- Home

- »

- Healthcare IT

- »

-

Healthcare Cloud Infrastructure Market Size Report, 2030GVR Report cover

![Healthcare Cloud Infrastructure Market Size, Share & Trends Report]()

Healthcare Cloud Infrastructure Market Size, Share & Trends Analysis Report By Component (Hardware, Services), By End-use (Healthcare Providers, Healthcare Payers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-812-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global healthcare cloud infrastructure market size was valued at USD 56.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.7% from 2023 to 2030. The growing trend of digitalization of healthcare, the integration of advanced AI/ML algorithms, cloud deployment of healthcare systems, rising expenditure, inefficient facility management, and overburdened systems are creating a surge in demand for healthcare cloud infrastructure. Care facilities would be able to integrate and streamline their workflows, drive their operational and functional outcomes, enhance data management and security, and deliver optimum care. It is anticipated to boost the adoption and demand for these cloud infrastructure systems and bolster market growth.

The market for healthcare cloud infrastructure increased by 9.7% from 2019 to 2020. The market is estimated to witness a y-o-y growth of approximately 16.7% to 17.5% in the next 5 years. The pandemic positively impacted the demand for advanced cloud infrastructure and solutions due to the rise in the implementation of these systems across several organizations. The Covid-19 pandemic has upended how businesses function and has overburdened back-end support services and increased traffic on networks.

Resilient and scalable IT computing solutions are paving the path to meet the growing demand for these advanced technologies. The pandemic led to remote working and relying on virtual digital events, which significantly increased the demand for cloud infrastructure implementation. Clinical providers are rapidly adjusting to adopt these advanced solutions. Furthermore, the implementation of these systems and solutions allows organizations to drastically cut down on their IT spending and focus on seamlessly remote working.

The increasing access of the healthcare industry to advanced technological solutions and the rise in the adoption of cloud computing to reduce costs and improve flexibility, storage, and scalability are expected to fuel the market growth. The growing IT infrastructure in developed countries is one of the key factors driving the demand. Care facilities are burdened with the growing patient population and volume of patient information and demand real-time data access and integration of data. The potential of the healthcare IT industry is attracting public and private investments, which are expected to positively impact market growth.

In the last quarter of 2017, the University of Pittsburgh Medical Center (UPMC) announced an investment of USD 2 billion to digitally transform all their hospitals, especially UPMC Vision & Rehabilitation Hospital, UPMC Hillman Cancer Hospital, and UPMC Heart and Transplant Hospital. Organizations are using cloud-deployed data dashboards to deliver real-time data visualizations and analytics for enhanced data management. For example, The Australian Department of Health initiated the Coronavirus Australia App in March 2020, utilizing Google Cloud to convey real-time information about virus spread trends, lockdowns and regulations, and Covid-19 specific healthcare details.

The rising demand for cost-effective healthcare services, growing demand for technological solutions, increasing need for high information mobility, growing government initiatives and incentives, and growing funding to implement hospital cloud computing technologies in care facilities are expected to drive the market. Cybercrimes and privacy threats are some of the main concerns restraining the market growth. Cloud infrastructure has been forming the base for recent advancements in the field of telemedicine, digital medical libraries, and management information systems.

The ongoing Covid-19 pandemic has only reassured the need for advanced computing technologies to adhere to successful digital transformations. Furthermore, the adoption of these advanced systems allows organizations to improve cost optimization and leverage these systems to efficiently handle rising network traffic, enhance resource management, and mitigate risks. Organizations are adopting the hybrid cloud model strategy to integrate operations and functions across multiple clouds. A growing need to adopt secure and scalable IT infrastructure in healthcare organizations to manage and maintain patient data.

Business organizations are rapidly implementing advanced computing systems and solutions to digitally transform their businesses, streamline their workflow, and reduce the burden on networks. The market is fragmented and some of the key players providing these solutions are IBM, Microsoft, Oracle, Salesforce, and Amazon. Companies are entering technological collaborations to expand and co-develop innovative products and solutions. In January 2022, IBM agreed to sell its Watson Health data and assets to an investment firm, Francisco Partners, which could have been a part of an effort to expedite IBM's operations while also focusing the company on cloud computing.

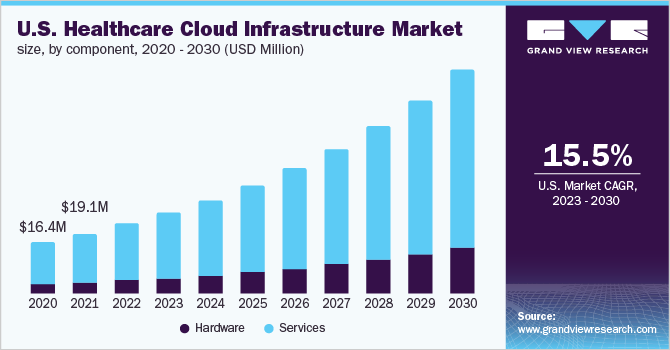

Component Insights

The services segment dominated the market with 79.2% share in 2022. Many organizations have a scarcity to occupy with the necessary resources and skillsets to implement enhanced computing services and solutions. Moreover, outsourced IT services are readily available for short-term project-based as well as long-term deals. These services are mainly of three types: software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS). Further, due to the increasing implementation of the system in the hospital, clinical, and community settings, Software-as-a-Service (SaaS) dominated the market in 2021 with a revenue share of over 55.0%.

The services included in the SaaS model range from web-based email to inventory control to database processing. The Platform-as-a-Service (PaaS) model is expected to register the fastest growth rate over the forthcoming years since it offers enhanced control and customization of apps developed by providers and additionally minimizes costs and ownership concerns, which are usually associated with Infrastructure-as-a-Service (IaaS).

Hardware segment is anticipated to grow at a fastest CAGR of 17.1%. The segment is growing due to a higher demand for hardware platforms with powerful computational power to run cloud infrastructure and systems. Moreover, all electronic devices but also human-machine interface devices, like computer systems and network assistant devices, are classified as hardware. The price of these devices, especially electronic devices, is expected to fall over the forecast period, which is anticipated to reduce the overall cost of healthcare cloud infrastructure implementation and thereby contribute to the growth in demand.

End-use Insights

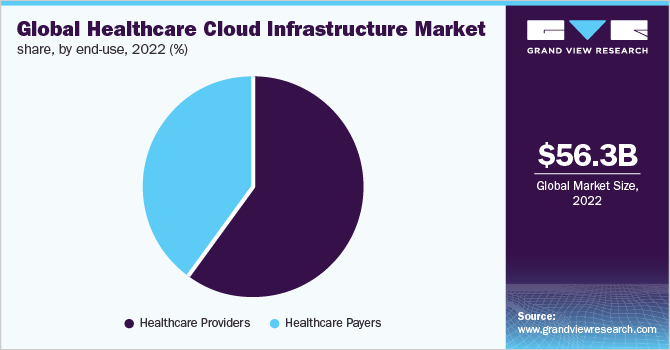

In 2021, the healthcare providers segment dominated the market and accounted for a revenue share of over 60.0%. This is due to a significant increase in hospital connections over cloud infrastructure, which impacted demand for the SaaS model. Some of the advantages of these systems include secure off-site data storage and management and the ease of outsourcing IT solutions and services, which eliminates the need for in-house IT personnel. Scalability, flexibility, and enhanced data management provided by advanced computing systems and solutions and constant technological advancements in this space are expected to propel the segment growth in the near future.

The Healthcare Providers segment dominated the market with 60.1% share in 2022. Healthcare payers comprise insurance companies, health plans sponsor (employers and unions), and third-party payers. Payers are rapidly adopting cloud computing solutions for secure data collection and storage, settlement of insurance claims, risk assessment, and fraud prevention. Management of high-risk patient populations and high utilization has always been a challenge for payers. Payers are adopting these advanced technological systems and solutions to minimize rising healthcare expenses. Furthermore, cloud computing helps payers expand their business, improve services, enhance quality, and reduce administrative costs.

Regional Insights

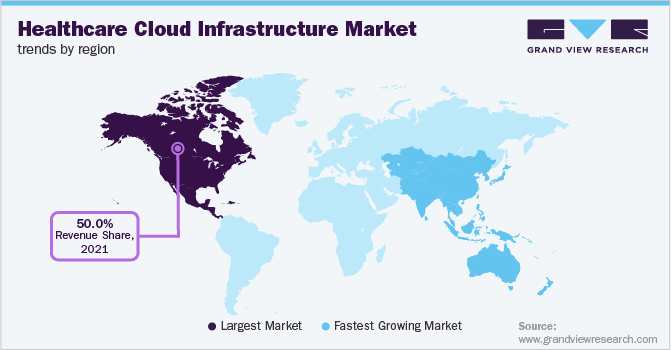

North America dominated the market and held a revenue share of over 50.0% in 2021. This is attributed to the rapidly rising care expenditure and growing advancements in the IT infrastructure. The market is composed of some of the major market players developing healthcare cloud infrastructure products and solutions and providing installation and training facilities, which is expected to contribute significantly to the regional market growth. To streamline their workflows, eliminate data siloes, and drive their operational, clinical, and financial outcomes, care facilities in North America are adopting cloud infrastructure products and services.

In the Asia Pacific, the market is anticipated to register the fastest growth rate during the forecast period owing to the surge in several innovative start-ups specializing in healthcare cloud infrastructure products and services. Furthermore, the developing healthcare IT infrastructure and the rise in adoption of advanced technological solutions by care facilities to enhance their workflow management and effectively serve the growing patient population are expected to propel the growth of the market in the Asia Pacific. The growing IT industry is showing tremendous potential and attracting public and private investors. It is expected to accelerate the future development of the industry.

Key Companies & Market Share Insights

The key players are constantly focusing on innovating and developing advanced products and solutions and providing services such as pre-implementation and user training. Key players are devising their technological collaboration strategies to expand their offerings and cater to larger clientele in developing nations. For instance, in February 2022, Lyniate obtained SAP SE with the objective of bringing technology and management consulting expertise to clients in order to help them adopt a hybrid cloud framework and move mission-critical workflow from SAP solutions towards the cloud for regulated as well as non-regulated businesses. In February 2022, IBM procured Neudesic, LLC with the objective of increasing IBM's portfolio of hybrid multi-cloud services and furthering the firm's hybrid cloud and AI strategy. Some prominent players in the global healthcare cloud infrastructure market include:

-

Dell, Inc.

-

Hewlett Packard Enterprise Development LP

-

Microsoft

-

Oracle

-

IBM

-

Salesforce

-

Amazon

Healthcare Cloud Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 65.7 billion

Revenue forecast in 2030

USD 193.4 billion

Growth Rate

CAGR of 16.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; Japan; India; Australia; Singapore; Thailand Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Dell, Inc.; Hewlett Packard Enterprise Development LP; Microsoft; Oracle; IBM; Salesforce; Amazon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Cloud Infrastructure Market Report Segmentation

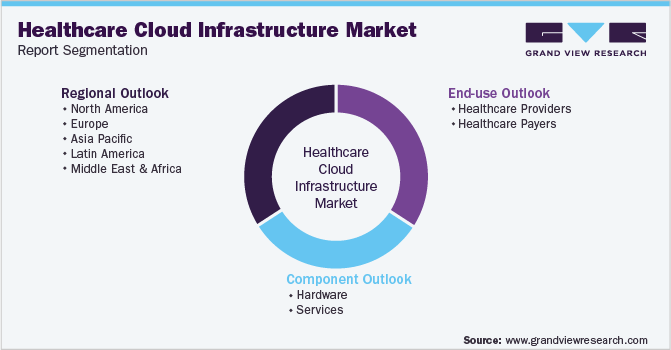

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global healthcare cloud infrastructure market report on the basis of component, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Server

-

Storage

-

Network

-

-

Service

-

Software-as-a-service (SaaS)

-

Infrastructure-as-a-service (IaaS)

-

Platform-as-a-service (PaaS) Payers

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Hospitals

-

Diagnostic & Imaging Centers

-

Ambulatory Centers

-

-

Healthcare Payers

-

Private Payers

-

Public Payers

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Russia

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global healthcare cloud infrastructure market size was estimated at USD 56.3 billion in 2022 and is expected to reach USD 65.7 billion in 2023.

b. The global healthcare cloud infrastructure market is expected to grow at a compound annual growth rate of 16.7% from 2023 to 2030 to reach USD 193.4 billion by 2030.

b. The services segment held the largest revenue share of over 79.2% in 2022.

b. Some key players operating in the healthcare cloud infrastructure market include Dell Inc; Microsoft; Oracle; IBM; and Salesforce

b. Key factors that are driving the healthcare cloud infrastructure market growth include the growing trend of digitalization of healthcare and the integration of advanced AI/ML algorithms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."