- Home

- »

- Healthcare IT

- »

-

Healthcare Contract Management Software Market Report, 2028GVR Report cover

![Healthcare Contract Management Software Market Size, Share & Trends Report]()

Healthcare Contract Management Software Market Size, Share & Trends Analysis Report By Component (Software, Services), By Pricing Model (Subscription Based), By Deployment, By End-use, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-324-9

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

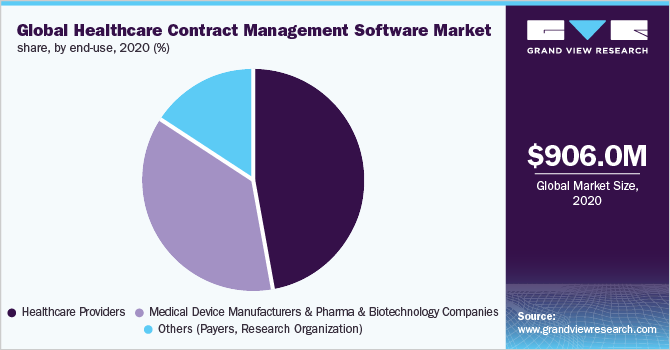

The global healthcare contract management software market size was valued at USD 906.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 22.8% from 2021 to 2028. The notable growth of the market is attributed to the growing adoption of cloud computing in healthcare and the high demand for remote working in the COVID-19 pandemic. The growing need to streamline the organization's work process and administrative tasks in the healthcare industry and the rising need to reduce healthcare expenditure while adhering to regulatory requirements are key drivers for this market. In addition, increasing complexity in organization contracts and the need to increase the operational efficiency of healthcare organizations are further boosting the adoption.

The Covid-19 pandemic accelerated the existing demand for healthcare contract management software owing to the associated benefits with its use, such as application scalability, operational efficiencies, and supportiveness to work from home culture. Moreover, it offers cost reduction and profitability to the organization. The demand for contract management solutions witnessed high growth during the coronavirus outbreak.

Market players witnessed strong growth in 2020. For instance, Contract Logix, LLC, a CLM software and services provider, reported a 682% surge in contracts executed through e-signatures in 2020. The company also reported a 367% rise in converted contract requests and a 112% increase in contracts and documents created in Contract Logix’s software. The company attributed the exponential growth to trends such as supply chain dynamics, remote workforces, change management, and the growing need for mitigating risk.

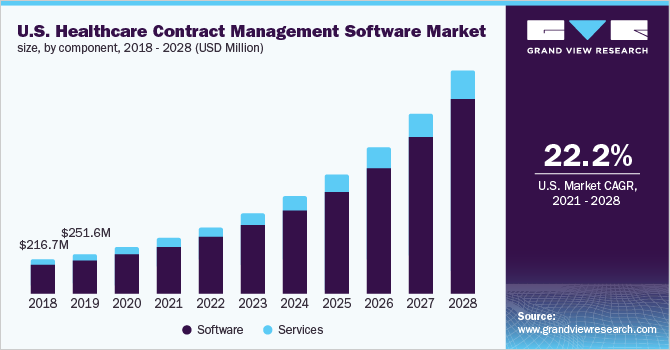

Component Insights

The software segment accounted for the largest revenue share of over 85.0% in 2020. The adoption of software is rising in the healthcare industry as the software helps patients with efficient compliance, streamlines contract lifecycle processes, and maintains complex contract documents in the repository. Contract Lifecycle Management (CLM) software emerged as a reliable and viable solution to manage the surge in contracts of doctors, sanitation workers, lab technicians, nurses, student-doctors, and more during the COVID-19 pandemic. The pandemic thus became a key driver that catalyzed the adoption of contract lifecycle management software solutions, and this trend is expected to continue.

A CLM software provides features such as centralized document repository, e-signatures, tracking, analytics, contract templates, and AI and machine learning. These are used by healthcare organizations, hospitals, providers, and companies to manage end-to-end contract lifecycles. For instance, CobbleStone Software offers two custom solutions of its Contract Insight CLM- for the healthcare industry and pharma and life sciences industry. Moreover, strategic collaborations and partnerships, along with product innovation, have augmented market growth. For instance, in November 2019, B. Braun Company implemented Apttus CLM to speed up procurement processes across its global enterprise.

Healthcare contract management services include implementation, on-boarding or training, data extraction and migration, consultation/advisory services, content management, risk and performance management, and post-sale customer support. The growing adoption of healthcare contract management software, the lack of skilled IT personnel, and the need to reduce labor costs by outsourcing services are anticipated to fuel the segment growth.

Pricing Model Insights

In 2020, the subscription-based pricing model dominated the market with a share of over 70.0% owing to the increased adoption of cloud-based healthcare contract management software. As a high percentage of vendors offer subscription-based pricing for cloud-based solutions, the adoption of these software has increased, which is expected to propel the segment growth over the forecast period. For instance, ContractWorks by SecureDocs offers its platform at three different pricing levels- standard, professional, and enterprise, all billed annually and includes unlimited users. Implementation is provided at no extra cost while data migration services are chargeable and provided in partnership with Cenza.

One-time purchase and pay as you go make up the others segment. Pay as you go and licensed software enables customers to pick a pricing model best suited to their consumption and needs. Additional payments, extensions, or upgrades to data storage or scalability are paid on an as-needed basis. Pay as you go and one-time purchase models have low barriers to entry with better cost-per-use and no long-term commitment. These benefits are anticipated to fuel the demand in the coming years.

Deployment Insights

Cloud-based contract software dominated the market with a share of over 78.0% in 2020. This type of deployment is safe and secure as compared to the on-premise system. These solutions gained traction in recent years. The COVID-19 pandemic and the AI trend in healthcare have positively impacted the adoption of cloud-based systems in contract management and this is expected to continue over the coming years.

Many providers have begun offering cloud-first solutions with options to deploy on-premise or on an as-needed basis. As the vendors are in charge of the data security and control the entire system in the cloud-based CLM system, many vendors have obtained security certifications to show compliance and their commitment to protecting customer data. The degree of customization and integration is another aspect, which influences the adoption of cloud-based systems among the numerous vendors in the market.

End-use Insights

The healthcare providers segment held the dominant share of over 45.0% as of 2020 owing to the increased adoption of contract management solutions by hospitals, physicians, and clinics. The growing need to reduce operational costs while increasing operational efficiency and the need to comply with regulatory policies have led to the increased adoption of healthcare contract management systems by healthcare organizations and providers.

Pharmaceutical and biotech organizations use healthcare contract management systems to manage clinical trial agreements, vendors, distributor agreements, consultants, and HCP payments. The growing regulatory requirements and the need to comply with complex laws and policies are expected to drive this segment. For instance, ContractWorks partnered with Xeris, a pharmaceutical company, to deploy a contract management solution to tighten internal controls around contract execution, track contract milestones, and easily report on contract data.

Regional Insights

North America held the largest share of over 42.0% in 2020. The growth is attributed to the favorable reimbursement policies and government regulations, such as Meaningful Use (MU) and the Health Insurance Portability & Accountability Act (HIPPA). MU facilitates the electronic exchange of patient information, submits claims electronically, and generates electronic records for patients and the HIPPA act focuses on ensuring privacy and security of health information, including information in electronic health records (EHR). The presence of strong regulatory requirements and demand for streamlining the process in this region are driving the market.

Asia Pacific is projected to grow at a lucrative rate over the forecast period. Increasing demand for outsourcing activities from this region, demand for a high level of data security, quick return on investment (ROI), and increasing demand for efficient tools to achieve operational goals are some of the factors contributing to this high demand. The migration of healthcare organizations towards digitization to streamline their complete workflow and ensure patient safety and care has resulted in an increased demand for contract management software in this region.

Key Companies & Market Share Insights

The market players are involved in strategic development activities, including new product launches, strategic collaborations, and regional expansion. For instance, in October 2018, Contract Logix introduced the Express Contract Management Software and Premium Contract Lifecycle Management at ACC annual meeting.

Icertis is one of the key market players that offers its Contract Intelligence (ICI) platform in combination with Icertis’ suite of applications to facilitate seamless contract collaboration between insurers, physician groups, and other stakeholders. The company deployed its platform at AbbVie pharmaceuticals and its subsidiaries to overhaul its procurement contracting process, improve supplier relations, and reduce contract cycle times by over 90%. Icertis has implemented its ICI solution for more than a dozen pharmaceutical and biotech companies. Some prominent players in the global healthcare contract management software market include:

-

Icertis

-

Conga

-

CobbleStone Software

-

Experian Information Solutions, Inc.

-

nThrive, Inc.

-

Concord Worldwide, Inc.

-

Coupa Software Inc.

-

Contract Logix, LLC

-

SecureDocs, Inc.

-

Ultria Inc.

-

PandaDoc Inc.

Healthcare Contract Management Software Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.09 billion

Revenue forecast in 2028

USD 4.59 billion

Growth rate

CAGR of 22.8% from 2021 to 2028

Base year for estimation

2020

Actual estimates/Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion& CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, pricing model, deployment, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Icertis; Conga; CobbleStone Software; Experian Information Solutions, Inc.; nThrive, Inc.; Concord Worldwide, Inc.; Coupa Software Inc.; Contract Logix, LLC; SecureDocs, Inc.; Ultria Inc.; PandaDoc Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this report, Grand View Research has segmented the global healthcare contract management software market report on the basis of component, pricing model, deployment, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2016 - 2028)

-

Software

-

Contract Lifecycle Management Software

-

Contract Document Management Software

-

-

Services

-

Support and Maintenance Services

-

Implementation and Integration Services

-

Training and Education Services

-

-

-

Pricing Model Outlook (Revenue, USD Million, 2016 - 2028)

-

Subscription Based

-

Others (One time purchase, Pay as you go)

-

-

Deployment Outlook (Revenue, USD Million, 2016 - 2028)

-

Cloud-Based

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Healthcare Providers

-

Medical Device Manufacturers and Pharma & Biotechnology Companies

-

Others (Payers, Research Organization)

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global healthcare contract management software market size was estimated at USD 906.0 million in 2020 and is expected to reach USD 1.09 billion in 2021.

b. The global healthcare contract management software market is expected to grow at a compound annual growth rate of 22.8% from 2021 to 2028 to reach USD 4.59 billion by 2028.

b. The subscription-based segment dominated the healthcare contract management software market with a share of 70.2% in 2020. This can be attributed to factors such as intuitive subscription pricing models offered by vendors and increased adoption of cloud-based healthcare contract management solutions.

b. Some key players operating in the healthcare contract management software market include Icertis; Conga; CobbleStone Software; Experian Information Solutions, Inc.; nThrive, Inc.; Concord Worldwide, Inc.; Coupa Software Inc.; Contract Logix, LLC; SecureDocs, Inc.; Ultria Inc.; and PandaDoc Inc.

b. Key factors driving the healthcare contract management software market growth include growing adoption of cloud computing, remote work, the need to minimize risk through better compliance, and demand for cost reduction & operational efficiency.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."