- Home

- »

- Smart Textiles

- »

-

Hand Protection Equipment Market Size, Share Report, 2030GVR Report cover

![Hand Protection Equipment Market Size, Share & Trends Report]()

Hand Protection Equipment Market Size, Share & Trends Analysis Report By Product (Disposable, Durable), By Raw Material (Nitrile, Vinyl), By End-use (Pharmaceuticals, Chemicals), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-379-9

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

The global hand protection equipment market size was estimated at USD 29.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030. The rising demand is attributed to the increasing concerns about hand hygiene and the product's efficiency in limiting the spread of COVID-19 in various end-use industries. The onset of the second wave of COVID-19 led to the shortage of hand protection equipment in hospitals and other sectors, such as manufacturing and construction. Various manufacturers started expanding their production at the end of 2020, thereby eliminating the demand-supply gap.

Economies that have been hit hard by the COVID-19 pandemic, such as the United States, have implemented specific regulations like the Defense Production Act (DPA), which provides local enterprises the duty of manufacturing hand protective equipment for healthcare professionals. Strict government regulations regarding the health and safety of doctors, nurses, and working professionals, coupled with a rise in COVID-19 cases, have prompted workers to use these products for protection against any kind of health hazards and healthcare-associated infections. Several government authorities, such as the Centers for Disease Control and Prevention, issued guidelines regarding the use of sterile barrier precautions, such as the use of hand protection equipment.

These gloves have excellent chemical and tear resistance, tactility, & flexibility, which makes them ideal for use in areas where there is direct contact with chemicals, microbes, and physiological fluids. The industry is an amalgamation of global and regional players having a broad portfolio of products, which restricts new players from entering the market. Amidst the pandemic, the U.S. government administration sustained the Defense Production Act (DFA) to increase the production of medical gloves and other such products to reduce their dependency on foreign countries.

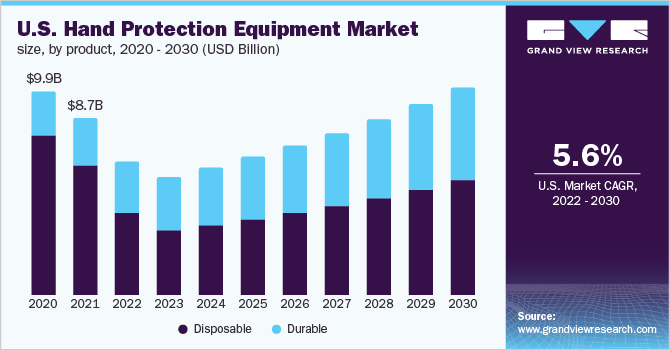

Product Insights

The disposable gloves product segment dominated the industry and accounted for the maximum share of more than 63.75% of global revenue in 2021. On the other hand, the durable gloves product segment is estimated to register the fastest CAGR during the forecast period. Durable gloves are mainly used in the construction and manufacturing industries to avoid injuries arising from burns, cuts, and hazardous chemicals. Durable gloves, which were formerly restricted to the industrial, construction, and healthcare industries, are now accessible to the general population, thereby propelling their demand. The disposable gloves segment is expected to witness a significant CAGR during the forecast period.

These gloves are mainly used in the food and healthcare industries for protection against the transmission of infection. The burst of COVID-19 cases has caused a rise in demand and a shortage in the supply of disposable gloves. The rising occurrence of healthcare-associated infections, such as COVID-19 and swine flu, coupled with increasing demand for disease control, drive the product demand. The lower costs of disposable gloves than durable gloves are anticipated to offer them a competitive advantage in short-duration industrial projects. The COVID-19 pandemic has surged the demand for gloves by almost three times. Although disposable gloves are widely used across various industries, it is prominently used in the healthcare & related industries. The demand for gloves has increased due to easier access to e-commerce platforms and high stocks in pharmacies.

End-use Insights

On the basis of end-uses, the global industry has been further categorized into construction, manufacturing, oil & gas, chemicals, food, pharmaceuticals, healthcare, transportation, mining, and others. The healthcare end-use segment dominated the industry in 2021 and accounted for the maximum share of 56.0% of the global revenue. Hand protection equipment is increasingly used in the healthcare industry. The pharmaceutical end-use segment is the second-largest end-use segment as employees working in the pharmaceutical industry face various on-the-job hazards as they come in contact with hazardous chemicals, solvents, and drugs.

These products protect workers from hazardous materials, chemicals, and aerosols. The construction segment is expected to witness a significant CAGR during the forecast period. The overhead costs related to industry fatalities and injuries increase the product demand across the globe. In addition, the rising number of activities in the construction sector, such as the renovation of roads, buildings, bridges, and others, also drives the industry. The food industry is largely dependent on hygiene and food quality, which leads to an increase in product demand in this industry.

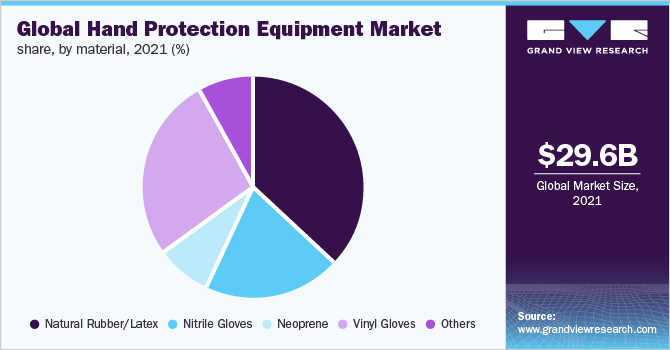

Raw Material Insights

The natural rubber segment dominated the industry in 2021 and accounted for more than 36.8% of the global revenue share. The demand for these products was relatively high as they are flexible and comfortable to wear and are ideal for handling sensitive applications, such as medical procedures and surgeries. Owing to the low cost of vinyl gloves, they have gained significant importance in the healthcare and medical sectors. Vinyl gloves are ideal for short-term applications. In comparison to natural rubber, vinyl rubber provides limited resistance and thus is not ideal for handling high-risk materials, but it offers high comfort and tactile sensitivity. Thus, vinyl gloves are in high demand where frequent change of gloves is required.

The demand for neoprene rubber is expected to advance at a considerable CAGR during the forecast period. Neoprene gloves are particularly used to handle wet materials, such as oils, caustics, acids, and other chemical materials, and are in high demand by dentists, physicians, & surgeons as they are more durable than nitrile gloves. Nitrile gloves are made of a synthetic material called nitrile rubber. Nitrile rubber is known for its high puncture resistance, excellent barrier protection, and durability, which leads to an increase in demand for these products. Disposable nitrile gloves are also often used by healthcare professionals to prevent contamination.

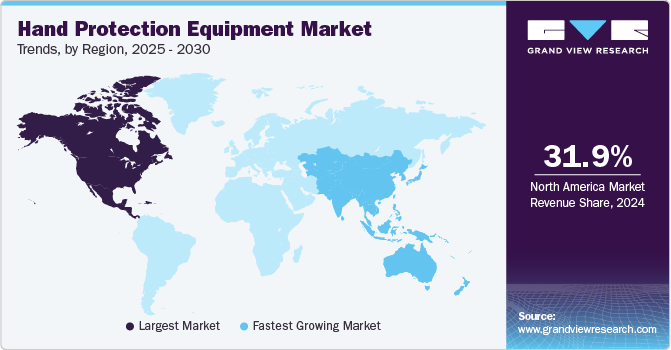

Regional Insights

A rising number of occupational injuries combined with increasing requirements for highly effective hand protection equipment in the majority of core industries, such as food & beverage, metal manufacturing, oil & gas, automotive, and chemical, is expected to boost the industry growth over the forecast period. North America dominated the global industry in 2021 and accounted for a 34.0% share of the overall revenue. The spread of COVID-19 in North America supported the regional market growth, owing to increasing healthcare expenditure, coupled with rising awareness pertaining to healthcare-acquired infections.

Furthermore, the up-gradation of the public healthcare system and infrastructure has a positive impact on the region’s growth. Asia Pacific is expected to witness the fastest CAGR during the forecast period owing to the rapid spread of coronavirus and increased public-private partnerships in the healthcare industry. In addition, growing concerns regarding hygiene across the healthcare industry are expected to have a positive impact on the market growth. The increasing workforce, strict government regulations, and strict labor laws in CSA, coupled with expansion in the healthcare institutions, are expected to drive the industry. Stringent restrictions on medical drug research and workplace conditions in the healthcare and pharmaceutical industries are anticipated to drive the industry's growth.

Key Companies & Market Share Insights

Major players are undertaking strategies, such as product development and distribution, and network expansion, to gain a higher share in the industry. For instance, in August 2020, Ansell Ltd. signed a distribution partnership with OneMed, a provider of medical supplies and support systems, with an existing distribution network in the Nordics. Manufacturers have also started expanding their businesses through mergers, acquisitions, and geographical expansions. For instance, in December 2021, Top Glove Corp. Bhd. announced expanding its production capacity to meet the global demand for gloves through strengthening its presence in key strategic markets, technological improvements to drive product innovation & production efficiency, as well as broadening its product portfolio to adjacent & other non-glove products. Some prominent players in the global hand protection equipment market include:

-

Top Glove Corp. Bhd.

-

Hartalega Holdings Berhad

-

Superior Gloves

-

Adenna LLC

-

MCR Safety

-

Atlantic Safety Products, Inc.

-

Ammex Corp.

-

Kimberly-Clark Corp.

-

Sempermed USA, Inc.

-

Halyard Health, Inc.

Hand Protection Equipment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 23.8 billion

Revenue forecast in 2030

USD 37.8 billion

Growth rate

CAGR of 5.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, raw material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; Russia; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Top Glove Corp. Bhd.; Hartalega Holdings; Superior Glove; Adenna LLC; MCR Safety.; Atlantic Safety Products; Ammex Corp.; KCWW; Sempermed USA, Inc.; Halyard Health, Inc.; Medline Industries, LP; Cardinal Health; Kossan Rubber Industries Bhd; Globus (Shetland) Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hand Protection Equipment Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global hand protection equipment market report on the basis of product, raw material, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Disposable

-

Durable

-

-

Raw Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Natural Rubber/Latex

-

Nitrile Gloves

-

Neoprene

-

Vinyl Gloves

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hand protection market size was estimated at USD 29.6 billion in 2021 and is expected to be USD 23.8 billion in 2022

b. The hand protection market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.9 % from 2022 to 2030 to reach USD 37.8 billion by 2030

b. North America dominated the hand protection market with a revenue share of 34.0% in 2021. Stringent guidelines regarding occupational health and safety regulations lead to increased demand for hand protection.

b. Some of the key players operating in the hand protection market include Top Glove Corporation Bhd; Hartalega Holdings; Superior Glove; Adenna LLC; MCR Safety.; Atlantic Safety Products; Ammex Corporation; KCWW, Sempermed USA, Inc., Halyard Health, Inc., Medline Industries, LP., Cardinal Health, Kossan Rubber Industries Bhd, Globus (Shetland) Ltd

b. The key factors that are driving the hand protection equipment market include raising awareness among industry participants regarding the importance of worker security and safety at workplaces, stringent regulations, rising manufacturing & chemical industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."