- Home

- »

- Healthcare IT

- »

-

Healthcare ERP Market Size & Share Report, 2021-2028GVR Report cover

![Healthcare ERP Market Size, Share & Trends Report]()

Healthcare ERP Market Size, Share & Trends Analysis Report By Function (Finance And Billing, Inventory And Material Management), By Deployment (On-premises, Cloud), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-390-4

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

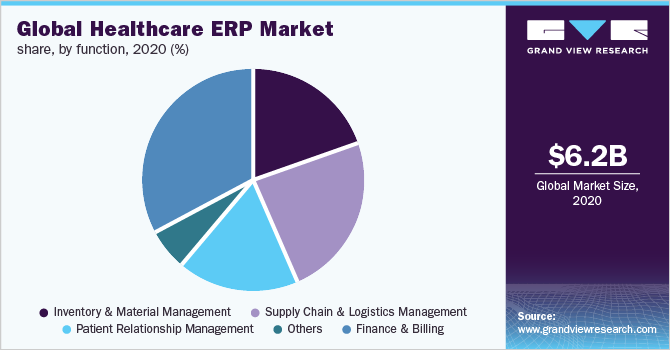

The global healthcare ERP market size was valued at USD 6.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2021 to 2028. Growing healthcare expenditure, ineffective hospital service management, rising workforce shortage, and rapidly growing patient population at healthcare facilities are motivating public and private stakeholders to innovate new modes of delivering healthcare. Clinicians are growing aware of the benefits associated with these advanced technological solutions, such as delivering high-quality patient care, reducing operational costs, and eliminating data siloes in back-end operations, which is expected to contribute to the growing demand for enterprise resource planning (ERP) solutions.

The growing adoption rate of ERP systems amongst small and medium businesses is contributing to the rising demand for these systems to reduce operational costs and enhance functional outcomes. Centralized patient data allows seamless access from remote locations to improve patient acquisition and patient management techniques. These systems allow businesses to amalgamate data generated from human resources, manufacturing and inventories, supply chain cycles, and finances & accounting, and optimize back-end processes such as payroll management, account management, and inventory management. Pharmacies and laboratories have begun adopting ERP systems for inventory management, point-of-sale profile, accounts, purchase, and selling.

Institutes and facilities are rapidly adopting cloud-deployed ERP systems due to multiple benefits associated with them, such as minimum ownership cost, agile and flexible infrastructure capacity, limited in-house technical expertise, low capital requirement, and consistent upgrades. Since on-premises systems require high capital expenditure and cost approximately between USD 50 million and USD 150 million, small and medium businesses are rapidly adopting cloud-deployed ERP systems. Cloud-based systems do not require upfront investment and are based on recurring fees.

COVID-19 healthcare ERP market impact: 3.9% increase in revenue growth from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The healthcare ERP market size increased by 3.9% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 5.7% to 6.8% in the next 5 years

The pandemic significantly supported the growth of the market, with numerous stakeholders focusing on increasing the degree of automation and digitalization in their business workflows

The existing healthcare systems are rapidly transitioning to remote working through the adoption of advanced digital technologies such as remote patient monitoring, electronic health records, and telehealth. To successfully achieve automation and digitalization in workflows, businesses are adopting ERP solutions to enhance their financial and operational outcomes

The pandemic burdened the workforce management, disrupted supply chains & manufacturing cycles, and exposed the shortcomings of mundane systems

ERP systems allowed businesses to streamline their workflow, manage production and inventory, and automation of manual tasks

The COVID-19 pandemic challenged the functioning of global healthcare systems. The pandemic burdened the workforce, exposed shortcomings in existing systems, and disrupted supply and demand cycles. With the increasing shift towards remote healthcare and remote working of employees, businesses are adopting cloud services to seamlessly access data, streamline workflow, automate inventory and supply chain management functions, and improve the financial and clinical outcomes of the industry. During the pandemic, many hospitals planned to go live with their ERP. For instance, the CentraCare healthcare system in the U.S. decided to go live with Oracle Cloud. The ERP solution strengthened CentraCare’s supply chain, which boosted the company’s position in managing the pandemic.

Vendors and developers are constantly focusing on integrating artificial intelligence algorithms into ERP systems for various applications such as customized patient engagement and data insights. According to an article published in Becker’s Hospital Review in 2019, 58% of software developers have already integrated or are integrating AI in their ERP software. The advantages of using AI-enabled ERP systems are advanced data processing capabilities and data analytics for improved decision making. Furthermore, these systems can be used in forecasting, warehouse management, sales and marketing automation, performance evaluation, and financial management. A few examples of AI-based ERPs are Infor Coleman, NetSuite Intelligent Cloud Suite, SAP S/4HANA Cloud, and Microsoft Dynamics AI.

Market players are constantly enhancing their technologies to deliver innovative products for the healthcare industry. In addition, the key players are focusing on mergers & acquisitions, technological collaborations, and product expansion strategies to propel the growth of the healthcare enterprise resource planning market. For instance, in January 2021, SAP and Microsoft announced their strategic alliance and plans to integrate SAP’s intelligent suite of software solutions with Microsoft Teams. In addition to their existing strategic alliance, the companies formalized an extensive expansion to accelerate the adoption of SAP S/4HANA on Microsoft Azure. Through this partnership, SAP is focusing on improving customer experience and expanding interoperability with Microsoft Azure.

Deployment Insights

In 2020, the on-premises deployment segment dominated the market with a revenue share of over 70.0% owing to numerous benefits such as minimum maintenance, low dependency on vendors, ease of access from remote locations, minimized costs, complete control over operations, security & privacy, and easy customization. On-premises deployment of software is generally known as “shrink-wrap” and includes installation of systems and solutions on computers available within the businesses. Although these solutions are installed on on-premises computers and servers, they can be accessed from remote locations, thereby reducing implementation cost and power consumption. However, the growth of cloud computing and its increasing adoption rates are expected to restrain the on-premises segment growth. In addition, the physical area cost and maintenance cost of server rooms are expected to hinder the on-premises segment growth.

The cloud deployment segment is anticipated to register the fastest growth rate over the forecast period. Cloud deployed software solutions are replacing on-premises installed software solutions. The growth of cloud computing and web-based applications, enhanced ease-of-access, and improved accessibility of the internet are driving the segment. Cloud-deployed software solutions do not require an upfront investment, and their operation on recurring fees is supporting the transition from on-premise deployed software to cloud-deployed software. In cloud-deployed software, the data is stored remotely and allows data retrieval as per the need of the user. Healthcare organizations are under significant pressure from consumers, employers, regulatory agencies, and governing boards for increasing cost-efficiency while maintaining the quality of care. Oracle Enterprise Resource Planning Cloud is being utilized by over 1,800 healthcare organizations for an efficient, collaborative, and intuitive back-office hub with rich operational and financial capabilities to support reducing costs and modernizing business practices to gain insights and improve productivity.

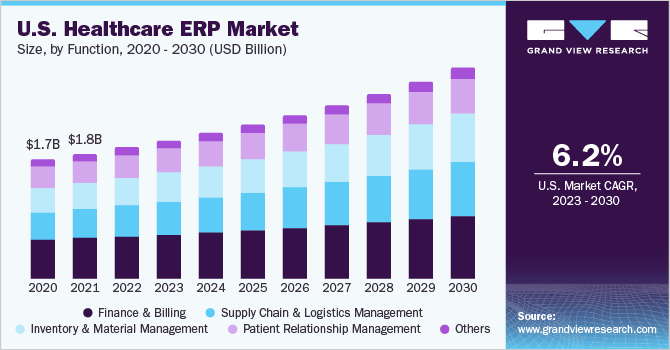

Function Insights

In 2020, the finance and billing segment accounted for the largest revenue share of over 30.0%. Healthcare organizations are rapidly adopting ERP systems to optimize processes and lower barriers between front-end revenue cycle management activities and back-end activities, such as claims management. Businesses are adopting these systems to eliminate financial data siloes, track profits, manage ledgers, manage fixed assets, risk management, multi-currency management, reporting, and tax management. ERP systems provide complete financial transparency, informed planning and budgeting, improve productivity, seamless integration of financial ERP modules into our business systems, and real-time financial monitoring, which is expected to drive the segment.

The inventory and material management segment is expected to record the fastest growth rate over the forecast period. Inventory and material management-based ERP modules provide improved reporting, real-time supply chain management, overall inventory analysis, enhanced quality checks, and inventory planning. The software’s effective and extensive functionality breaks information silo, streamlines manufacturing processes, and automates numerous operations. As per an article published by Xtelligent Healthcare Media, LLC, in March 2018, the integration of analytics and automation with inventory management has resulted in an efficient order of supplies and management of the organization. It also eliminates double handling of goods and automates routine processes, such as reordering. These aforementioned factors have driven the adoption of ERP solutions for inventory and material management.

Regional Insights

North America held the largest revenue share of over 35.0% in 2020. This can be attributed to the rapidly developing and evolved healthcare infrastructure, growing demand for advanced technological solutions, and significant presence of key market players. North American consumers are rapidly adopting ERP systems to streamline workflows and enhance productivity and cost savings. The adoption of healthcare ERP in North America can be attributed to various benefits offered by ERP software such as better utilization of resources and increasing caregiving efficiency. Key players in North America are innovating and expanding their product portfolios to serve small and medium businesses.

Asia Pacific is anticipated to register the fastest growth rate during the forecast period due to the rising healthcare expenditures and the growing workforce shortage. In addition, ineffective health facilities’ services management, growing patient community, rising adoption of advanced technological solutions, and the emergence of start-ups are boosting the growth of the Asia Pacific market. Moreover, the industry is attracting public and private infrastructure and contributing to the growth of infrastructure and economic development.

Key Companies & Market Share Insights

Key players are devising product innovation strategies to expand their product portfolios. In addition, they are focusing on technological collaborations and partnerships to support product innovations and launches.

For instance, in January 2020, Infor acquired Intelligent InSites, Inc., a leading provider of healthcare software and services based in North Dakota. Intelligent InSites, Inc. provides businesses with dynamic, scalable, and intuitive location platforms to optimize operations, streamline patient journeys, and enhance clinical outcomes. Through this acquisition, Infor expanded its technological offerings portfolio and strengthened its business footprint in clinics, emergency departments, urgent care, procedural care, inpatient care, and behavioral health. Some prominent players in the global healthcare ERP market include:

-

McKesson Corporation

-

Microsoft

-

Infor

-

Odoo

-

SAP

-

Oracle

-

Epicor Software Corporation

-

QAD, Inc.

-

Aptean

-

Sage Group PLC

Healthcare ERP Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 6.6 billion

Revenue forecast in 2028

USD 10.3 billion

Growth Rate

CAGR of 6.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Brazil; Mexico; South Africa; UAE

Key companies profiled

McKesson Corporation; Oracle; SAP; Microsoft; Aptean; Odoo; Infor; Epicor Software Corporation; SAGE Group PLC; QAD Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research, Inc. has segmented the global healthcare ERP market report on the basis of function, deployment, and region:

-

Function Outlook (Revenue, USD Million, 2016 - 2028)

-

Inventory and Material Management

-

Supply Chain and Logistics Management

-

Patient Relationship Management

-

Finance and Billing

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2016 - 2028)

-

On-premises

-

Cloud

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global healthcare ERP market size was estimated at USD 6.2 billion in 2020 and is expected to reach USD 6.6 billion in 2021.

b. The global healthcare ERP market is expected to grow at a compound annual growth rate of 6.6% from 2021 to 2028 to reach USD 10.3 billion by 2028.

b. The finance and billing segment dominated the global healthcare enterprise resource panning market with a share of 32.9% in 2020.

b. Some key players operating in the global healthcare ERP market include McKesson Corporation, Oracle, SAP, Microsoft, Infor, and Aptean

b. Key factors that are driving the global healthcare ERP market growth include growing healthcare expenditure, ineffective hospital service management, rising workforce shortage, and rapidly growing patient population at healthcare facilities

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."