- Home

- »

- Personal Care & Cosmetics

- »

-

Global Cosmetic Chemicals Market Size Report, 2020-2027GVR Report cover

![Cosmetic Chemicals Market Size, Share & Trends Report]()

Cosmetic Chemicals Market Size, Share & Trends Analysis Report By Product Type (Surfactants, Emollients & Moisturizers, Film-Formers), By Application (Skin Care, Hair Care, Makeup), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-790-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Bulk Chemicals

Report Overview

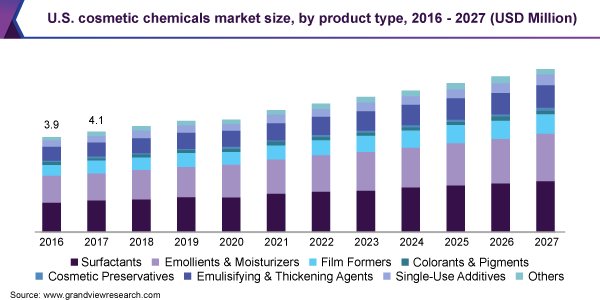

The global cosmetic chemicals market size was valued at USD 19.9 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2020 to 2027. Rising demand for cosmetic products formulated with natural ingredients coupled with consumer willingness to spend on premium products is driving demand for organic grade cosmetic chemicals.

Some of the commonly used ingredients in cosmetics include emulsifiers, preservatives, thickeners, moisturizers, colors, and fragrances. They can be developed synthetically or naturally. Synthetic chemicals are also derived from natural products such as petroleum or bio-based ingredients. However, these chemicals are manufactured using complex production process and derived reagents and catalysts, therefore are termed synthetic. Natural products include plant, mineral, animal, and microbial.

The industry is categorized by continuous research and development activities related to product innovation. Market players are focused on obtaining sustainable formulations made from natural ingredients that are free of artificial additives. Elevance Renewable Sciences, Inc., a specialty chemical manufacturer develops, and markets emollients formulated using its patented technology from plant based products for further use in skin lotions, cosmetics, and hair styling products.

Moreover, technological advances to manufacture active ingredients for cosmetic use are expected to disrupt the market for cosmetic chemicals in the coming years. For instance, Givaudan is using plant cell culture and phyto peptides technology to develop skin care products. Continuous R&D activities undertaken by industry players to develop sustainable products that meet consumer demands along with growing inclination towards natural and organic cosmetic products is expected to drive the market for cosmetic chemicals over the forecast period.

Product Type Insights

The emollients and moisturizer segment held a revenue share of approximately 30.0% in 2019 and emerged as the major segment in the market for cosmetic chemicals. Emollients soften the skin by preventing water loss. They are used in several personal care and cosmetics products such as body lotions, skin moisturizers, face creams, and lipsticks. These emollients are commercially sold in natural as well as synthetic forms. Some of the widely used emollients include olive oil, coconut oil beeswax, and lanolin, as well as petrolatum (petroleum jelly), glycerin, mineral oil, zinc oxide, diglycol laurate, and butyl stearate.

Preservatives constitute a major part of cosmetics products and are normally added to the formulations to extend their shelf life and prevent the growth of bacteria and fungi. The growth of these microorganisms can easily ruin the product and can be harmful to the application. As most of the microbes reside in water, the preservatives used should need to be water-soluble.

Preservatives in cosmetics vary in compositions and quantities. The preservatives used in the formulations can vary from around 0.01% to 5.0% depending upon the necessity of the product. Some of the commonly used preservatives include formaldehyde, parabens, salicylic acid, benzyl alcohol, and tetrasodium ethylenediaminetetra-acetic acid (EDTA).

Application Insights

The skin care products segment held a revenue share of 35.0% in 2019 and emerged as the major end use segment in 2019. This is owing to increasing demand for skin care products among individuals due to increasing concerns regarding healthy skin and skin care. Escalating demand for face creams, sunscreens, and body lotions across the globe is expected to have a positive impact on the market for cosmetic chemicals.

Key players in operating in the cosmetic chemicals market are now focused towards the development of advanced skin care products serving the consumer needs. Also, shifting consumer preference towards natural and organically derived products having natural ingredients among the manufacturers is driving the market for cosmetic chemicals. For instance, COBIOSA a specialty chemicals manufacturer develops and distributes chemicals for skin care formulations and other personal care and cosmetic products. The company primarily develops its chemicals from botanical including polyphenols,camelina, and marine, such as algae, collagen as well as insects.

Several cosmetics and personal care product manufacturers including Eminence and L’Oréal are now inclined towards producing naturally derived skin care products. The ability of natural ingredients to enhance and improve skin health without having any side effects is expected to be an advantageous factor for market growth in the coming years.

Growing concerns among the individuals regarding grey hair and hair fall coupled with evolving hair styling trends in the fashion industry are the primary factors driving the sale of hair care products market. Increasing stress and pollution is a major factor contributing to hair fall, discoloring, thinning, and dandruff among the youth and middle-aged population. This is further anticipated to boost the consumption of hair care products among them. The aforementioned factors are expected to contribute significantly to the market for cosmetic chemicals over the forecast period.

Increasing disposable income allows customers to spend more on luxury products, such as fragrances. The hygiene products segment is also expected to witness growth over the forecast period owing to the improved standards of living of among consumers. Increased spending by cosmetics product manufacturers on advertising and commercialization is also a key trend influencing the growth in consumer awareness and thus in the product demand.

Regional Insights

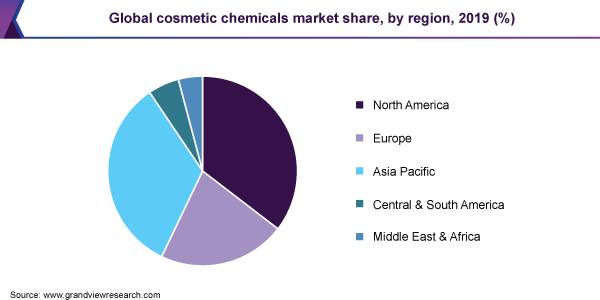

North America accounted for a revenue share of over 35.6% in the market for cosmetic chemicals in 2019. The demand for cosmetic chemicals in the region is majorly driven by their use for manufacturing organic personal care products. Increasing R&D investments by manufacturers coupled with associated technological innovations in the areas of ingredient processing and cost-effective production of organic personal care products have been the key factors responsible for driving the market for cosmetic chemicals in the region and the trend is expected to continue over the forecast period.

The presence of various small and large-scale producers and suppliers of the ingredients characterize the market for cosmetic chemicals in North America. Huntsman Corporation, Dow, and Stepan Company along with various other small and medium-scale companies are players operating in the market for cosmetic chemicals.

The U.S. is the largest market for cosmetic chemicals in the region. Manufacturers in the country are adopting an integrated approach towards health and beauty products rather than treating each as an individual category in personal care. As a result, they are becoming more receptive to innovations that link technological developments in health and biotechnology industry to the effectiveness of beauty products. Several industry players are focusing on increasing the cross-over of pharmaceutical, biotechnology, and food ingredient companies into the beauty market, resulting in the launch of technologically advanced ingredients.

Key Companies & Market Share Insights

Manufacturers in this region are also engaged in regular R&D activities, introducing new skin-care products containing a mixture of natural and organic ingredients, in an attempt to tap into new customer groups.E-commerce distribution is emerging as a tough competitor to direct sales for all mass and premium brands. Direct sales, however, continue to hold and grow in terms of market value. Customers across the globe have been looking for value-for-money products that are natural, organic, and beneficial for the skin and provide the benefits of high-priced premium products at a lower price. Some of the prominent players in the cosmetic chemicals market include:

-

Dow

-

Givaudan

-

Ashland Inc.

-

Eastman Chemical Company

-

Lonza Group

-

BASF SE

-

Lanxess

-

P&G Chemicals

-

Solvay S.A.

-

Evonik Industries AG

-

Bayer AG.

Cosmetic Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 20.3 billion

Revenue forecast in 2027

USD 29.2 billion

Growth Rate

CAGR of 4.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Dow; Givaudan; Ashland Inc.; Eastman Chemical Company; Lonza Group; BASF SE; Lanxess; P&G Chemicals; Solvay S.A.; Evonik Industries AG; Bayer AG.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global cosmetic chemicals market report on the basis of product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Surfactants

-

Anionic

-

Cationic

-

Non-ionic

-

Amphoteric

-

-

Emollients & Moisturizers

-

Amino Acids & Polypeptides

-

Esters & Fatty Acids

-

Hydrocarbons

-

Lanolin & derivatives

-

Polyol Sweeteners

-

Silicones

-

Triglycerides

-

Others

-

-

Film-Formers

-

Colorants & Pigments

-

Inorganic

-

Organic

-

-

Preservatives

-

Parabens

-

Esters

-

Formaldehyde Donors

-

Phenol Derivatives

-

Alcohols

-

Quaternary Compounds

-

Organic Acids

-

-

Emulsifying & Thickening Agents

-

Cellulose ethers

-

Hydrocolloids

-

Polyacrylates

-

Silicas and silicates

-

Others

-

-

Single-Use Additives

-

Conditioning polymers

-

Antidandruff agents

-

Antiperspirants and deodorants

-

UV ingredients

-

Anti-aging Ingredients

-

-

Others

-

-

Application Outlook (Revenue, USD Million; 2016 - 2027)

-

Skin Care

-

Hair Care

-

Makeup

-

Oral Care

-

Fragrances

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East& Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cosmetic chemicals market size was estimated at USD 19.9 billion in 2019 and is expected to reach USD 20.3 billion in 2020.

b. The global cosmetic chemicals market is expected to grow at a compound annual growth rate of 4.8% from 2019 to 2027 to reach USD 29.2 billion by 2027.

b. North America dominated the cosmetic chemicals market with a share of 35.5% in 2019. This is attributable to rising use of cosmetic chemicals in manufacturing organic personal care products.

b. Some key players operating in the cosmetic chemicals market include Dow, Givaudan, Ashland Inc, Eastman Chemical Company, Lonza Group, BASF SE, Lanxess, P&G Chemicals, Solvay S.A., Evonik Industries AG, and Bayer AG.

b. Key factors that are driving the market growth include increasing demand for cosmetic products formulated with natural ingredients coupled with consumer willingness to spend on premium products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."