- Home

- »

- Biotechnology

- »

-

High Throughput Screening Market, HTS Industry Report, 2018-2025GVR Report cover

![High Throughput Screening (HTS) Market Size, Share & Trends Report]()

High Throughput Screening (HTS) Market Size, Share & Trends Analysis Report By Application (Drug Discovery, Cell- and Organ-based Screening, Biochemical Screening), By Technology, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-155-9

- Number of Pages: 117

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Healthcare

Report Overview

The global high throughput screening (HTS) market size was valued at USD 15.62 billion in 2016. It is expected to expand at a CAGR of 7.89% over the forecast period. The rising number of drug targets for screening, which in turn are used for drug discovery and development, and growing investments by government and research institutes are among the key trends escalating market growth.

High throughput screening, also known as high content screening (HCS), is mainly used for conducting various genetic, chemical, and pharmacological tests that aid the drug discovery process starting from drug design to drug trials and other drug interactions. This process involves control software, various devices to handle liquids, and other detectors, which help to rapidly identify active compounds, genetic interactions, and other biomolecular interactions.

However, most of these techniques need expertise and software that can handle and store multiple sets of data at a rapid pace, lack of which is anticipated to inhibit growth prospects.

Technology Insights

Soaring need for newer therapies for a number of conditions is supporting technological advancements. Analyzing the data processed and screened is the most important step that is to be handled with accuracy for the required results. Recent trends show the development of software and chemical libraries in the establishment of best standards and reporting of results.

Regulatory bodies are being pushed to establish tighter quality control standards to achieve integrity and accuracy on the information and data obtained and stored. However, the lack of efficient software to handle automated robotic arms and liquid handling systems is estimated to influence the growth of the market negatively.

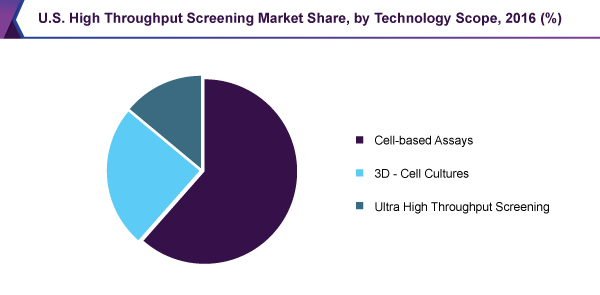

Cell-based assays held more than 55.0% of the overall revenue in 2016. Fluorometric imaging plate reader assays have become the most used cell-based assays owing to visible results and their ability to test with the smallest of volumes. Ultra high throughput screening is the latest technology and used for increased output in lesser time.

A majority of companies are in a transition phase from 2D – cell cultures to 3D - cell cultures as 3D cells show more lifelike properties while testing in the natural environment and other cell-related manipulations, aided for drug design and discovery.

Various steps such as increasing the capacity of chemical libraries for the proactive identification of chemical identity hits while testing, development of hardware and software that can handle and fully automate the testing process, and increased funding from governments and other research institutes to adopt newer technologies and faster data processing software are projected to provide a fillip to the market.

Application Insights

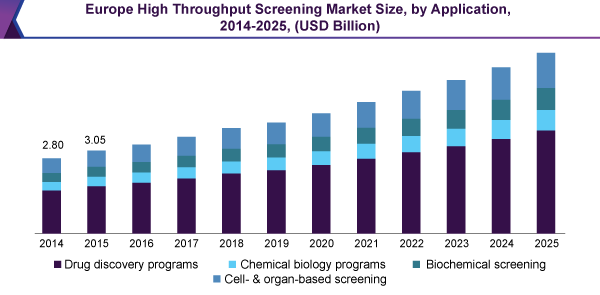

Stiff competition between companies to reach the market first with a new product will ensure the expansion of the market. The biggest advantage of HTS technology is the reduction of time required to develop a drug. Drug discovery programs dominated the market in terms of revenue in 2016. The growth of the segment can be attributed to the fact that most of the big and small pharmaceutical companies are focused on the development and manufacturing of new and novel molecules for several life-threatening conditions.

This has led to the adoption of automated high-throughput screening and ultra-high throughput screening techniques to screen huge chemical libraries to meet the needs of ever-increasing drug target molecules. For instance, an automated HTS system can typically help screen 10,000 to 100,000 target compounds per day and uHTS more than 100,000 compounds per day.

Regional Insights

North America is likely to be at the forefront of the high throughput screening market throughout the forecast period owing to technological advancements in the US. Drug discovery techniques using 3D-cell cultures have gained popularity among companies competing to reach the market with a new drug molecule.

On the other hand, Asia Pacific registered the highest CAGR over the forecast years due to rising efforts for new pharmaceutical molecules and the adoption of newer technologies to improve the standard of the medicine being supplied. Japan, China, and India are the sights of high growth rates in the region.

High Throughput Screening (HTS) Market Share Insights

Some of the key players in this market space are Agilent Technologies, Inc.; Danaher Corporation; Thermofisher Scientific, Inc.; PerkinElmer, Inc.; Tecan Group Ltd.; Merck Millipore; Bio-Rad Laboratories; Hamilton Company; Axxam S.p.A.; and Aurora Biomed.

High competition between manufacturers to commercialize novel molecules is pushing companies to adopt newer and faster technologies that would effectively reduce drug development time. This is poised to act as a potential driver in the expansion of the market during the forecast period.

High Throughput Screening Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 21.09 billion

Revenue forecast in 2025

30.91 billion

Growth Rate

CAGR of 7.89% from 2018 to 2025

Base year for estimation

2016

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD Billion and CAGR from 2018 to 2025

Report coverage

Revenue forecast; company share; competitive landscape; growth factors and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; Japan; Brazil; South Africa

Key companies profiled

Agilent Technologies, Inc.; Danaher Corporation; Thermofisher Scientific, Inc.; PerkinElmer, Inc.; Tecan Group Ltd.; Merck Millipore; Bio-Rad Laboratories; Hamilton Company; Axxam S.p.A.; Aurora Biomed.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global HTS market report based on application, technology, and region:

-

Technology Outlook (Revenue, USD Billion, 2014 - 2025)

-

Cell-based Assays

-

Fluorometric Imaging Plate Reader Assays

-

Clinical applications (Cardiotoxicity assays)

-

In-vitro studies (Pharmacophores identification in drug discovery)

-

-

Reporter based Assays

-

Clinical applications (Reporter assay in biological systems analysis)

-

In-vitro studies (Genetic reporter assays in cloning tools for live-cell work)

-

-

-

3D - Cell Cultures

-

Clinical applications (Regenerative medicine)

-

In-vitro studies (Drug discovery, Molecular cell biology)

-

-

Ultra High Throughput Screening

-

-

Application Outlook (Revenue, USD Billion, 2014 - 2025)

-

Drug discovery programs

-

Chemical biology programs

-

Biochemical screening

-

Cell- & organ-based screening

-

-

Regional Outlook (Revenue, USD Billion, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high throughput screening market size was estimated at USD 19.55 billion in 2019 and is expected to reach USD 21.09 billion in 2020.

b. The global high throughput screening market is expected to grow at a compound annual growth rate of 7.89% from 2018 to 2025 to reach USD 30.91 billion by 2025.

b. Drug discovery programs dominated the high throughput screening market with a share of 58.4% in 2019. This is attributed to to the fact that most of the big and small pharmaceutical companies are focused on manufacturing of novel molecules for several life threatening conditions.

b. Some key players operating in the high throughput screening market include Agilent Technologies, Inc.; Danaher Corporation; Thermofisher Scientific, Inc.; PerkinElmer, Inc.; Tecan Group Ltd.; Merck Millipore; Bio-Rad Laboratories; Hamilton Company; Axxam S.p.A.; and Aurora Biomed.

b. Key factors that are driving the market growth include rising number of drug targets for screening, which in turn are used for drug discovery & development, and growing investments by government & research institutes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."