malaysia; Thailand; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

GSE Holdings, Inc.,; Koninklijke Ten Cate N.V.; Officine Maccaferri S.p.A.; NAUE GmbH & Co. KG; Propex Operating Company, LLC; Low and Bonar PLC; TENAX Group; Fibertex Nonwovens A/S; Global Synthetics; AGRU America; TYPAR; HUESKER Group; PRS Geo-Technologies, Tensar International, Solmax

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geosynthetics Market Report Segmentation

This report forecasts market share and revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global geosynthetics market report based on product and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Geotextiles

-

By Raw Material

-

Natural

-

Jute

-

Others

-

-

Synthetic

-

Polypropylene

-

Polyester

-

Polyethylene

-

-

-

By Product

-

Woven

-

Non-woven

-

Knitted

-

-

By Application

-

Erosion control

-

Reinforcement

-

Drainage systems

-

Lining systems

-

Asphalt overlays

-

Separation & stabilization

-

Silt Fences

-

-

-

Geomembranes

-

By Raw Material

-

HDPE

-

LDPE

-

Ethylene Propylene Diene Monomer (EPDM)

-

Polyvinyl chloride (PVC)

-

Others

-

-

By Application

-

Waste management

-

Water management

-

Mining

-

Lining Systems

-

Others

-

-

By Technology

-

Extrusion

-

Calendering

-

Others

-

-

-

Geogrids

-

By Raw Material

-

HDPE

-

Polypropylene

-

Polyester

-

-

By Application

-

Road construction

-

Railroad

-

Soil reinforcement

-

Others

-

-

By Product

-

Uniaxial

-

Biaxial

-

Multi-axial

-

-

-

Geonets

-

By Raw Material

-

HDPE

-

MDPE

-

Others

-

-

By Application

-

Road construction

-

Drainage

-

Railroad

-

Others

-

-

-

Geocells

-

By Raw Material

-

HDPE

-

Polypropylene (PP)

-

Others

-

-

By Application

-

Earth reinforcement

-

Load support

-

Tree root protection

-

Slope protection

-

Others

-

-

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

New Zealand

-

Australia

-

Malaysia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global geosynthetics market size was estimated at USD 15.53 billion in 2023 and is expected to reach USD 16.51 billion in 2024

b. The global geosynthetics market is expected to grow at a compound annual growth rate a CAGR of 6.9% from 2024 to 2030 to reach USD 24.59 billion by 2030.

b. Asia Pacific dominated the geosynthetics market with a share of 42% in 2023. This is attributable to the construction industry in developing regions in Asia Pacific, is anticipated to outperform compared to developed regions on account of increasing per capita income and rapid urbanization

b. Some key players operating in the geosynthetics market include Koninklijke Ten Cate B.V., GSE Holdings, Inc., NAUE GmbH & Co. KG, Officine Maccaferri S.p.A., Low and Bonar PLC, Propex Operating Company, LLC, Fibertex Nonwovens A/S, TENAX Group, AGRU America, Global Synthetics, HUESKER Group, TYPAR, Machina-TST, Gayatri Polymers & Geo-synthetics

b. Key factors that are driving the market growth include the rapid infrastructure development in emerging economies, such as India and Brazil, is anticipated to fuel the market growth over the forecast period.

Table of Contents

Chapter 1. Geosynthetics Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Geosynthetics Market: Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Geotextile Market: Variables, Trends & Scope

3.1. Penetration & Growth Prospect Mapping

3.2. Geosynthetics Market - Value chain analysis

3.2.1. Raw Material Trends

3.2.2. Manufacturing Trends Analysis

3.2.3. Sales Channel Analysis

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Geosynthetics Market - Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Global COVID-19 Pandemic

3.6. Geosynthetics Market - Porter’s Analysis

3.6.1. Supplier Power

3.6.2. Threat of New Entrants

3.6.3. Threat of Substitution

3.6.4. Buyer Power

3.6.5. Competitive Rivalry

3.7. Geosynthetics Market - PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technology Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

3.8. Case Studies

Chapter 4. Geosynthetics Market: Product Estimates & Trend Analysis

4.1. Product Movement Analysis & Market Share, 2023 & 2030

4.2. Geotextiles

4.2.1. Market estimates & forecasts, by raw material, 2018 - 2030

4.2.2. Market estimates & forecasts, by product, 2018 - 2030

4.2.3. Market estimates & forecasts, by application, 2018 - 2030

4.3. Geomembranes

4.3.1. Market estimates & forecasts, by raw material, 2018 - 2030

4.3.2. Market estimates & forecasts, by technology, 2018 - 2030

4.3.3. Market estimates & forecasts, by application, 2018 - 2030

4.4. Geogrids

4.4.1. Market estimates & forecasts, by raw material, 2018 - 2030

4.4.2. Market estimates & forecasts, by product, 2018 - 2030

4.4.3. Market estimates & forecasts, by application, 2018 - 2030

4.5. Geonets

4.5.1. Market estimates & forecasts, by raw material, 2018 - 2030

4.5.2. Market estimates & forecasts, by application, 2018 - 2030

4.6. Geocells

4.6.1. Market estimates & forecasts, by raw material, 2018 - 2030

4.6.2. Market estimates & forecasts, by application, 2018 - 2030

Chapter 5. Geosynthetics Market: Regional Estimates & Trend Analysis

5.1. Definition & Scope

5.2. Geosynthetics Market: Regional Overview, 2023 & 2030

5.3. Geosynthetics Market: Regional Movement Analysis, 2023 & 2030

5.4. North America

5.4.1. North America geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.4.2. North America geosynthetics market estimates and forecast, by product, 2018 - 2030 (Million Square Meters) (USD million)

5.4.3. U.S.

5.4.3.1. U.S. geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.4.3.2. U.S. geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.4.4. Canada

5.4.4.1. Canada geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.4.4.2. Canada geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.4.5. Mexico

5.4.5.1. Mexico geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.4.5.2. Mexico geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.5. Europe

5.5.1. Europe geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.2. Europe geosynthetics market estimates and forecast, by product, 2018 - 2030 (Million Square Meters) (USD million)

5.5.3. UK

5.5.3.1. UK geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.3.2. UK geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.4. Germany

5.5.4.1. Germany geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.4.2. Germany geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.5. France

5.5.5.1. France geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.5.2. France geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.6. Spain

5.5.6.1. Spain geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.6.2. Spain geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.7. Italy

5.5.7.1. Italy geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.5.7.2. Italy geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.6. Asia Pacific

5.6.1. Asia Pacific geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.2. Asia Pacific geosynthetics market estimates and forecast, by product, 2018 - 2030 (Million Square Meters) (USD million)

5.6.3. China

5.6.3.1. China geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.3.2. China geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.4. India

5.6.4.1. India geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.4.2. India geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.5. Japan

5.6.5.1. Japan geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.5.2. Japan geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.6. New Zealand

5.6.6.1. New Zealand geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.6.2. New Zealand geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.7. Australia

5.6.7.1. Australia geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.7.2. Australia geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.8. Thailand

5.6.8.1. Thailand geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.8.2. Thailand geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.9. Malaysia

5.6.9.1. Malaysia geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.6.9.2. Malaysia geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.7. Central & South America

5.7.1. Central & South America geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.7.2. Central & South America geosynthetics market estimates and forecast, by product, 2018 - 2030 (Million Square Meters) (USD million)

5.7.3. Brazil

5.7.3.1. Brazil geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.7.3.2. Brazil geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.8. Middle East & Africa

5.8.1. Middle East & Africa geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.8.2. Middle East & Africa geosynthetics market estimates and forecast, by product, 2018 - 2030 (Million Square Meters) (USD million)

5.8.3. Saudi Arabia

5.8.3.1. Saudi Arabia geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.8.3.2. Saudi Arabia geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.8.4. UAE

5.8.4.1. UAE geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.8.4.2. UAE geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

5.8.5. South Africa

5.8.5.1. South Africa geosynthetics market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Million)

5.8.5.2. South Africa geosynthetics market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters) (USD Million)

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis, By Key Market Participants

6.2. Vendor Landscape

6.3. Company/Competition Categorization

6.4. Public Companies

6.5. Private Companies

Chapter 7. Company Profiles

7.1. Koninklijke Ten Cate B.V.

7.1.1. Company overview

7.1.2. Financial performance

7.1.3. Product benchmarking

7.1.4. Strategic initiatives

7.2. GSE Environmental

7.2.1. Company overview

7.2.2. Financial performance

7.2.3. Product benchmarking

7.2.4. Strategic initiatives

7.3. NAUE GmbH & Co. KG

7.3.1. Company overview

7.3.2. Financial performance

7.3.3. Product benchmarking

7.3.4. Strategic initiatives

7.4. Officine Maccaferri S.p.A.

7.4.1. Company overview

7.4.2. Financial performance

7.4.3. Product benchmarking

7.4.4. Strategic initiatives

7.5. Low & Bonar

7.5.1. Company overview

7.5.2. Financial performance

7.5.3. Product benchmarking

7.5.4. Strategic initiatives

7.6. Propex Operating Company, LLC

7.6.1. Company overview

7.6.2. Financial performance

7.6.3. Product benchmarking

7.6.4. Strategic initiatives

7.7. Fibertex Nonwovens A/S

7.7.1. Company overview

7.7.2. Financial performance

7.7.3. Product benchmarking

7.7.4. Strategic initiatives

7.8. TENAX Group

7.8.1. Company overview

7.8.2. Financial performance

7.8.3. Product benchmarking

7.8.4. Strategic initiatives

7.9. AGRU America, Inc.

7.9.1. Company overview

7.9.2. Financial performance

7.9.3. Product benchmarking

7.9.4. Strategic initiatives

7.10. Global Synthetics

7.10.1. Company overview

7.10.2. Financial performance

7.10.3. Product benchmarking

7.10.4. Strategic initiatives

7.11. HUESKER Group

7.11.1. Company overview

7.11.2. Financial performance

7.11.3. Product benchmarking

7.11.4. Strategic initiatives

7.12. TYPAR Geosynthetics

7.12.1. Company overview

7.12.2. Financial performance

7.12.3. Product benchmarking

7.12.4. Strategic initiatives

7.13. Machina-TST

7.13.1. Company overview

7.13.2. Financial performance

7.13.3. Product benchmarking

7.13.4. Strategic initiatives

7.14. Gayatri Polymers & Geo-synthetics

7.14.1. Company overview

7.14.2. Financial performance

7.14.3. Product benchmarking

7.14.4. Strategic initiatives

7.15. ACE Geosynthetics

7.15.1. Company overview

7.15.2. Financial performance

7.15.3. Product benchmarking

7.15.4. Strategic initiatives

7.16. Nilex Inc.

7.16.1. Company overview

7.16.2. Financial performance

7.16.3. Product benchmarking

7.16.4. Strategic initiatives

7.17. Geofabrics Australasia Pty. Ltd.

7.17.1. Company overview

7.17.2. Financial performance

7.17.3. Product benchmarking

7.17.4. Strategic initiatives

7.18. Asahi Kasei Advance Corporation

7.18.1. Company overview

7.18.2. Financial performance

7.18.3. Product benchmarking

7.18.4. Strategic initiatives

7.19. Carthage Mills, Inc.

7.19.1. Company overview

7.19.2. Financial performance

7.19.3. Product benchmarking

7.19.4. Strategic initiatives

7.20. Belton Industries

7.20.1. Company overview

7.20.2. Financial performance

7.20.3. Product benchmarking

7.20.4. Strategic initiatives

List of Tables

Table 1 Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 2 Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 3 Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 4 Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 5 Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 6 Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 7 Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 8 Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 9 Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 10 Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 11 Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 12 Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 13 Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 14 Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 15 Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 16 Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 17 Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 18 Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 19 Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 20 Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 21 Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 22 Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 23 Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 24 Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 25 Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 26 Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 27 Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 28 Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 29 Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 30 Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 31 Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 32 Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 33 Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 34 Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 35 Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 36 North America Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 37 North America Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 38 North America Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 39 North America Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 40 North America Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 41 North America Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 42 North America Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 43 North America Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 44 North America Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 45 North America Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 46 North America Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 47 North America Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 48 North America Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 49 North America Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 50 North America Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 51 North America Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 52 North America Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 53 North America Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 54 North America Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 55 North America Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 56 North America Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 57 North America Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 58 North America Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 59 North America Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 60 North America Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 61 North America Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 62 North America Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 63 North America Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 64 North America Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 65 North America Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 66 North America Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 67 North America Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 68 North America Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 69 North America Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 70 North America Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 71 U.S. Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 72 U.S. Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 73 U.S. Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 74 U.S. Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 75 U.S. Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 76 U.S. Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 77 U.S. Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 78 U.S. Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 79 U.S. Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 80 U.S. Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 81 U.S. Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 82 U.S. Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 83 U.S. Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 84 U.S. Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 85 U.S. Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 86 U.S. Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 87 U.S. Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 88 U.S. Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 89 U.S. Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 90 U.S. Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 91 U.S. Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 92 U.S. Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 93 U.S. Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 94 U.S. Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 95 U.S. Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 96 U.S. Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 97 U.S. Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 98 U.S. Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 99 U.S. Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 100 U.S. Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 101 U.S. Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 102 U.S. Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 103 U.S. Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 104 U.S. Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 105 U.S. Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 106 Canada Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 107 Canada Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 108 Canada Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 109 Canada Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 110 Canada Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 111 Canada Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 112 Canada Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 113 Canada Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 114 Canada Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 115 Canada Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 116 Canada Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 117 Canada Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 118 Canada Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 119 Canada Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 120 Canada Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 121 Canada Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 122 Canada Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 123 Canada Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 124 Canada Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 125 Canada Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 126 Canada Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 127 Canada Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 128 Canada Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 129 Canada Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 130 Canada Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 131 Canada Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 132 Canada Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 133 Canada Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 134 Canada Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 135 Canada Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 136 Canada Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 137 Canada Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 138 Canada Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 139 Canada Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 140 Canada Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 141 Mexico Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 142 Mexico Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 143 Mexico Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 144 Mexico Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 145 Mexico Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 146 Mexico Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 147 Mexico Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 148 Mexico Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 149 Mexico Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 150 Mexico Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 151 Mexico Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 152 Mexico Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 153 Mexico Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 154 Mexico Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 155 Mexico Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 156 Mexico Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 157 Mexico Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 158 Mexico Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 159 Mexico Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 160 Mexico Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 161 Mexico Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 162 Mexico Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 163 Mexico Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 164 Mexico Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 165 Mexico Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 166 Mexico Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 167 Mexico Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 168 Mexico Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 169 Mexico Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 170 Mexico Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 171 Mexico Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 172 Mexico Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 173 Mexico Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 174 Mexico Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 175 Mexico Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 176 Europe Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 177 Europe Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 178 Europe Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 179 Europe Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 180 Europe Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 181 Europe Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 182 Europe Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 183 Europe Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 184 Europe Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 185 Europe Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 186 Europe Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 187 Europe Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 188 Europe Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 189 Europe Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 190 Europe Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 191 Europe Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 192 Europe Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 193 Europe Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 194 Europe Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 195 Europe Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 196 Europe Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 197 Europe Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 198 Europe Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 199 Europe Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 200 Europe Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 201 Europe Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 202 Europe Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 203 Europe Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 204 Europe Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 205 Europe Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 206 Europe Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 207 Europe Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 208 Europe Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 209 Europe Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 210 Europe Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 211 UK Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 212 UK Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 213 UK Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 214 UK Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 215 UK Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 216 UK Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 217 UK Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 218 UK Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 219 UK Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 220 UK Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 221 UK Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 222 UK Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 223 UK Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 224 UK Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 225 UK Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 226 UK Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 227 UK Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 228 UK Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 229 UK Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 230 UK Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 231 UK Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 232 UK Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 233 UK Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 234 UK Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 235 UK Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 236 UK Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 237 UK Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 238 UK Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 239 UK Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 240 UK Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 241 UK Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 242 UK Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 243 UK Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 244 UK Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 245 UK Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 246 Germany Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 247 Germany Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 248 Germany Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 249 Germany Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 250 Germany Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 251 Germany Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 252 Germany Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 253 Germany Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 254 Germany Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 255 Germany Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 256 Germany Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 257 Germany Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 258 Germany Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 259 Germany Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 260 Germany Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 261 Germany Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 262 Germany Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 263 Germany Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 264 Germany Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 265 Germany Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 266 Germany Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 267 Germany Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 268 Germany Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 269 Germany Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 270 Germany Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 271 Germany Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 272 Germany Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 273 Germany Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 274 Germany Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 275 Germany Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 276 Germany Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 277 Germany Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 278 Germany Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 279 Germany Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 280 Germany Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 281 France Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 282 France Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 283 France Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 284 France Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 285 France Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 286 France Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 287 France Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 288 France Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 289 France Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 290 France Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 291 France Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 292 France Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 293 France Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 294 France Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 295 France Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 296 France Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 297 France Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 298 France Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 299 France Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 300 France Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 301 France Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 302 France Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 303 France Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 304 France Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 305 France Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 306 France Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 307 France Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 308 France Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 309 France Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 310 France Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 311 France Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 312 France Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 313 France Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 314 France Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 315 France Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 316 Spain Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 317 Spain Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 318 Spain Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 319 Spain Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 320 Spain Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 321 Spain Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 322 Spain Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 323 Spain Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 324 Spain Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 325 Spain Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 326 Spain Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 327 Spain Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 328 Spain Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 329 Spain Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 330 Spain Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 331 Spain Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 332 Spain Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 333 Spain Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 334 Spain Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 335 Spain Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 336 Spain Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 337 Spain Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 338 Spain Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 339 Spain Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 340 Spain Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 341 Spain Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 342 Spain Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 343 Spain Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 344 Spain Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 345 Spain Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 346 Spain Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 347 Spain Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 348 Spain Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 349 Spain Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 350 Spain Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 351 Italy Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 352 Italy Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 353 Italy Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 354 Italy Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 355 Italy Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 356 Italy Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 357 Italy Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 358 Italy Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 359 Italy Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 360 Italy Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 361 Italy Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 362 Italy Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 363 Italy Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 364 Italy Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 365 Italy Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 366 Italy Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 367 Italy Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 368 Italy Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 369 Italy Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 370 Italy Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 371 Italy Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 372 Italy Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 373 Italy Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 374 Italy Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 375 Italy Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 376 Italy Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 377 Italy Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 378 Italy Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 379 Italy Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 380 Italy Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 381 Italy Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 382 Italy Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 383 Italy Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 384 Italy Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 385 Italy Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 386 Asia Pacific Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 387 Asia Pacific Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 388 Asia Pacific Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 389 Asia Pacific Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 390 Asia Pacific Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 391 Asia Pacific Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 392 Asia Pacific Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 393 Asia Pacific Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 394 Asia Pacific Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 395 Asia Pacific Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 396 Asia Pacific Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 397 Asia Pacific Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 398 Asia Pacific Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 399 Asia Pacific Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 400 Asia Pacific Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 401 Asia Pacific Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)

Table 402 Asia Pacific Geomembranes market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 403 Asia Pacific Geomembranes market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 404 Asia Pacific Geogrids market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 405 Asia Pacific Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 406 Asia Pacific Geogrids market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 407 Asia Pacific Geogrids market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 408 Asia Pacific Geogrids market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 409 Asia Pacific Geogrids market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 410 Asia Pacific Geogrids market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 411 Asia Pacific Geonets market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 412 Asia Pacific Geonets market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 413 Asia Pacific Geonets market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 414 Asia Pacific Geonets market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 415 Asia Pacific Geonets market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 416 Asia Pacific Geocells market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 417 Asia Pacific Geocells market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 418 Asia Pacific Geocells market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 419 Asia Pacific Geocells market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 420 Asia Pacific Geocells market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 421 China Geotextiles market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 422 China Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 423 China Geotextiles market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 424 China Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 425 China Natural geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 426 China Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (Million Square Meters)

Table 427 China Synthetic geotextiles market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 428 China Geotextiles market estimates and forecasts, by product, 2018 - 2030 (Million Square Meters)

Table 429 China Geotextiles market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 430 China Geotextiles market estimates and forecasts, by application, 2018 - 2030 (Million Square Meters)

Table 431 China Geotextiles market estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 432 China Geomembranes market estimates and forecasts, 2018 - 2030 (Million Square Meters) (USD Billion)

Table 433 China Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (Million Square Meters)

Table 434 China Geomembranes market estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 435 China Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (Million Square Meters)

Table 436 China Geomembranes market estimates and forecasts, by technology, 2018 - 2030 (USD Billion)