- Home

- »

- Next Generation Technologies

- »

-

Green Data Center Market Size, Share, Growth Report, 2030GVR Report cover

![Green Data Center Market Size, Share & Trends Report]()

Green Data Center Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Enterprise Size (Large, SMEs), By End-use (IT & Telecom, BFSI), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-115-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global green data center market size was estimated at USD 49.75 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 19.0% from 2023 to 2030. The growing focus on reducing carbon emissions, energy consumption, and other overall resource usage is boosting the growth of the market. Growing climate change awareness and the need for environmental sustainability have increased the demand for more enhanced energy-efficient and eco-friendly solutions around various applications, including data centers. The growing pressure from regulatory bodies and governments across countries is also driving the need for adopting energy-efficient solutions, leading to the growth of the market.

Many enterprises incorporate corporate social responsibility (CSR) and sustainability into their company strategies. Adopting green data centers enables businesses to stay aligned with these sustainability standards, thereby enhancing the overall business reputation. Green data centers frequently use renewable energy sources like solar, wind, and hydroelectric electricity to lessen their dependency on non-renewable fossil fuels. Energy-efficient solutions lead to significant cost savings for data center operators. By minimizing energy consumption, companies can reduce the overall operational expense.

Data centers use renewable energy sources like solar, wind, and hydroelectric. Moreover, some countries are developing local green data centers, as sovereignty and data privacy are becoming more critical leading to the rising need to follow sustainable practices. These countries are focused on storing data related to citizens within borders and maintaining control over it. Green data centers enable these countries to align with the regulatory requirements and minimize the security risks and environmental impact through advanced energy-efficient technologies. Henceforth, green data centers may be encouraged or required to be built in countries that aim to achieve their environmental objectives.

These data centers help the nation's sustainability initiatives while also addressing concerns about data sovereignty. International measures, such as the Paris Agreement, which is the global framework designed to prevent global warming, are being made to prevent climate change and cut carbon emissions. With efforts to keep the increase to 1.5 degrees Celsius, the Paris Agreement particularly aspires to keep global warming far below 2 degrees Celsius above pre-industrial levels. Compared to conventional data centers, green data centers can dramatically lower carbon emissions by using energy-efficient technologies and renewable energy sources.

The rising efforts undertaken by various countries around the world to lower overall emissions of greenhouse gases (GHG) support market growth. However, the high upfront investment required to build and design green data centers is anticipated to hamper the market's growth. The construction of such energy-efficient data centers needs to use advanced technologies and follow sustainable practices. Furthermore, converting an existing traditional data center into a green one involves a costly and complex process. Some businesses may find retrofitting less appealing because it necessitates meticulous planning and may result in downtime or operational delays, thereby hindering market growth.

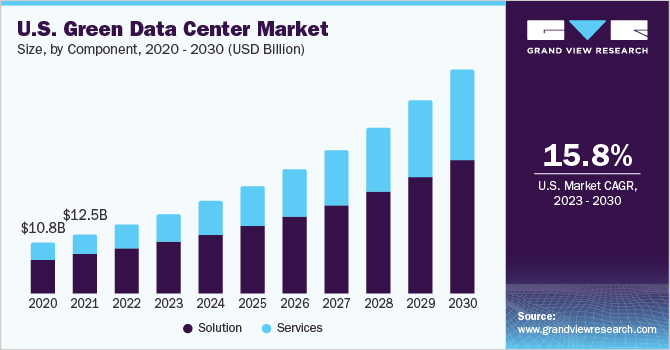

Component Insights

The solution segment held the highest revenue share of 64.82% in 2022. The green data center solutions comprise cooling systems, monitoring and management systems, power systems, network systems, and others. The growing demand for cooling systems is expected to fuel the segment demand, thereby enhancing market growth. These solutions are built and designed using more energy-efficient technology, which reduces operational costs over time. Many companies are analyzing the potential for substantial cost savings in maintenance and electricity expenses.

The service segment is expected to register the fastest CAGR of 21.4% over the forecast period. The growing need for installation & deployment, consulting, and support & maintenance services across industries is expected to fuel the segment growth. The growing consciousness for environmental sustainability, brand reputation, cost savings, and technological advancement has emerged with the need for green data center services across the globe. Organizations frequently need more internal knowledge to handle this complexity, forcing them to seek consulting services with specialized experience.

Enterprise Size Insights

The large enterprise segment held the highest revenue share of 73.17% in 2022. Large businesses consider corporate social responsibility (CSR) an essential strategy to align their operations with moral and ethical standards. Green data center adoption reflects a dedication to minimizing environmental effects and is consistent with the principles of ethical corporate conduct. A company's reputation as an environmentally responsible and progressive corporation is enhanced by operating green data centers. This favorable reputation might draw clients, associates, and financiers who value doing business with environmentally conscious organizations.

The small and medium enterprises (SMEs) segment is expected to register a CAGR of 21.7% from 2023 to 2030. The increasing need for green data centers in this segment is driven by several variables compatible with particular requirements and difficulties of SMEs. Although SMEs may have lower carbon footprints than large-scale enterprises, many are dedicated to reducing their environmental impact. Adopting green data centers helps them achieve their environmental objectives and exemplifies ethical corporate conduct.

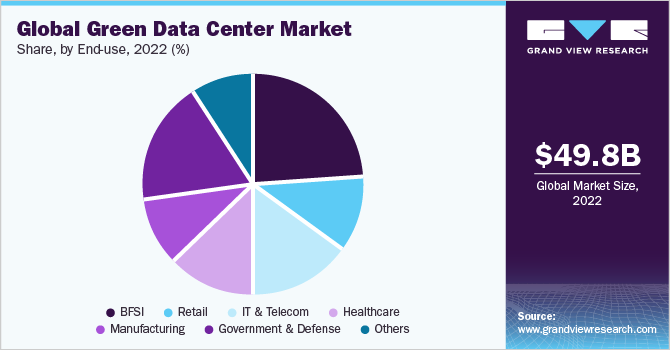

End-use Insights

The BFSI segment accounted for the largest revenue share of 24.47% in 2022. The high market share can be attributed to the growing adoption of green data centers in this sector due to specific regulatory pressures, industry dynamics, and focus on enhancing operational efficiency with environmental sustainability. Risk management is highly valued in the BFSI sector. Green data centers help reduce risks related to interruptions in the energy supply, security breaches, and compliance violations owing to the energy-efficient and resilient technology.

The IT & telecom segment is anticipated to grow at the fastest CAGR of 21.4% during the forecast period. The rapid growth of digital services, rising energy prices, and environmental consciousness drive the demand for green data centers in the IT and telecom sectors. With growing environmental concerns, IT and telecom firms know the need to reduce their carbon footprint. Data center demand is rising as cloud computing becomes more prevalent. The provision of energy-efficient infrastructure to serve cloud services is largely made possible by green data centers. Green data centers support sustainability objectives and reduce carbon emissions.

Regional Insights

North America held the largest market share of 38.42% in 2022. The regional growth can be attributed to the emergence of energy efficiency targets, regulatory demands, and the desire to support sustainability efforts. Rising green approaches across a variety of businesses in the region as a consequence of rising environmental consciousness also support the growth. Asia Pacific is expected to register the fastest CAGR of 22.2% over the forecast period. The growth of the Asia Pacific regional market can be attributed to rapid economic development, rising data traffic, environmental concerns, and rising support for international sustainability programs.

Some of the world's most populous nations and fastest-growing economies are located in the Asia Pacific region. With a rise in the electricity demand, there is an emphasis on maximizing energy usage and implementing green measures to control energy prices. Many countries in the Asia Pacific region are implementing more stringent regulations governing energy consumption and emissions. Green data centers assist businesses in adhering to these laws while avoiding penalties.

Key Companies & Market Share Insights

Intense competition among leading players for introducing advanced and innovative products is encouraging companies to invest in research and development of energy-efficient data centers. Furthermore, several end-users are adopting green data center solutions, making it easier for data centers to adopt green practices without compromising performance. Companies are adopting strategies to leverage new opportunities in the market and target new customers by developing sustainable products.

For instance, in February 2022, Fujitsu Ltd. led the advancement of energy-efficient photonics smart network interface cards (NIC) and CPUs to overcome the challenges of rising power consumption across data centers under the NEO program. This innovative solution for supporting next-generation green data centers enhances energy efficiency & capacity and decreases latency in data centers, contributing to a green society. Some of the prominent players in the global green data center market include:

-

ABB Ltd.

-

Asetek, Inc.

-

Delta Electronics, Inc.

-

Digital Realty Trust

-

Cisco Systems, Inc.

-

Dell Technologies, Inc.

-

Equinix, Inc.

-

Fujitsu Ltd.

-

General Electric

-

Hewlett Packard Enterprise Company

-

Huawei Technologies Co., Ltd.

-

Hitachi, Ltd.

-

International Business Machines Corporation

-

Schneider Electric

-

Siemens AG

Green Data Center Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 59.20 billion

Revenue Forecast in 2030

USD 200.46 billion

Growth rate

CAGR of 19.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Segments covered

Component, enterprise size, end-use, region

Key companies profiled

ABB Ltd.; Asetek, Inc.; Delta Electronics, Inc.; Digital Realty Trust; Cisco Systems, Inc.; Dell Technologies, Inc.; Equinix, Inc.; Fujitsu Ltd.; General Electric; Hewlett Packard Enterprise Company; Huawei Technologies Co., Ltd.; International Business Machines Corp.; Hitachi, Ltd.; Schneider Electric; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Data Center Market Segmentation

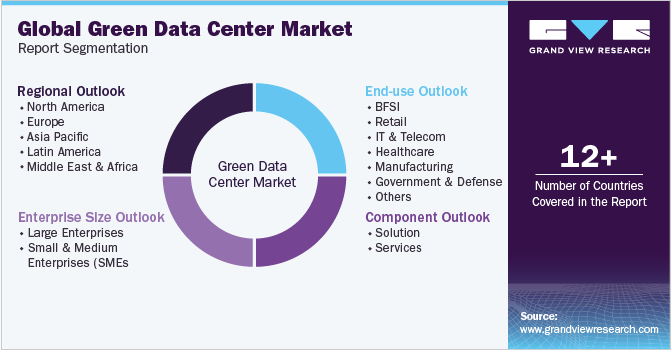

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the green data center market report on the basis of component, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Monitoring & Management System

-

Cooling System

-

Networking System

-

Power Systems

-

Others

-

-

Services

-

Installation & Deployment

-

Consulting

-

Support & Maintenance

-

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green data center market size was estimated at USD 49.75 billion in 2022 and is expected to reach USD 59.20 billion in 2023.

b. The global green data center market is expected to grow at a compound annual growth rate of 19.0% from 2023 to 2030 to reach USD 200.46 billion by 2030.

b. North America dominated the green data center market with a share of 38.4% in 2022. The regional growth can be attributed to the emergence of energy efficiency targets, regulatory demands, and the desire to support sustainability efforts. Green approaches are growing increasingly prevalent across a variety of businesses as a consequence of rising environmental consciousness.

b. Some key players operating in the green data center market include ABB Ltd., Delta Electronics, Inc., Digital Realty Trust, Cisco Systems, Inc., Dell Technologies, Inc., Equinix, Inc., Fujitsu Ltd., General Electric, Hewlett Packard Enterprise Company, International Business Machines Corporation, Huawei Technologies Co., Ltd., Hitachi, Ltd., Schneider Electric, Asetek, Inc., and Siemens AG

b. The growing focus on reducing carbon emissions, energy consumption, and other overall resource usage is boosting the growth of the global green data center market. Growing climate change awareness and the need for environmental sustainability have heightened the demand for more enhanced energy-efficient and nature-friendly solutions around various applications, including data centers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."