- Home

- »

- Advanced Interior Materials

- »

-

High Performance Fibers Market Size & Share Report, 2030GVR Report cover

![High Performance Fibers Market Size, Share & Trends Report]()

High Performance Fibers Market Size, Share & Trends Analysis Report By Product (PBI, Carbon, Aramid), By Application (Aerospace & Defense, Construction & Building), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-806-0

- Number of Pages: 198

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

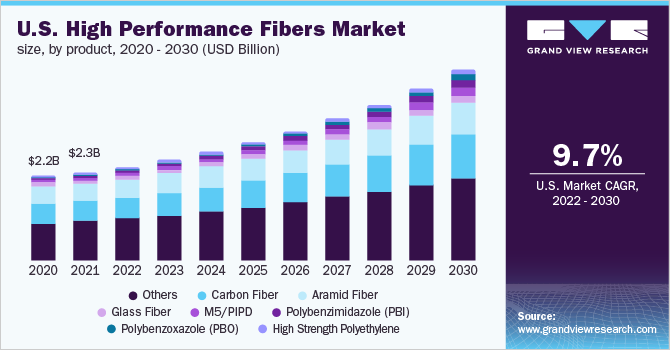

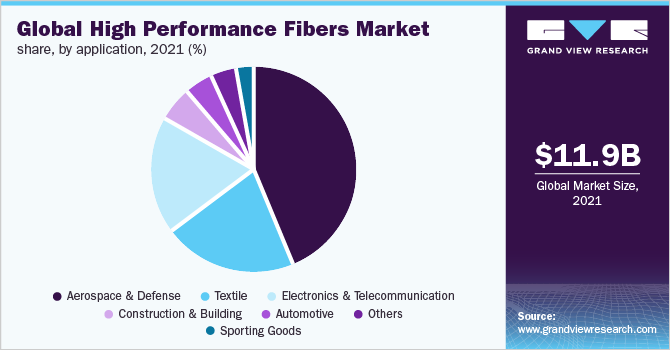

The global high performance fibers market size was valued at USD 11.90 billion in 2021 and is expected to grow at a compounded annual growth rate (CAGR) of 8.7% from 2022 to 2030. Increasing usage of high performance fibers (HPF) in the reinforcement of composites for applications in military vehicles, aircraft, electronics, and sports goods is projected to drive the industry growth over the forecast period. Some of the high-performance fibers provide superior features, such as high thermal and chemical resistance to most organic solvents, high abrasion resistance, non-conductivity, and good fabric integrity at elevated temperatures. In addition, the product offers superior strength to weight ratio and high rigidity, thereby providing high utility in aerospace applications.

The HPF market is subjected to stringent rules and regulations regarding the use of materials followed by aircraft manufacturers. The regulations regarding usage of materials, processing & transportation, and waste disposal are implied by authorities, such as Federal Aviation Association (FAA), Federal Aviation Regulations (FAR), EPA, REACH, and OSHA. Increasing technological advancements in the use of additive manufacturing in aerospace production are expected to open new avenues for the market. Players in the market are focusing on research and development of HPF-reinforced composites to increase their strength due to the growing demand for lightweight materials.

The HPF is acting as an asbestos substitute for bullet-proof jackets, tires, belts, concrete reinforcing, and heat-resistant cushions. In addition, they also find applications in wind power generator blades, ropes, and fishing nets. The cut, thermal, chemical, and abrasion resistance offered by these fibers also enhance their utility in the manufacturing of protective gloves and mooring ropes. Toxicity issues concerning the production of Carbon-reinforced Fiber Composites (CFRC) may negatively influence the market growth. However, enhancement of fuel efficiency and emission reduction in vehicles & aircraft owing to the application of high-performance fiber is expected to benefit the market growth.

Product Insights

The Polybenzimidazole (PBI) fibers segment is expected to register the fastest CAGR of more than 14.00% from 2022 to 2030 owing to superior properties offered by the product, such as high glass transition temperature, no melting point, and extremely high heat deflection temperature. PBI fibers are finding applications in several products including heat and safety garments, such as firefighter uniforms and safety gloves. PBI fibers are widely used for several applications with other high-performance fibers like Kevlar. PBI fibers exhibit high flexibility, low moisture regains, low tenacity, superior strength to weight ratio, and do not melt & burn. They are also used in plastic reinforcements, for chemical and heat resistant filters, and also for several civil engineering applications.

Carbon fiber was the second-largest product segment and accounted for over 22% share of the global market revenue in 2021 owing to a wide range of applications in the aerospace industry including aircraft, rockets, satellites, and missiles. In addition, the rising penetration of CFRCs in aircraft components, owing to their lightweight and rigidity properties, is expected to drive the demand. Carbon fiber structures weigh half of their steel counterparts, and around one-third of aluminum. However, the usage of CFRC costs significantly more than metals. The high cost linked with carbon fiber has restricted its consumption to performance vehicles, such as jet fighters, spacecraft, racing cars, sports cars, racing yachts, and notably Airbus and Boeing airliners.

Application Insights

The aerospace and defense application segment led the market and accounted for over 44% share of the global revenue in 2021. It is expected to register a steady CAGR from 2022 to 2030as the industry is moving towards lightweight materials in an attempt to improve the cost-efficiency and environmental performance of the aircraft. Hence, high-strength, lightweight, and fiber-reinforced composite materials are vital to the aircraft manufacturing industry. Lightweight materials and structures provide an advantage in aerospace applications as it offers high strength and stiffness at a reduced weight, substantially reducing the fuel consumption. These materials enable to carry more fuel and payload, thereby increasing mission duration and idle time for aircraft in the case of military aircraft.

Increasing carbon fiber demand in the automotive industry is expected to drive market growth over the forecast period. Increasing fuel prices have triggered the need for fuel-efficient vehicles. Presently, a substantial number of vehicles/cars run on conventional fuel technology, which has stimulated the demand for fuel-efficient vehicles. The automotive application segment is projected to register a significant CAGR over the forecast period on account of the rising use of fiber-reinforced composite materials in the industry due to curb weight reduction trends. Reduction in curb weight drastically increases fuel efficiency and reduces vehicular pollution.

Regional Insights

The Asia Pacific region led the market and accounted for more than 43.00% share of global revenue in 2021. It is also projected to register the fastest CAGR over the forecast period owing to the rise in demand for fiber-reinforced composite materials in the automotive, electronics, and construction sectors. Also, the product developments, availability of raw materials at affordable prices, and setting up of manufacturing facilities by market leaders are expected to drive the market. The growing need for security & protection measures in various end-use industries, such as oil & gas, mining, manufacturing, healthcare/medical, military, and building & construction, are fuelling product usage in major economies, such as China and India.

Also, increasing usage of high-performance fibers as an alternative to asbestos and steel is likely to drive market growth. North America also held a considerable market share in 2021 as the region contributes immensely to the product demand owing to the presence of key aircraft manufacturers. Also, the regional market is expected to witness positive growth trends owing to the rising defense expenditure in the region, especially in the U.S. Stringent regulations laid down by various regulatory bodies, such as HSE, ANSI, and state bodies, pertaining to the security and protection measures of workers in various industries are driving the demand for protective clothing over the past few years. This is likely to be a key factor driving the regional market during the forecast period.

Key Companies & Market Share Insights

The competitive rivalry among manufacturers is high as the market is characterized by the presence of a large number of global and regional players. Raw material suppliers play a crucial role in the value chain as they provide basic raw materials required to initiate the manufacturing process of various fibers. The high production cost of PBO, PBI, M5/PIPD, and aramid fibers is challenging the growth and profitability of the market across the world. Other than high production cost, initial capital investment and monomer supply is further anticipated to pose a challenge to the capacity expansion of the aforementioned fibers over the forecast period. Some prominent players in the global high performance fibers market include:

-

Toray Industries, Inc.

-

Dupont

-

Teijin Limited

-

Toyobo Co. Ltd

-

DSM

-

Kermel S.A.

-

Kolon Industries, Inc.

-

Huvis Corp.

High Performance Fibers Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 12.58 billion

Revenue forecast in 2030

USD 25.32 billion

Growth rate

CAGR of 8.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea

Key companies profiled

Toray Industries, Inc.; Dupont; Teijin Ltd.; Toyobo Co. Ltd.; DSM; Kermel S.A.; Kolon Industries, Inc.; Huvis Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global high performance fibers market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2017 - 2030)

-

Carbon Fiber

-

Polybenzimidazole (PBI)

-

Aramid Fiber

-

M5/PIPD

-

Polybenzoxazole (PBO)

-

Glass Fiber

-

High Strength Polyethylene

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2017 - 2030)

-

Electronics & Telecommunication

-

Textile

-

Aerospace & Defense

-

Construction & Building

-

Automotive

-

Sporting Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global high performance fibers market size was estimated at USD 11.90 billion in 2021 and is expected to reach USD 12.58 billion in 2022.

b. The high performance fibers market is expected to grow at a compound annual growth rate of 8.7% from 2022 to 2030 to reach USD 25.32 billion by 2030.

b. Carbon fiber product segment accounted for second largest market share with 22.1% of the global revenue in 2021. These fibers offer benefits such as enhanced strength to weight ratio of aerospace and automotive components thus improving their performance.

b. Some of the key players operating in the high performance fibers market include Toray Industries, Inc., Dupont, Teijin Limited, Toyobo Co. Ltd, DSM, Kermel S.A., Kolon Industries, Inc, Huvis Corp

b. The key factors driving the high performance market include exceptional properties offered by these materials such durability, and superior strength to weight ratio across various applications

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."