- Home

- »

- Plastics, Polymers & Resins

- »

-

Green Packaging Market Size, Share & Growth Report, 2030GVR Report cover

![Green Packaging Market Size, Share & Trends Report]()

Green Packaging Market Size, Share & Trends Analysis Report By Packaging Type (Recycled, Reusable, Degradable), By Application (Food & Beverages, Healthcare), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-052-1

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Green Packaging Market Size & Trends

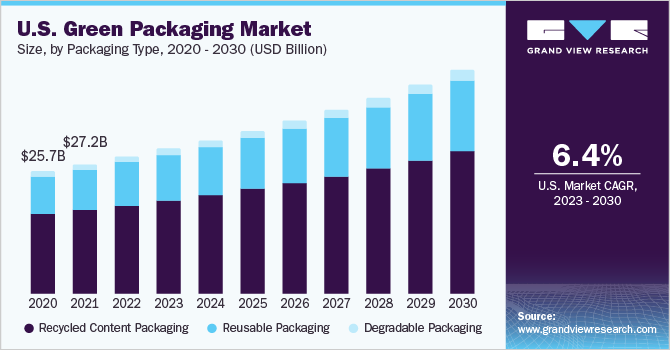

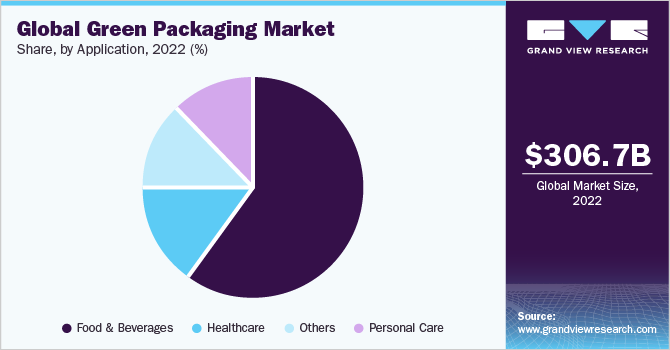

The global green packaging market size was estimated at USD 306.73 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. This is attributed to the rising consumer awareness regarding sustainable packaging solutions and stringent government regulations, such as banning single-use plastic packaging products. Green packaging solutions made from sustainable materials such as paper, plant-based materials, recycled materials, and other degradable materials reduce their carbon footprint throughout their lifecycle, from production to disposal.

The increased consumer awareness in the U.S. regarding the negative environmental impact of single-use plastic products has encouraged manufacturers and suppliers to adopt green packaging solutions as their preferred option. For instance, Returnity Innovations Inc., a U.S based packaging company, focuses on reducing plastic packaging waste in landfills by offering sustainable packaging solutions such as poly-mailer bags, garment bags, and other reusable packaging products.

In addition, the stringent U.S. government regulations and policies on plastic packaging solutions have led to a positive impact on the country’s green packaging market. For instance, the government has emphasized sustainable packaging to encourage producers and suppliers to adopt green packaging solutions, through initiatives such as Sustainable Packaging Coalition, an environmental organization in the U.S. promoting sustainable packaging practices and providing resources and guidance to companies looking to implement sustainable packaging solutions.

Moreover, various programs and initiatives on promoting green packaging solutions in the country are taking place. For instance, in September 2022, Green Seal, a U.S.-based non-profit organization, initiated a sustainable packaging solutions program, where they promote manufacturers and producers in commercial and household markets to adopt recycled content packaging to reduce plastic waste in landfills.

Packaging Type Insights

Based on type, the market for green packaging has been categorized into recycled content packaging, reusable packaging, and degradable packaging. Among these, recycled content packaging dominated with a market share of over 60.0% in 2022. Recycled content packaging is further segmented into paper, plastic, glass, metal, and others. Recycled plastics such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE) are the most used options in a wide range of packaging products such as pouches, bottles, and containers, owing to their cost effectiveness compared to other recycled materials.

The paper sub-segment under recycled content packaging type is expected to advance at a fast CAGR during the forecast period of 2023 to 2030. This growth is owing to its enhanced properties such as waterproofing through the use of coatings and laminates, making it more effective for a wider range of uses and applications.

Reusable packaging is further segmented into drums, plastic containers, and others made from durable materials that can be reused for a longer period. Reusable drums are used mainly for warehousing and shipment of industrial chemicals, food & beverage ingredients, healthcare products, and others. This packaging type eliminates the need for recycling or remanufacturing single-use packaging solutions that could add to landfill waste. Moreover, the reusable packaging solution consumes up to 64% lower energy than single-use plastic packaging items, which further drives segment demand.

Plastic containers are often lighter in weight and are more cost-effective than other materials, such as metal or glass. This makes them a popular choice for manufacturers that are looking for a sustainable cost-effective packaging solution that is still durable and effective, which further fuels the market growth for this segment.

Application Insights

Based on application, the green packaging market has been categorized into food & beverages, personal care, healthcare, and others. Among these, the food & beverages segment accounted for the largest market share of around 60.0% in 2022, owing to the rising popularity of sustainable packaging solutions such as compostable and molded pulp in fast food outlets, restaurants, frozen foods, dairy products, beverages, and pet food products.

For instance, Burger King, a renowned fast-food chain outlet, offers recycled products for the most used items by consumers such as forks, knives, spoons, French fries containers, and others. On the other hand, Starbucks Coffee Company offers recycled content reusable cups every holiday season with a unique theme, made with 50% recycled materials as a part of their sustainability initiative to reduce plastic waste.

The healthcare segment is expected to expand at a substantial CAGR during the forecast period, which is attributed to the increasing use of green packaging such as molded pulp packaging solutions, instead of traditional reusable utensils in hospitals and healthcare facilities, for more convenience. In addition, aluminum foil, which can be recycled, is used for the packaging of pharmaceutical oral drugs such as pills and capsules. The increased disposable sustainable packaging demand, driven by consumer concerns about hygiene during COVID-19, is contributing to the green packaging growth in the healthcare sector.

The personal care segment recorded a significant market share In 2022, owing to the wide application of recycled PET pouches, bottles, and containers for creams, body lotion, gel, and others. Moreover, personal care product manufacturers are increasingly recognizing the importance of sustainability to their brand reputation, as it helps convey the company's commitment to sustainability and social responsibility to consumers, which further drives the demand for this segment.

For instance, Olive Natural Skincare offers 100% recycled packaging for all its products and has achieved a zero-carbon certification. This shows its customers that the company is committed to sustainability and helps enhance its brand reputation.

Regional Insights

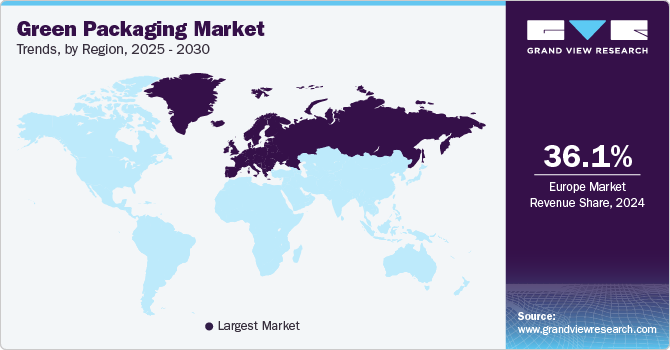

Europe accounted for the largest market share of over 36.0% in 2022 in the green packaging industry. This is due to the growing consumer awareness of the environmental impact of plastic packaging materials, as well as the increased demand for green packaging solutions in applications such as healthcare and food & beverage. The use of bioplastics made from renewable sources, such as sugarcane or corn starch, has also contributed to market growth by offering improved biodegradability and reduced carbon emissions in applications such as food packaging and shopping bags.

Germany led the European market in 2022, as it is a leading manufacturer and promoter of recycled packaging solutions. Several personal care product manufacturers & suppliers such as HCP Packaging have adopted green packaging owing to various government initiatives promoting sustainable packaging in the country. These include the Packaging Act, which requires organizations to take back and recycle their packaging waste, and the Green Dot system, which encourages the use of recyclable materials in production, manufacturing, and packaging. This helps drive the market demand for green packaging.

During the forecast period, the Asia Pacific region is anticipated to grow at the fastest CAGR due to the growth of the recyclable packaging market, particularly in the food and beverage sector to the market

Thegrowing awareness about the significance of circular economy principles in reducing waste and promoting sustainability is leading to greater investment in recycling infrastructure and the development of new materials and technologies in the Asia Pacific packaging sector. Moreover, the increasing demand for FMCG products in the region has led to a corresponding increase in the production of green packaging solutions to protect and transport these products.

This has resulted in the growing demand for sustainable packaging solutions that can meet the needs of the FMCG industry, while also reducing waste and environmental impact, which further contributes to the growth of green packaging demand. For instance, Nestlé offers reusable containers for its food & beverage products in Asian countries such as Japan and more than 80% of its plastic packaging solutions are recyclable to reduce plastic waste.

China is a major producer and consumer of green packaging owing to various government regulations and policies, such as Prevention and Control of Environmental Pollution by Solid Wastes, which restricts the disposal and dumping of solid wastes. In addition, several retailers are adopting green packaging solutions to meet the growing consumer demand for sustainable packaging and adhere to government policies. For instance, Alibaba, the e-commerce retailer, encourages its sellers to use sustainable packaging materials for their products and provides incentives, which drives market growth.

The market growth for green packaging in North America is attributed to the growing trend towards sustainable packaging innovation and design, such as lightweight and reusable packaging, which helps in reducing the environmental impact of packaging and saves costs for manufacturers. Moreover, the region is home to several key players in the green packaging industry such as Ball Corporation, DuPont, and Sealed Air, among others, which fuels the market growth in this region.

Initiatives by the Canadian government to reduce plastic waste by actively investing and supporting businesses in developing innovations in sustainable packaging are expected to drive the market for green packaging in the country. For instance, in March 2023, the government of Canada announced that it invested in three sustainable packaging manufacturers, including Friendlier, Omnia Packaging Inc., and Unified Flex Packaging Technologies, to meet the goal of zero-plastic waste in the country.

Key Companies & Market Share Insights

Key companies resort to strategies such as multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, companies build technological collaborations to produce an advanced product with superior performance characteristics to increase revenue. For instance, in February 2023, Sealed Air announced the acquisition of Liquibox, a sustainable liquid packaging manufacturer. With this acquisition, Sealed Air is expected to expand its product portfolio in the food & beverage application segment to meet the growing demand of consumers for sustainable packaging solutions.

Moreover, in September 2022, Sealed Air announced an expansion to its product portfolio by launching a new product range of protective packaging solutions containing more than 50% of recycled plastic, under its ‘BUBBLE WRAP’ brand. Some prominent players in the global green packaging market include:

-

Amcor plc

-

Be Green Packaging

-

DS Smith Plc

-

DuPont

-

Evergreen Packaging LLC

-

Mondi

-

Nampak Ltd.

-

Ball Corporation

-

Sealed Air

-

Tetra Laval

Green Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 324.83 billion

Revenue forecast in 2030

USD 503.43 billion

Growth Rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Packaging type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; Australia; Brazil; South Africa

Key companies profiled

Amcor; Be Green Packaging; DS Smith; DuPont; Evergreen Packaging; Mondi; Nampak; Ball Corporation; Sealed Air; Tetra Laval

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global green packaging market report based on packaging type, application, and region:

-

Packaging Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Recycled Content Packaging

-

Paper

-

Plastic

-

Metal

-

Glass

-

Others

-

-

Reusable Packaging

-

Drum

-

Plastic Container

-

Others

-

-

Degradable Packaging

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Personal Care

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green packaging market was valued at USD 306.73 billion in the year 2022 and is expected to reach USD 324.83 billion in 2023.

b. The global green packaging market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 503.43 billion by 2030.

b. The recycled content packaging segment accounted for the largest market share of over 60.0% owing to the wide application of paper, plastic, metal, glass, and other recycled contents in food & beverage, healthcare, and personal care industries.

b. The key market players in the Green Packaging market include Amcor; Be Green Packaging; DS Smith; DuPont; Evergreen Packaging; Mondi; Nampak; Ball Corporation; Sealed Air; Tetra Laval and others.

b. The increasing consumer awareness about the environmental impact of traditional packaging and stringent government regulations regarding single-use plastic packaging products ban are driving the demand for green packaging market

b. Plastics accounted for the largest market share in the green packaging market based on recycled type packaging material. The increasing use of recyclable plastics such as PET, PE, and PP in packaging of various end use industry products is expected to help positon the plastics share higher as compared to other materials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."