- Home

- »

- Medical Devices

- »

-

Hysteroscope Market Size, Share & Trends, Industry Report, 2019-2026GVR Report cover

![Hysteroscope Market Size, Share, & Trends Report]()

Hysteroscope Market Size, Share, & Trends Analysis Report By Product (Rigid Hysteroscope), By Application (Myomectomy), By End Use (Hospitals), By Region, Competitive Insights, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-760-5

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2015 - 2018

- Industry: Healthcare

Industry Insights

The global hysteroscope market size was valued at USD 205.8 million in 2018 and is expected to grow at a CAGR of 5.0% over the forecast period. Increasing use of hysteroscopes for fertility examinations, checkup for abnormal uterine bleeding, and transcervical sterilizations are some of the key factors responsible for market growth. According to French guideline for therapeutic management of uterine fibroids, less than 4 cm in length, hysteroscopic resection is an effective treatment technique, especially where conceiving is desired.

Hysteroscopy is a minimally invasive diagnostic intervention used to detect intrauterine and endocervical conditions. Hysteroscopic myomectomy, polypectomy, and endometrial ablation are commonly performed procedures that use a hysteroscope device. In January 2019, Hologic launched Omni hysteroscope-a modular scope designed for diagnostic and therapeutic hysteroscopy. In Canada, around 16% of couples experience infertility, and the required treatment or assisted human reproduction differs in each province. For instance, in British Columbia, Medical Services Plan, a publicly funded care system, ensures easy access to healthcare services. Moreover, it ensures suitable prescription medications and pharmacy services through PharmaCare program.

Growth can be attributed to increase in female diseases such as transcervical sterilization, abnormal uterine bleeding, and fertility disorders. Hysteroscopy is used to evaluate uterine abnormalities and is increasingly being used in fertility assistance. Hence, a rise in the number of couples opting for Assisted Reproduction Technology (ART) procedures is expected to boost the hysteroscope market.

Hysteroscopy is associated with a speedy recovery, decreased number of hospitalizations, and minimal blood loss. The procedure is preferred due to its low post-operational discomfort, allowing patients to resume their routine activities in relatively less number of days than traditional invasive procedures. Moreover, hysteroscopy enables gynecologists to examine endometrial health and plan an appropriate surgical solution.

New developments and advancements in technology have enhanced instrumentation and equipment used to perform a hysteroscopy. Optical light channels in hysteroscope were traditionally available with an outer diameter of 3 to 4 mm. However, current rigid endoscopes have a diameter of 1.9 mm with many separate lenses in the optical fiber system. The resultant image is enhanced and obtained from individual fibers separately.

Product Insights

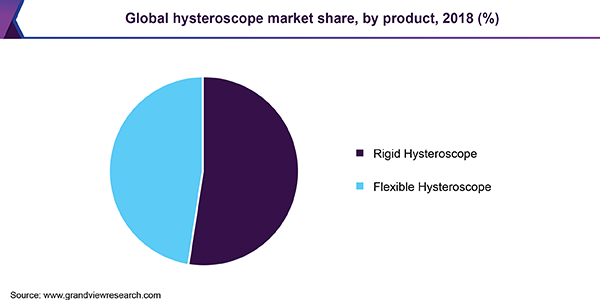

Based on product, the market is segmented into rigid and flexible hysteroscopes. Rigid hysteroscope held the largest share in 2018 and is expected to dominate the hysteroscope product segment during the forecast period. Rigid hysteroscopes are extensively used in hospitals and clinics due to availability of a wide range of diameters, allowing in-office and operating room procedures.

Flexible hysteroscopes provide full visualization, but are difficult to use in case of procedures related to endometrial lesions. Rigid hysteroscopes provide better optical visualization due to higher pixel count compared to flexible hysteroscope. For instance, in April 2019, Luminelle DTx Hysteroscopy System by UVision360 received FDA approval to perform diagnostic and operative procedures in office-based settings.

Application Insights

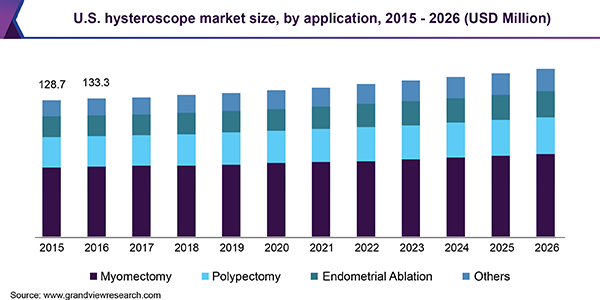

Based on application, the market is segmented into myomectomy, polypectomy, endometrial ablation, and others. Myomectomy segment dominated the market in terms of revenue share in 2018. Hysteroscopy is performed to treat various clinical conditions, especially prolonged infertility. This procedure is helpful in diagnosing the cause of multiple miscarriages. It also assists in evaluating pelvic pain in women. Moreover, in some cases, operative hysteroscopy is used to remove adhesions, which are scar tissues that form in the uterus. Operative hysteroscopy can be performed during a diagnostic hysteroscopy, avoiding the need for a second surgery.

End-use Insights

Based on end-use, the market is divided into hospitals, ambulatory surgical centers, gynecology clinics, and others. Hospitals dominated the market in 2018 and gynecology clinics segment is likely to grow at the fastest rate during the forecast period. This can be attributed to rapid increase in the number of hospital facilities and gynecology diagnosis & treatment units. For instance, in June 2017, Ferty9 Hospital and Research Center inaugurated Hysteroscopy Skill Building Course. The launch of this facility was aimed at diagnosing infertility and treating conditions associated with the uterus.

Regional Insights

North America held the largest share in 2018. This can be attributed to presence of key market players, favorable government regulations & reimbursement policies, approval & commercialization of products, and rise in awareness about women health. Moreover, increasing demand for minimally invasive procedures and growing R&D for gynecological systems are some factors responsible for growth in the U.S. In August 2018, the U.S. FDA approved Luminelle DTx Hysteroscopy System by UVision360 for hysteroscopy and cystoscopy. The system allows physicians to perform in-office hysteroscopic procedures such as biopsy and detection of abnormal tissue growth.

Asia Pacific is expected to exhibit the fastest growth during the forecast period. This can be attributed to increasing awareness about women health, supportive government initiatives for reimbursement, and rising incidence of infertility & other associated disorders.

Hysteroscope Market Share Insights

Some of the key players are Stryker; Boston Scientific Corporation; OLYMPUS CORPORATION; Medtronic; Ethicon, Inc.; B. Braun Melsungen AG; Hologic, Inc.; KARL STORZ GMBH & CO. KG; Richard Wolf GmbH; CooperSurgical, Inc.; and XION. Collaborations for development, expansion of product portfolio, and regional expansion in emerging markets are some of the key strategic initiatives adopted by these companies to increase their share.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2018

Forecast period

2019 - 2026

Market representation

Revenue in USD Billion & CAGR from 2019 to 2026

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, Japan, China, India, Brazil, Mexico, South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, & trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2015 to 2026. For this study, Grand View Research has segmented the global hysteroscope market based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2026)

-

Rigid Hysteroscope

-

Flexible Hysteroscope

-

-

Application Outlook (Revenue, USD Million, 2015 - 2026)

-

Myomectomy

-

Polypectomy

-

Endometrial Ablation

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2015 - 2026)

-

Hospitals

-

Ambulatory Surgical Centers

-

Gynecology Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2026)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."