- Home

- »

- Advanced Interior Materials

- »

-

High Strength Steel Market Size & Share, Industry Report, 2018-2025GVR Report cover

![High Strength Steel Market Size, Share & Trends Report]()

High Strength Steel Market Size, Share & Trends Analysis Report By Product (High Strength Low Alloy, Dual Phase), By Application (Automotive, Construction, Aviation & Marine, Mining), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-340-9

- Number of Pages: 123

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Advanced Materials

Industry Insights

The global high strength steel market size was valued at USD 15.4 billion in 2016. Growing demand from the construction and automotive industries, coupled with the environmental sustainability of high strength steel, is expected to drive market demand over the forecast period

The automotive industry has faced significant challenges in meeting various governmental norms regarding safety, automotive weight, fuel economy, and emission. The product has provided an efficient solution to achieve these compliance requirements, by enabling designers to develop safe and fuel-efficient vehicles with reduced weight. The excellent metallurgical properties of the product encourage its usage in the automotive industry as an alternative to conventional materials.

High strength steel includes a variety of grades of specialty steel with broad applications in various sectors. Iron ore, manganese, and microalloying elements are key raw materials used in the manufacturing of this product. It is used in various application industries, including construction, automotive, aviation and marine, wind energy, mining equipment, electrical equipment, and pipes.

Rising levels of air pollution caused by greenhouse gas emissions have motivated industry players across the globe to reduce their environmental footprint. Steel manufactures are aiming to enhance their environmental sustainability by lowering CO2 emissions, energy consumption, lower liquid waste generation, and waste residues. Production of high strength steel requires less energy as compared to carbon steel production.

Recent advancements in research programs have led to the development of advanced and improved grades of the product. The use of hot stamping technology and equipment has led to enhancement in structural properties. Processes used in advanced hot stamping technology include microstructure control, heating, stimulation of phase control, and simulation. Various CAD and CAE software, along with non-destructive testing instruments, are being developed for use in product development.

A major portion of the produced product goes into manufacturing automotive parts, such as rocker-panels and reinforcements, pillar inner and reinforcements, various cross-car beams, and rails. The growth of the automotive industry is, therefore, expected to propel product demand.

High strength steel is widely used by major automotive, aircraft, and welding equipment manufacturers. Rising focus on products with improved performance, strength, and durability is expected to have a positive impact on the market over the forecast period.

Product Insights

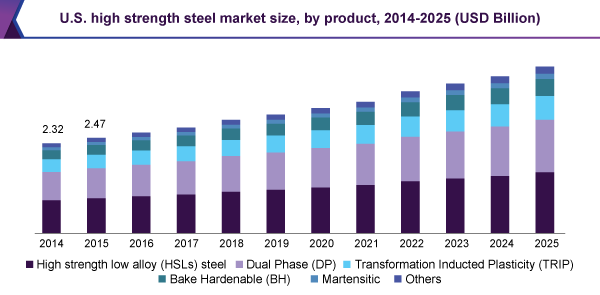

On the basis of product, the market has been segmented into High Strength Low Alloy (HSLs), Dual Phase (DP), Transformation Induced Plasticity (TRIP), Bake Hardenable (BH), martensitic, and others. These products are majorly used in the automotive industry. However, with increasing demand for lightweight, durable, and strong materials from the construction and aviation and marine industries, demand for the product is expected to grow further over the forecast period.

HSLs have been gaining a significant share in the high strength steel market over the past few years and the segment is expected to continue this trend over the forecast period. HSLs held a share of about 37.0% of the global revenue in 2016. This product is specially designed to offer greater resistance to atmospheric corrosion and improved mechanical properties, as compared to conventionally available carbon steels. These elements enhance strength by forming stable carbonitrides, carbides, or nitrides, and affect the hardenability of steel.

Dual phase steel is expected to gain significant market share over the forecast period.DP steels have a homogeneous plastic flow, high tensile strength, high early-stage strain hardening, and low initial yielding stress. These features make DP steels ideal materials for use in structural parts and reinforcements, among other automotive-related operations. Dual phase steel gives high mechanical strength, extraordinary fatigue resistance, and good energy absorption capacity to the finished part.

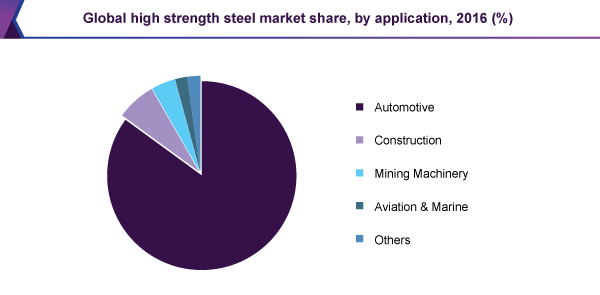

Application Insights

Automotive, construction, mining machinery, and aviation and marine are major application sectors in the market. In 2016, the automotive segment dominated the overall industry, accounting for over 85.0% of the total revenue. The product is widely used in automotive body structures where good durability is required. Complex shapes are difficult to make using high strength steel, but a good die design and proper analysis can result in successful and strong automotive parts.

Stringent regulations by the U.S. EPA and a few other regulatory bodies regarding storage and use of high strength steel and related raw materials are expected to restrict the market growth. With an increase in population, demand for apartments and houses is expected to boost demand for high strength steel. In addition, the growth of the residential and commercial construction sectors is expected to impact demand over the forecast period.

The aviation and marine application segment is expected to witness steady growth over the forecast period, particularly in advanced economies such as the U.S. The product is used in a variety of marine and aviation applications. Since both ships and airplanes need to be lightweight, the product is expected to gain popularity in these applications. They are also being increasingly used in marine applications since they are resistant to corrosion.

Regional Insights

Asia Pacific was the leading market segment in 2016 and is expected to continue its dominance over the forecast period. Population growth, increase in household formation, low mortgage rates, strong economic conditions that are keeping unemployment levels low, and growing incomes are expected to propel residential construction activities in the region. In addition, rising demand for single-family houses and apartments is expected to boost product demand.

Promising growth of the global automotive industry is expected to play a key role in driving demand for high strength steel in the region, owing to its increasing use in automotive body parts. Production of passenger cars and commercial vehicles has increased steadily over the past few years, especially in the U.S., India, Germany, and Mexico. Healthy rise in automotive manufacturing marked a positive impact on product demand. A significant reduction in weight was a key factor influencing the usage of the product.

The North America market accounted for the second-largest share in global revenues in 2016. This can be mainly attributed to the growth of the construction sector in member countries, along with the rapid growth of the automotive industry in Mexico. Future product demand is expected to be driven by these industries and their progress across the region.

High Strength Steel Market Share Insights

Raw material suppliers, manufacturers, distributors, and applications make up the competitive landscape of the market for high strength steel. Presence of large international manufacturers in the market has intensified competitiveness among players. Augmented use of the product in automotive parts, mining equipment, and construction components has increased product demand. Collaboration through long-term agreements and joint ventures with consumers has resulted in stiff competition in the industry. Various manufacturers are involved in the development of high strength steel to meet the specific requirements of customers from the automotive, construction, and mining sectors. Manufacturers are focusing on increasing their production capacity to match rising demand from consumers.

Some of the key companies present in the industry are ArcelorMittal S.A., Tata Steel, United States Steel Corporation, Voestalpine AG, POSCO Co., Ltd, SSAB, ThyssenKrupp AG, Ansteel Group Corporation, AK Steel Corporation, and Nucor Corporation.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Volume in kilotons, Revenue in USD Million & CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country Scope

U.S., U.K., Germany, China, India, Brazil, Saudi Arabia

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global high strength steel market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

High strength low alloy (HSLs) steel

-

Dual Phase (DP)

-

Transformation Induced Plasticity (TRIP)

-

Bake Hardenable (BH)

-

Martensitic

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Automotive

-

Construction

-

Mining Machinery

-

Aviation & Marine

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."