- Home

- »

- Next Generation Technologies

- »

-

Disaster Recovery Solutions Market Size & Share, Industry Report 2025GVR Report cover

![Disaster Recovery Solutions Market Size, Share & Trends Report]()

Disaster Recovery Solutions Market Size, Share & Trends Analysis Report By Type (Backup & Recovery, Data Security, Replication), By Deployment, By End Use, By Enterprise Size, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-437-6

- Number of Pages: 135

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Technology

Industry Insights

The global disaster recovery solutions market size was valued at USD 1.69 billion in 2016 and is expected to gain significant traction over the forecast period. Increasing applications of cloud computing and growing awareness about the benefits offered by disaster recovery (DR) solutions are propelling the market. DR solutions offer benefits such as reduced costs, greater flexibility, reliability, faster recovery, and scalability of customers.

Rising investments in disruptive cloud technologies and an increase in instances of natural and manmade disasters are expected to drive the market over the forecast period. Cyberattacks such as WannaCry and Locky ransomware that occurred in the past few years have negatively influenced businesses across various sectors and most businesses were unable to recover from losses incurred during the disruption of business operations. Thus, demand for DR has increased significantly, especially among small and medium enterprises (SMEs).

Established ICT players are observed making considerable investments to expand their existing data center storage capabilities. Companies are extensively relying on virtual platforms to perform computing and this is promoting the adoption of virtual server infrastructure. Additionally, virtual infrastructure is considered to be more resilient and convenient to replicate.

Most organizations are seeking Disaster-as-a-Recovery Services (DRaaS), owing to the need for remote monitoring, protection, and centralized backup/recovery at relatively lower costs. They are also demanding DR plans that facilitate a considerable reduction in costs incurred due to site failures or downtime.

With increasing awareness about the advantages of DR solutions and the growing adoption of cloud-based solutions, small and medium enterprises are expected to increasingly implement DR plans in their business continuity strategies.

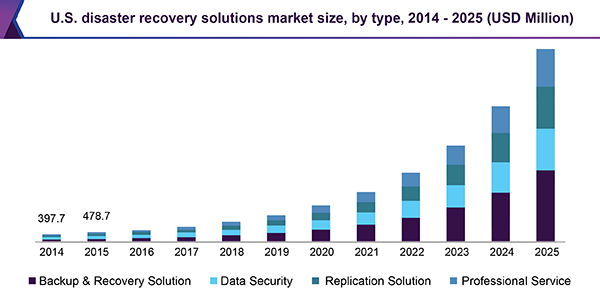

Type Insights

In 2016, the backup and recovery segment accounted for a significant market share and was valued at USD 457.5 million. The growth of the segment can be largely attributed to the cost advantages they offer and their increased demand in businesses with low IT budgets.

Organizations that do not rely on round-the-clock operational IT systems prefer these solutions for non-critical business systems. Moreover, backup and recovery solutions are scalable and can be automated, and are thus an apt choice for disaster recovery plans.

Managed services are expected to form the fastest-growing segment over the forecast period. The growth of the services can be attributed to additional features such as remote monitoring, low costs, and management of IT infrastructure through subscription-based pricing models.

Deployment Insights

Hybrid cloud dominated the market by deployment and was valued at USD 763.4 million in 2016. This can be primarily attributed to the fact that deployment of disaster recovery solutions through hybrid cloud enables users to utilize on-premise software and hardware appliances, along with recovery services in the cloud. It also allows users to use a combination of virtual cloud servers and dedicated hosting infrastructure. It further enables organizations to significantly reduce costs related to the installation of disaster recovery solutions.

Moreover, hybrid cloud deployment eliminates redundancy and enhances fault tolerance. It also offers flexible, reliable, scalable, and cost-effective architecture and facilitates backup and recovery of business data and applications on secondary infrastructure.

Enterprise Size Insights

The large enterprise segment dominated the disaster recovery solutions market and was valued at USD 1.02 billion in 2016. The growth of the segment can be attributed to the capability of large enterprises to make considerable IT investments in order to enhance and update their existing DR plans. Large enterprises generally have dispersed operations across the globe and possess massive amounts of critical business data. Thus, they are compelled to incorporate efficient DR plans into their business continuity strategies.

The small and medium enterprise segment is expected to witness higher adoption and register the highest CAGR of 37.9% from 2017 to 2025. SMEs are aware of the fact that tape backup and offsite disc backup are inadequate to safeguard important data. Moreover, decreasing costs of DR solutions, due to the availability of DRaaS, are enabling SMEs to implement DR plans at reduced costs.

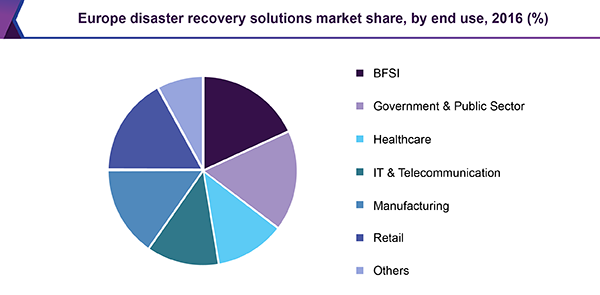

End-use Insights

In 2016, BFSI dominated the market by end use and was valued at USD 348.0 million. This growth can be attributed to increasing regularization by governments across the globe for ensuring appropriate implementation of disaster recovery solutions in business continuity strategies.

For instance, the Reserve Bank of India (RBI) mandated banks across the nation to ensure effective deployment of business continuity and disaster recovery strategies. The step was undertaken to make sure every bank operating in India was equipped with the required risk management strategy.

The government and public sector is expected to exhibit the highest CAGR of 41.9% over the forecast years. This can be attributed to the increasing need for government and public sector units to possess a certain level of disaster recovery capabilities to comply with set industry standards.

Regional Insights

North America acquired a significant market share and was valued at USD 728.0 million in 2016. This can be largely attributed to the presence of a large number of key industry players in the U.S. As a consequence, the region also possesses a technological edge over other regions.

Asia Pacific is anticipated to experience the fastest growth, registering a CAGR of 40.0% from 2017 to 2025. This growth can be attributed to accelerated IT investments in developing countries such as China and India. Developing countries in the region are observed promoting digitalization and are introducing various initiatives to develop IT infrastructure. Moreover, these nations are observed promoting the SME sector to improve their GDPs.

Disaster Recovery Solutions Market Share Insights

The industry is characterized by the presence of numerous market players, including established players with worldwide operations and regional/local players catering to a limited number of clients. Prominent players in the market include IBM Corporation, Unitrends, Sungard Availability Services, iland Internet Solutions, and Microsoft Corporation.

The presence of numerous players has resulted in increased competition and fragmentation of the market. Increased competition has compelled key industry players to undertake various strategic initiatives, such as partnerships and acquisitions, for new product development and improvement of their existing market position.

Companies such as Unitrends, IBM Corporation, and Microsoft Corporation are a few of the industry players who have collaborated with other vendors in the past few years. These partnerships usually covered technology sharing and new product development activities.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, U.K., Germany, India, Japan, China, and Brazil

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global disaster recovery solutions market report based on type, deployment, enterprise size, end use, and region:

-

Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Backup & Recovery

-

Data Security

-

Replication

-

Professional Service

-

Integration & Deployment

-

Managed Services

-

Others

-

-

-

Deployment Outlook (Revenue, USD Million, 2014 - 2025)

-

Hybrid Cloud

-

Public Cloud

-

Private Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2014 - 2025)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2025)

-

BFSI

-

Government & Public Sector

-

Healthcare

-

IT & Telecommunication

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

MEA

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."