- Home

- »

- Medical Devices

- »

-

HIV Clinical Trials Market Size, Share & Analysis Report, 2030GVR Report cover

![HIV Clinical Trials Market Size, Share & Trends Report]()

HIV Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design (Interventional, Expanded Access), By Sponsor, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-955-8

- Number of Pages: 98

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

The global HIV clinical trials market size was valued at USD 1.1 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2022 to 2030. The market growth is due to a rise in R&D investment in HIV clinical trials by pharmaceutical and biotechnology companies, increasing drug approvals for HIV, and increasing incidence of HIV in the population. This growth was halted due to the COVID-19 pandemic as the sudden surge in the pandemic resulted in the slow enrollment of trials and a sudden shift in the COVID-19 drug trials.

The government announced stay-at-home orders due to the COVID-19 pandemic that caused disruption and restricted HIV testing and diagnosis, which led to a steep slowdown in referral and treatment for HIV and AIDS. However, from the start of 2021, the increasing prevalence of HIV among people and their inability to be treated due to staying at home will create a large patient pool and lead to the development of new treatment methods to prevent HIV infection. This will lead to the growth of the market.

A large number of non-profit organizations and pharmaceutical and biotechnology companies are investing in HIV clinical research industry for its treatment therapies. For instance, in April 2021, non-profit organizations: IAVI and Scripps Research announced that they had completed a phase I clinical trial for a novel vaccine against HIV. In addition, Excision has announced that the FDA has approved its Investigational New Drug (IND) as a treatment to cure chronic HIV, which is called EBT-101.

Numerous drug improvements have occurred in recent years as a result of the increased expenditure on HIV drug research and development. For instance, in December 2021, ViiV Healthcare announced the use of a Food and Drug Administration (FDA) accepted treatment to prevent HIV-1 infection that is acquired sexually, namely Apretude. It is a long-acting injectable pre-exposure prophylaxis (PrEP) for the treatment of the disease.

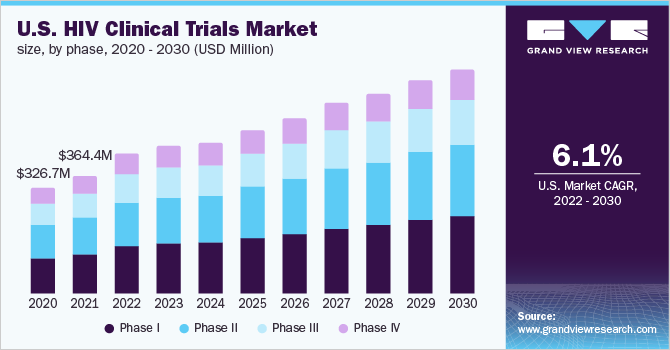

Phase Insights

Phase I held the largest revenue share of over 30.0% in 2021. This segment is also anticipated to register the fastest CAGR during the forecast period. Phase I studies assess the safety of HIV drugs and involve the evaluation of tolerability and pharmacokinetics of molecules. It determines the effect of HIV drugs on humans including the way it is absorbed, metabolized, and excreted. It also examines the side effects of the drug in case of the increased dosage level. The stage includes 20 to 100 healthy volunteers or people with the disease.

The Phase II segment is expected to register the second-fastest CAGR of 6.4% over the forecast period. This is due to the increasing investments in the R&D of HIV clinical trials by industry and non-industry sponsors. The growing number of industry-sponsored and non-industry-sponsored clinical trials in phase II, the complexity associated with phase II clinical trials, and the globalization of clinical trials are factors expected to drive the market.

Sponsor Insights

The pharmaceutical and biopharmaceutical companies dominated the market and held a revenue share of over 70.0% in 2021. It is also expected to register the fastest CAGR during the forecast period. This can be largely attributed to the rising R&D investments and the introduction of new drugs for HIV prevention, which have increased in the past two decades. Based on sponsors, this segment is segmented into pharmaceutical and biopharmaceutical companies, non-profit organizations, and others. Others include government institutes, academics, and research centers.

The non-profit organizations' segment is expected to register the second-highest CAGR of 5.5% during the forecast period. This growth is due to the increasing staff, reinvesting the revenue generated for new drug discovery for HIV treatment, and improving service. They are also searching for new ways to conduct trials for treating HIV infection.

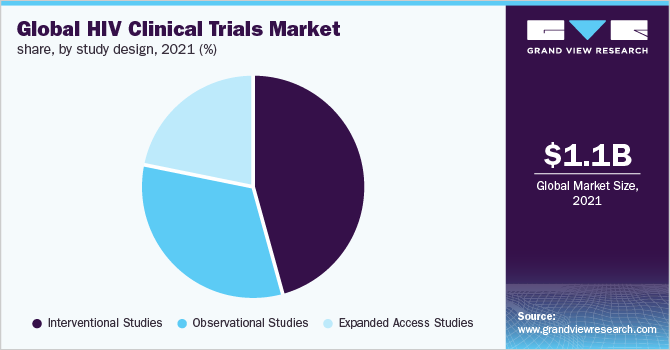

Study Design Insights

The interventional studies segment held the largest revenue share of over 45.0% in 2021 and it is expected to register the second-fastest CAGR during the forecast period. Intervention studies help in determining cost-effective, scalable, and preventive measures to treat HIV infection. It is also used to determine the weaknesses and strengths of a trial, estimate the impact of the treatment on individuals, and minimize limitations at the initial stage.

Based on study design, the market is segmented into interventional studies, observational studies, and expanded access studies. The expanded access studies segment is expected to expand at the fastest CAGR of 6.4% over the forecast period. The main driver is increasing innovation for HIV treatment. Expanded access is expected to be a good approach for patients with serious, life-threatening HIV conditions. In this, the patient is allowed to have treatment outside of a clinical trial when the result of the trial is not satisfactory or no improvement is shown.

Regional Insights

North America dominated the market with a revenue share of over 45.0% in 2021 and is expected to exhibit a significant CAGR over the forecast period. This market is likely to grow due to the high number of HIV clinical trials being conducted in the region. Major R&D investments and government support for HIV clinical trials are further promoting the market growth.

The Asia Pacific region is anticipated to register the fastest CAGR of 8.7% during the forecast period. Developed clinical research infrastructure, a strong hospital network, and the availability of skilled medical practitioners for HIV prevention are factors supporting the growth of the Asia Pacific market. In addition, the large and diverse patient pools that are infected with HIV in these countries lead to market growth.

Key Companies & Market Share Insights

The players are continuously involved in new product development, facility expansions, partnerships, and mergers and acquisitions. These are key strategic initiatives that are influencing the industry dynamics. For instance, in June 2021, Gilead Sciences, Inc. submitted a new drug application to the Food and Drug Administration (FDA). It is a long-acting HIV-1 capsid inhibitor that is used for the treatment of HIV-1 infection. Some prominent players in the global HIV clinical trials market include:

-

PPD Inc.

-

IQVIA Inc.

-

Parexel International Corporation

-

ICON plc

-

Syneos Health

-

WuXi AppTec

-

Janssen Global Services, LLC

-

Gilead Sciences, Inc.

-

Bionor Holding AS

-

Charles River Laboratories

-

GSK plc.

-

SGS SA

HIV Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.3 billion

Revenue forecast in 2030

USD 2.1 billion

Growth rate

CAGR of 6.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Phase, study design, sponsor, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Thailand; South Korea; Mexico; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key Companies Profiled

PPD Inc.; IQVIA Inc.; Parexel International Corporation; ICON plc; Syneos Health; WuXi AppTec; Janssen Global Services, LLC; Gilead Sciences, Inc.; Bionor Holding AS; Charles River Laboratories; GSK plc.; SGS SA

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global HIV Clinical Trials Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HIV clinical trials market report based on phase, study design, sponsor, and region:

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional Studies

-

Observational Studies

-

Expanded Access Studies

-

-

Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Non Profit Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global HIV Clinical Trials market size was estimated at USD 1.1 billion in 2021 and is expected to reach USD 1.3 billion in 2022.

b. The global HIV Clinical Trials market witnessed a moderate growth rate of 6.3% from 2022 to 2030 to reach USD 2.1 billion by 2030.

b. Pharmaceutical & biopharmaceutical companies dominated the market and held the largest revenue share of 70.1% in 2021 and also accounted for the fastest CAGR of 6.6% during the forecast period. This can largely be attributed to the rising R&D investments and introduction of new drugs, which have increased in the past two decades.

b. Some of the players operating in the market include PPD Inc., IQVIA Inc., Parexel International Corporation, ICON plc, Syneos Health, WuXi AppTec, Janssen Global Services, LLC, Gilead Sciences, Inc., Bionor Holding AS, Charles River Laboratories, GSK plc., and SGS SA .

b. Increasing incidence of HIV in population, rise in R&D investment for the development of HIV drugs and vaccines by pharmaceutical companies are major growth driving factors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."