- Home

- »

- Pharmaceuticals

- »

-

Hunter Syndrome Treatment Market Size, Share, Industry Report, 2026GVR Report cover

![Hunter Syndrome Treatment Market Size, Share & Trend Report]()

Hunter Syndrome Treatment Market Size, Share & Trend Analysis By Treatment (Enzyme Replacement Therapy, Hematopoietic Stem Cell Transplant), By Region, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-2-68038-743-8

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Industry Insights

The global Hunter syndrome treatment market size was valued at USD 864.9 million in 2018 and is expected to witness attractive growth over the forecast period. Introduction of novel therapies, robust product pipeline, rising government initiatives, and increasing awareness regarding Hunter syndrome and its available therapeutic options are expected to significantly fuel the market growth over the forecast period.

Hunter syndrome, also known as mucopolysaccharidosis type II (MPS II), is a rare genetic disorder caused by an iduronate-2-sulfatase enzyme deficiency. Presently, there is no permanent cure for Hunter syndrome. Existing treatment including enzyme replacement therapy (ERT) and hematopoietic stem cell transplantation (HSCT) focuses on providing symptomatic relief and management of complications associated with the disease progression.

According to the data published by the National Institute of Health (NIH) in 2018, Hunter syndrome affects around 1 in 160,000 males globally. The risk of developing this disease is far less among women because they inherit two X chromosomes and one of them can provide a functioning gene if the other X chromosome is defective. However, in men, there is no other X chromosome to compensate for the defective one.

Expected approval of novel therapies in late-phase clinical trials and increasing R&D activities by key players for the development of such novel therapies are anticipated to be two major factors driving the market growth in the near future. For instance, in June 2019, Denali Therapeutics Inc. received FDA’s Orphan Drug Designation (“ODD”) and Rare Pediatric Disease Designation for its pipeline drug candidate DNL310, which is being evaluated for the treatment of the disease.

Initiatives undertaken by various organizations for creating awareness regarding the disease diagnosis and its treatment is expected to support market growth over the forecast timeframe. For instance, in May 2018, Shire Plc. in collaboration with the National MPS Society and International MPS Network launched its third #FlyforMPS digital campaign aimed to increase awareness about.

Treatment Insights

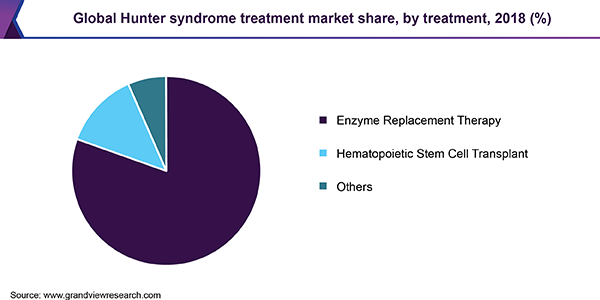

Based on treatment type, the market is categorized into enzyme replacement therapy (ERT), hematopoietic stem cell transplant (HSCT), and others. In 2018, the ERT segment accounted for the largest market share and is anticipated to hold onto its dominance over the forecast period. This is attributed to improved sales of Shire Plc’s ELAPRASE and potential for worldwide approval of GC Pharma’s product called Hunterase.

Shire Plc’s Elaprase (idursulfase) is the single major drug used for the treatment of Hunter syndrome, with GC Pharma’s Hunterase (idursulfase beta) being approved only in South Korea as of now. These drugs have addressed a significant unmet need. However, the high cost of these drugs is expected to be a major factor hindering their market growth. For instance, Idursulfase (Elaprase) drug costs around USD 3,100 per 6mg/3ml vial.

Regional Insights

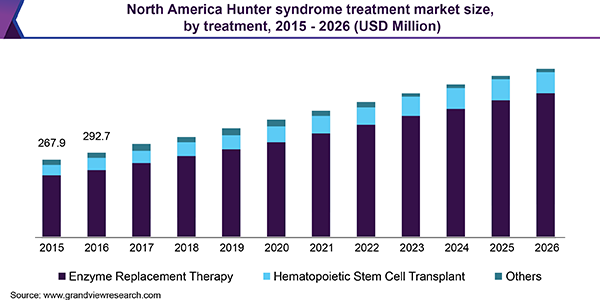

In 2018, North America dominated the market owing to favorable regulations for orphan drug development, rising awareness among people concerning rare diseases, increased funding for research activities and improved healthcare facilities. Furthermore, the favorable reimbursement policies for expensive drugs such as ELAPRASE in the U.S. have supported its adoption and fueled the regional growth.

Asia Pacific region is projected to exhibit a lucrative growth rate over the forecast period. Japan, China, and India are expected to emerge as potential countries for growth, owing to their high unmet needs in the market. Major players are focused on gaining approval for their novel therapies and are penetrating these markets to attain a major share. For instance, in July 2019, CANbridge Pharmaceuticals Inc. filed a New Drug Application (NDA) with the National Medical Products Administration (NMPA) for its novel treatment drug called Hunterase in China. Hunterase (idursulfase beta) is a patented therapy of GC Pharma indicated for the treatment of Hunter syndrome.

Hunter Syndrome Treatment Market Share Insights

Some of the key players in the market comprise Shire Plc. (Takeda Pharmaceutical Company); GC Pharma; JCR Pharmaceuticals Co Ltd.; RegenxBio Inc.; Sangamo Therapeutics, Inc.; ArmaGen Inc; Inventiva S.A.; Denali Therapeutics Inc.; Bioasis Technologies Inc.; and Esteve.

Currently, Shire Plc. (acquired by Takeda Pharmaceutical Company Limited in April 2019) is a prominent market player, with strong sales of its drug ELAPRASE, indicated for the treatment of Hunter syndrome. However, Shire plc is expected to face stiff competition from Green Cross (GC) Pharma over the forecast period. GC Pharma is emerging as a global player in the Hunter syndrome treatment market with its orphan drug, Hunterase.

GC Pharma is undertaking inorganic growth strategies such as partnerships and collaborations for the commercialization and geographical expansion of Hunterase. For instance, in April 2019, Clinigen Group plc and GC Pharma entered into an exclusive licensing agreement under which Clinigen gained the rights to commercialize Hunterase in Japan.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historic data

2015 - 2017

Forecast period

2019 - 2026

Market representation

Revenue in USD Million & CAGR from 2019 to 2026

Regional scope

North America, Europe, Asia Pacific, Latin America,Middle East & Africa

Country scope

U.S., Canada, UK, Germany, Spain, France, Italy, Russia, Japan, India, China, South Korea, Australia, Singapore, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented the global Hunter syndrome treatment market report on the basis of treatment and region:

-

Treatment Outlook (Revenue, USD Million, 2015 - 2026)

-

Enzyme Replacement Therapy (ERT)

-

Hematopoietic Stem Cell Transplant (HSCT)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2026)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."