- Home

- »

- HVAC & Construction

- »

-

Aerial Work Platform Truck Market Size & Share Report 2030GVR Report cover

![Aerial Work Platform Truck Market Size, Share & Trends Report]()

Aerial Work Platform Truck Market Size, Share & Trends Analysis Report By Product (Boom Lifts, Scissor Lifts, Vertical Mast Lifts, Personnel Portable Lifts), By End-Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-484-0

- Number of Pages: 106

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Aerial Work Platform Truck Market Size & Trends

The global aerial work platform truck market size was valued at USD 12.19 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The surge in demand across the telecommunication sector, especially in China, India, Brazil, Indonesia, and Taiwan, is expected to drive industry growth over the coming years. The rise in maintenance and repair activities in developed regions such as Europe and North America may also catapult the aerial work platform (AWP) truck market demand.

Increasing government investment in the construction industry, rapid infrastructure development, and growing private investment in the real-estate sector, particularly in Asia Pacific, are also estimated to escalate demand over the next few years. The industry is poised for growth owing to rising demand for material handling equipment in manufacturing units and factories and growing concerns regarding worker safety.

The COVID-19 pandemic positively impacted the market for aerial work platform (AWP) truck. The pandemic caused disruptions in various industries, including the construction, manufacturing, and maintenance sectors. As operations gradually resumed, there was a heightened need for efficient and agile equipment like AWP trucks to accelerate the pace of work and meet project deadlines. AWP trucks enable workers to perform tasks at heights quickly and effectively, enhancing productivity and minimizing project delays.

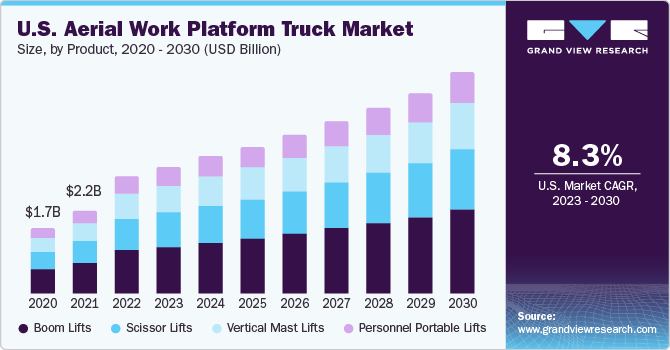

Product Insights

Aerial work platform truck products mainly comprise boom lifts, scissor lifts, vertical mast lifts, and personal portable lifts. The boom lift segment accounted for the largest revenue share of 37.5% in 2022. It may be attributed to increasing usage in intricate architectural settings or confined spaces with limited access. Further, boom lifts offer several benefits, including more platform height, mobility, tight turning radius, standard oscillating axle, and compact design.

The scissor lifts segment is expected to grow at a significant CAGR of 7.6% during the forecast period. Increasing demand in maintenance and installation applications may fuel scissor lifts demand over the next few years. Additionally, operational benefits offered by scissor lifts, such as maneuvering capability in tight spaces, may spur product demand significantly.

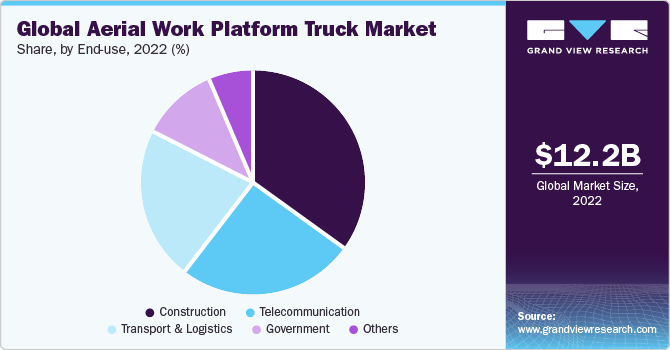

End-use Insights

The end-use segments include construction, telecommunication, transport & logistics, and government sectors. The construction segment held the largest revenue share of 35.0% in 2022, owing to increasing government and private investment in the real-estate sector and infrastructure development. Growing concerns regarding worker safety are also anticipated to fuel product demand in this sector.

The telecommunication segment is expected to grow at a significant CAGR of 7.9% over the forecast period. It may be attributed to a surge in demand, particularly for relevant infrastructure across the telecommunication sector, primarily in developing regions such as Brazil, India, and China.

The transport & logistics sector may also grow considerably due to the growing demand for material handling in manufacturing plants. The government sector is expected to be driven by increasing investment in infrastructure development and other related activities.

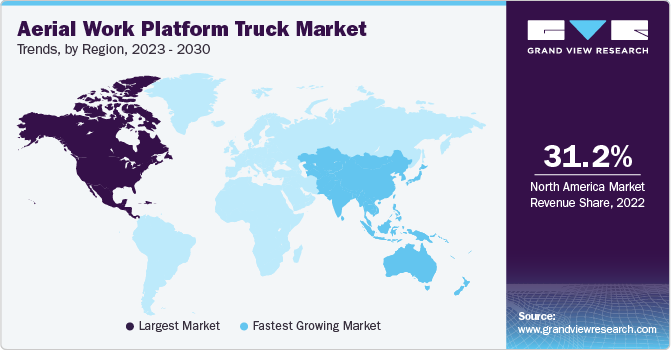

Regional Insights

North America dominated the market and accounted for the largest revenue share of 31.2% in 2022. The robust construction industry and stringent regulatory scenario regarding regional safety norms drive product demand. Latin America and MEA may also witness an upsurge in demand, attributed to the changing regulations and a rise in government investment for infrastructure development. Additionally, a growing number of large construction projects, especially in Middle east countries, is anticipated to elevate product demand over the coming years.

Asia Pacific is expected to grow at a significant CAGR of 7.5% due to growing infrastructure and heavy investments, both in the commercial and domestic sectors. Smartphone proliferation and the associated need for improved telecom infrastructure may positively impact the industry demand over the forecast period.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in June 2022, Haulotte, a major French aerial work platform, partnered with Bouygues Energies & Services. As part of the collaboration between the two organizations, Bouygues, an engineering, and services specialist, will conduct real-world testing of a Haulotte MEWP (Mobile Elevating Work Platform) integrated with a hydrogen fuel cell system across multiple construction sites for one year. The following are some of the major participants in the global aerial work platform (AWP) truck market:

-

AICHI CORPORATION

-

Altec Industries

-

Bronto Skylift

-

CTE

-

RUNSHARE Heavy Industry Company, Ltd

-

Calcanto Werbeagentur

-

Shenyang North Traffic Heavy Industry Group Co., Ltd

-

Tadano Ltd.

-

Terex Corporation

-

TEUPEN Maschinenbau GmbH

Recent Developments

-

For instance, in February 2023, ACE, Indian material handling and construction equipment manufacturing company, launched India's first electric crane with a lifting capacity of 180 tonnes. These innovations offer real-time monitoring, remote diagnostics, energy efficiency, and reduced environmental impact, aligning with the growing demand for sustainable and connected solutions.

-

For instance, in February 2021, Oshkosh Corporation, an American industrial company, invested in Micro vast, a provider of next-generation battery technologies for specialty and commercial electric vehicles. This new partnership strengthened and advanced the progress of electrified solutions across the JLG product line, including vertical access lifts, scissor lifts, boom lifts, low-level access lifts, towable lifts stock, order picker lifts, and telehandlers.

-

In September 2022, Imer, an Italy-based manufacturer, launched IM 5080, a mini scissor lift model, at Bauma, held in Germany. The IM 5080 has a capacity of 230kg, with a total weight of 810kg and one operator. It can be fitted with a manual podium attachment of 6cm, which assures a capacity of 130kg.

-

In April 2022, ProLift Toyota, a material handling company, merged with another Toyota-owned subsidiary, Toyota Material Handling Ohio. This merger allows ProLift to bring additional resources to the existing customers and expand its operations in central and northern Ohio.

-

In April 2023 LineWise, a utility company, improved its insulated work platform. One enhancement was adding a hydraulic articulation feature, allowing the jib to reach angles of up to 45 degrees. This modification facilitates access to challenging areas that were previously difficult to reach. The insulated work platform is specifically developed for installation on hydraulically telescoping cranes to increase the utilization of existing equipment.

Aerial Work Platform Truck Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.16 billion

Revenue forecast in 2030

USD 21.93 billion

Growth Rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

AICHI CORPORATION; Altec Industries; Bronto Skylift; CTE; RUNSHARE Heavy Industry Company, Ltd; Calcanto Werbeagentur; Shenyang North Traffic; Heavy Industry Group Co., Ltd; Tadano Ltd.; Terex Corporation; TEUPEN Maschinenbau GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerial Work Platform Truck Market Report Segmentation

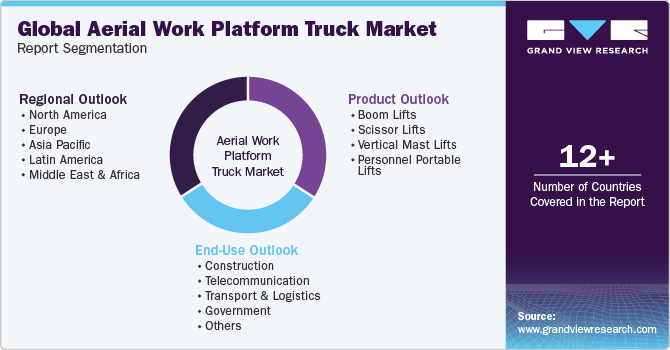

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global aerial work platform (AWP) truck market based on product, end-use, and region:

-

Product Outlook (Revenue in USD Million, 2017 - 2030)

-

Boom Lifts

-

Scissor Lifts

-

Vertical Mast Lifts

-

Personnel Portable Lifts

-

-

End-Use Outlook (Revenue in USD Million, 2017 - 2030)

-

Construction

-

Telecommunication

-

Transport & Logistics

-

Government

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. North America dominated the aerial work platform truck market with a share of over 31% in 2022. This is attributable to modernization of existing infrastructure and rise in new construction projects in the region.

b. Some key players operating in the aerial work platform truck market include Aichi, Altec, Bronto Skylift, CTE, Runshare, Ruthmann, Shen Yang North Traffic Heavy Industry Group, Tadano, Terex, and Time Benelux.

b. Key factors that are driving the market growth include increasing government and private investments in the construction industry resulting in rapid infrastructure development worldwide.

b. The global aerial work platform truck market size was estimated at USD 12.19 billion in 2022 and is expected to reach USD 13.16 billion in 2023.

b. The global aerial work platform truck market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 21.93 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."