- Home

- »

- Advanced Interior Materials

- »

-

Glass Manufacturing Market Size, Share, Trends Report, 2030GVR Report cover

![Glass Manufacturing Market Size, Share & Trends Report]()

Glass Manufacturing Market Size, Share & Trends Analysis Report By Product (Container, Flat, Fiber), By Application (Packaging, Construction), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-699-8

- Number of Pages: 151

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

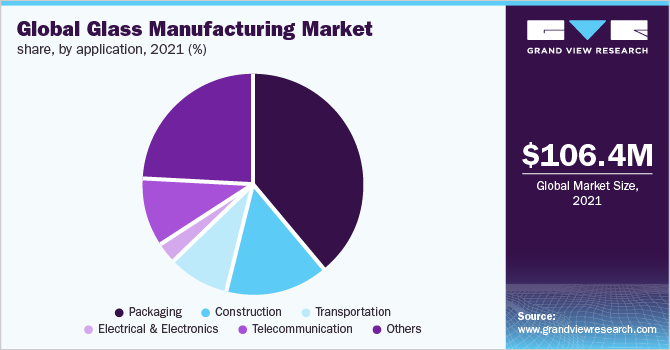

The global glass manufacturing market size was valued at USD 106.44 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. Rising spending on residential and commercial construction, along with the growing penetration of recyclable materials in the packaging sector, is anticipated to boost market growth during the forecast period.

The product finds various end-uses such as façades, windows, doors, and railings in the construction industry. Its rising usage in the industry is compelling manufacturers to expand their production to cater to the growing demand. Furthermore, increasing demand for glass containers such as bottles and ampoules in the food and beverage and medical industries is boosting product manufacturing.

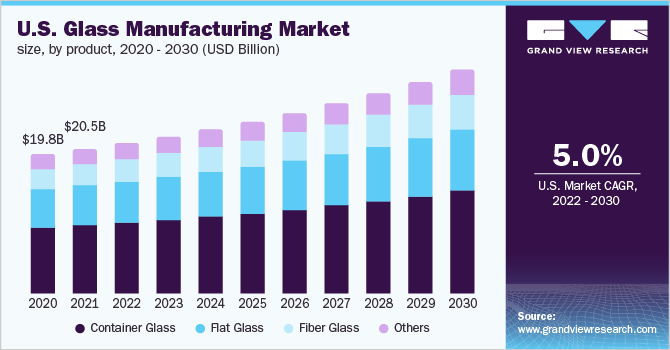

The U.S. market is projected to grow during the forecast period owing to the rising construction activities and growing investments in automobile and food and beverage production facilities. According to the U.S. Census Bureau, total construction expenditure in the country grew by 8.3% in June 2022, rising to USD 1,762.3 billion compared to June 2021.

Furthermore, companies involved in the food and beverage business are expanding their production with the rise in demand for packaged foods. This is likely to augment the market growth in the U.S. during the forecast period. For instance, in July 2022, PepsiCo. acquired 152 acres of land to construct a 1.2 million square foot production plant in Denver, U.S. The plant is expected to be operational by 2023.

Moreover, due to the increasing investments in solar energy, the processed glass demand for solar panels is witnessing high growth, which, in turn, is propelling its manufacturing. For instance, in July 2022, South Korea-based Hanwha Group announced signing an agreement to procure solar glass from Canadian Premium Sand. This procurement is for supporting Hanwha’s new manufacturing facility in the U.S., which is anticipated to have a solar energy production capacity of 3GW.

The market is however impacted by volatility in raw material prices as they constitute a major part of the cost structure of the glass manufacturing process. For instance, average world soda ash prices rose by ~23.5% from 2020 to 2021, reaching USD 180.0 per ton. Also, due to the ongoing increase in the cost of energy, labor, and transportation, U.S. Silica Holdings, Inc. announced a price increase from 6-14% across its industrial and specialty products business, from February 2022 onward.

Product Insights

Container glass held the largest revenue share of over 45.0% in 2021. The large share is attributed to its rising demand in packaging applications. For instance, in March 2021, a U.S.-based hybrid packaging supplier, Berlin Packaging, acquired Glass Line, an Italian manufacturer of glass packaging. With this acquisition, Berlin Packaging anticipates strengthening its presence in the European wine and olive oil market.

The growth of flat glass is credited to growing infrastructural developments, coupled with rising investments in residential and commercial buildings. For instance, according to the National Investment Promotion & Facilitation Agency of India, the domestic construction industry is likely to reach USD 1.4 trillion by 2025. These include investments in 100 smart cities, data centers, and commercial warehousing space.

Growth in the construction sector is boosting product manufacturing. For instance, in March 2022, Saint-Gobain inaugurated its new float glass facility and an integrated window line in Chennai, India, which is worth an investment of INR 500 crore (~USD 62.5 million). The company holds a leadership position in India in building materials and sustainable construction and also projects the country to witness sustained high growth over a long period.

Furthermore, the growth of the fiberglass segment can be attributed to the telecom industry. It has been found that pultruded glass fiber can reduce attenuation of the high frequency 5G signals, resulting in improved and better lines of telecommunication. Thus, rising digitization and expansion of the 5G network are anticipated to boost segment growth over the coming years.

Application Insights

The packaging segment held the largest revenue share of over 35.0% in 2021. Glass has been found to be a more economical and eco-friendly packaging alternative compared to plastic. This has led major food and beverage players such as Coca-Cola to promote glass bottle packaging for their drinks, especially in developing markets such as India.

In the first quarter of 2022, Coca-Cola India Pvt. Ltd. sold 500 million additional bottles in India. Of the total bottles sold, nearly 70% of sales were from returnable glass bottles and single-serve PET bottles. As per the company, expenditure on logistics and plastics is a significant part of the overall cost and glass bottles are proving to be cost-effective as it is a one-time cost and can be rotated.

Construction is another significant application segment. The growth can be credited to the focus on green buildings, considering the growing environmental concerns. The incorporation of insulated glass helps in minimizing the energy costs of buildings. Vitro, one of the key market players, announced that four of the top 10 green building projects in 2022 selected by the AIA Committee were glazed with the company’s Solarban solar control, low-E glasses.

Moreover, growing automobile production, especially in the electric vehicles segment, is boosting product demand and manufacturing. For instance, in December 2021, Chinese EV company Nio announced its second electric Sedan ET5, and its delivery is expected to commence in September 2022. The sedan has custom augmented reality glasses made by the company Nreal.

Regional Insights

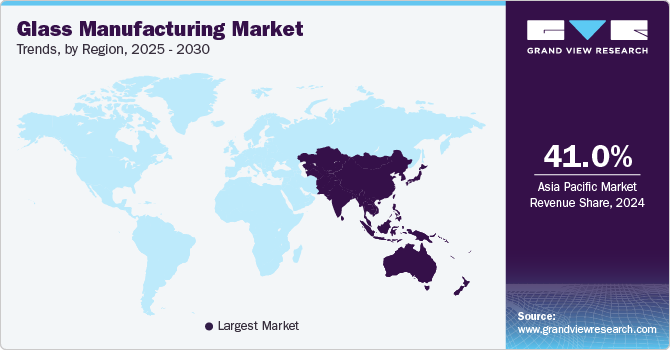

Asia Pacific held the largest revenue share of over 40.0% in 2021 and this trend is expected to continue during the forecast period. Growing demand from end-use industries is encouraging manufacturers to expand production. In April 2022, Chiefway unveiled the first smart glass factory in Malaysia, which came into existence owing to the rising popularity of eco-friendly and smart home developments.

North America is anticipated to register a revenue-based CAGR of 5.3% during the forecast period. Increasing investments in the construction, food & beverages, and pharmaceutical industries are driving product demand. For instance, in June 2022, Saverglass announced to expand its production capacity for glass bottles in 2023 to meet the growing demand from the American continent.

Europe held a considerable revenue share in 2021; however, considering the low economic growth, rising inflation, trade conflicts, and the Russia-Ukraine war, the growth rate is anticipated to be low for the region. However, the region is focusing on domestic manufacturing, which is expected to benefit market growth. For instance, in May 2022, Alliaverre, a French company, expressed its interest in building a solar glass plant in France by the end of 2023.

Key Companies & Market Share Insights

The fragmented nature of the market and rising product demand have led to high competitive rivalry. Market players are focusing on competitive differentiation in terms of the manufacturing process and product innovation. For instance, in September 2021, Gerresheimer announced to make the use of hybrid technology for melting glass at its plant in Lohr, France. With this technology, the company plans to make significant CO2 reduction in the glass tube and container production. Some prominent players in the global glass manufacturing market include:

-

AGC Inc.

-

Fuyao Glass Industry Group Co. Ltd.

-

Guardian Industries

-

Saint-Gobain

-

O-I Glass Inc.

-

AGI glaspac

-

Nihon Yamaura Glass Co., Ltd.

-

Vitro

-

3B- the fiberglass company

Glass Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 110.61 billion

Revenue forecast in 2030

USD 167.50 billion

Growth rate

CAGR of 5.2% from 2022 to 2030

Market demand in 2022

166.92 million tons

Volume forecast in 2030

231.01 million tons

Growth Rate

CAGR of 3.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons/million tons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; China; India; Japan; South Korea; Brazil

Key companies profiled

AGC Inc.; Fuyao Glass; Guardian; Nippon Sheet Glass; Saint-Gobain; Vitro; O-I Glass

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glass Manufacturing Market Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global glass manufacturing market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Container Glass

-

Flat Glass

-

Fiber Glass

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Packaging

-

Construction

-

Transportation

-

Electrical & Electronics

-

Telecommunication

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global glass manufacturing market size was estimated at USD 106.44 billion in 2021 and is expected to reach USD 110.61 billion in 2022.

b. The glass manufacturing market is expected to grow at a compound annual growth rate of 5.2% from 2022 to 2030 to reach USD 167.50 billion by 2030.

b. Packaging was the key application segment of the market with a revenue share of above 38.0% of the market in 2021. The move towards sustainable packaging materials is projected to positively aid the market growth over the near future.

b. Some of the key players operating in the glass manufacturing market include AGC Inc., Fuyao Glass, Guardian, Nippon Sheet Glass, Saint-Gobain, Vitro, and O-I Glass, among others.

b. Growing demand from the packaging and construction industries is anticipated to drive the demand for glass and eventually expand its production over the forecast period. Rising investments in green buildings and increasing penetration of glass bottles as a sustainable and recyclable packaging material is benefiting market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."