- Home

- »

- Healthcare IT

- »

-

Healthcare Information System Market Size Report, 2030GVR Report cover

![Healthcare Information System Market Size, Share & Trends Report]()

Healthcare Information System Market Size, Share & Trends Analysis Report By Application (HIS, PAS), By Deployment, By Component, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-549-6

- Number of Pages: 190

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global healthcare information system market size was valued at USD 406.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 13.3% from 2023 to 2030. Rise in healthcare expenditure and advancements in its IT infrastructure are some of the primary drivers boosting the market. High demand for remote patient monitoring is also significantly driving its adoption rate. According to a report published by OECD, health expenditure per capita for the period 2015-2030 is projected to grow at an average annual rate of 2.7% across the OECD. Health expenditure as a share of GDP is projected to increase to 10.2% by 2030, which was 8.8% in 2015.

Patient-centred care management, population health management, and point-of-care solutions assist providers in cutting down healthcare expenditure and improving outcomes through the development of patient registries and patient portals. Technological advancement in healthcare IT infrastructure, such as the use of IoT, big data, and AI is one of the significant factors propelling the market growth. Companies are developing newer technologies, which have increased the number of IT solutions for cybersecurity and AI applications in hospitals and other facilities. Data interoperability, AI, and machine learning (ML) are some of the promising ones.

The rise in the prevalence of chronic diseases such as diabetes, cancer, and congestive heart failure is significantly contributing to the adoption of remote patient monitoring services, which in turn is expected to boost the demand for IT solutions in the industry. According to the International Diabetes Federation (IDF), people living with diabetes are expected to rise to 643 million by 2030 and 783 million by 2045. American Cancer Society estimated that around 1.9 million newly diagnosed cancer cases were registered in the U.S. in 2021.

Many companies and healthcare institutions are launching mHealth programs for remote patient monitoring, which is leading to an increase in the adoption of IT solutions for remote patient monitoring services. For instance, in 2019, Wisconsin’s Marshfield Clinic Health System will use mHealth devices for remote monitoring of patients with congestive heart failure. The eHealth initiatives span developing current IT infrastructure and promoting the adoption of patient engagement as well as patient-physician coordination tools. The number of initiatives being undertaken for the implementation of eHealth is rising globally.

Europe is one of the leading regions that invest heavily to develop eHealth infrastructure. As a result of these initiatives, the use of eHealth in the EU to improve health service delivery and public health is increasing. Developing countries are also adopting eHealth through various initiatives undertaken by them. In October 2020, India and Netherlands collaborated in the field of eHealth to provide digital health facilities and security to Indians and also aid the Netherlands to accelerate the digital transformation of health.

Increasing applications of smartphones, such as telemedicine, remote disease management, Health Management Information Systems (HMIS), and others, are expanding the scope of IT, especially in healthcare. Technological advancements in smartphone technology for improving disease diagnosis are anticipated to drive the growth of IT in this sector. For instance, in February 2022, Teladoc Health, Inc. introduced Chronic Care Complete, which is a complete solution for chronic condition management that focused on improving the outcomes of healthcare.

During the COVID-19 pandemic, upgraded government mandates with growing support and initiatives for healthcare IT solutions have boosted the adoption of information systems in hospitals, laboratories, academic institutes, and diagnostic centres. With the implementation of telemedicine and remote patient monitoring, these facilities are creating opportunities in the market. The COVID-19 pandemic exposed some vital opportunities to identify the strengths and weaknesses of the existing healthcare information system.

Application Insights

The revenue cycle management (RCM) segment accounted for the largest market share of 66.2% in 2022. This is attributed to the need of reducing medical billing errors, reducing reimbursements in healthcare, shifting the trend toward the development of synchronized management systems, and increasing the need for optimization of workflows in hospitals and other facilities. Based on a 2020 study, around 67% of providers are using AI for RCM and almost 100% of the surveyed executives are projected to incorporate AI for RCM within the next 3 years. This is further expected to increase the growth rate of RCM over the forecast period.

An increase in the adoption of hospital information systems to improve operational efficiency, growing awareness regarding technologically advanced services, and the subsequent need for reducing healthcare costs are among the key factors that can be attributed to the market growth of hospital information systems. Owing to several benefits associated with technology, such as high operational efficiency and low healthcare expenditure, the demand for analytical IT solutions is increasing in the healthcare sector.

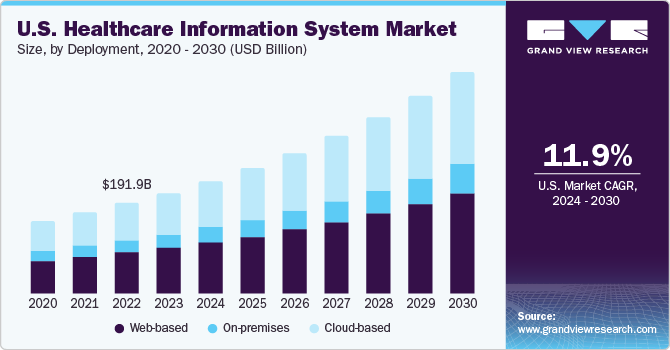

Deployment Insights

Web-based deployment segment dominated the market in 2022 with a 43.3% share. The use of web-based systems significantly reduces operational obstacles encountered due to handling large volumes of data. However, the capability of web-based deployments to support software and systems depends on the availability of the required technical needs and operational prowess of the systems. Web-based applications are custom-built to the needs of the healthcare organization, which facilitate improved business workflows resulting in generating maximum value for the business.

The cloud-based deployment segment is anticipated to showcase the fastest CAGR during the forecast period. Cloud-based technology enables software & systems, hosting applications, and services remotely, which can be accessed or used freely through the internet. The utilization of cloud-based technology has increased due to various security breaches via on-premises and web-based deployment. With the advancements in edge computing, data processing at the edge has been easier, thus, leading to high processing efficiency that enables the transfer of the required data to a private or public cloud for advanced analytics.

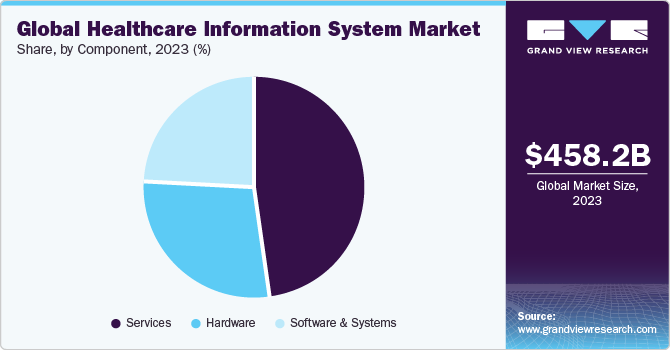

Component Insights

The service segment held the largest market share of 47.4% in 2022 among the component category. This is mainly due to the various services provided by the companies such as optimization, hosting, consulting, and revenue cycle services to manage the information systems in the healthcare facilities. The rise in the need for IT and communication services in healthcare information systems has further boosted the market demand for information system services in this industry. Other services such as installation, education & training, and upgradation also play an important part in driving the market segment.

The software & systems segment is expected to witness a rapid growth rate over the forecast period. The increasing need for efficient management of organizational work processes within the healthcare sector, the shift toward value-based care in economically developed regions, and the rising number of initiatives being undertaken by key players for improving healthcare IT infrastructure are driving the market for software used in such management and information systems.

End-Use Insights

The hospital segment dominated the market in 2022 with a share of 76.4%. The growing adoption of healthcare information systems in hospitals has led to increased efficiency of the professionals resulting in easy and organized patient care. It helps in managing administrative, financial, and clinical aspects of hospitals, which in turn helps in maintaining hospital inventory and patient records efficiently. Technological advancements in cloud-based systems have also resulted in rising hospital information systems adoption.

Diagnostic centers are projected to witness the highest CAGR over the forecast period due to the increasing need for laboratory informatics systems for services such as sample collection and machine interfacing. Healthcare information systems used in diagnostic centers allow the service providers to make informed decisions, which will help in preparing diagnoses or predicting medical conditions like drug interactions and reactions.

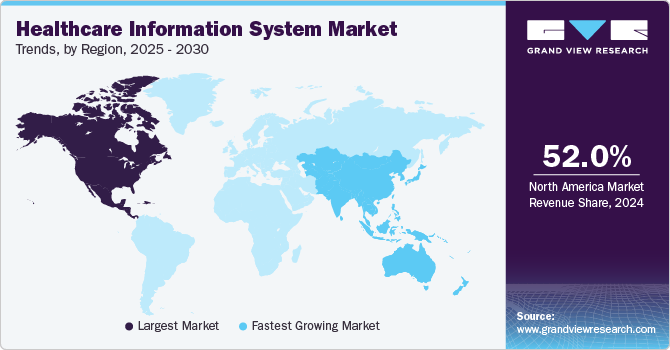

Regional Insights

North America dominated the market in 2022 with a 52.0% share mainly due to factors such as high economic development and the presence of hospitals, advanced research centers, universities, & medical device manufacturers in this region. Large hospitals and research centers, such as the Mayo Clinic, the University of Maryland Medical Center, Cleveland Clinic, St. Jude Children’s Research Hospital, and John Hopkins Medicine create potential growth opportunities in terms of healthcare IT services for market players.

Asia Pacific is the fastest-growing regional market, with high demand for healthcare IT services, owing to an increase in government spending on healthcare. In addition, an increase in healthcare expenditure in developing Asian countries & improvement in healthcare infrastructure, owing to growth in the adoption of advanced technology to streamline hospital workflow & cut down medical costs, are the key drivers of demand for the market in this region.

Key Companies & Market Share Insights

Various strategic initiatives such as collaborations, product launches, and investments are increasingly being undertaken by the key providers to capture maximum market share. For instance, in June 2022, Athenahealth expanded its mobile EHR voice capabilities for healthcare providers. The voice assistant will help them improve documentation accuracy, provide a better patient experience, and save time. Some prominent players in the global healthcare information system market include:

-

Athenahealth, Inc.

-

Agfa Gevaert Group

-

eClinicalWorks

-

Philips Healthcare

-

Hewlett Packard

-

McKesson Corporation

-

Allscripts Healthcare, LLC

-

GE Healthcare

-

Oracle (Cerner Corporation)

-

Epic Systems Corporation

-

Carestream Health

-

Novarad Corporation

-

e-MDs Incorporation

-

Medidata Solutions Inc.

-

Siemens Healthineers

-

NextGen Healthcare

-

Ada Health GmbH

-

SWORD Health

-

Siilo

-

NXGN Management, LLC,

-

GREENWAY HEALTH, LLC.,

-

Infor

Healthcare Information System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 458.6 billion

Revenue forecast in 2030

USD 1,097.0 billion

Growth Rate

CAGR of 13.3% from 2023 to 2030

The base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segment Covered

Application, deployment, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.K.; Germany; France; Italy; Spain; Russia; Netherlands ;Denmark; Sweden; Norway; Japan ;China; India ;Singapore; Australia; South Korea; Malaysia; Thailand; Indonesia; Philippines; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Athenahealth, Inc.; Agfa Gevaert Group; eClinicalWorks; Philips Healthcare; Hewlett Packard; McKesson Corporation; Allscripts Healthcare, LLC; GEHealthcare; Cerner Corporation; Epic Systems Corporation; Carestream Health; Novarad Corporation; e-MDs Incorporation; Medidata Solutions Inc.; Siemens Healthineers; NextGen Healthcare; Ada Health GmbH; SWORD Health; Siilo; Oracle; NXGNManagement, LLC; GREENWAY HEALTH, LLC.; Infor

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Information System Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global healthcare information system market report based on application, deployment, component, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Information System

-

Electronic Health Record

-

Electronic Medical Record

-

Real-time Healthcare

-

Patient Engagement Solution

-

Population Health Management

-

-

Pharmacy Automation Systems

-

Medication Dispensing System

-

Packaging & Labeling System

-

Storage & Retrieval System

-

Automated Medication Compounding System

-

Tabletop Tablet Counters

-

-

Laboratory Informatics

-

Revenue Cycle Management

-

Medical Imaging Information System

-

Radiology Information Systems

-

Monitoring Analysis Software

-

Picture Archiving and Communication Systems

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

On-premises

-

Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software & Systems

-

Services

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Academic And Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Singapore

-

Australia

-

South Korea

-

Malaysia

-

Thailand

-

Indonesia

-

Philippines

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the healthcare information system market growth include increasing adoption of technologically advanced infrastructure in hospitals, diagnostic centers, clinical laboratories, growing awareness regarding e-prescriptions among practitioners and patients.

b. The global healthcare information system market size was estimated at USD 406.4 billion in 2022 and is expected to reach USD 458.6 billion in 2023.

b. The global healthcare information system market is expected to grow at a compound annual growth rate of 13.3% from 2023 to 2030 to reach USD 1,097.0 billion by 2030.

b. Revenue Cycle Management (RCM) dominated the healthcare information system market with a share of 66.2% in 2022. This is mainly due to the increasing need for reducing medical billing errors, & reducing reimbursements in healthcare.

b. Some key players operating in the healthcare information system market include Philips Healthcare; NextGen Healthcare; Carestream Health; Cerner Corporation; GE Healthcare; McKesson Corporation; Athenahealth, Inc.; Allscripts; Medidata Solutions Inc.; and Siemens Healthineers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."