- Home

- »

- Advanced Interior Materials

- »

-

HVAC Systems Market Size, Share & Growth Report, 2030GVR Report cover

![HVAC Systems Market Size, Share & Trends Report]()

HVAC Systems Market Size, Share & Trends Analysis Report By Equipment (Heat Pump, Air Purifier), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-641-7

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Advanced Materials

HVAC Systems Market Size & Trends

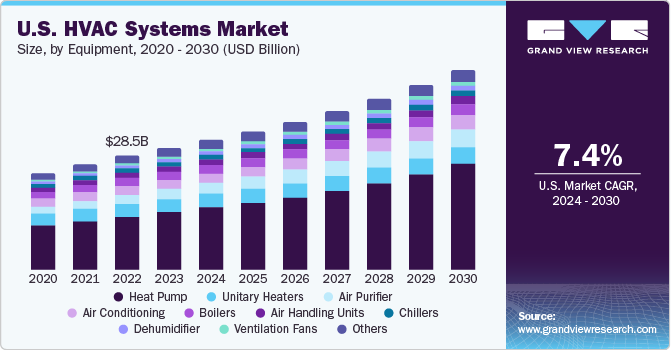

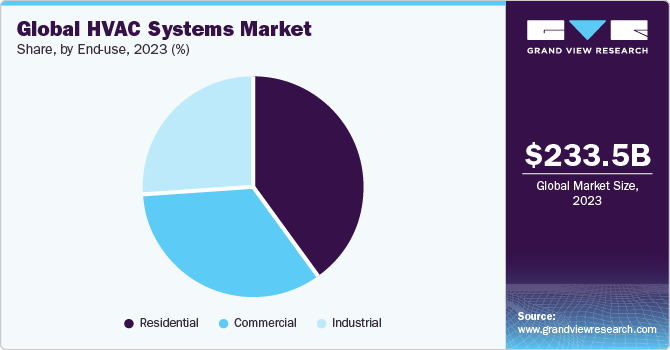

The global HVAC systems market size was estimated at USD 233.55 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030. The market growth is driven by the rising need for cost-effective and energy-efficient space cooling and heating applications in the commercial and industrial sectors. Furthermore, rising demand for the high seasonal coefficient of performance (SCOP) heating equipment, which can be efficient in both winter and summer, is expected to fuel the product demand. Moreover, the growing global population is increasing the requirements for affordable housing units and enhanced commercial infrastructure.

According to the United Nations, the global population is expected to reach 9.7 billion in 2050, exhibiting a growth of 2 billion in the next 30 years. This significant increase in the global population is facilitated by the improving standard of living of the masses, increasing lifespan, decreasing mortality rate, and ongoing advancements in medical technologies and medicines. As such, new housing projects are being launched worldwide. This is expected to positively impact market growth. Rapid urbanization coupled with increasing demand for energy-efficient products is expected to drive the demand for heat pumps in the residential sector. Favorable government initiatives and tax rebates offered on the installation of energy-saving products are expected to propel product demand.

For instance, the U.S. federal government extended the federal tax credit of 26% for residential ground-source heat pump installations up to 31st December 2022. This tax credit was lowered to 22% for systems that were installed in 2023. Moreover, the governments have set forth some standards that aim at the manufacturing of energy-efficient equipment, reducing environmental hazards & carbon footprints. In addition, several governments offer benefits to encourage the use of energy-efficient or renewable energy-based products. Moreover, the introduction of new HVAC regulations and standards or the updation of the existing ones in the U.S. is expected to positively impact market growth.

In January 2023, a new regulation related to energy efficiency SEER2 (Seasonal Energy Efficiency Ratio) was implemented in the U.S. The energy efficiency rating according to this regulation for heat pumps & air conditioners for northern states of the country has been changed to 14, while for southern states, it is 15. Moreover, the U.S. EPA is said to ban R-410 refrigerant in HVAC systems across the country by 2024 and promote the adoption of a new class of refrigerant, namely A2L in these systems by 2025. Such changes are expected to boost the replacement activities of existing HVAC systems with new ones or update them. This is anticipated to contribute to market growth.

Market Concentration & Characteristics

Market growth stage is high, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements. Moreover, companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Technological innovations are influencing the HVAC systems for better and optimum operations. The next-generation AI-based automated solutions for heating and cooling are likely to have a promising future. The market is characterized by a race toward highly intelligent, fully automatic, and ecologically sound HVAC systems. Installing Internet of Things (IoT) sensors on HVAC systems offers capabilities of real-time data recording and efficient functioning of HVAC systems. Smart HVAC incorporates IoT technology, which plays a significant role in enhancing the functioning and overall performance of HVAC (heating, ventilation, and air conditioning) systems.

The market is also characterized by a high level of product launch activities by leading players. This is due to several factors, including increasing the reach of their products in the market and enhancing the availability of their products & services in diverse geographical areas. Key players adopting this organic growth strategy include Carrier Corporation, Rheem Manufacturing Company, Hitachi Ltd., Daikin Industries, Ltd., and SAMSUNG.

Regulations play a pivotal role in shaping the market, influencing both its dynamics and evolution. Moreover, environmental regulations and sustainability concerns are driving changes in the market. Governments worldwide are implementing stricter standards for energy efficiency and refrigerant usage. The transition to eco-friendly refrigerants, such as hydrofluoroolefins (HFOs), is an example of the industry's response to regulatory pressures.

There is an increased emphasis on improving indoor air quality, particularly in commercial and residential buildings. HVAC systems are incorporating advanced air filtration, UV-C sterilization, and ventilation solutions to address IAQ concerns. For instance, high-efficiency particulate air (HEPA) filters and UV-C light systems are being integrated into HVAC setups to eliminate airborne contaminants.

Furthermore, the increasing focus on sustainable construction practices has a direct impact on the HVAC market. Green building certifications, such as LEED (Leadership in Energy and Environmental Design), encourage the adoption of energy-efficient HVAC systems. Ground-source heat pumps, solar-powered HVAC solutions, and other sustainable technologies are gaining traction.

Equipment Insights

The heat pump equipment segment led the market and accounted for a share of 37.8% in 2023. The demand for heat pumps is experiencing a notable surge driven by a growing emphasis on energy efficiency, environmental sustainability, and a shift toward renewable heating solutions. Heat pumps, which can both heat and cool spaces by transferring heat between the indoors and outdoors, are gaining popularity in residential, commercial, and industrial applications. Moreover, increasing focus on decarbonization and reducing greenhouse gas (GHG) emissions is bolstering product demand as they offer a cleaner alternative to traditional heating methods, such as fossil fuel-based systems.

The demand for air purifiers is witnessing a robust increase as concerns about indoor air quality and respiratory health grow worldwide. Driven by factors, such as rising pollution levels, allergens, and awareness of airborne viruses, consumers and businesses are increasingly investing in air purification technologies. Moreover, the COVID-19 pandemic has further accentuated the importance of clean indoor air, leading to a surge in demand for air purifiers in residential, commercial, and healthcare settings. As individuals prioritize well-being and cleaner living environments, the market continues to expand rapidly, with innovations in filtration technologies and smart features contributing to its growth.

End-use Insights

The residential segment registered lucrative growth from 2024 to 2030. An increase in multi-family and individual homeowners is creating avenues for the residential HVAC segment. Rapid urbanization, rising disposable incomes, and growing awareness of energy efficiency contribute to the increased demand for comfortable living environments. These factors are anticipated to fuel the adoption of HVAC systems, such as air-conditioning, air filtration, air purifiers, and dehumidifiers, over the forecast period. Commercial HVAC systems are bigger and more complex than residential HVAC units.

These systems are used in large places, such as shopping malls, airports, hotels, big restaurants, theaters, and other service sector companies. The growing number of commercial spaces, such as shopping malls, offices, theatres, and hotels, is anticipated to fuel product demand in the commercial sector. Many factors are considered while choosing a commercial HVAC system, such as air quality, building design, and energy efficiency. The type of commercial HVAC system that is acceptable may also be determined by the local climate. The budget and the lifespan of the system are additional factors to consider.

Regional Insights

Asia Pacific led the market and accounted for a share of 46.5% in 2023. Factors, such as improving economic conditions, rapid industrialization, and commercialization, are anticipated to have a positive impact on the market growth. Asia Pacific is characterized by the availability of skilled labor at low cost. The shift in the production bases to emerging economies, India, and China, is expected to positively influence the growth of the regional market.

Canada HVAC Systems Market

The market in Canada is driven by the flourishing construction industry in the country. The growth of the construction industry in Canada can be attributed to the increasing demand for residential, commercial, and industrial spaces. The Government of Canada intends to spend USD 22.1 billion on social infrastructure development projects and residential building construction activities until 2027. Moreover, the government of the country is projected to invest USD 142.9 billion in infrastructure development projects over 12 years till 2028 under its ‘Investing in Canada’ program. These factors are anticipated to drive product demand in Canada over the forecast period.

France HVAC Systems Market

The market in France is expected to witness growth in the coming years owing to increasing emphasis on energy efficiency. The government has implemented and continues to reinforce regulations to reduce energy consumption and promote sustainable practices in buildings. These regulations influence the demand for HVAC systems that meet high energy efficiency standards. For instance, the French regulatory framework includes the RT2012 (Réglementation Thermique 2012), which sets energy performance standards for new buildings. Compliance with these regulations often requires the installation of advanced HVAC systems with a focus on efficiency.

China HVAC Systems Market

The market in China is expected to witness growth in the coming years owing to government initiatives and subsidiary plans. For instance, in China, subsidies under the Air Pollution Prevention and Control Action Plan are helping reduce the upfront installation and equipment costs. China’s Ministry of Environmental Protection established financial subsidies ranging from USD 1,100 to 4,350 for households buying air-source heat pumps in 2020 in Shanxi, Shandong, Beijing, Hebei, and Tianjin. Furthermore, the government has implemented the National New-type Urbanization Plan 2014-2020 to manage excessive growth in urban areas. The growth in the construction industry is facilitating high demand for the installation of HVAC systems. Various demographic factors, such as rising population and increasing standards of living owing to rapid urbanization, are expected to drive the construction industry’s growth.

Brazil HVAC Systems Market

The market growth in Brazil is driven by rising investments in the technology and IT sector. For instance, in November 2023, John Deere invested USD 180 million to develop the technology center. In October 2023, Boeing opened its engineering & technology center in Brazil. Hence, with the increasing influx of FDIs and technology centers, the demand for HVAC systems is anticipated to increase over the forecast period.

Saudi Arabia HVAC Systems Market

The market in Saudi Arabia is experiencing significant growth driven by factors, such as rapid urbanization, increased construction activities, and a focus on energy-efficient solutions. With the extreme climatic conditions in the region, there is a high demand for both heating and cooling systems. The adoption of advanced HVAC technologies, such as variable refrigerant flow systems and energy-efficient air conditioning units, is on the rise. In addition, government initiatives promoting sustainable practices and stringent building codes contribute to the market's expansion. The regional market is characterized by a growing emphasis on smart and connected systems to enhance overall energy efficiency, reflecting a broader trend towards modern and sustainable building practices in the region.

Key HVAC Systems Company Insights

To increase market penetration and cater to changing technological requirements from various end-uses, such as residential, commercial, and industrial, product manufacturers use a variety of strategies, such as joint ventures, mergers, acquisitions, new product launches, and geographical expansions. Manufacturers are undertaking strategic acquisitions to gain an edge in the industry and increase their geographic presence.

For instance, in May 2023, Carrier Corporation introduced i-Vu Pro v8.5 for upgrading controller firmware, improving serviceability for customers, and reducing downtime of connected HVAC equipment. The latest enhancements are expected to help customers with Internet of Things (IoT) connectivity, robust security, and leading serviceability features. Furthermore, in February 2022, Johnson Controls, Inc. launched commercial rooftop units (RTUs) with series, such as Johnson Controls, YORK, and TempMASTER. These products are certified by the DOE 2023 efficiency standards.

Key HVAC systems Companies:

The following are the leading companies in the HVAC systems market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these HVAC systems companies are analyzed to map the supply network.

- Carrier Corporation

- Daikin Industries, Ltd.

- Fujitsu

- Haier Group

- Havells India Ltd.

- Hitachi Ltd.

- Johnson Controls

- LG Electronics

- Lennox International Inc.

- Mitsubishi Electric Corporation

- Rheem Manufacturing Company

- SAMSUNG

- Trane

Recent Developments

-

In February 2023, Lennox International launched packaged rooftop units with the introduction of Xion and Enlight product lines. These new products reduce environmental impact by offering exceptional efficiency, sustainable design, and efficient service

-

In January 2023, Trane launched the new AirfinityS rooftop air-to-air heat pump systems with variable speed compressors, adaptive frequency drive, and low GWP R-454B refrigerant

-

SAMSUNG announced a new range of WindFree AC. It involves AI technology that auto-cools the surroundings by reducing energy consumption by 77%. Furthermore, it has a motion detector sensor, voice control, and welcome cooling. Some of the models of this AC have an in-built air purifier that filters PM2.5 particles

HVAC Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 249.37 billion

Revenue forecast in 2030

USD 382.66 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, end-use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Latvia; China; Japan; India; South Korea; Australia; Argentina; Brazil; Saudi Arabia; South Africa

Key companies profiled

Carrier Corporation; Daikin Industries, Ltd.; Fujitsu; Haier Group; Havells India Ltd.; Hitachi Ltd.; Johnson Controls; LG Electronics; Lennox International Inc.; Mitsubishi Electric Corporation; Rheem Manufacturing Company; SAMSUNG; Trane

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HVAC Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the HVAC systems market report based on equipment, end-use, and region:

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Heat Pump

-

Furnace

-

Unitary Heaters

-

Boilers

-

Air Purifier

-

Dehumidifier

-

Air Handling Units

-

Ventilation Fans

-

Air Conditioning

-

Chillers

-

Cooling Towers

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Latvia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global HVAC systems market size was estimated at USD 233.55 billion in 2023 and is expected to be USD 249.37 billion in 2024.

b. The HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 382.66 billion by 2030.

b. Residential segment dominated the global HVAC systems market.

Which region held the largest share in the Heating, Ventilation and Air conditioning Systems Market?b. Asia Pacific led the market and accounted for 46.5% of the global revenue share in 2023. Factors such as improving economic conditions, rapid industrialization, and commercialization are anticipated to have a positive impact on the HVAC systems market growth.

b. The market is driven by the rising need for cost-effective and energy-efficient space cooling and heating applications in commercial and industrial sectors. Furthermore, rising demand for the high seasonal coefficient of performance (SCOP) heating equipment, which can be efficient in both winter and summer, is expected to fuel the product demand over the forecast period.

b. Some of the key players operating in the global HVAC systems market include Carrier Corporation; Daikin Industries, Ltd.; Emerson Electric Co.; Hitachi Ltd.; Johnson Controls International plc; Lennox International, Inc.; Trane Technologies

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. HVAC Systems Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Concentration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Raw Material Outlook

3.3.2. Manufacturing Outlook

3.3.3. Distribution Outlook

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Challenge Analysis

3.5.4. Market Opportunity Analysis

3.6. Industry Analysis Tools

3.6.1. Porter’s Five Forces Analysis

3.6.2. Macro-environmental Analysis

3.7. Economic Mega Trend Analysis

3.7.1. COVID-19 Impact Analysis

3.7.2. Russia-Ukraine War

Chapter 4. HVAC Systems Market: Equipment Estimates & Trend Analysis

4.1. Equipment Movement Analysis & Market Share, 2023 & 2030

4.2. HVAC Systems Market Estimates & Forecast, By Equipment, 2018 to 2030 (USD Billion)

4.3. Heat Pump

4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.4. Furnace

4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.5. Unitary Heaters

4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.6. Boilers

4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.7. Air Purifier

4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.8. Dehumidifier

4.8.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.9. Air Handling Units

4.9.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.10. Ventilation Fans

4.10.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.11. Air Conditioning

4.11.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.12. Chillers

4.12.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.13. Cooling Towers

4.13.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.14. Others

4.14.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

Chapter 5. HVAC Systems Market: End-use Estimates & Trend Analysis

5.1. End-use Movement Analysis & Market Share, 2023 & 2030

5.2. HVAC Systems Market Estimates & Forecast, By End-use, 2018 to 2030 (USD Billion)

5.3. Residential

5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.4. Commercial

5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.5. Industrial

5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

Chapter 6. HVAC Systems Market: Regional Estimates & Trend Analysis

6.1. Regional Movement Analysis & Market Share, 2023 & 2030

6.2. North America

6.2.1. North America HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.2.2. North America HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.2.3. North America HVAC Systems Market Estimates & Forecast, By End-use, 2018 - 2030 (USD Billion)

6.2.4. U.S.

6.2.4.1. Key country dynamics

6.2.4.2. U.S. HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.2.4.3. U.S. HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.2.4.4. U.S. HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.2.5. Canada

6.2.5.1. Key country dynamics

6.2.5.2. Canada HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.2.5.3. Canada HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.2.5.4. Canada HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.2.6. Mexico

6.2.6.1. Key country dynamics

6.2.6.2. Mexico HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.2.6.3. Mexico HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.2.6.4. Mexico HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.3. Europe

6.3.1. Europe HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.3.2. Europe HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.3. Europe HVAC Systems Market Estimates & Forecast, By End-use, 2018 - 2030 (USD Billion)

6.3.4. UK

6.3.4.1. Key country dynamics

6.3.4.2. UK HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.4.3. UK HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.4.4. UK HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.3.5. Germany

6.3.5.1. Key country dynamics

6.3.5.2. Germany HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.5.3. Germany HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.5.4. Germany HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.3.6. France

6.3.6.1. Key country dynamics

6.3.6.2. France HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.6.3. France HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.6.4. France HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.3.7. Spain

6.3.7.1. Key country dynamics

6.3.7.2. Spain HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.7.3. Spain HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.7.4. Spain HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.3.8. Italy

6.3.8.1. Key country dynamics

6.3.8.2. Italy HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.8.3. Italy HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.8.4. Italy HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.3.9. Latvia

6.3.9.1. Key country dynamics

6.3.9.2. Latvia HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.3.9.3. Latvia HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.3.9.4. Latvia HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.3.9.5.

6.4. Asia Pacific

6.4.1. Asia Pacific HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.4.2. Asia Pacific HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.3. Asia Pacific HVAC Systems Market Estimates & Forecast, By End-use, 2018 - 2030 (USD Billion)

6.4.4. China

6.4.4.1. Key country dynamics

6.4.4.2. China HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.4.3. China HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.4.4. China HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.4.5. India

6.4.5.1. Key country dynamics

6.4.5.2. India HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.5.3. India HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.5.4. India HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.4.6. Japan

6.4.6.1. Key country dynamics

6.4.6.2. Japan HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.6.3. Japan HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.6.4. Japan HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.4.7. South Korea

6.4.7.1. Key country dynamics

6.4.7.2. South Korea HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.7.3. South Korea HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.7.4. South Korea HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.4.8. Australia

6.4.8.1. Key country dynamics

6.4.8.2. Australia HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.4.8.3. Australia HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.4.8.4. Australia HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.5. Central & South America

6.5.1. Central & South America HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.5.2. Central & South America HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.5.3. Central & South America HVAC Systems Market Estimates & Forecast, By End-use, 2018 - 2030 (USD Billion)

6.5.4. Brazil

6.5.4.1. Key country dynamics

6.5.4.2. Brazil HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.5.4.3. Brazil HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.5.4.4. Brazil HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.5.5. Argentina

6.5.5.1. Key country dynamics

6.5.5.2. Argentina HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.5.5.3. Argentina HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.5.5.4. Argentina HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.5.6. Chile

6.5.6.1. Key country dynamics

6.5.6.2. Chile HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.5.6.3. Chile HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.5.6.4. Chile HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.6. Middle East & Africa

6.6.1. Middle East & Africa HVAC Systems Market Estimates & Forecast, 2018 - 2030 (USD Billion)

6.6.2. Middle East & Africa HVAC Systems Market Estimates & Forecast, By Equipment, 2018 - 2030 (USD Billion)

6.6.3. Middle East & Africa HVAC Systems Market Estimates & Forecast, By End-use, 2018 - 2030 (USD Billion)

6.6.4. Saudi Arabia

6.6.4.1. Key country dynamics

6.6.4.2. Saudi Arabia HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.6.4.3. Saudi Arabia HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.6.4.4. Saudi Arabia HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

6.6.5. South Africa

6.6.5.1. Key country dynamics

6.6.5.2. South Africa HVAC systems market estimates & forecast, 2018 - 2030 (USD Billion)

6.6.5.3. South Africa HVAC systems market estimates & forecast, By Equipment, 2018 - 2030 (USD Billion)

6.6.5.4. South Africa HVAC systems market estimates & forecast, By End-use, 2018 - 2030 (USD Billion)

Chapter 7. HVAC Systems Market - Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Market Share Analysis, 2023

7.4. Company Market Positioning

7.5. Competitive Dashboard Analysis

7.6. Company Heat Map Analysis, 2023

7.7. Strategy Mapping

7.7.1. Expansion

7.7.2. Mergers & Acquisition

7.7.3. Partnerships & Collaborations

7.7.4. New Product Launches

7.7.5. Research And Development

7.8. Company Profiles

7.8.1. Carrier Corporation

7.8.1.1. Participant’s overview

7.8.1.2. Financial performance

7.8.1.3. Product benchmarking

7.8.1.4. Recent developments

7.8.2. Daikin Industries, Ltd.

7.8.2.1. Participant’s overview

7.8.2.2. Financial performance

7.8.2.3. Product benchmarking

7.8.2.4. Recent developments

7.8.3. Fujitsu

7.8.3.1. Participant’s overview

7.8.3.2. Financial performance

7.8.3.3. Product benchmarking

7.8.3.4. Recent developments

7.8.4. Haier Group

7.8.4.1. Participant’s overview

7.8.4.2. Financial performance

7.8.4.3. Product benchmarking

7.8.4.4. Recent developments

7.8.5. Havells India Ltd.

7.8.5.1. Participant’s overview

7.8.5.2. Financial performance

7.8.5.3. Product benchmarking

7.8.5.4. Recent developments

7.8.6. Hitachi Ltd.

7.8.6.1. Participant’s overview

7.8.6.2. Financial performance

7.8.6.3. Product benchmarking

7.8.6.4. Recent developments

7.8.7. Johnson Controls

7.8.7.1. Participant’s overview

7.8.7.2. Financial performance

7.8.7.3. Product benchmarking

7.8.7.4. Recent developments

7.8.8. LG Electronics

7.8.8.1. Participant’s overview

7.8.8.2. Financial performance

7.8.8.3. Product benchmarking

7.8.8.4. Recent developments

7.8.9. Lennox International Inc.

7.8.9.1. Participant’s overview

7.8.9.2. Financial performance

7.8.9.3. Product benchmarking

7.8.9.4. Recent developments

7.8.10. Mitsubishi Electric Corporation

7.8.10.1. Participant’s overview

7.8.10.2. Financial performance

7.8.10.3. Product benchmarking

7.8.10.4. Recent developments

7.8.11. Rheem Manufacturing Company

7.8.11.1. Participant’s overview

7.8.11.2. Financial performance

7.8.11.3. Product benchmarking

7.8.11.4. Recent developments

7.8.12. SAMSUNG

7.8.12.1. Participant’s overview

7.8.12.2. Financial performance

7.8.12.3. Product benchmarking

7.8.12.4. Recent developments

7.8.13. Trane

7.8.13.1. Participant’s overview

7.8.13.2. Financial performance

7.8.13.3. Product benchmarking

7.8.13.4. Recent developments

7.8.14. Emerson Electric Co.

7.8.14.1. Participant’s overview

7.8.14.2. Financial performance

7.8.14.3. Product benchmarking

7.8.14.4. Recent developments

7.8.15. Nortek Air Managment

7.8.15.1. Participant’s overview

7.8.15.2. Financial performance

7.8.15.3. Product benchmarking

7.8.15.4. Recent developments

List of Tables

Table 1 Global HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 2 Global HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 3 Global HVAC systems market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 4 North America HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 5 North America HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 6 U.S. Macroeconomic Outlay

Table 7 U.S. HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 8 U.S. HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 9 Canada Macroeconomic Outlay

Table 10 Canada HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 11 Canada HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 12 Mexico Macroeconomic Outlay

Table 13 Mexico HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 14 Mexico HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 15 Europe HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 16 Europe HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 17 UK Macroeconomic Outlay

Table 18 UK HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 19 UK HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 20 Germany Macroeconomic Outlay

Table 21 Germany HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 22 Germany HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 23 France Macroeconomic Outlay

Table 24 France HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 25 France HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 26 Spain Macroeconomic Outlay

Table 27 Spain HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 28 Spain HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 29 Italy Macroeconomic Outlay

Table 30 Italy HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 31 Italy HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 32 Latvia Macroeconomic Outlay

Table 33 Latvia HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 34 Latvia HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 35 Asia Pacific HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 36 Asia Pacific HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 37 China Macroeconomic Outlay

Table 38 China HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 39 China HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 40 India Macroeconomic Outlay

Table 41 India HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 42 India HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 43 Japan Macroeconomic Outlay

Table 44 Japan HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 45 Japan HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 46 South Korea Macroeconomic Outlay

Table 47 South Korea HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 48 South Korea HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 49 Australia Macroeconomic Outlay

Table 50 Australia HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 51 Australia HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 52 Central & South America HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 53 Central & South America HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 54 Brazil Macroeconomic Outlay

Table 55 Brazil HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 56 Brazil HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 57 Argentina Macroeconomic Outlay

Table 58 Argentina HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 59 Argentina HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 60 Middle East & Africa HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 61 Middle East & Africa HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 62 Saudi Arabia Macroeconomic Outlay

Table 63 Saudi Arabia HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 64 Saudi Arabia HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 65 South Africa Macroeconomic Outlay

Table 66 South Africa HVAC systems market estimates and forecasts by equipment, 2018 - 2030 (USD Billion)

Table 67 South Africa HVAC systems market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot

Fig. 8 Competitive Landscape Snapshot

Fig. 9 HVAC Systems Market Value, 2023 (USD Billion)

Fig. 10 Market Concentration & Growth Prospect Mapping

Fig. 11 Value Chain Analysis

Fig. 12 HVAC Systems: Market Dynamics

Fig. 13 HVAC Systems Market: PORTER’s Analysis

Fig. 14 HVAC Systems Market : PESTEL Analysis

Fig. 15 Impact Of COVID-19 On GDP, 2021 vs 2019

Fig. 16 Real GDP Compared To Pre-Pandemic Levels (%), 2019 - 2023

Fig. 17 Impact Of Russia-Ukraine War On Inflation (%), 2022-2023

Fig. 18 HVAC Systems Market, By Product: Key Takeaways

Fig. 19 HVAC Systems Market: Product Movement Analysis & Market Share, 2023 & 2030

Fig. 20 Heat Pump Protection Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 21 Furnace Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 22 Unitary Heaters Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 23 Boilers Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 24 Air Purifier Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 25 Dehumidifier Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 26 Air Handling Units Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 27 Ventilation Fans Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 28 Air Conditioning Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 29 Chillers Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 30 Cooling Towers Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 31 Other Products Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Fig. 32 HVAC Systems Market, By End-use: Key Takeaways

Fig. 33 HVAC Systems Market: End-use Movement Analysis & Market Share, 2023 & 2030

Fig. 34 HVAC Systems Market Estimates And Forecasts, In Residential, 2018 - 2030 (USD Billion)

Fig. 35 Global Value Of Construction, 2020-2022 (USD Trillion)

Fig. 36 HVAC Systems Market Estimates And Forecasts, In Commercial, 2018 - 2030 (USD Billion)

Fig. 37 HVAC Systems Market Estimates And Forecasts, In Industrial, 2018 - 2030 (USD Billion)

Fig. 38 HVAC Systems Market Revenue, By Region, 2023 & 2030 (USD Billion)

Fig. 39 Region Marketplace: Key Takeaways

Fig. 40 Region Marketplace: Key Takeaways

Fig. 41 North America HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 42 North America HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 43 North America HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 44 U.S. HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 45 U.S. HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 46 U.S. HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 47 Canada HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Canada HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 49 Canada HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 50 Mexico HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 51 Mexico HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 52 Mexico HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 53 Europe HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 Europe HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 55 Europe HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 56 UK HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 UK HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 58 UK HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 59 Germany HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 Germany HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 61 Germany HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 62 France HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 France HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 64 France HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 65 Spain HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 Spain HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 67 Spain HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 68 Italy HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 69 Italy HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 70 Italy HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 71 Latvia HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 72 Latvia HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 73 Latvia HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 74 Asia Pacific HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 75 Asia Pacific HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 76 Asia Pacific HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 77 China HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 78 China HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 79 China HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 80 India HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 81 India HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 82 India HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 83 Japan HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 84 Japan HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 85 Japan HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 86 South Korea HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 87 South Korea HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 88 South Korea HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 89 Australia HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 90 Australia HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 91 Australia HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 92 Central & South America HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 93 Central & South America HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 94 Central & South America HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 95 Brazil HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 96 Brazil HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 97 Brazil HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 98 Argentina HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 99 Argentina HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 100 Argentina HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 101 Middle East & Africa HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 102 Middle East & Africa HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 103 Middle East & Africa HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 104 Saudi Arabia HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 105 Saudi Arabia HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 106 Saudi Arabia HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 107 South Africa HVAC Systems Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 108 South Africa HVAC Systems Market Estimates & Forecasts, by Equipment, 2018 - 2030 (USD Billion)

Fig. 109 South Africa HVAC Systems Market Estimates & Forecasts, by End-use, 2018 - 2030 (USD Billion)

Fig. 110 Key Company/Competition Categorization

Fig. 111 Competitive Dashboard Analysis

Fig. 112 Company Market Positioning

Fig. 113 Company Market Share Analysis, 2023

Fig. 114 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- HVAC Systems Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- HVAC Systems End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Residential

- Commercial

- Industrial

- HVAC Systems Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- North America HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- U.S.

- U.S. HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- U.S. HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- U.S. HVAC Systems Market, By Equipment

- Canada

- Canada HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Canada HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Canada HVAC Systems Market, By Equipment

- Mexico

- Mexico HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Mexico HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Mexico HVAC Systems Market, By Equipment

- North America HVAC Systems Market, By Equipment

- Europe

- Europe HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Europe HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- UK

- UK HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- UK HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- UK HVAC Systems Market, By Equipment

- Germany

- Germany HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Germany HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Germany HVAC Systems Market, By Equipment

- France

- France HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- France HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- France HVAC Systems Market, By Equipment

- Spain

- Spain HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Spain HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Spain HVAC Systems Market, By Equipment

- Italy

- Italy HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Italy HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Italy HVAC Systems Market, By Equipment

- Latvia

- Latvia HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Latvia HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Latvia HVAC Systems Market, By Equipment

- Europe HVAC Systems Market, By Equipment

- Asia Pacific

- Asia Pacific HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Asia Pacific HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- China

- China HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- China HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- China HVAC Systems Market, By Equipment

- India

- India HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- India HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- India HVAC Systems Market, By Equipment

- Japan

- Japan HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Japan HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Japan HVAC Systems Market, By Equipment

- South Korea

- South Korea HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- South Korea HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- South Korea HVAC Systems Market, By Equipment

- Australia

- Australia HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Australia HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Australia HVAC Systems Market, By Equipment

- Asia Pacific HVAC Systems Market, By Equipment

- Central & South America

- Central & South America HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Central & South America HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Brazil

- Brazil HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Brazil HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Brazil HVAC Systems Market, By Equipment

- Argentina

- Argentina HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Argentina HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Argentina HVAC Systems Market, By Equipment

- Central & South America HVAC Systems Market, By Equipment

- Middle East & Africa

- Middle East & Africa HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Middle East & Africa HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Saudi Arabia

- Saudi Arabia HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- Saudi Arabia HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- Saudi Arabia HVAC Systems Market, By Equipment

- South Africa

- South Africa HVAC Systems Market, By Equipment

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Air Conditioning

- Chillers

- Cooling Towers

- Others

- South Africa HVAC Systems Market, By End-use

- Residential

- Commercial

- Industrial

- South Africa HVAC Systems Market, By Equipment

- Middle East & Africa HVAC Systems Market, By Equipment

- North America

HVAC Systems Market Dynamics

Driver: Growing Real Estate Sector

Real-estate industry is one of the main consumers of HVAC systems. The industry comprises four sub-sectors -housing, retail, commercial, and hospitality. The growing demand real-estate owing to rapid urbanization, increasing need for office space, growth of the corporate environment, and semi-urban & public accommodations. The market is primarily driven by factors such as rising population, growing industrial & commercial units, and developments in the residential markets. Furthermore, the demand for HVAC in the construction industry across the Asia Pacific and South America is also expected to increase owing to rising demographic demands and government support. For instance, in February 2021, the Indian Government granted USD 545.81 billion to the Ministry of Housing and Urban Affairs in the 2021 Budget. Rise in new construction activities provides avenues for new AC installations, subsequently driving the market growth. With the increasing disposable income, consumers are looking to improve their lifestyle by enhancing comfort and convenience by adopting new smart HVAC systems. Thus, the growth of real estate industry is anticipated to boost the growth of the HVAC market.

Driver: Increasing Replacements and Refurbishment Demand For HVAC Systems

Growing technological advancements in the HVAC industry such as the integration of IoT, improved energy efficiency, hybrid technology, etc. lead to improved performance, reduced cost, and increased energy efficiency. The need to replace old HVAC systems with new and advanced HVAC systems to deliver higher energy efficiency and performance is anticipated to boost market growth in the coming years. The utmost prominent factors for replacement of HVAC unit are the age of the system, building remodeling, poor air quality, and high cost of repair. Furthermore, remodeling of commercial, industrial, or residential buildings can lead to a replacement of the HVAC unit due to the possibility of the interruption in the airflow of HVAC systems and increasing running costs. This need for remodeling HVAC system is anticipated to drive market growth.

Restraint: High Installation Cost And Maintenance

The high initial cost of the HVAC system is predicted to hamper market growth. The average life of HVAC systems is about 13 years with proper maintenance. This maintenance includes frequent cleaning to remove any sediment and dust settled on the filters to avoid damage, which can lead to the failure of the entire system. Thus, such initial high cost and maintenance cost is projected to hamper market growth.

What Does This Report Include?

This section will provide insights into the contents included in this HVAC systems market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

HVAC systems market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

HVAC systems market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the HVAC systems market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for HVAC systems market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of HVAC systems market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

HVAC Systems Market Categorization:

The HVAC systems market was categorized into three segments, namely product (Heating, Ventilation, Cooling), end-use (Residential, Commercial, Industrial), and region (North America, Europe, Asia Pacific, South America, and Middle East & Africa).

Segment Market Methodology:

The HVAC systems market was segmented into product, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The HVAC systems market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into seventeen countries, namely, the U.S.; Canada; Mexico; the UK; Germany; France; Spain; Italy; Latvia; China; India; Japan; South Korea; Australia; Brazil; Argentina; Chile.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

HVAC systems market companies & financials:

The HVAC systems market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Carrier Corporation - Carrier was founded in 1915 and it is an American multinational heating, ventilation, and air conditioning (HVAC), refrigeration, and fire and security equipment corporation based in Palm Beach Gardens, Florida.

-

Daikin Industries, Ltd. - Daikin Industries Ltd was founded in 1924 as Ōsaka Metalworking Industries LP. In 1963 the company was renamed Daikin Industries, Ltd. In 2006, Daikin Industries acquired McQuay International, a Minneapolis, MN-based global corporation that designs, manufactures and sells commercial, industrial and institutional heating, ventilation and air conditioning (HVAC) products.

-

Emerson Electric Co. - Emerson Electric Co. is an American multinational corporation headquartered in Ferguson, Missouri. The Fortune 500 company manufactures products and provides engineering services for industrial, commercial, and consumer markets. Emerson has approximately 86,700 employees and 170 manufacturing locations.

-

Haier Group Corporation - Haier Group Corporation is a Chinese multinational home appliances and consumer electronics company headquartered in Qingdao, Shandong. It designs, develops, manufactures and sells products including refrigerators, air conditioners, washing machines, dryers, microwave ovens, mobile phones, computers, and televisions.

-

Johnson Controls International plc - Johnson Controls International is an American, Irish-domiciled multinational conglomerate headquartered in Cork, Ireland, that produces fire, HVAC, and security equipment for buildings. As of mid-2019, it employed 105,000 people in around 2,000 locations across six continents.

-

L.G. Electronics - LG Corporation, formerly known as Lucky-Goldstar, is a South Korean multinational conglomerate founded by Koo In-hwoi and managed by successive generations of his family. It is the fourth-largest chaebol in South Korea. Its headquarters are in the LG Twin Towers building in Yeouido-dong, Seoul.

-

Lennox International, Inc. - Lennox International Inc. is a provider of climate control products for the heating, ventilation, air conditioning, and refrigeration markets. The company is based outside Dallas, Texas in the United States and has operations globally. The company was founded in 1895, in Marshalltown, Iowa, by Dave Lennox, the owner of a machine repair business for railroads. Inventors Ezra William Smith and Ernest Bryant brought their idea for a riveted steel coal-fired furnace to his machine shop to build parts for a prototype.

-

Mitsubishi Electric U.S. Inc. - Mitsubishi Electric is one of the world's leading names in the manufacture and sales of electrical and electric products and systems used in a broad range of fields and applications. As a global, leading green company, we're applying our technologies to contribute to society and daily life around the world.

-

Rheem Manufacturing Company - Rheem Manufacturing Company is an American privately held manufacturer that produces residential and commercial water heaters and boilers, as well as heating, ventilating and air conditioning equipment. The company also produces and sells products under the Ruud brand name. It is an independent subsidiary of Paloma Industries.What became Rheem started in 1925 as a supplier of packaging to the petroleum industry, and is currently headquartered in Atlanta, Georgia in the United States.

-

Trane Technologies - Trane Technologies is an American manufacturing company focused on heating, ventilation, and air conditioning (HVAC) and refrigeration systems. The company traces its corporate history back more than 150 years and was created after a series of mergers and spin-offs. In 2008, HVAC manufacturer Trane was acquired by Ingersoll Rand, a US industrial tools manufacturer. In 2020, the tools business was spun off as Ingersoll Rand and the remaining company was renamed Trane Technologies.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

HVAC Systems Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2022, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

HVAC Systems Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-