- Home

- »

- Healthcare IT

- »

-

Clinical Trials Market Size, Share And Growth Report, 2030GVR Report cover

![Clinical Trials Market Size, Share & Trends Report]()

Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design, By Indication, Indication By Study Design, By Sponsors, By Service Type, By Region and Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-975-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Clinical Trials Market Size & Trends

The global clinical trials market size was valued at USD 80.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.49% from 2024 to 2030. The market growth spiked in 2020 owing to the COVID-19 pandemic. This growth pattern was witnessed by both virtual clinical trials and traditional ones. Several companies invested heavily in novel drug development to minimize COVID-19 patient burden. One such example being, in 2020, Synairgen plc and Parexel collaborated on a Phase III study of Interferon-beta (IFN-beta) treatment for COVID-19. Furthermore, rapid technological evolution, rising prevalence of chronic diseases, globalization of clinical trials, penetration of personalized medicine and a rise in demand for CROs for conducting research activities is expected to positively impact the market growth.

In addition, the COVID-19 pandemic led to changing the ways of conducting upcoming or ongoing clinical trials. Regulatory agencies including the U.S. FDA, the European Medicines Agency (EMA), the National Institutes of Health (NIH), and China’s National Medical Products Administration among several others issued various guidelines for conducting trials during the pandemic to support the implementation of decentralized clinical trials and virtual services. The current scenario for research and development activities across the globe and the need for several new treatment options have also led to the adoption of fast-track clinical trials. Thus, aforementioned factors are estimated to offer new avenues to the clinical trials market growth.

Favorable government support and initiatives is another aspect boosting the market growth potential. For instance, the WHO launched Solidarity, an international clinical trial to determine effective treatment against COVID-19. [PS2] It includes comparing four treatment options against the standard of care to evaluate their effectiveness against the coronavirus. In May 2020, the WHO also announced an international alliance for simultaneously developing multiple candidate vaccines to prevent the spread of the coronavirus disease, calling this effort the Solidarity trial for vaccines.

Furthermore, the use of CRO services helps manufacturers/sponsors pay complete attention to the production capacity and enhance their in-house processes. The availability of the vast array of services from drug discovery to post marketing surveillance has further simplified processes for mid-size & small-scale pharmaceutical and biotechnological organizations by providing them the option to outsource research and development activities to reduce infrastructure investment. For instance, in November 2023, Syneos Health signed an agreement with GoBroad Healthcare Group. This collaborative initiative extended the company’s clinical trial capabilities into a more extensive array of therapeutic areas in China.

Moreover, digitization in biomedical research is also paving the way for overall market growth. Incorporating advanced technologies, such as Electronic Data Capture (EDC), aids companies in streamlining data collection and managing patient data ultimately reducing monitoring costs & accelerating clinical trial timelines by enabling real-time data access & analysis. The adoption of Clinical Outcome Assessment (e-COA) software to maintain patient data records aids in adhering to strict regulations and also decreases errors during clinical trials. Growing adoption of decentralized/virtual clinical trials and telemedicine in clinical trials offers several advantages, such as enhanced patient recruitment & retention and reduced geographical barriers, thereby positively influencing overall market growth potential.

Market Concentration & Characteristics

The industry growth stage is moderate, and the pace of the growth is accelerating. The clinical trials market is characterized by a moderate-to-high degree of growth owing to increasing investment in R&D programs, growing preference for outsourcing activities to minimize time, curtail clinical trial cost and patent expiration of blockbuster drugs. With increasing clinical trial privatization, there is a surge in outsourcing to developing countries, and many CROs are enhancing their global research network to provide better customer services.

Key strategies implemented by players in the clinical trials market are new product launches, expansion, acquisitions, partnerships, and other strategies. Thermo Fisher Scientific, in August 2023, announced the acquisition of CorEvitas, LLC (CorEvitas) for USD 912.5 million. The initial agreement to acquire CorEvitas was announced by Thermo Fisher on July 6, 2023.

Degree of Innovation: advancements in drug development, adoption of advanced therapies such as cell and gene therapy and rising demand for personalized medicine are likely to influence the industry growth. The market has seen a surge in innovative technologies such as AI, big data analytics, and remote monitoring. Companies are investing highly in advanced technologies and effectively utilizing these technologies often gain a competitive edge, driving market growth. Such advancements and innovations in clinical trials drive market growth.

Impact of Regulations: Stringent quality protocols and regulatory norms by several nations to ensure patient safety and data integrity, which highly impact operational capabilities in the clinical trials market. Companies with robust compliance measures and a track record of fulfilling regulatory standards gain credibility and preference from biopharmaceutical sponsors. Compliance with these regulations demands substantial resources, leading to barriers for smaller or newer firms.

Level of M&A Activities: Mergers and acquisition activities in the clinical trials market are increasing and witness similar growth during the analysis timeframe. Several companies are acquiring development-stage companies to enhance the company’s service portfolio to cater large patient pool. Moreover, these firms are integrating advanced facilities and form strategic alliances to achieve synergies in capabilities and resources, enhancing their competitiveness.

Market Fragmentation: The market comprises a large number of bio-pharmaceutical, medical device manufacturers and CROS specialized in drug development leading to a fragmented scenario.

Regional Expansion: The geographical distribution of clinical trials is slowly shifting from developed nations to emerging countries. The rising cost of clinical trials and difficulty in patient recruitment have led biopharmaceutical companies to shift toward regions like Central & Eastern Europe, Asia Pacific, Latin America, & Middle East for cost savings and quick patient recruitment. Emerging countries also possess greater disease variation compared to North America and Western Europe, where traditional diseases are growing.

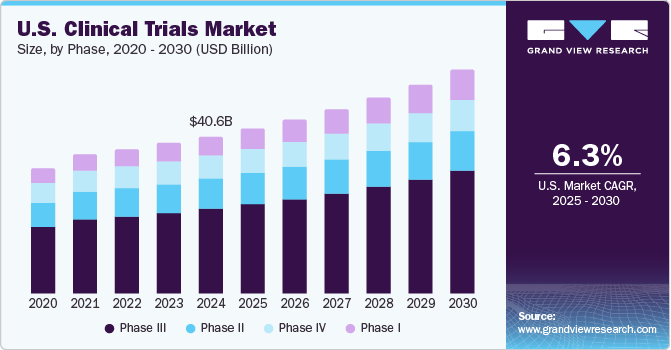

Phase Insights

Phase III segment led the market and accounted for 53.3% of the total revenue share in 2023. clinical trial statistics indicate market growth due to rising phase III trials, involving a large number of subjects. The median cost for a single-phase III trial is over USD 19.0 million. Also, phase III requires a higher number of patients and often a longer treatment period. According to a clinical trial logistics survey by Nice Insights, 35.0% of phase III clinical trials are outsourced and the number is likely to increase owing to the growing number of investigational drugs advancing to the next phase.

Phase II segment is expected to witness considerable growth over the analysis period. Phase II is the second most expensive stage after phase III studies. This study is performed in two parts; the first part includes exploring a range of doses along with efficacy studies and the second part includes finalizing the dose. Phase II plays a crucial role, especially in oncology-related studies. The FDA estimated that around 33.0% of the investigational drugs are usually under phase II trial. Furthermore, there are numerous therapeutics and vaccines currently in phase II that are indicated for the treatment of oncology thereby boosting the growth. The growing number of industry-sponsored and non-industry-sponsored clinical trials in phase II, complexity associated with phase II clinical trials, and globalization of clinical trials are factors expected to drive the growth of the clinical trials market.

Study Design Insights

The interventional studies segment dominated the market in 2023. It is one of the most prominent methods used in clinical trials. Interventional studies comprised over 75.0% of the total registered studies in 2022,ut of which most were for drug or biologics, followed by clinical procedure, behavioral, and device interventional studies. These studies contribute to 94.0% of the total studies that posted results, out of which drug or biologics contribute the most, followed by behavioral, devices, and Clinical procedure intervention studies.

The expanded access trials segment also referred to as compassionate use trials, is anticipated to register notable CAGR during the forecast period. It is a potential pathway for patients with serious disease conditions where lack of satisfactory therapies to undergo treatment outside the trial. Increasing innovation in clinical trial methods will drive the expanded access trials segment. Numerous oncology drugs are regularly administered to patients before their approval by the U.S. FDA and are considered part of the expanded access trial, thereby accelerating segmental revenue growth.

Indication by Study Design Insights

The interventional trials market for autoimmune/inflammation accounted for the largest revenue share in 2023. This can be attributed to large number of interventional studies on autoimmune/inflammation worldwide. Numerous advantages of interventional studies, such as minimization of confounding effects, avoidance of bias in allocation to exposure groups, and efficient detection of small to moderate clinically important effects. There are over 8,900 interventional studies listed on Clinicaltrails.gov related to autoimmune/inflammation.

Indication Insights

Oncology segment accounted for the largest revenue share in 2023. As per the U.S. FDA and various other sources, more than USD 38.0 billion is currently being spent by the pharmaceutical industry on the pre-clinical and clinical development of oncology therapy products. The cardiovascular condition segment is also anticipated to witness lucrative growth over the forecast period. The growing prevalence and increased demand for cost-effective medications worldwide have led to significant investment in R&D in this segment with more than 190 drugs in the pipeline. The majority of the drugs in the pipeline are indicated for heart failure, lipid disorders, vascular diseases, and stroke. Growing demand for cost-effective medicines in low- and middle-income countries is expected to boost the R&D investment by the government, thereby strengthening the industry growth.

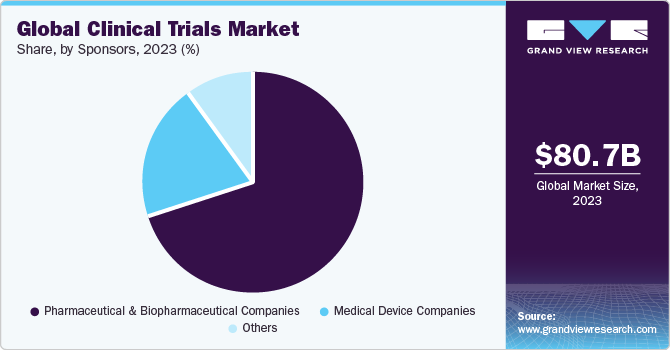

Sponsors Insights

Pharmaceutical & biopharmaceutical companies accounted for the largest revenue share in 2023. This can be attributed to the greater interest of the pharmaceutical industry in the research field. In addition, there has been an increase in the number of clinical trials funded by pharmaceutical & biopharmaceutical companies. The pharmaceutical industry plays a vital role in financing the research for the development of new drugs.

Although grants from the National Institutes of Health (NIH) fund most of the basic research in academic laboratories, it is largely the industry that bears the cost of identifying new molecular entities and testing them on animal models and human subjects. Clinical studies account for the major portion of the estimated cost, ranging from USD 266 million to USD 802 million for bringing each new drug to the market. Currently, in the U.S., around 75% of all funding for Clinical studies is received from corporate sponsors.

Patient recruitment and retention segment garnered a significant share in 2023. The growing number of clinical studies globally is one of the key reasons supporting the demand for clinical trial patient recruitment services. Moreover, there is a growing amount of funding for clinical research, and the wide adoption of digital technologies in clinical research further supports the growth. The market is further fueled by major investments in R&D and government support for clinical trials. The presence of leading Contract Research Organizations (CROs) that offer comprehensive support services, including patient recruitment, along with the active participation of multinational pharmaceutical & biopharmaceutical companies, has contributed to the market expansion.

Data management segment held a significant share in 2023 and is anticipated to show a similar trend over the forecasted period. The segment growth is owing to increasing adoption of data management services coupled with a growing trend towards decentralized trials. Moreover, integration of advanced technologies as Artificial Integration (AI) and Machine Learning (ML) for data entry and analysis and quality control. Thus, abovementioned factors are expected to drive segmental demand.

Regional Insights

North America accounted for 50.3% of the global market in 2023 and is expected to continue its dominance over the forecast period. This can be attributed to an increase in R&D investments and a rise in the adoption of new technologies in clinical trials in this region. For instance, the implementation of virtual services in various stages of clinical trials by market players, such as IQVIA and PRA Health Sciences, is anticipated to further propel the North American market growth.

Moreover, favorable government support in the U.S. clinical trials market is anticipated to boost the demand. For instance, in March 2020, the FDA launched a Coronavirus Treatment Acceleration Program (CTAP) for possible therapies to accelerate the development of treatment for global diseases caused by the coronavirus. The program employs every available way to provide novel treatment to patients as rapidly as possible, simultaneously finding out whether they are harmful or helpful.

Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period owing to the availability of a large patient pool allowing easy recruitment. The global COVID-19 pandemic is one of the major factors driving the market. Asia Pacific’s largest, expertized biotech CRO “Novotech”, has reported an increase in demand from biotechnology sponsors for studies due to good quality and quick turnaround. An increasing number of biotechnology firms prefer the APAC region for conducting COVID-19 trials to leverage a large patient pool and fast-track procedures.

Indian clinical trials market is anticipated to grow at a CAGR of 8.3% over the forecast period. The key factors estimated to drive the market are the globalization of clinical trials, adoption of new technology in clinical research, growing disease variation and prevalence, and increasing research and development promoting outsourcing.

Key Companies & Market Share Insights

The global clinical trials market is highly competitive. Some of the players operating in the market include IQVIA, PAREXEL International Corporation, Pharmaceutical Product Development, LLC, and Charles River Laboratory. The major factor influencing the competitive nature is the quick adoption of advanced technology for improved healthcare. In addition, to retain their market share and expand their product portfolio, major players are often involved in mergers and acquisitions as well as initiating new product launches.

Key Clinical Trials Companies:

- Pharmaceutical Product Development, INC. (Thermo Fisher Scientific, Inc.)

- ICON plc

- Charles River Laboratories International, Inc.

- IQVIA

- SYNEOS HEALTH

- SGS SA

- PAREXEL International Corporation

- Wuxi AppTec, Inc

- Chiltern International Ltd (Laboratory Corporation of America)

- Eli Lilly and Company

- Novo Nordisk A/S

- Pfizer

- Clinipace (Caidya)

Recent Developments

- In August 2023, Parexel & Partex entered a strategic partnership aimed at utilizing Artificial Intelligence (AI)-driven solutions to expedite the process of drug discovery and development for biopharmaceutical clients globally. The collaboration aimed to reduce risks associated with the assets in their respective portfolios.

- In August 2023, Novo Nordisk announced to acquire Inversago Pharma. This acquisition was part of Novo Nordisk's strategic efforts to develop new therapies targeting individuals with obesity, diabetes, and other significant metabolic diseases

- In April 2022, Charles River Laboratories International, Inc. disclosed its acquisition of Explora BioLabs Holdings, Inc., a leading provider of contract vivarium research services.

Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 84.7 billion

Revenue forecast in 2030

USD 123.5 billion

Growth rate

CAGR of 6.49% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Phase, Study Design, Indication, Sponsor, Indication By Study Design, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Clombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Pharmaceutical Product Development, inc. (Thermo Fisher Scientific, Inc.), ICON plc, Charles River Laboratories International, Inc., IQVIA, Syneos Health, SGS SA, PAREXEL International Corporation, Wuxi AppTec, Inc, Chiltern International Ltd (Laboratory Corporation of America), Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Clinipace (Caidya)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trials Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the clinical trials market report based on phase, study design, indication, sponsor, indication by study design, and region

-

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Billion, 2018 - 2030)

-

Interventional

-

Observational

-

Expanded Access

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Autoimmune/Inflammation

-

Rheumatoid arthritis

-

Multiple Sclerosis

-

Osteoarthritis

-

Irritable Bowel Syndrome (IBS)

-

Others

-

-

Pain Management

-

Chronic Pain

-

Acute Pain

-

-

Oncology

-

Blood Cancer

-

Solid Tumors

-

Other

-

- CNS Condition

-

Epilepsy

-

Parkinson's Disease (PD)

-

Huntington's Disease

-

Stroke

-

Traumatic Brain Injury (TBI)

-

Amyotrophic Lateral Sclerosis (ALS)

-

Muscle Regeneration

-

Others

-

-

Diabetes

-

Obesity

-

Cardiovascular

-

Others

-

-

Indication by Study Design Outlook (Revenue, USD Billion, 2018 - 2030)

-

Autoimmune/Inflammation

-

Interventional

-

Observational

-

Expanded Access

-

Pain Management

-

Interventional

-

Observational

-

Expanded Access

-

Oncology

-

Interventional

-

Observational

-

Expanded Access

-

CNS Condition

-

Interventional

-

Observational

-

Expanded Access

-

Diabetes

-

Interventional

-

Observational

-

Expanded Access

-

Obesity

-

Interventional

-

Observational

-

Expanded Access

-

Cardiovascular

-

Interventional

-

Observational

-

Expanded Access

-

Others

-

Interventional

-

Observational

-

Expanded Access

-

-

Sponsor Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Protocol Designing

-

Site Identification

-

Patient Recruitment

-

Laboratory Services

-

Bioanalytical Testing Services

-

Clinical Trial Data Management Services

-

Others

-

- Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

- Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

- Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trials market size was estimated at USD 49.8 billion in 2022 and is expected to reach USD 52.7 billion in 2023.

b. The global clinical trials market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 78.3 billion by 2030.

b. North America dominated the market for clinical trials and accounted for the largest revenue share of 50.5% in 2022.

b. Some key players operating in the clinical trials market include IQVIA; PAREXEL International Corporation; Pharmaceutical Product Development, LLC; Charles River Laboratory; ICON Plc; Wuxi AppTec Inc.; PRA Health Sciences; SGS SA; Syneos Health; Chiltern International Ltd.; Eli Lilly and Company; Novo Nordisk A/S; Pfizer; and Clinipace.

b. Key factors that are driving the clinical trials market growth include the adoption of new technology in clinical trials, the increasing prevalence of chronic diseases, and demand from developing countries.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Clinical Trials Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Ancillary Market Outlook

3.2. Fast track of clinical trials

3.3. Virtual/decentralized clinical trials

3.4. Real-world Evidence (RWE)

3.5. verage Cost of Clinical Trial /Price of Clinical Trails

3.5.1. By Phase

3.5.2. By TheArapeutic Area

3.5.3. By Region

3.6. Market Dynamics

3.6.1. Market Driver Analysis

3.6.1.1. Increasing Research and Development Promoting Outsourcing

3.6.1.2. Adoption of New Technology in Clinical Research

3.6.1.3. Increasing Prevalence of Chronic Disease

3.6.1.4. Globalization of Clinical Trials

3.6.1.5. Shift Toward Personalized Medicine

3.6.2. Market Restraint Analysis

3.6.2.1. Stringent Regulations in New Drug Development

3.6.2.2. Lack of Skilled Workforce in Clinical Research

3.6.3. Market Challenge Analysis

3.6.3.1. Rising Cost of Clinical Trial

3.7. Clinical Trials Market Analysis Tools

3.7.1. Industry Analysis - Porter’s

3.7.1.1. Bargaining power of suppliers

3.7.1.2. Bargaining power of buyers

3.7.1.3. Threat of substitutes

3.7.1.4. Threat of new entrants

3.7.1.5. Competitive rivalry

3.7.2. PESTEL Analysis

3.7.2.1. Political & Legal Landscape

3.7.2.2. Economic and Social Landscape

3.7.2.3. Technological landscape

3.7.3. COVID-19 Impact Analysis

3.7.3.1. Disrupted Clinical Trials

3.7.3.2. Obstacles in Clinical Trials

Chapter 4. Clinical Trials Market: Phase Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Clinical Trials Market: Phase Movement Analysis & Market Share, 2023 & 2030

4.3. Phase I

4.3.1. Phase I Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Phase II

4.4.1. Phase II Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Phase III

4.5.1. Phase III Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Phase IV

4.6.1. Phase IV Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Clinical Trials Market: Study Design Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Clinical Trials Market: Study Design Movement Analysis & Market Share, 2023 & 2030

5.3. Interventional

5.3.1. Interventional Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Observational

5.4.1. Observational Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Expanded Access

5.5.1. Expanded Access Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Clinical Trials Market: Indication Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Clinical Trials Market: Indication Movement Analysis & Market Share, 2023 & 2030

6.3. Autoimmune/Inflammation

6.3.1. Autoimmune/Inflammation Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.2. Rheumatoid Arthritis

6.3.2.1. Rheumatoid Arthritis Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.3. Multiple Sclerosis

6.3.3.1. Multiple Sclerosis Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.4. Osteoarthritis

6.3.4.1. Osteoarthritis Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.5. Irritable Bowel Syndrome (IBS)

6.3.5.1. Irritable Bowel Syndrome (IBS) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.6. Others

6.3.6.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Pain Management

6.4.1. Pain Management Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.2. Chronic Pain

6.4.2.1. Chronic Pain Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.3. Acute Pain

6.4.3.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5. Oncology

6.5.1. Oncology Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.2. Blood Cancer

6.5.2.1. Blood Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.3. Solid Tumors

6.5.3.1. Solid Tumors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.4. Others

6.5.4.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. CNS Conditions

6.6.1. CNS Conditions Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.2. Epilepsy

6.6.2.1. Epilepsy Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.3. Parkinson's Disease (PD)

6.6.3.1. Parkinson's Disease (PD) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.4. Huntington's Disease

6.6.4.1. Huntington's Disease Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.5. Stroke

6.6.5.1. Stroke Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.6. Traumatic Brain Injury (TBI)

6.6.6.1. Traumatic Brain Injury (TBI) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.7. Amyotrophic Lateral Sclerosis (ALS)

6.6.7.1. Amyotrophic Lateral Sclerosis (ALS) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.8. Muscle Regeneration

6.6.8.1. Muscle Regeneration Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.9. Others

6.6.9.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Diabetes

6.7.1. Diabetes Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.8. Obesity

6.8.1. Obesity Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.9. Cardiovascular

6.9.1. Cardiovascular Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.10. Others

6.10.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Clinical Trials Market: Sponsor Type Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Clinical Trials Market: Sponsor Movement Analysis & Market Share, 2024 & 2030

7.3. Pharmaceutical

7.3.1. Pharmaceutical & Biopharmaceutical Companies Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4. Medical Device Companies

7.4.1. Medical Device Companies Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5. Others

7.5.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Clinical Trials Market: by Service Type Estimates & Trend Analysis

8.1. Definitions & Scope

8.2. Study Design Market Share Analysis, 2024 & 2030

8.3. Segment Dashboard

8.4. Global Clinical Trials Market, By Service Type, 2018 to 2030

8.5. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

8.5.1. Protocol Designing

8.5.2. Site Identification

8.5.3. Patient Recruitment

8.5.4. Laboratory Services

8.5.5. Bioanalytical Testing Services

8.5.6. Clinical Trial Data Management Services

8.5.7. Others

Chapter 9. Clinical Trials Market: Regional Estimates & Trend Analysis

9.1. Regional Outlook

9.2. Clinical Trials Market: Regional Movement Analysis & Market Share, 2023 & 2030

9.3. North America

9.3.1. North America Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.2. U.S.

9.3.2.1. Key Country Dynamics

9.3.2.2. Competitive Scenario

9.3.2.3. Regulatory Scenario

9.3.2.4. U.S. Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.3. Canada

9.3.3.1. Key Country Dynamics

9.3.3.2. Competitive Scenario

9.3.3.3. Regulatory Scenario

9.3.3.4. Canada Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4. Europe

9.4.1. Europe Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.2. UK

9.4.2.1. Key Country Dynamics

9.4.2.2. Competitive Scenario

9.4.2.3. Regulatory Scenario

9.4.2.4. UK Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.3. Germany

9.4.3.1. Key Country Dynamics

9.4.3.2. Competitive Scenario

9.4.3.3. Regulatory Scenario

9.4.3.4. Germany Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.4. France

9.4.4.1. Key Country Dynamics

9.4.4.2. Competitive Scenario

9.4.4.3. Regulatory Scenario

9.4.4.4. France Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.5. Italy

9.4.5.1. Key Country Dynamics

9.4.5.2. Competitive Scenario

9.4.5.3. Regulatory Scenario

9.4.5.4. Italy Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.6. Spain

9.4.6.1. Key Country Dynamics

9.4.6.2. Competitive Scenario

9.4.6.3. Regulatory Scenario

9.4.6.4. Spain Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.7. Denmark

9.4.7.1. Key Country Dynamics

9.4.7.2. Competitive Scenario

9.4.7.3. Regulatory Scenario

9.4.7.4. Denmark Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.8. Sweden

9.4.8.1. Key Country Dynamics

9.4.8.2. Competitive Scenario

9.4.8.3. Regulatory Scenario

9.4.8.4. Sweden Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.9. Norway

9.4.9.1. Key Country Dynamics

9.4.9.2. Competitive Scenario

9.4.9.3. Regulatory Scenario

9.4.9.4. Norway Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5. Asia Pacific

9.5.1. Asia Pacific Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.2. Japan

9.5.2.1. Key Country Dynamics

9.5.2.2. Competitive Scenario

9.5.2.3. Regulatory Scenario

9.5.2.4. Japan Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.3. China

9.5.3.1. Key Country Dynamics

9.5.3.2. Competitive Scenario

9.5.3.3. Regulatory Scenario

9.5.3.4. China Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.4. India

9.5.4.1. Key Country Dynamics

9.5.4.2. Competitive Scenario

9.5.4.3. Regulatory Scenario

9.5.4.4. India Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.5. South Korea

9.5.5.1. Key Country Dynamics

9.5.5.2. Competitive Scenario

9.5.5.3. Regulatory Scenario

9.5.5.4. South Korea Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.6. Australia

9.5.6.1. Key Country Dynamics

9.5.6.2. Competitive Scenario

9.5.6.3. Regulatory Scenario

9.5.6.4. Australia Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.7. Thailand

9.5.7.1. Key Country Dynamics

9.5.7.2. Competitive Scenario

9.5.7.3. Regulatory Scenario

9.5.7.4. Thailand Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6. Latin America

9.6.1. Latin America Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.2. Brazil

9.6.2.1. Key Country Dynamics

9.6.2.2. Competitive Scenario

9.6.2.3. Regulatory Scenario

9.6.2.4. Brazil Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.3. Mexico

9.6.3.1. Key Country Dynamics

9.6.3.2. Competitive Scenario

9.6.3.3. Regulatory Scenario

9.6.3.4. Mexico Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.4. Argentina

9.6.4.1. Key Country Dynamics

9.6.4.2. Competitive Scenario

9.6.4.3. Regulatory Scenario

9.6.4.4. Argentina Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.7. Middle East & Africa

9.7.1. Middle East & Africa Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.7.2. South Africa

9.7.2.1. Key Country Dynamics

9.7.2.2. Competitive Scenario

9.7.2.3. Regulatory Scenario

9.7.2.4. South Africa Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.7.3. Saudi Arabia

9.7.3.1. Key Country Dynamics

9.7.3.2. Competitive Scenario

9.7.3.3. Regulatory Scenario

9.7.3.4. Saudi Arabia Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.7.4. UAE

9.7.4.1. Key Country Dynamics

9.7.4.2. Competitive Scenario

9.7.4.3. Regulatory Scenario

9.7.4.4. UAE Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

9.7.5. Kuwait

9.7.5.1. Key Country Dynamics

9.7.5.2. Competitive Scenario

9.7.5.3. Regulatory Scenario

9.7.5.4. Kuwait Clinical Trials Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 10. Competitive Landscape

10.1. Market Participant Categorization

10.2. Key Company Profiles

10.2.1. IQVIA

10.2.1.1. Company Overview

10.2.1.2. Financial Performance

10.2.1.3. Service Benchmarking

10.2.1.4. Strategic Initiatives

10.2.2. Chiltern International Ltd (Laboratory Corporation of America)

10.2.2.1. Company Overview

10.2.2.2. Financial Performance

10.2.2.3. Service Benchmarking

10.2.2.4. Strategic Initiatives

10.2.3. PAREXEL International Corporation

10.2.3.1. Company Overview

10.2.3.2. Financial Performance

10.2.3.3. Service Benchmarking

10.2.3.4. Strategic Initiatives

10.2.4. Pharmaceutical Product Development, LLC (Thermo Fisher Scientific Inc.)

10.2.4.1. Company Overview

10.2.4.2. Financial Performance

10.2.4.3. Service Benchmarking

10.2.4.4. Strategic Initiatives

10.2.5. Charles River Laboratories International Inc.

10.2.5.1. Company Overview

10.2.5.2. Financial Performance

10.2.5.3. Service Benchmarking

10.2.5.4. Strategic Initiatives

10.2.6. ICON Plc

10.2.6.1. Company Overview

10.2.6.2. Financial Performance

10.2.6.3. Service Benchmarking

10.2.6.4. Strategic Initiatives

10.2.7. Wuxi AppTec Inc.

10.2.7.1. Company Overview

10.2.7.2. Financial Performance

10.2.7.3. Service Benchmarking

10.2.7.4. Strategic Initiatives

10.2.7.5. SGS SA

10.2.7.6. Company Overview

10.2.7.7. Financial Performance

10.2.7.8. Service Benchmarking

10.2.7.9. Strategic Initiatives

10.2.8. Syneos Health

10.2.8.1. Company Overview

10.2.8.2. Financial Performance

10.2.8.3. Service Benchmarking

10.2.8.4. Strategic Initiatives

10.2.9. Eli Lilly and Company

10.2.9.1. Company Overview

10.2.9.2. Financial Performance

10.2.9.3. Service Benchmarking

10.2.9.4. Strategic Initiatives

10.2.10. Novo Nordisk A/S

10.2.10.1. Company Overview

10.2.10.2. Financial Performance

10.2.10.3. Service Benchmarking

10.2.10.4. Strategic Initiatives

10.2.11. Clinipace (Caidya)

10.2.11.1. Company Overview

10.2.11.2. Financial Performance

10.2.11.3. Service Benchmarking

10.2.11.4. Strategic Initiatives

10.2.12. AstraZeneca

10.2.12.1. Company Overview

10.2.12.2. Financial Performance

10.2.12.3. Service Benchmarking

10.2.12.4. Strategic Initiatives

10.2.13. Pfizer Inc.

10.2.13.1. Company Overview

10.2.13.2. Financial Performance

10.2.13.3. Service Benchmarking

10.2.13.4. Strategic Initiatives

10.3. Heat Map Analysis/ Company Market Position Analysis

10.4. Estimated Company Market Share Analysis, 2022

10.5. List of Other Key Market Players

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 Global Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 4 Global Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 5 Global Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 6 Global Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 7 Global Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 8 Global Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 9 Global Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 10 Global Clinical Trials Market, by Region, 2018 - 2030 (USD Million)

Table 11 North America Clinical Trials Market, by Country, 2018 - 2030 (USD Million)

Table 12 North America Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 13 North America Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 14 North America Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 15 North America Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 16 North America Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 17 North America Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 18 North America Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 19 US Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 20 US Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 21 US Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 22 US Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 23 US Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 24 US Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 25 US Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 26 Canada Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 27 Canada Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 28 Canada Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 29 Canada Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 30 Canada Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 31 Canada Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 32 Canada Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 33 Europe Clinical Trials Market, by Country, 2018 - 2030 (USD Million)

Table 34 Europe Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 35 Europe Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 36 Europe Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 37 Europe Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 38 Europe Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 39 Europe Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 40 Europe Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 41 Germany Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 42 Germany Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 43 Germany Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 44 Germany Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 45 Germany Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 46 Germany Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 47 Germany Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 48 UK Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 49 UK Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 50 UK Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 51 UK Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 52 UK Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 53 UK Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 54 UK Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 55 France Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 56 France Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 57 France Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 58 France Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 59 France Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 60 France Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 61 France Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 62 Italy Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 63 Italy Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 64 Italy Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 65 Italy Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 66 Italy Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 67 Italy Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 68 Italy Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 69 Spain Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 70 Spain Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 71 Spain Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 72 Spain Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 73 Spain Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 74 Spain Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 75 Spain Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 76 Denmark Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 77 Denmark Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 78 Denmark Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 79 Denmark Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 80 Denmark Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 81 Denmark Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 82 Denmark Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 83 Sweden Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 84 Sweden Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 85 Sweden Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 86 Sweden Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 87 Sweden Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 88 Sweden Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 89 Sweden Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 90 Norway Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 91 Norway Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 92 Norway Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 93 Norway Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 94 Norway Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 95 Norway Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 96 Norway Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 97 Asia Pacific Clinical Trials Market, by Country, 2018 - 2030 (USD Million)

Table 98 Asia Pacific Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 99 Asia Pacific Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 100 Asia Pacific Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 101 Asia Pacific Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 102 Asia Pacific Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 103 Asia Pacific Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 104 Asia Pacific Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 105 China Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 106 China Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 107 China Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 108 China Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 109 China Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 110 China Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 111 China Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 112 Japan Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 113 Japan Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 114 Japan Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 115 Japan Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 116 Japan Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 117 Japan Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 118 Japan Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 119 India Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 120 India Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 121 India Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 122 India Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 123 India Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 124 India Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 125 India Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 126 South Korea Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 127 South Korea Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 128 South Korea Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 129 South Korea Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 130 South Korea Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 131 South Korea Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 132 South Korea Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 133 Australia Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 134 Australia Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 135 Australia Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 136 Australia Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 137 Australia Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 138 Australia Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 139 Australia Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 140 Thailand Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 141 Thailand Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 142 Thailand Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 143 Thailand Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 144 Thailand Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 145 Thailand Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 146 Thailand Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 147 Latin America Clinical Trials Market, by Country, 2018 - 2030 (USD Million)

Table 148 Latin America Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 149 Latin America Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 150 Latin America Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 151 Latin America Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 152 Latin America Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 153 Latin America Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 154 Latin America Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 155 Brazil Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 156 Brazil Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 157 Brazil Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 158 Brazil Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 159 Brazil Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 160 Brazil Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 161 Brazil Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 162 Mexico Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 163 Mexico Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 164 Mexico Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 165 Mexico Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 166 Mexico Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 167 Mexico Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 168 Mexico Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 169 Argentina Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 170 Argentina Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 171 Argentina Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 172 Argentina Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 173 Argentina Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 174 Argentina Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 175 Argentina Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 176 Middle East & Africa Clinical Trials Market, by Country, 2018 - 2030 (USD Million)

Table 177 Middle East & Africa Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 178 Middle East & Africa Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 179 Middle East & Africa Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 180 Middle East & Africa Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 181 Middle East & Africa Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 182 Middle East & Africa Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 183 Middle East & Africa Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 184 South Africa Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 185 South Africa Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 186 South Africa Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 187 South Africa Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 188 South Africa Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 189 South Africa Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 190 South Africa Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 191 Saudi Arabia Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 192 Saudi Arabia Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 193 Saudi Arabia Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 194 Saudi Arabia Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 195 Saudi Arabia Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 196 Saudi Arabia Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 197 Saudi Arabia Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 198 UAE Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 199 UAE Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 200 UAE Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 201 UAE Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 202 UAE Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 203 UAE Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 204 UAE Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 205 Kuwait Clinical Trials Market, by Phase, 2018 - 2030 (USD Million)

Table 206 Kuwait Clinical Trials Market, by Study Design, 2018 - 2030 (USD Million)

Table 207 Kuwait Clinical Trials Market, by Indication, 2018 - 2030 (USD Million)

Table 208 Kuwait Clinical Trials Market, Indication by Study Design, 2018 - 2030 (USD Million)

Table 209 Kuwait Clinical Trials Market, by Sponsor, 2018 - 2030 (USD Million)

Table 210 Kuwait Clinical Trials Market, by Service Type, 2018 - 2030 (USD Million)

Table 211 Kuwait Clinical Trials Market, by Service Provider, 2018 - 2030 (USD Million)

Table 212 Participant’s Overview

Table 213 Financial Performance

Table 214 Service Benchmarking

Table 215 Strategic Initiatives

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Clinical Trials Market, Market Segmentation

Fig. 7 Market Driver Relevance Analysis (Current & Future Impact)

Fig. 8 Market Restraint Relevance Analysis (Current & Future Impact)

Fig. 9 Market Challenge Relevance Analysis (Current & Future Impact)

Fig. 10 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 11 Porter’s Five Forces Analysis

Fig. 12 Regional Marketplace: Key Takeaways

Fig. 13 Global Clinical Trials Market, for Phase I, 2018 - 2030 (USD Million)

Fig. 14 Global Clinical Trials Market, for Phase II, 2018 - 2030 (USD Million)

Fig. 15 Global Clinical Trials Market, for Phase III, 2018 - 2030 (USD Million)

Fig. 16 Global Clinical Trials Market, for Phase IV, 2018 - 2030 (USD Million)

Fig. 17 Global Clinical Trials Market, for Interventional, 2018 - 2030 (USD Million)

Fig. 18 Global Clinical Trials Market, for Observational, 2018 - 2030 (USD Million)

Fig. 19 Global Clinical Trials Market, for Expanded Access, 2018 - 2030 (USD Million)

Fig. 20 Global Clinical Trials Market, for Autoimmune/Inflammation, 2018 - 2030 (USD Million)

Fig. 21 Global Clinical Trials Market, for Rheumatoid Arthritis, 2018 - 2030 (USD Million)

Fig. 22 Global Clinical Trials Market, for Multiple Sclerosis, 2018 - 2030 (USD Million)

Fig. 23 Global Clinical Trials Market, for Osteoarthritis, 2018 - 2030 (USD Million)

Fig. 24 Global Clinical Trials Market, for Irritable Bowel Syndrome (IBS), 2018 - 2030 (USD Million)

Fig. 25 Global Clinical Trials Market, for Others, 2018 - 2030 (USD Million)

Fig. 26 Global Clinical Trials Market, for Pain Management, 2018 - 2030 (USD Million)

Fig. 27 Global Clinical Trials Market, for Chronic Pain, 2018 - 2030 (USD Million)

Fig. 28 Global Clinical Trials Market, for Acute Pain, 2018 - 2030 (USD Million)

Fig. 29 Global Clinical Trials Market, for Oncology, 2018 - 2030 (USD Million)

Fig. 30 Global Clinical Trials Market, for Blood Cancer, 2018 - 2030 (USD Million)

Fig. 31 Global Clinical Trials Market, for Solid Tumors, 2018 - 2030 (USD Million)

Fig. 32 Global Clinical Trials Market, for Others, 2018 - 2030 (USD Million)

Fig. 33 Global Clinical Trials Market, for CNS Conditions, 2018 - 2030 (USD Million)

Fig. 34 Global Clinical Trials Market, for Epilepsy, 2018 - 2030 (USD Million)

Fig. 35 Global Clinical Trials Market, for Parkinson's Disease (PD), 2018 - 2030 (USD Million)

Fig. 36 Global Clinical Trials Market, for Huntington's Disease, 2018 - 2030 (USD Million)

Fig. 37 Global Clinical Trials Market, for Stroke, 2018 - 2030 (USD Million)

Fig. 38 Global Clinical Trials Market, for Traumatic Brain Injury (TBI), 2018 - 2030 (USD Million)

Fig. 39 Global Clinical Trials Market, for Amyotrophic Lateral Sclerosis (ALS), 2018 - 2030 (USD Million)

Fig. 40 Global Clinical Trials Market, for Muscle Regeneration, 2018 - 2030 (USD Million)

Fig. 41 Global Clinical Trials Market, for Others, 2018 - 2030 (USD Million)

Fig. 42 Global Clinical Trials Market, for Diabetes, 2018 - 2030 (USD Million)

Fig. 43 Global Clinical Trials Market, for Obesity, 2018 - 2030 (USD Million)

Fig. 44 Global Clinical Trials Market, for Cardiovascular, 2018 - 2030 (USD Million)

Fig. 45 Global Clinical Trials Market, for Others, 2018 - 2030 (USD Million)

Fig. 46 Global Clinical Trials Market, for Autoimmune/Inflammation Interventional, 2018 - 2030 (USD Million)

Fig. 47 Global Clinical Trials Market, for Autoimmune/Inflammation Observational, 2018 - 2030 (USD Million)

Fig. 48 Global Clinical Trials Market, for Autoimmune/Inflammation Expanded Access, 2018 - 2030 (USD Million)

Fig. 49 Global Clinical Trials Market, for Pain Management Interventional, 2018 - 2030 (USD Million)

Fig. 50 Global Clinical Trials Market, for Pain Management Observational, 2018 - 2030 (USD Million)

Fig. 51 Global Clinical Trials Market, for Pain Management Expanded Access, 2018 - 2030 (USD Million)

Fig. 52 Global Clinical Trials Market, for Oncology Interventional, 2018 - 2030 (USD Million)

Fig. 53 Global Clinical Trials Market, for Oncology Observational, 2018 - 2030 (USD Million)

Fig. 54 Global Clinical Trials Market, for Oncology Expanded Access, 2018 - 2030 (USD Million)

Fig. 55 Global Clinical Trials Market, for CNS Conditions Interventional, 2018 - 2030 (USD Million)

Fig. 56 Global Clinical Trials Market, for CNS Conditions Observational, 2018 - 2030 (USD Million)

Fig. 57 Global Clinical Trials Market, for CNS Conditions Expanded Access, 2018 - 2030 (USD Million)

Fig. 58 Global Clinical Trials Market, for Diabetes Interventional, 2018 - 2030 (USD Million)

Fig. 59 Global Clinical Trials Market, for Diabetes Observational, 2018 - 2030 (USD Million)

Fig. 60 Global Clinical Trials Market, for Diabetes Expanded Access, 2018 - 2030 (USD Million)

Fig. 61 Global Clinical Trials Market, for Obesity Interventional, 2018 - 2030 (USD Million)

Fig. 62 Global Clinical Trials Market, for Obesity Observational, 2018 - 2030 (USD Million)

Fig. 63 Global Clinical Trials Market, for Obesity Expanded Access, 2018 - 2030 (USD Million)

Fig. 64 Global Clinical Trials Market, for Cardiovascular Interventional, 2018 - 2030 (USD Million)

Fig. 65 Global Clinical Trials Market, for Cardiovascular Observational, 2018 - 2030 (USD Million)

Fig. 66 Global Clinical Trials Market, for Cardiovascular Expanded Access, 2018 - 2030 (USD Million)

Fig. 67 Global Clinical Trials Market, for Other Indications Interventional, 2018 - 2030 (USD Million)

Fig. 68 Global Clinical Trials Market, for Other Indications Observational, 2018 - 2030 (USD Million)

Fig. 69 Global Clinical Trials Market, for Other Indications Expanded Access, 2018 - 2030 (USD Million)

Fig. 70 Global Clinical Trials Market, for Pharmaceutical & Biopharmaceutical Companies, 2018 - 2030 (USD Million)

Fig. 71 Global Clinical Trials Market, for Medical Device Companies, 2018 - 2030 (USD Million)

Fig. 72 Global Clinical Trials Market, for Others, 2018 - 2030 (USD Million)

Fig. 73 Global Clinical Trials Market, for Regulatory Affairs, 2018 - 2030 (USD Million)

Fig. 74 Global Clinical Trials Market, for Site Identification, Selection and Management, 2018 - 2030 (USD Million)

Fig. 75 Global Clinical Trials Market, for Drug Logistics, 2018 - 2030 (USD Million)

Fig. 76 Global Clinical Trials Market, for Laboratory Services, 2018 - 2030 (USD Million)

Fig. 77 Global Clinical Trials Market, for Patient Recruitment and Retention, 2018 - 2030 (USD Million)

Fig. 78 Global Clinical Trials Market, for Data Management, 2018 - 2030 (USD Million)

Fig. 79 Global Clinical Trials Market, for Others, 2018 - 2030 (USD Million)

Fig. 80 Global Clinical Trials Market, for In-House, 2018 - 2030 (USD Million)

Fig. 81 Global Clinical Trials Market, for Outsourcing, 2018 - 2030 (USD Million)

Fig. 82 Regional Outlook, 2021 & 2030

Fig. 83 North America Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 84 U.S. Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 85 Canada Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 86 Europe Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 87 Germany Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 88 UK Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 89 France Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 90 Italy Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 91 Spain Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 92 Denmark Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 93 Sweden Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 94 Norway Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 95 Asia Pacific Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 96 Japan Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 97 China Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 98 India Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 99 Australia Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 100 South Korea Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 101 Thailand Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 102 Latin America Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 103 Brazil Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 104 Mexico Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 105 Argentina Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 106 Middle East and Africa Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 107 South Africa Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 108 Saudi Arabia Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 109 UAE Clinical Trials Market, 2018 - 2030 (USD Million)

Fig. 110 Kuwait Clinical Trials Market, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Clinical Trials Phase Outlook (Revenue, USD Million, 2018 - 2030)

- Phase I

- Phase II

- Phase III

- Phase IV

- Clinical Trials Study Design Outlook (Revenue, USD Million, 2018 - 2030)

- Interventional

- Observational

- Expanded Access

- Clinical Trials Indication Outlook (Revenue, USD Million, 2018 - 2030)

- Autoimmune/Inflammation

- Interventional

- Observational

- Expanded Access

- Pain Management

- Interventional

- Observational

- Expanded Access

- Oncology

- Interventional

- Observational

- Expanded Access

- CNS Conditions

- Interventional

- Observational

- Expanded Access

- Diabetes

- Interventional

- Observational

- Expanded Access

- Obesity

- Interventional

- Observational

- Expanded Access

- Cardiovascular

- Interventional

- Observational

- Expanded Access

- Others

- Interventional

- Observational

- Expanded Access

- Autoimmune/Inflammation

- Clinical Trials Indication By Study Design Outlook (Revenue, USD Million, 2018 - 2030)

- Autoimmune/Inflammation

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Chronic Pain

- Acute Pain

- Oncology

- Blood Cancer

- Solid Tumors

- Others

- CNS Conditions

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

- Autoimmune/Inflammation

- Clinical Trials Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

- Clinical Trials Service Type Outlook (Revenue, USD Million, 2018 - 2030)

- Regulatory Affairs

- Site Identification, Selection and Management

- Drug Logistics

- Laboratory Services

- Patient Recruitment and Retention

- Data Management

- Others

- Clinical Trials Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Clinical Trials Phase Outlook (Revenue, USD Million, 2018 - 2030)

- Phase I

- Phase II

- Phase III

- Phase IV

- Clinical Trials Study Design Outlook (Revenue, USD Million, 2018 - 2030)

- Interventional

- Observational

- Expanded Access

- Clinical Trials Indication By Study Design Outlook (Revenue, USD Million, 2018 - 2030)

- Autoimmune/Inflammation

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Chronic Pain

- Acute Pain

- Oncology

- Blood Cancer

- Solid Tumors

- Others

- CNS Conditions

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

- Autoimmune/Inflammation

- Clinical Trials Indication Outlook (Revenue, USD Million, 2018 - 2030)

- Autoimmune/Inflammation

- Interventional

- Observational

- Expanded Access

- Pain Management

- Interventional

- Observational

- Expanded Access

- Oncology

- Interventional

- Observational

- Expanded Access

- CNS Conditions

- Interventional

- Observational

- Expanded Access

- Diabetes

- Interventional

- Observational

- Expanded Access

- Obesity

- Interventional

- Observational

- Expanded Access

- Cardiovascular

- Interventional

- Observational

- Expanded Access

- Others

- Interventional

- Observational

- Expanded Access

- Autoimmune/Inflammation

- Clinical Trials Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

- Clinical Trials Service Type Outlook (Revenue, USD Million, 2018 - 2030)

- Regulatory Affairs

- Site Identification, Selection and Management

- Drug Logistics

- Laboratory Services

- Patient Recruitment and Retention

- Data Management

- Others

- Clinical Trials Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

- In-house

- Outsourcing

- U.S.

- Clinical Trials Phase Outlook (Revenue, USD Million, 2018 - 2030)

- Phase I

- Phase II

- Phase III

- Phase IV

- Clinical Trials Study Design Outlook (Revenue, USD Million, 2018 - 2030)

- Interventional

- Observational

- Expanded Access

- Clinical Trials Indication By Study Design Outlook (Revenue, USD Million, 2018 - 2030)

- Autoimmune/Inflammation

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Chronic Pain

- Acute Pain

- Oncology

- Blood Cancer

- Solid Tumors

- Others

- CNS Conditions

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

- Autoimmune/Inflammation

- Clinical Trials Indication Outlook (Revenue, USD Million, 2018 - 2030)

- Autoimmune/Inflammation

- Interventional

- Observational

- Expanded Access

- Pain Management

- Interventional

- Observational

- Expanded Access

- Oncology

- Interventional

- Observational

- Expanded Access

- CNS Conditions

- Interventional

- Observational

- Expanded Access

- Diabetes

- Interventional

- Observational

- Expanded Access

- Obesity

- Interventional

- Observational

- Expanded Access

- Cardiovascular

- Interventional

- Observational

- Expanded Access

- Others

- Interventional

- Observational

- Expanded Access

- Autoimmune/Inflammation

- Clinical Trials Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

- Clinical Trials Service Type Outlook (Revenue, USD Million, 2018 - 2030)

- Regulatory Affairs

- Site Identification, Selection and Management

- Drug Logistics

- Laboratory Services

- Patient Recruitment and Retention

- Data Management

- Others

- Clinical Trials Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

- In-house

- Outsourcing

- Clinical Trials Phase Outlook (Revenue, USD Million, 2018 - 2030)

- Canada

- Clinical Trials Phase Outlook (Revenue, USD Million, 2018 - 2030)

- Phase I

- Phase II

- Phase III

- Phase IV

- Clinical Trials Study Design Outlook (Revenue, USD Million, 2018 - 2030)

- Interventional

- Observational

- Expanded Access

- Clinical Trials Indication By Study Design Outlook (Revenue, USD Million, 2018 - 2030)

- Autoimmune/Inflammation

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Chronic Pain

- Acute Pain

- Oncology

- Blood Cancer

- Solid Tumors

- Others

- CNS Conditions

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

- Autoimmune/Inflammation

- Clinical Trials Indication Outlook (Revenue, USD Million, 2018 - 2030)

- Autoimmune/Inflammation

- Interventional

- Observational

- Expanded Access

- Pain Management

- Interventional

- Observational

- Expanded Access

- Oncology

- Interventional

- Observational

- Expanded Access

- CNS Conditions

- Interventional

- Observational

- Expanded Access

- Diabetes

- Interventional

- Observational

- Expanded Access

- Obesity

- Interventional

- Observational

- Expanded Access

- Cardiovascular

- Interventional

- Observational

- Expanded Access

- Others

- Interventional

- Observational

- Expanded Access

- Autoimmune/Inflammation

- Clinical Trials Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

- Clinical Trials Service Type Outlook (Revenue, USD Million, 2018 - 2030)

- Regulatory Affairs

- Site Identification, Selection and Management