- Home

- »

- Medical Devices

- »

-

Hospital Acquired Infection Control Market Report, 2021-2028GVR Report cover

![Hospital Acquired Infection Control Market Size, Share & Trends Report]()

Hospital Acquired Infection Control Market Size, Share & Trends Analysis Report By Type (Equipment, Services, Consumables), By End User (Hospitals & ICUs, Ambulatory Surgical & Diagnostic Centers), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-383-5

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global hospital acquired infection control market size was valued at USD 5.5 billion in 2020 and is estimated to expand at a compound annual growth rate (CAGR) of 4.9% from 2021 to 2028. Increasing awareness pertinent to Hospital Acquired Infections (HAIs), the need to curb cross infections, the prevalence of infectious diseases in healthcare facilities, and supportive government initiatives to promote infection control practices are some of the key drivers of this market. The establishment of infection prevention standards and protocols at the hospital, regional, and national levels, and the growing adoption of monitoring solutions are further promoting the growth.

The COVID-19 pandemic had a notable impact on the hospital acquired infection control market. It fueled the demand for consumables in particular hand sanitizers, disinfectants, PPE kits, masks, and gloves. Increased demand for infection control products and services was recorded during the previous year. For instance, in August 2020, the Metall Zug Group reported the adverse impact of the COVID-19 pandemic on its overall business. However, the company reported an upward shift in its infection control business segment.

According to a 2020 study on the Impact of the COVID-19 pandemic on the HAI Rate in Iran, a statistically significant reduction was noted in the rate of hospital acquired infections during the outbreak. The low rate of HAIs was attributed to high usage of infection control equipment, adherence to infection control protocols, isolation of infected patients, and elimination of infection using antimicrobial agents. The study also found that raising awareness, continuing education, and using effective and appropriate methods of infection control contributed to the low rate of nosocomial infections.

COVID19 Hospital Acquired Infection Control market impact: ~3.0% increase in demand

Pandemic Impact

Post COVID Outlook

The market experienced an increase of 3.3% in growth rate from 2019 to 2020 as compared to 1.5% from 2018 to 2019.

Adoption of infection control products increased during the pandemic which is anticipated to positively impact market growth.

In 2020, Arkema S.A., the France-based company repurposed its production line in order to produce, 20 tons per week of alcohol-based disinfectants.

As the covid-19 pandemic has proven the importance of implementing infection prevention and control strategies to spread HAIs, the market is expected to witness lucrative growth in the coming years.

Despite the situation of pandemics, market players including Steris and Belimed expanded their business in the infection control segment.

The pandemic also spurred the development of new technology and solutions to combat the detection and spread of infections in healthcare facilities. In January 2021, the National Human Genome Research Institute (NHGRI) developed a new tool to prevent the spread of HAIs in the era of COVID-19. The new tool is based on co-presence, that is patients who either had a confirmed case or were suspected of having an infection, as a measure to predict hospital-acquired infections. These types of innovations are anticipated to fuel the market demand for infection control products in hospitals over the forecast period.

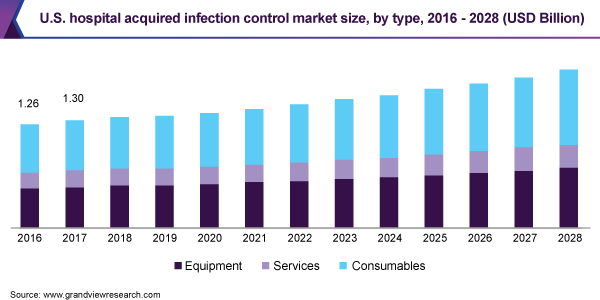

Type Insights

As of 2020, the consumables segment dominated the market and accounted for the largest revenue share of 47.0%. This is owing to the high usage of consumables in hospitals and ambulatory centers coupled with increasing investments in R&D by market players. The COVID-19 pandemic acted as a key contributor for the largest share held by the consumables segment. In April 2020, for instance, Steris received Emergency Use Authorization (EUA) from the U.S. FDA for respirator decontamination. This allowed the company to temporarily offer a solution for decontamination of compatible N95 or N95-equivalent respirators using STERIS V-PRO Low Temperature Sterilization Systems.

The services segment is anticipated to register the highest CAGR of 5.2% over the forecast period. These include disinfection-as-a-service, design, and implementation of infection control programs, and software for monitoring compliance, among others. The demand is expected to increase in the coming years due to increasing awareness levels and supportive policies promoted by the government authorities.

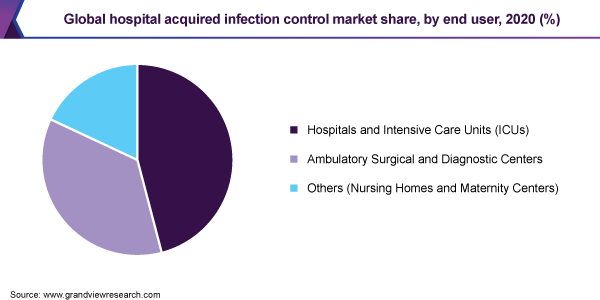

End-user Insights

The hospitals and Intensive Care Units (ICUs) segment dominated the market and accounted for the largest revenue share of 46.0% in 2020. According to a study conducted by the Kerman University of Medical Sciences in Iran, during the COVID-19 pandemic, the incidence of nosocomial (HAIs) infections was higher due to the long duration of hospital stay, admissions, and the implementation of procedures even though the number of patients admitted to ICUs was less than as compared to other wards.

The ambulatory surgical and diagnostic centers segment is expected to witness the fastest CAGR of 5.2% over the forecast period. The custom-made products offered by the competitors specific to ASCs are expected to boost the adoption of HAIs control products in coming years. Steris for example provides a range of steam sterilizers designed for a variety of small spaces including ambulatory surgery centers and satellite locations to provide quick turnaround.

Regional Insights

North America dominated the market and accounted for the largest revenue share of more than 34.0% in 2020. The large share can be attributed to the presence of key players, initiatives implemented by them in the public and private sector, and increasing awareness of HAIs in this region.FO instance, in December 2020, Ecolab, headquartered in the U.S. acquired vanBaerle Hygiene AG in Switzerland. This added a full range of cleaning, disinfectant, and hygiene solutions to Ecolab’s product line and service capabilities.

In the U.S., the CDC is responsible for outbreak investigations, surveillance, research, and prevention of HAIs. The CDC also devises new strategies to prevent healthcare-associated infections in accordance with the HHS Action Plan to Prevent Healthcare-Associated in acute care hospitals. Such supportive initiatives are expected to drive regional growth in the coming years.

In Asia Pacific, the market is estimated to witness the fastest CAGR of 5.7% over the next few years. This is owing to the rising prevalence of hospital acquired infections and developing healthcare infrastructure in low and middle-income economies. According to the World Health Organization (WHO), the frequency of ICU-acquired infection is 2 to 3 times higher in low- and middle-income countries compared to high-income countries. Whereas device-associated infections are about 13 times higher than in the U.S. In addition, newborns in developing countries are at a higher risk of contracting healthcare-associated infections than in high-income countries. The WHO pegs the infection rates at about 3 to 20 times higher. This is expected to fuel the market growth, especially in the Latin American, MEA, and Asia Pacific regions.

Key Companies & Market Share Insights

The market for hospital acquired infection control is competitive in nature. Market players are undertaking strategic initiatives, such as customer acquisition, strategic partnerships, strengthening of distribution network, and R&D. Key players are also involved in portfolio diversification and investments in new technologies to increase market share. For instance, in June 2021, Steris acquired a key provider of infection prevention products and services—Cantel Medical, to expand its offerings.

In October 2020, Olympus launched OER-Elite, an automated touchscreen endoscope reprocessor as part of its infection prevention product portfolio. This extended the company’s automated endoscope reprocessor (AER) lineup. Xenex on the other hand launched Deactivate in February 2021. The device is a handheld LED UV solution intended to disinfect surfaces in confined spaces. Several such initiatives undertaken by market players are estimated to fuel the market growth. Some of the prominent players in the hospital acquired infection control market include:

-

Olympus Corporation

-

BD

-

Getinge AB

-

Xenex Disinfection Services Inc.

-

3M

-

STERIS

-

ASP (Advanced Sterilization Products)

-

Ecolab

-

Belimed AG

-

KCWW (Kimberly-Clark Worldwide, Inc.)

Hospital Acquired Infection Control Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 5.8 billion

Revenue forecast in 2028

USD 8.1 billion

Growth Rate

CAGR of 4.9% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end user, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Olympus Corporation; BD; Getinge AB; Xenex Disinfection Services Inc.; 3M; STERIS; ASP (Advanced Sterilization Products); Ecolab; Belimed AG; KCWW (Kimberly-Clark Worldwide, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this report, Grand View Research has segmented the global hospital acquired infection control market report on the basis of type, end user, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Equipment

-

Sterilization Equipment

-

Heat Sterilization Equipment

-

Moist Heat Sterilization

-

Dry Heat Sterilization

-

-

Low Temperature Sterilization

-

Radiation Sterilization

-

Others

-

-

Disinfection Equipment

-

Washer Disinfector

-

Flusher Disinfector

-

Endoscopic Reprocessor Systems

-

-

-

Services

-

Consumables

-

Disinfectants

-

Sterilization Consumables

-

Others (Waste Disposal, PPE)

-

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals and Intensive Care Units (ICUs)

-

Ambulatory Surgical and Diagnostic Centers'

-

Others (Nursing Homes and Maternity Centers)

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hospital acquired infection control market was valued at 5.55 billion in 2020 and is expected to reach USD 5.80 billion in 2021.

b. The global hospital acquired infection control market is expected to grow at a compound annual growth rate of 4.9% from 2021 to 2028 to reach USD 8.1 billion by 2028.

b. As of 2020, the consumables segment dominated the hospital acquired infection control market and accounted for the largest revenue share of 47.0%.

b. Some key players operating in the hospital acquired infection control market include Olympus Corporation, BD, Getinge AB, Xenex Disinfection Services Inc., 3M, STERIS, ASP (Advanced Sterilization Products), Ecolab, Belimed AG, and KCWW (Kimberly-Clark Worldwide, Inc.).

b. Key factors driving the hospital acquired infection control market growth include the establishment of infection prevention standards & protocols at the hospital, regional, and national levels, supportive government initiatives, and increasing prevalence of HAIs.

b. The hospitals and Intensive Care Units (ICUs) segment dominated the hospital acquired infection control market and accounted for the largest revenue share of 46.0% in 2020.

b. North America dominated the hospital acquired infection control market and accounted for the largest revenue share of more than 34.0% in 2020.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."