- Home

- »

- IT Services & Applications

- »

-

Human Resource Professional Services Market, Industry Report, 2025GVR Report cover

![Human Resource Professional Services Market Size, Share & Trends Report]()

Human Resource Professional Services Market Size, Share & Trends Analysis Report By Type (Core HR, Recruiting, Talent Management), By Deployment (Hosted, On-premise), By Enterprise Size, By End Use, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-479-6

- Number of Pages: 183

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Technology

Report Overview

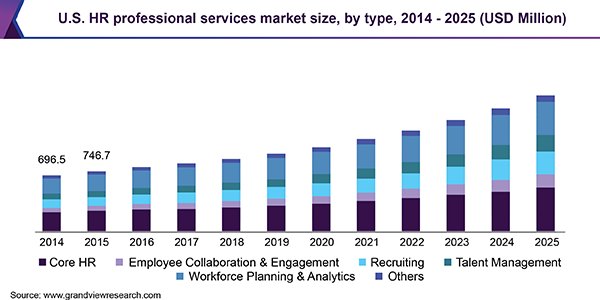

The global HR professional services market size was valued at USD 2.99 billion in 2017 and is expected to exhibit a CAGR of 12.4% during the forecast period. Growing preference for automating HR processes and integration of big data analytics and mobile technology into professional services are driving the market.

There is an increasing need for management of additional human resource activities such as strategic decision-making and aligning an organization’s goals, vision, and mission in line with HR functions. In order to dedicate additional time for decision-making and analysis, organizations prefer to opt for HR professional services for regular administrative human resource functions.

There have been significant advancements in big data analytics and Artificial Intelligence (AI) over the last decade. These technologies are being deployed by organizations for managing large volumes of human resource data and for gaining significant insights into the overall performance of an organization. Predictive analytics helps organizations in better decision-making and maximizing their capital by retaining human resources.

Increasing demand for flexibility in accessing data pertaining to leaves, attendance, work schedule, and training modules is expected to boost market growth over the forecast period. These services offer better communication, professional assistance, online access to personal data, and evaluation of employee performance.

Leading market players are constantly engaged in updating and modifying their services to maintain competitiveness, which is further creating new growth opportunities for market expansion. However, concerns regarding lack of expertise in advanced technologies, while implementing the latest solutions and offerings, are expected to hinder market growth over the forecast period.

Nevertheless, service providers are offering complete support for the implementation of HRM systems in an organization to make the transition more seamless and efficient. Several service providers are providing organizations with training sessions dedicated to ensuring efficient operation of HRM services and solutions.

Type Insights

The core HR segment was valued at USD 1.02 billion in 2017 and is expected to account for the dominant share in the overall market revenue during the forecast period. This is primarily due to the growing need of organizations to automate their business processes related to human resource functions. A majority of organizations implement core HR systems to carry out traditional human resource activities and offer adequate time to personnel and managers for strategic decision-making.

Talent management is projected to be the fastest-growing segment by type by 2025. Talent management services enhance workflow and help improve the overall productivity of an organization through career and succession planning, time and attendance tracking, and workforce and employee benefits management such as annual bonuses, leaves, and insurance. They also aid in improving employee retention.

Deployment Insights

On-premise deployment is expected to remain the most widely adopted method of deploying HR professional services. This deployment method allows largescale customization of products and services while increasing flexibility. Furthermore, it helps in improving cost-efficiency in terms of the total cost of ownership and setting up a control center in an organization for coordinating and managing various tasks of human resource management (HRM).

Hosted deployment is projected to emerge as the fastest-growing segment within the HR professional services market and is preferred by enterprises owing to advancements in technology and features. The significant benefit of this deployment method is that organizations using hosted services need not upgrade; service providers upgrade system software and services as and when required.

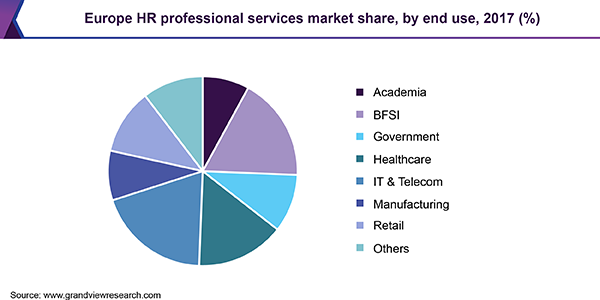

End-use Insights

The IT and telecom segment held the largest market share in 2017 and was valued at USD 586.7 million. An increase in efficiency of HRM capabilities of organizations can be attributed to the growth of the IT and telecom industry and integration of big data and machine learning into HR professional services. This is expected to further propel the segment over the forecast period.

The retail sector is expected to emerge as the fastest-growing end-use segment over the forecast period. The adoption of HR professional services allows retailers to focus on their core tasks while implementing improved HRM techniques. Furthermore, the rapid growth of the retail industry has resulted in largescale hiring of employees, which creates employee retention issues. Largescale hiring can lead to difficulties in efficiently managing a massive workforce in any organization. As a result, many employees often tend to switch their jobs if they are not satisfied with human resource services. These professional services are therefore being adopted to overcome these challenges associated with employee retention.

Enterprise Size Insights

Small and medium enterprises (SMEs) are anticipated to emerge as the fastest-growing segment with a CAGR of 14.0% over the forecast period. The number of SMEs operating in developing economies such as China, India, and Japan is increasing at a rapid pace and are increasingly implementing robust solutions to optimize their business capabilities.

Increasing government initiatives and various digital SME campaigns across the globe are expected to further drive the growth of this segment through 2025. Increasing implementation of information technology infrastructure by SMEs and automation of HR processes are expected to boost segment growth.

Regional Insights

North America dominated the global market in terms of revenue, valuing USD 1.08 billion in 2017. Growth of the region can be attributed to the concentration of multiple providers of HR professional services and solutions. Increasing complexities of business operations due to the increasing workforce are encouraging companies to automate basic human resource operations, thereby, increasing demand for these services in the region.

The Asia Pacific market was valued at USD 558.7 million in 2017 and is estimated to witness significant growth over the forecast period. Growth of the region can be attributed to increasing favorable government initiatives, especially in India, China, and Japan, to efficiently manage the workforce. Furthermore, increasing expenditure due to the implementation of the latest technologies by organizations for developing their businesses is predicted to contribute to market growth.

Key Companies & Market Share Insights

ADP, Inc.; Oracle Corporation; SAP SE; Ultimate Software; Workday, Inc.; IBM Corporation; Kronos, Inc.; Skillsoft; and Cornerstone On Demand, Inc. are some of the leading participants in the market. In August 2018, ADP acquired Celergo, a prominent provider of payroll management solutions. This strategic acquisition was aimed at enhancing ADP’s international payroll offerings.

Leading market players are focusing on strategic partnerships and acquisitions to boost their foothold in the industry. Moreover, they are collaborating with other organizations that are willing to automate and streamline their HR processes to gain a competitive edge. The players are also investing in new product development, research, and development activities, and product portfolio expansion to offer cost-effective and reliable service offerings.

Human Resource (HR) Professional Services Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 4.07 billion

Revenue forecast in 2025

USD 7.48 billion

Growth Rate

CAGR of 12.4% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, and region.

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; France; Germany; U.K.; Australia; China; Hong Kong; India; Japan; Singapore; Thailand; and Brazil

Key companies profiled

ADP, Inc.; Oracle Corporation; SAP SE; Ultimate Software; Workday, Inc.; IBM Corporation; Kronos, Inc.; Skillsoft; and Cornerstone On Demand, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global HR professional services market report based on type, deployment, enterprise size, end use, and region:

-

Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Core HR

-

Employee Collaboration & Engagement

-

Recruiting

-

Talent Management

-

Workforce Planning & Analytics

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2014 - 2025)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2014 - 2025)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2014 - 2025)

-

Academia

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

France

-

Germany

-

U.K.

-

-

Asia Pacific

-

Australia

-

China

-

Hong Kong

-

India

-

Japan

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."