- Home

- »

- Healthcare IT

- »

-

Healthcare ERP Consulting Services Market Report, 2028GVR Report cover

![Healthcare ERP Consulting Services Market Size, Share & Trends Report]()

Healthcare ERP Consulting Services Market Size, Share & Trends Analysis Report By Functionality (Implementation, Training & Education), By End-use (Healthcare Providers, Life Science Companies), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-577-3

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

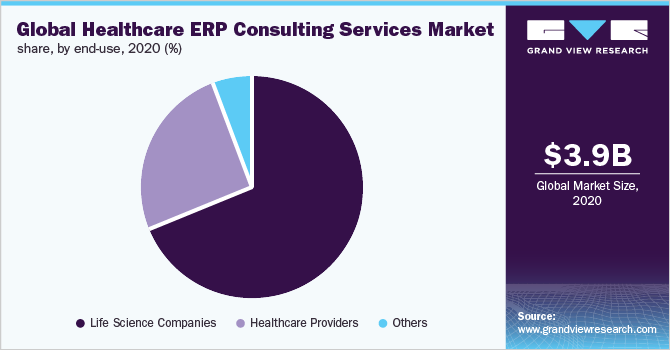

The global healthcare ERP consulting services market size was valued at USD 3.9 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of 9.2% from 2021 to 2028. Factors, such as rising healthcare expenditure, overburdened systems, labor shortage, inefficient hospital service management, and the rapidly increasing number of patients at facilities, are creating a demand for advanced technological business solutions. The adoption of these systems will allow healthcare facilities to integrate & streamline their workflows, enhance functional & operational outcomes, reduce expenses, eliminate data silos, and deliver premium-quality patient care, which is expected to drive the demand and adoption rate of these solutions, thereby augmenting the market growth.

The rising demand for advanced technological solutions among clinicians & healthcare professionals for delivering high-quality patient care, reducing operational costs, and eliminating data silos in back-end operations is driving the adoption of enterprise resource planning (ERP) solutions globally. A centralized patient database allows providers to seamlessly access the data from remote locations to enhance patient acquisition and management. In addition, the increasing dependency of organizations on consultancy services for gathering insights regarding the benefits offered by the platform, including positive Return-on-Investment (RoI), is anticipated to drive the market growth over the forecast period.

Businesses adopting and implementing ERP systems are integrating the data generated from manufacturing, inventories, supply chains, human resources, finances, and back-end operations, such as accounts management & payroll management. Life science companies have initiated the implementation of these software systems to improve their manufacturing, supply chain, and inventory management. The emergence of cloud-deployed systems coupled with developing IT infrastructure is driving the market growth for consultancy services. Numerous benefits associated with cloud-deployed solutions, such as minimum ownership cost, low capital requirement, limited in-house technical expertise, and flexible infrastructure, are driving businesses towards consulting services. These consultancy firms provide services, such as project management, prior implementation planning, and end-user training & education.

The ongoing COVID-19 pandemic exposed the overburdened global healthcare systems and their shortcomings. The pandemic burdened the labor force and disrupted manufacturing and supply chains. Increasing transition and adoption of remote accessibility and remote healthcare drove businesses to adopt advanced cloud technology services to streamline business workflows and improve financial, clinical, and operational outcomes. During the pandemic healthcare facilities witnessed the need to adopt ERP systems, which positively impacted the demand for consultancy services and strategic guidance for the same. In addition, life science companies began adopting ERP solutions for their businesses to integrate workflows and eliminate data silos.

Businesses are actively seeking consulting services and partners for the successful implementation of ERP systems for rapid RoIs. The organizations seek technical guidance, training, and aid in the management of changes in workflow. Consulting firms are selected based on the size and scope of the organization. Some of the large firms providing consulting services include KPMG, Accenture, Deloitte, PwC, and Huron. Smaller consultancy firms across the globe are Avaap, Bails, Impact Advisors, and ROI Healthcare Solutions, which are usually preferred by mid- and small-scale healthcare organizations.

COVID19 healthcare ERP consulting services market impact: 0.3% decrease in revenue growth from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The healthcare ERP consulting services market decreased by 0.3% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 3.0% to 9.5% in the next 5 years

The pandemic significantly impacted the demand for consultancy services due to the decline in implementation and training of ERP systems in healthcare organizations

The pandemic challenged the healthcare systems and unearthed the shortcomings of the sector. The growing demand for adopting digitally advanced technologies is driving the adoption of ERP systems and consultancy services. Through successful implementation and adequate training of the same will drive the growth of the market over the coming years.

The pandemic overburdened the normal functioning of healthcare systems, disrupted supply chains, and exposed shortfalls in workforce management

Through the implementation of ERP systems, organizations can integrate and automate their workflow under one database and access it remotely

Moreover, as healthcare organizations are shifting toward cloud technology, demand for cloud implementation, training, and change management consultants is gaining traction. Organizations are shifting toward intelligent ERP systems to automate functions and bridge business gaps.

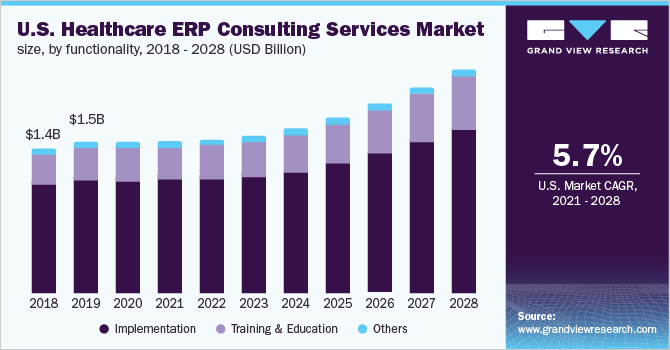

Functionality Insights

In 2020, the implementation segment accounted for the highest revenue share of 75.2%. The growing demand for consultancy services amongst businesses before implementing ERP systems to understand the complexity of the technological solutions estimate the size and scope of business, type of modules to be implemented, and number & type of work required by external resources are driving the segment growth. Post understanding their business requirements, organizations can decide their ERP implementation partner from a wide array of software vendors, staffing firms, or business transformation leadership firms. Every implementation partner has a different skill set to aid the organization in the implementation process. Some of the key implementation partners are Oracle, Premier Inc, Accenture, Deloitte, KPMG, PwC, and Atos SE.

On the other hand, the training and education segment is expected to record the fastest CAGR over the forecast period. The growing need for training & education, project management, and technical expertise to accustom to the change in business operation is contributing to the segment growth. The benefits associated with successful training and education include increased user adoption, maximized productivity, successful goal achievement, strengthened ownership, and reduced implementation risk. Some of the key training and education providers for ERP systems are Workday Inc, Accenture, Huron, PwC, and Avaap.

End-use Insights

In 2020, the life sciences companies segment dominated the market with a revenue share of 68.7% due to the rising adoption of ERP systems and solutions by life science companies to integrate and streamline workflows to enhance the accuracy and efficiency of business operations. Life science companies are constantly in need of advanced technological solutions to amalgamate their various functions, such as research & development, sales & marketing, human resources, legal & regulations, and finances & accounting functionalities, to improve operational and financial efficiency. The growing need for product quality improvement and enhancing the overall business performance is driving these organizations to adopt ERP systems, which, in turn, is contributing to the market growth.

On the other hand, the healthcare providers segment is anticipated to register the fastest CAGR over the forecast years owing to the rising adoption of ERP systems by hospitals and other healthcare facilities. A significant surge in adoption rates of these technological business solutions due to the associated application in patient care management, remote patient management, chronic care management, population health management, diseases surveillance, operational intelligence, financial management, and performance management. ERP systems enable healthcare facilities to improve overall workflow efficiency and reduce expenses, and therefore it is anticipated to register significant growth over the forecasted years.

Regional Insights

North America held the largest revenue share of more than 52.8% in 2020. The presence of major market players developing ERP systems and providing consultancy services is contributing to the regional market growth. Businesses are becoming aware of the necessities of adopting these advanced systems and the benefits associated with them, which include an overall improvement in clinical, operational, and financial outcomes. The emergence of the integration of Artificial Intelligence (AI) and cloud computing into ERP systems is also expected to propel market growth.

However, Asia Pacific is anticipated to register the fastest CAGR during the forecast period due to a rise in the number of startups specializing in AI-enabled advanced systems. Other factors driving the market include growing IT infrastructure, rising workforce shortage, ineffective health facilities’ service management, surging patient population, and high adoption of advanced technological solutions. The regional market is attracting numerous public and private investments due to the development and advancements in the economy and infrastructure.

Key Companies & Market Share Insights

These key players in addition to developing ERP systems also provide consultancy services, such as project management, pre-implementation planning, change management, and end-user training. Market players are focusing on entering technological collaborations to expand their scope and serve larger customer bases in emerging economies. For instance, In July 2021, Oracle launched new updates for Oracle ERP Cloud and Oracle Fusion Cloud Enterprise Performance Management (EPM). A few of the updates introduced are machine learning-enhanced intelligent performance management, enhanced financial reporting skills, improved risk management workflows & dashboards, and unified project planning & execution tools. Some of the prominent players in the healthcare ERP consulting services market are:

-

Accenture

-

Deloitte

-

PWC

-

KPMG

-

Cerner Corp.

-

Premier, Inc.

-

Workday, Inc.

-

Oracle

-

Atos SE

-

Avaap USA LLC

-

Infor

Healthcare ERP Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 4.0 billion

Revenue forecast in 2028

USD 7.4 billion

Growth rate

CAGR of 9.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Functionality, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Brazil; Mexico; South Africa; UAE

Key companies profiled

Deloitte; KPMG; PWC; Accenture; Oracle Corp.; Infor; Cerner Corp.; Premier Inc; Workday, Inc.; Atos SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the subsegments from 2016 to 2028. For the purpose of this study, Grand View Research, Inc. has segmented the global healthcare ERP consulting services market report on the basis of functionality, end-use, and region:

-

Functionality Outlook (Revenue, USD Million, 2016 - 2028)

-

Implementation

-

Training & Education

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2016 - 2028)

-

Life Science Companies

-

Healthcare Providers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

Europe

-

Germany

-

U.K.

-

France

-

Asia Pacific

-

Japan

-

China

-

India

-

Latin America

-

Brazil

-

Mexico

-

Middle East & Africa

-

South Africa

-

UAE

-

Frequently Asked Questions About This Report

b. The global healthcare ERP consulting services market size was estimated at USD 3.9 billion in 2020 and is expected to reach USD 4.0 billion in 2021.

b. The global healthcare ERP consulting services market is expected to grow at a compound annual growth rate of 9.2% from 2021 to 2028 to reach USD 7.4 billion by 2028.

b. North America dominated the healthcare ERP consulting services market with a share of 50.8% in 2020. This is attributable to developed healthcare infrastructure and positive attitude toward adoption of advanced technologies to streamline processes as well as enhance productivity & cost savings.

b. Some key players operating in the healthcare ERP consulting services market include Cerner Corporation; Infor; Oracle Corporation; Premier; Workday, Inc.; Accenture; Microsoft; Epicor Software Corporation; and others.

b. Key factors that are driving the healthcare ERP consulting services market growth include rising healthcare expenditure, ineffective hospital service management, increasing workforce shortage, growing influx of patients at various healthcare facilities, rising demand for advanced technological solutions among clinicians & healthcare professionals for delivering high-quality patient care, and eliminating data silos in back-end operations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."