- Home

- »

- Homecare & Decor

- »

-

Golf Club Market Size & Share, Industry Report, 2020-2027GVR Report cover

![Golf Club Market Size, Share & Trends Report]()

Golf Club Market Size, Share & Trends Analysis Report By Application (Leisure, Professional), By Distribution Channel (Sporting Goods Retailers, Online), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-809-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Consumer Goods

Report Overview

The global golf club market size was valued at USD 3.66 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 2.5% from 2020 to 2027. The market is majorly driven by the growing popularity and adoption of golf as an active sport. Moreover, premium resorts and hotels are incorporating sporting activities in their hospitality facilities, golf being one of them. Establishment of miniature golf courses to increase the inflow of patrons and endorsing it as a healthy leisure activity is contributing to the rising sales of golf clubs. According to a report by the National Golf Foundation (NGF), in 2015, the number of new golf players rose to about 2.5 million, nearly a 14.0% increase. This number was an all-time high, breaking the previous record of 2.4 million in 2000 when Tiger Woods was at the peak of his career. The number of golf enthusiasts has been growing significantly, which included people whose favorite sport or one of their many recreational pursuits was golf.

Most millennials consider golf a game for the elite, and hence it is still considered a very traditional and formal sport, which does not align with the millennial mindset. To keep the spirit of golf alive, it is the need of the hour to reintroduce this game as a game for all. With this basic approach in mind, the sports entertainment company Topgolf has made some millennial-friendly innovations and introduced a platform to attract numerous consumers by making golf more fun and engaging.

Young consumers prefer buying trendy equipment whereas the experienced ones only look for the technical specification of the equipment. For instance, the selection of the right clubs has always been important for taking the game to another level. Most professional players only look for the placement of the center of gravity and materials while purchasing any club. Material selection is also important. For instance, very heavy Tungsten material and extremely lightweight carbon fiber lead to new ways to manipulate the center of gravity placements.

Woods with higher numbers have a deeper club face angle and generate more loft. With advancements in product innovations, hybrid clubs are also favored by many consumers. A hybrid is a relatively newer type of club, designed with a mixture of fairway wood and iron. Several golfers prefer this over long irons since hybrids are easier to hit than their corresponding long irons.

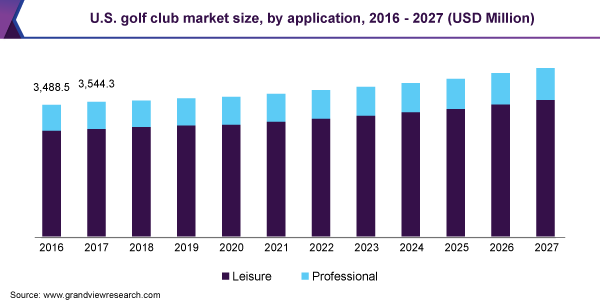

Application Insights

In terms of revenue, golf clubs used for leisure dominated the market with a share of 80.3% in 2019. This is attributed to the growing popularity of this sport due to the availability of golf courses in most cities and towns around the world. Golf tourism is gaining much traction among enthusiasts and a number of people travel to specific destinations for the sole purpose of playing golf. Scotland, for instance, is an excellent vacation spot that also offers golfers centuries-old courses and a sense of history playing on these ancient grounds. Development and expansion of golf courses, along with increasing government initiatives to promote golf tourism, have popularized this sport, thereby ramping up the demand for its associated equipment, such as golf equipment.

The professional application segment is expected to expand at a CAGR of 2.0% from 2020 to 2027. An increasing number of professional golfers, along with the rising interest of amateur golfers and the efforts taken by them to become professionals, is acting as a major factor driving the segment. According to a Golf Adviser article in 2019, in the U.S., the sport welcomed 2.6 million beginners in 2018, almost the same as the previous year, and a number that remains at or near an all-time measured high. There were 2.5 million junior golfers (aged 6-17) in 2017 and another 2.2 million in that age group who played exclusively off-course.

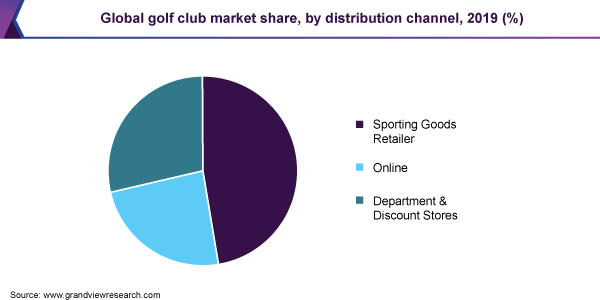

Distribution Channel Insights

In terms of revenue, sporting goods retailers dominated the market with a share of 47.2% in 2019. There has been increasing consumer preference for high-end golf clubs, which are generally sold at sporting goods retail stores. These stores offer a rich shopping experience and make it easier for consumers to understand the specifications and quality of golf clubs. These retail stores are usually located at the golf courses, thereby ensuring high visibility and generating maximum revenue. Moreover, discounts are often offered upon taking club membership, which further drives the purchase decision of consumers. In terms of brand preference, consumers have shown an increased preference for Callaway Golf, Titleist, Wilson, TaylorMade, and other trusted brands.

Online distribution channels are expected to emerge as the fastest-growing segment over the forecast period owing to the increasing popularity of e-commerce and dependence of Generation X, millennials, and Generation Z on the internet. Consumers prefer online portals and official websites to purchase premium golf clubs due to the availability of a wide range of products from a variety of manufacturers. In addition, numerous value-added services are provided by online retailers, such as cash on delivery, convenient return policies, and integrated and centralized customer services.

Regional Insights

North America dominated the market for golf clubs with a share of 45.3% in 2019. As per R&A, in North America, 77.0% of the golf facilities are open to fee-paying golfers on a per-round basis, unlike the scenario in private facilities and clubs. This, in turn, increases the number of participants, thereby increasing the scope of golf equipment, such as clubs, in the region. According to the National Golf Foundation, in 2018, 33.5 million Americans aged 6+ have played golf both on-course and off-course.

Asia Pacific is expected to register the fastest CAGR of 3.3% over the forecast period. Asia Pacific offers strong growth potential for golf clubs owing to rising golf-playing population and increasing disposable income of the middle-class population. The sales of golf equipment are mainly driven by the increasing number of golf tournaments and a growing number of participants. While the sport is more commonly played by men, the number of women golfers has increased over the past few years. As per the HSBC Golf Report, Asia holds the highest number of female golfers across the globe, wherein 6 out of the top 10 players hail from Asia.

Key Companies & Market Share Insights

The market is characterized by the presence of several well-established players. These players account for a significant market share and have diverse product portfolios and a strong presence across the globe. The market also comprises small to midsized players that offer a selected range of golf clubs and mostly serve regional customers. The impact of leading players on the market is rather high as a majority of them have vast distribution networks across the globe to reach out to their large customer base. Key players operating in the market are focusing on strategic initiatives, such as new product launches, acquisitions, and partnerships, in order to drive revenue growth and reinforce their position in the global market. Some of the prominent players in the golf club market include:

-

Callaway Golf Company

-

Acushnet Holdings Corp

-

PING

-

Sumitomo Rubber Industries, Ltd.

-

TAYLORMADE GOLF COMPANY, INC.

-

MIZUNO Corporation

-

Amer Sports

-

Bridgestone Corporation

-

Studio B

-

Ben Hogan Golf Equipment Company

Golf Club Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 3.7 billion

Revenue forecast in 2027

USD 4.45 billion

Growth Rate

CAGR of 2.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; U.K.; Germany; China; India; Brazil; South Africa

Key companies profiled

Callaway Golf Company; Acushnet Holdings Corp.; PING; Sumitomo Rubber Industries, Ltd.; TAYLORMADE GOLF COMPANY, INC.; MIZUNO Corporation; Amer Sports; Bridgestone Corporation; Studio B; Ben Hogan Golf Equipment Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global golf club market report on the basis of application, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Leisure

-

Professional

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Sporting Goods Retailers

-

Online

-

Department and Discount Stores

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The golf club market size was estimated at USD 3,658.6 million in 2019 and is expected to reach USD 3,684.2 million in 2020.

b. The golf club market is expected to grow at a compound annual growth rate of 2.5% from 2020 to 2027 to reach USD 4,447.9 million by 2027.

b. North America region dominated the golf club market with a share of 45.3% in 2019. This is attributable to the growing consumer interest in golf as a sport and a rise in the number of golf facilities.

b. Some key players operating in the golf club market include Callaway Golf Company; Acushnet Holdings Corp.; PING; and Sumitomo Rubber Industries, Ltd.

b. Key factors that are driving the market growth include the rising number of golfers and the growing trend of developing golf courses by hotels.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."