- Home

- »

- Medical Devices

- »

-

Hyaluronic Acid Raw Material Market Size, Share Report 2030GVR Report cover

![Hyaluronic Acid Raw Material Market Size, Share & Trends Report]()

Hyaluronic Acid Raw Material Market Size, Share & Trends Analysis Report By Application (Ophthalmology, Orthopedics), By Source (Non-Animal, Animal), By Grade, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-431-4

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global hyaluronic acid raw material market size was estimated at USD 6.61 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The market is anticipated to increase due to the enlarging aging population and the introduction of technologically advanced products enabling localized drug delivery. In addition, the growing number of aesthetic procedures in various countries, such as the U.S., Brazil, China, Japan, and South Korea, is one of the crucial factors anticipated to boost the market over the coming few years.

The COVID-19 pandemic had a significant impact on the demand for hyaluronic acid, particularly in the early stages. Despite its widespread use in elective treatments, the demand for hyaluronic acid decreased as patients decided to postpone surgeries to minimize the risk of infection. This trend had a negative effect on the sector, leading to a decrease in overall revenue. Moreover, the utilization of hyaluronic acid-based supplements witnessed a significant decline during the pandemic. Anika Therapeutics, one of the main providers of these products, reported a 24% decrease in the use of hyaluronic acid supplements for osteoarthritis. However, as pandemic restrictions gradually eased, injection-based elective procedures gained popularity over surgical operations. This shift is expected to boost the market for hyaluronic acid in the post-pandemic period.

Recognizing the challenging times, major market players introduced new and innovative products to maintain their market positions. For instance, in April 2021, Bausch & Lomb, the eye health segment of Bausch Health Companies Inc., received approval from the U.S. Food and Drug Administration (FDA) for its ophthalmic viscosurgical device (OVD), ClearVisc, to be used in ophthalmic surgery applications.

Hyaluronic acid is extensively utilized in skincare products such as moisturizers, serums, and anti-aging creams due to its moisturizing and plumping properties. The demand for hyaluronic acid within the cosmetics industry is primarily driven by the expanding consumer interest in anti-aging and skin rejuvenation products. Moreover, hyaluronic acid finds application in ophthalmic viscosurgical devices (OVDs) used during eye surgeries, such as cataract removal and corneal transplantation. OVDs assist in maintaining space, protecting tissues, and facilitating surgical procedures. The rising prevalence of eye-related disorders and the subsequent increase in surgeries contribute to the demand for hyaluronic acid raw materials in the field of ophthalmology.

Hyaluronic acid injections are used in the treatment of joint disorders, particularly osteoarthritis, wherein it offers lubrication and cushioning to the affected joints, thereby relieving pain and enhancing mobility. The escalating incidence of osteoarthritis and the expanding aging population are major factors in propelling the demand for hyaluronic acid within the field of orthopedics. In addition, hyaluronic acid is a prevalent component in dermal fillers utilized for facial aesthetics, such as lip augmentation and wrinkle reduction. The growing popularity of non-surgical cosmetic procedures and the consumer shift toward facial rejuvenation are anticipated to increase the demand for hyaluronic acid in dermal filler applications.

The rising investment in new product development by companies such as Genzyme Corporation (Sanofi-Aventis) and Zimmer Biomet, which have launched single-injection products, has facilitated the penetration of new single-injection hyaluronic acid visco-supplements. In addition, the growing prevalence of arthritis amongst the middle-aged population and the surging interest of significant players such as ALLERGAN, Sanofi, Genzyme Corporation, and Alcon Laboratories, Inc. (Novartis AG) are some of the factors anticipated to drive the market growth.

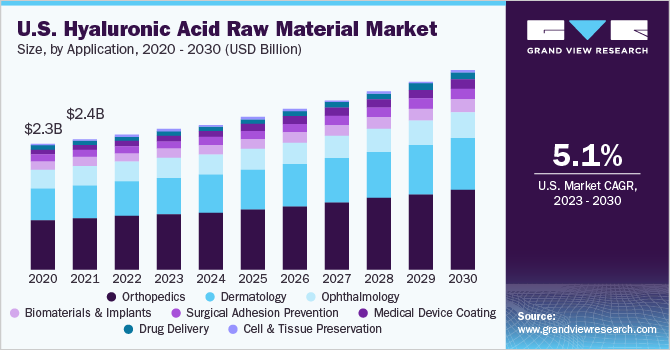

Application Insights

In terms of application, the orthopedics segment dominated the market in 2022 with the largest revenue share of 39.7% owing to the growing adoption of technologically advanced drugs coupled with the wide usage of hyaluronic acid in the treatment procedures of osteoarthritis. The demand for these agents arises from the growing prevalence of arthritis, thereby increasing the number of approved therapeutic products.

On the other hand, the drug delivery segment is anticipated to grow at the fastest CAGR of 8.0% from 2023 to 2030. The research and development activities in the drug delivery segment are anticipated to increase with the growing demand for innovative medication delivery systems. To create cutting-edge technology for diverse products, major industry players are constantly involved in strategic alliances. For instance, in January 2019, Aptamer Group, a provider of custom Optimer development and selection services, announced a partnership with AstraZeneca, a pharmaceutical and biotechnology company based in Sweden, for the development of innovative and advanced drug delivery devices. Under a two-year agreement, AstraZeneca will be granted access to Aptamer Group's proprietary technology to assess the potential for developing the next generation of drug delivery vehicles known as Aptamer Drug Conjugates (ApDCs). This collaboration aims to explore the feasibility of utilizing Aptamer Group's innovative technology in advancing drug delivery methods for enhanced therapeutic outcomes.

Source Insights

In terms of source, the non-animal segment dominated the market in 2022 with the largest revenue share of 96.8% and is expected to grow at the fastest CAGR of 6.6% over the forecast period. The most common adverse event to non-animal hyaluronic acid gel, according to statistics on adverse events reported globally, is hypersensitivity, which is most likely secondary to contaminants of bacterial fermentation. Data show that after the introduction of a purer hyaluronic acid raw material, the incidence of hypersensitivity seems to be decreasing. Non-animal stabilized hyaluronic acid (NASHA), an innovative hyaluronic acid preparation obtained strictly from non-animal sources, is utilized to prolong the intra-articular residence duration, extending it from a matter of hours to several weeks. This innovative approach aims to enhance the effectiveness and longevity of intra-articular treatments by utilizing NASHA as a more durable and sustained therapeutic solution.

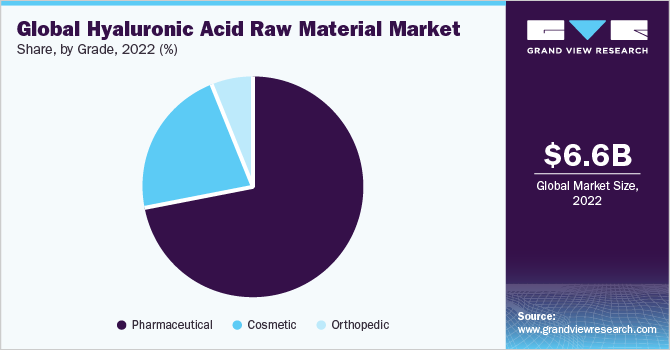

Grade Insights

In terms of grade, the pharmaceutical segment dominated the market in 2022 with the largest revenue share of 72.1%. Hyaluronic acid is mostly used in the pharmaceutical industry for its special qualities, such as its capacity to hold onto water, lubricate joints, and offer cushioning. Pharmaceutical companies spend heavily on hyaluronic acid-based drugs, medical devices, and novel formulations. The pharmaceutical industry's demand for hyaluronic acid raw material is expected to rise as awareness of its therapeutic potential grows and the development of novel pharmaceutical formulations continues.

The cosmetic segment is anticipated to grow at the fastest CAGR of 7.2% over the forecast period. The cosmetics industry witnessed an increase in demand for hyaluronic acid raw materials as consumers prioritize skincare and seek products that offer hydration, anti-aging benefits, and rejuvenation properties. The utilization of hyaluronic acid raw material in cosmetics is projected to grow due to its application in various areas such as miniaturization, hydration, anti-aging, wrinkle reduction, skin rejuvenation, firming, and lip & facial augmentation. This growing demand across these segments is expected to drive the growth of the market within the cosmetics industry. In addition, an aging population and improved awareness of skincare have both contributed to the surge in demand for antiaging skincare products. With its capacity to moisturize the skin, hyaluronic acid has emerged as a popular element in anti-aging cosmetics. Cosmetic businesses are taking advantage of this demand by including hyaluronic acid in the composition of their products.

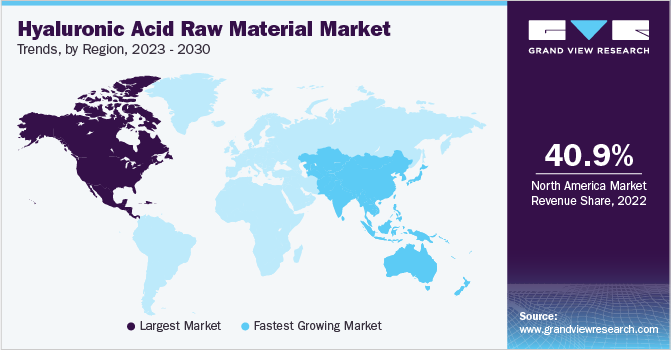

Regional Insights

In terms of region, North America dominated the market in 2022 with the largest revenue share of 40.9%. The sizable share of this regional segment is majorly attributable to the introduction of advanced technologies, sophisticated healthcare infrastructure, and increasing patient awareness pertaining to the availability of aesthetic and anti-aging procedures in the region. Moreover, the increasing demand for minimally invasive cosmetic procedures is one of the crucial factors expected to influence expansion. According to an article published by the Wake Forest School of Medicine regarding the growing use of dermal fillers by physicians in the U.S., approximately 600,000 annual visits related to procedures using dermal fillers were recorded.

Asia Pacific is expected to grow at the fastest CAGR of 9.0% during the forecast period. The demand for hyaluronic acid raw material in the region is expected to witness significant growth, largely due to the region's strong skincare and beauty culture. Hyaluronic acid, prominent for its moisturizing and anti-aging properties, serves as an important ingredient in numerous skincare products. The increasing awareness of skincare routines and the pursuit of effective skincare solutions are key factors driving the demand for hyaluronic acid in the region. Furthermore, the expanding middle-class population in countries such as China and India is fueling the demand for personal care products, including skincare items that incorporate hyaluronic acid. The middle-class segment seeks skincare solutions that are both affordable and efficacious, making hyaluronic acid an appealing choice given its versatility and wide range of applications.

Key Companies & Market Share Insights

Product launches, investment in R&D, along the expansion of product portfolios are strategies being undertaken by key players to strengthen their market position. For instance, in June 2023, Galderma, a provider of skin care and dermatological treatment products, announced the approval of Restylane Eyelight, by the U.S. Food and Drug Administration (FDA). This approval grants the use of Restylane Eyelight for the treatment of undereye hollows, commonly referred to as dark shadows, in adults aged 21 and above. Restylane Eyelight is an under-eye dermal filler composed of hyaluronic acid (HA) and is unique in the U.S. market as it incorporates NASHA Technology. The inclusion of NASHA Technology aims to address volume loss in the undereye area, offering patients natural-looking outcomes. Some prominent players in the global hyaluronic acid raw material market include:

-

AbbVie Inc.

-

Salix Pharmaceuticals

-

Lifecore Biomedical, Inc.

-

Sanofi

-

Anika Therapeutics, Inc.

-

Zimmer Biomet

-

Smith+Nephew

-

LG Chem

-

Maruha Nichiro Corporation

-

Ferring B.V.

-

SEIKAGAKU CORPORATION

-

F. Hoffmann-La Roche Ltd.

Hyaluronic Acid Raw Material Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.94 billion

Revenue forecast 2030

USD 10.8 billion

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, source, grade, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK: Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

AbbVie Inc.; Salix Pharmaceuticals; Lifecore Biomedical, Inc.; Sanofi; Anika Therapeutics, Inc.; Zimmer Biomet; Smith+Nephew; LG Chem; Maruha Nichiro Corporation; Ferring B.V.; SEIKAGAKU CORPORATION; F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

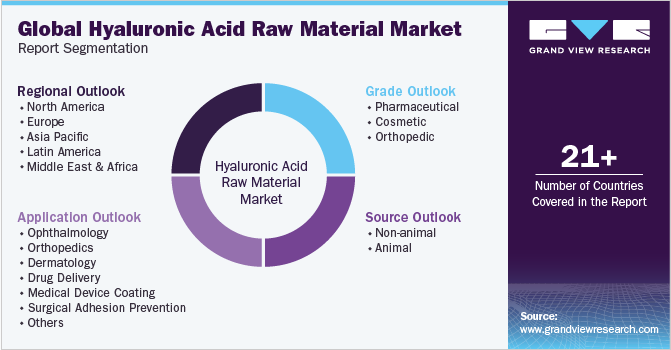

Global Hyaluronic Acid Raw Material Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hyaluronic acid raw material marketbased on application, source, grade, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ophthalmology

-

Cataract surgery

-

Aqueous eye drop

-

Contact lens

-

-

Orthopedics

-

Viscosupplements

-

Bone regeneration

-

-

Dermatology

-

Intradermal

-

Dermal filler

-

Wound healing

-

-

Drug Delivery

-

Medical Device Coating

-

Surgical Adhesion Prevention

-

Biomaterials and Implants

-

Cell and Tissue Preservation

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Animal

-

Animal

-

-

Grade Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Cosmetic

-

Orthopedic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global hyaluronic acid raw material market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 10.8 billion by 2030.

b. The Orthopedics segment dominated the hyaluronic acid raw material market with a share of 39.9% in 2022. This is attributable to the growing adoption of technologically advanced drugs coupled with the wide usage of hyaluronic acid in the treatment procedures of osteoarthritis.

b. Some key players operating in the hyaluronic acid raw material market include Salix Pharmaceuticals; ALLERGAN; Lifecore Biomedical, LLC; Shiseido Co., Ltd.; Anika Therapeutics, Inc.; Smith & Nephew; Maruha Nichiro Corporation; Ferring B.V.; SEIKAGAKU CORPORATION; Genzyme Corporation; F. Hoffmann-La Roche Ltd., Contipro a.s.; Zimmer Biomet.

b. Key factors that are driving the market growth include the enlarging aging population, the introduction of technologically advanced products enabling localized drug delivery and the growing number of aesthetic procedures in various countries, such as the U.S., Brazil, China, Japan, and South Korea.

b. The global hyaluronic acid raw material market size was estimated at USD 6.61 billion in 2022 and is expected to reach USD 6.94 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."