- Home

- »

- Electronic Devices

- »

-

Household Refrigerators And Freezers Market Report 2030GVR Report cover

![Household Refrigerators And Freezers Market Size, Share & Trends Report]()

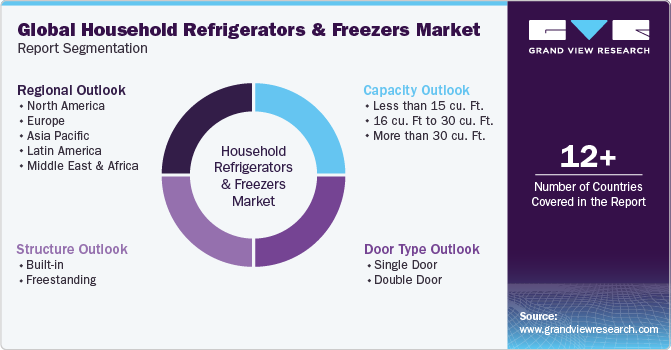

Household Refrigerators And Freezers Market Size, Share & Trends Analysis Report By Capacity (Less Than 15 cu. Ft., 15 to 30 cu. Ft.), By Structure (Built-in, Freestanding), By Door Type (Single Door, Double Door), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-255-6

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Market Size & Trends

The global household refrigerators and freezers market size was valued at USD 88.74 billion in 2022 and is expected to grow at a CAGR of 4.1% from 2023 to 2030. Increasing consumer preference for smart equipment to simplify daily food storage tasks is the primary factor responsible for the promising growth prospects of the market over the forecast period. Furthermore, factors such as the increasing purchasing power of consumers, the rise in the number of nuclear families, the growing popularity of modular kitchen spaces, and changing dietary preferences are driving the market. Refrigerators mounted with freezers are equipped with heat pumps and thermally insulated compartments built to keep food and beverage items cool and fresh for a comparatively long time.

Owing to these benefits, the appliance has become an everyday necessity in households globally. The intense competition in the market has pushed manufacturers to introduce improvements in their offerings to keep consumers intrigued and encourage them to replace their traditional household refrigeration equipment with modern appliances. The groundbreaking rise in demand for refrigeration technology in the 1950s stimulated developments, such as the inclusion of the automatic defrost feature and increased freezer sizes. Since then, subsequent technological and design advancements have replaced conventional units, creating continual market opportunities.

Continual upgrades have ensured an increase in energy consumption and the electricity costs associated with the operations of conventional equipment. Regulatory bodies worldwide are formulating regulations focusing on lowering the energy consumption and Greenhouse Gas (GHG) emissions of refrigerators & freezers to lower their environmental impact. The European Commission (EC) mandates that regional manufacturers ensure their products carry the suitable energy rating label. In 2021, the EC introduced a new regulation, the Ecodesign Requirements of refrigerating appliances (EU) 2019/2019, which intends to support the circular economy by emphasizing refrigeration product repairability, easy disassembly, and recyclability.

Product innovation has been playing a constructive role in fueling market growth over the past few years. Present-day household equipment combines design aesthetics, energy efficiency, and temperature moderation to prevent food from spoiling. Modifications in compressor technologies and improved insulation have also helped drive the demand for state-of-the-art refrigeration equipment. Furthermore, innovations allow manual adjustment of the refrigerator's temperature as the various items require distinctive thermal conditions and humidity scales to increase their shelf life.

The emergence of the COVID-19 pandemic in 2020 brought about significant transformations in the market's underlying dynamics. The manufacturing sector experienced temporary production interruptions, and the logistics industry faced a deceleration, leading to a contraction in product sales during the year's initial months. Nevertheless, implementing stay-at-home mandates to mitigate the communal spread of the virus presented avenues for business expansion.

Structure Insights

The structure segment is categorized into freestanding and built-in. The freestanding structure held the largest market share of 57.6% in 2022. Freestanding refrigerators, commonly called standalone equipment, are the most common equipment. Since their inception, the products have witnessed several changes and enhancements in design and ergonomic features. These appliances can be relocated quickly, which helps resolve the complexity of maintenance, repair, and operations. Furthermore, the availability of various types of standalone refrigeration equipment in the market, ranging from the right and left hinge options to French doors to considerable depth to store items, ensures segment growth.

The built-in segment is projected to register the fastest CAGR of 5.2% over the forecast period. The rising trend of modular kitchen spaces is projected to supplement the segment's growth. Built-in appliances are gaining traction as they help users achieve upscale front panels that match other elements of a high-end kitchen. Furthermore, built-in refrigerators and freezers facilitate better kitchen movement as they require less space. However, built-in appliances are expensive, ranging from USD 5,000 to USD 10,000, while freestanding household refrigeration equipment usually costs between USD 1,000 and USD 3,000.

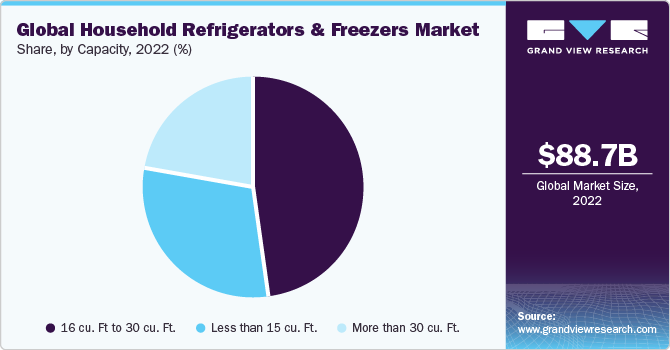

Capacity Insights

The 16 cu. Ft. to 30 cu. Ft. segment dominated the market with the highest revenue share of 48.3% in 2022. As households evolve and family sizes change, there is a growing need for larger storage capacities to accommodate groceries and perishable items. Larger families or those with diverse dietary preferences require more space to store food and beverages.

The more than 30 cu. Ft. segment is expected to grow at a significant CAGR over the forecast period. Higher usable capacity is often linked with more energy consumption patterns, directly impacting electricity bills. To prevent this, manufacturers are incorporating energy-efficiency features with larger capacities. For instance, most high-capacity refrigeration equipment features automatic energy-saving systems giving options to the consumers for switching off compressors when non-functional.

On the other hand, the 16 to 30 cu. Ft. segment accounted for the fastest CAGR of 5.1% over the forecast period. Storage capacity is a primary factor when purchasing household refrigerators & freezers. The majority of households worldwide require 4 to 6 cu. Ft. of storage space per adult. As the average family consists of three to four people, refrigerators with built-in freezers at mid-capacity ranges are preferred for home use due to the rising global trend of a nuclear family.

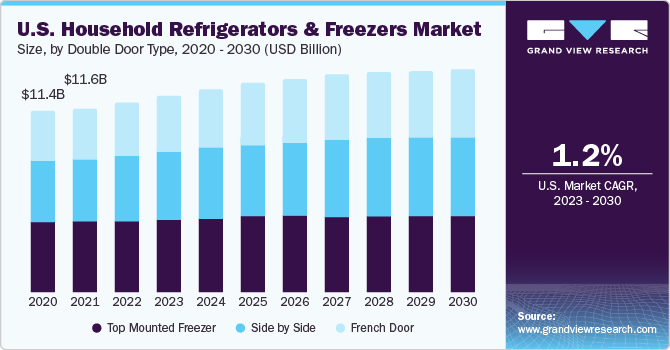

Door Type Insights

The door type segment is divided into single door and double door. The double door segment dominated the market with the highest revenue share of 69.0% in 2022 due to the high demand for products with several shelves, door bins, and adjustable freshness and temperature control features for the freezing compartment. The automatic frost-free cooling technology, one of the essential attributes of double-door designs, also favors the segment. Moreover, double door refrigerators offer more storage space with the systematic partition of compartments according to food and beverage items, making them more convenient and efficient.

The double door segment is divided into top-mounted freezers, side-by-side, and French doors. Among these, the French door segment is expected to grow fastest during the forecast period. French door designs have separate spaces to store groceries, beverages, and other food items and have freezers placed at the bottom, offering extra shelf space and wide-door bins compared to other refrigerators. This refrigeration equipment can assist in conserving energy by allowing easy access to smaller compartments while the others are closed.

The single-door segment is expected to witness significant growth of CAGR of 1.9% over the forecast period. Single-door refrigerators and freezers typically come cheaper than larger and more feature-rich models. This affordability makes them an attractive option for budget-conscious consumers, especially in price-sensitive markets.

Regional Insights

Asia Pacific dominated the global household refrigerators and freezers market with the largest revenue share of 36.5% in 2022. The region is a manufacturing hub featuring the presence of the headquarters of numerous leading market participants, such as Panasonic Corp., LG Electronics, Samsung, and Haier Group. In addition, rapid urbanization and government initiatives for the electrification of rural areas in developing countries, such as India, Nepal, Indonesia, the Philippines, and Bangladesh, will support regional market growth.

Led by the U.S., North America also accounted for a considerable market share in 2022 due to the region's early proliferation of advanced appliances. The rising usage of smart home automation products in the region boosts the demand for high-end appliances. Other factors contributing to the region's growth include a more extensive urban population base and the growing number of nuclear families.

The MEA is expected to grow at the fastest CAGR of 6.2% during the forecast period. Economic growth and increasing disposable income in the MEA region have led to higher consumer purchasing power. It has translated into greater demand for durable goods such as household appliances, refrigerators, and freezers.

Key Companies & Market Share Insights

The market is witnessing exponential growth worldwide, with numerous domestic and international companies operating globally. However, established players have a stronghold on the market owing to brand image, diverse product portfolios, and constant focus on innovations. Leading vendors also spend more on R&D activities to introduce modernized systems to help them attain a competitive edge in the market. These state-of-the-art features are digital temperature control to regularize optimal temperature, AI sensors to lower energy consumption, Internet of Things (IoT) connectivity to remotely monitor refrigerator temperature, and touch display panels. These customer-centric solutions add multiple benefits, such as simplifying daily tasks and keeping food items fresh longer.

Key players closely analyze the global market for collaboration opportunities to expand their businesses. Some key players are collaborating with technology providers to strengthen their product portfolio. For instance, in September 2022, LG Electronics introduced its revolutionary MoodUP refrigerator, showcasing innovative color-changing LED door panels. This product boasts mesmerizing color transitions on its door panels and includes an integrated speaker for playing music. Users can select from a palette of 22 colors for the upper panels and 19 for the lower ones.

Key Household Refrigerators And Freezers Companies:

- General Electric

- Dover Corporation

- AB Electrolux (publ)

- Haier Group

- LG Electronics

- LIEBHERR

- Robert Bosch GmbH

- Panasonic Holdings Corporation

- SAMSUNG

- Whirlpool Corporation

Recent Developments

-

In May 2023, Entergy Corporation initiated a novel recycling initiative aimed at residential customers to streamline the process of replacing outdated refrigerators or freezers. This initiative presents a convenient avenue for disposing of and recycling energy-inefficient refrigerators and freezers, effectively contributing to reducing energy expenses. Participants can receive a $25 incentive check for recycling their former appliance.

-

In March 2023, Blue Star Limited unveiled a fresh collection of deep freezers tailored for commercial users. This newly introduced line of deep freezers is produced at Blue Star's advanced Wada Plant, boasting an indigenous design that provides additional storage space and enhanced cooling capacity.

-

In January 2023, SAMSUNG introduced its 2023 lineup of Side-by-Side Refrigerators, entirely produced within India and tailored to the preferences of the Indian market. This new range results from extensive consumer insights and is equipped with distinctive features aimed at enhancing convenience and overall quality of life for consumers in India.

-

In February 2021, Blue Star Limited introduced a range of commercial refrigeration solutions tailored for vaccine storage and other essential purposes. This lineup includes meticulously crafted, temperature-controlled refrigerators and transporters. These products are vital in establishing a resilient ecosystem for efficient vaccine distribution within India.

Household Refrigerators And Freezers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 94.16 billion

Revenue forecast 2030

USD 124.80 billion

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Structure, capacity, door type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

General Electric; Dover Corporation; AB Electrolux (publ); Haier Group; LG Electronics; LIEBHERR; Robert Bosch GmbH; Panasonic Holdings Corporation; SAMSUNG; Whirlpool Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Household Refrigerators And Freezers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global household refrigerators and freezers marketreport on the basis of structure, capacity, door type, and region:

-

Structure Outlook (Revenue in USD Billion, 2017 - 2030)

-

Built-in

-

Freestanding

-

-

Capacity Outlook (Revenue in USD Billion, 2017 - 2030)

-

Less than 15 cu. Ft.

-

16 cu. Ft to 30 cu. Ft.

-

More than 30 cu. Ft.

-

-

Door Type Outlook (Revenue in USD Billion, 2017 - 2030)

-

Single Door

-

Double Door

-

Top Mounted Freezer

-

Side by Side

-

French Door

-

-

-

Regional Outlook (Revenue in USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global household refrigerators & freezers market size was estimated at USD 88.74 billion in 2022 and is expected to reach USD 94.16 billion by 2023.

b. The global household refrigerators & freezers market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 124.8 billion by 2030.

b. The Asia Pacific region accounted for the highest revenue share of 36.48% in 2022 and is expected to retain its dominance over the forecast period in the household refrigerators & freezers market.

b. Some key players operating in the household refrigerators & freezers market include LG Electronics, Haier Inc., Electrolux, Samsung, Whirlpool Corporation, and Robert Bosch GmbH.

b. Key factors that are driving the household refrigerators & freezers market growth include rising disposable income, availability of smart and energy-efficient refrigerator units, and widening base of nuclear families.

b. The double door segment accounted for the highest revenue share of more than 68% in 2022 in the household refrigerators & freezers market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."