- Home

- »

- Medical Devices

- »

-

Immunoassay Market Size, Share & Growth Report, 2030GVR Report cover

![Immunoassay Market Size, Share & Trends Report]()

Immunoassay Market Size, Share & Trends Analysis Report By Product (Reagent & Kits, Analyzers/Instruments), By Technology (RIA, ELISA), By Application, By Specimen, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-066-8

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Immunoassay Market Size & Trends

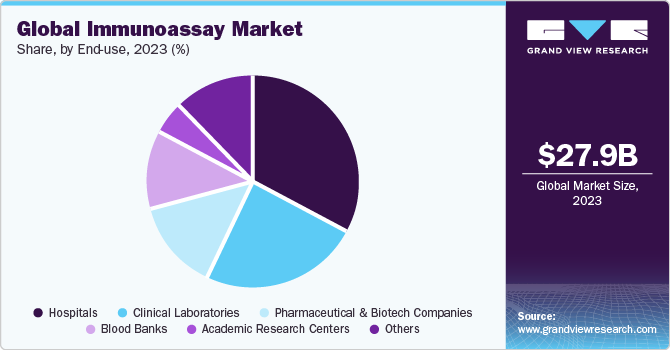

The global immunoassay market size was estimated at USD 27.87 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.60% from 2024 to 2030. Increasing incidence of chronic diseases, such as infectious and noninfectious diseases, is a major factor driving the marketgrowth. Similarly, growing concerns regarding infections caused by multidrug-resistant bacteria and frequent disease outbreaks in endemic areas are boosting the need for point-of-care technologies to enable testing of large population subsets.

The increasing incidence of infectious as well as noninfectious diseases, such as diabetes, cardiovascular diseases, cancer, & gastrointestinal diseases, is a significant driver for the global market growth. The rising prevalence of these diseases can be attributed to several factors, including alcohol abuse, antimicrobial resistance, smoking, and unhealthy and sedentary lifestyles. Similarly, cancer cases are also increasing globally. The International Agency for Research on Cancer (IARC) has projected the diagnosis of over 20.77 million new cancer cases in 2023.

Furthermore, immunoassay techniques are significant for the determination of oncogenesis and diagnosis of cancer and identification of its different stages. Immunoassay technology also facilitates the use of monoclonal and polyclonal antibodies for the detection of specific antigenic molecules in tissues and aids in the rapid identification of tumor antigens. Hence, an increase in the number of cancer cases is anticipated to drive market growth.

Applications of immunoassay-based diagnostics are rapidly expanding with the global increase in patient awareness. Several public and private programs are fueling collaborative efforts to enhance scientific awareness and foster innovations in this domain. For instance, the International Society for Infectious Diseases runs an advocacy program for increasing collaborations among public health practitioners, clinicians, and researchers globally, supporting the exchange of scientific knowledge and innovations. This increase in scientific awareness is driving the demand for automated and portable immunoassays, especially in developing countries.

Market Concentration & Characteristics

The market is rapidly adopting automation technologies to improve efficiency and accuracy and reduce turnaround time. Automation reduces the possibility of errors and enhances the accuracy and precision of results. Automated systems are also capable of handling a large volume of samples, allowing increased throughput. The entry of novel automated point-of-care (POC) analyzers in the market, which provide testing at cost-effective rates and can conduct multiple tests, is anticipated to demonstrate an increased adoption. The trend of adopting novel products has increased, and the pandemic is attributable to the enhanced availability of advanced diagnostic instruments that support novel assays.

Growing concerns regarding infections caused by multidrug-resistant bacteria and frequent disease outbreaks in endemic areas are generating the need for point-of-care technologies to enable testing of large population subsets. Moreover, environmental changes, genetic variation in hosts and pathogens, and population pressure are fueling a rapid increase in incidences of emerging diseases. As a result, point-of-care applications of immunoassays are gaining a strong foothold within the diagnostics space. New product launch is becoming a key strategy adopted by the players. For instance, in March 2023, Quidel Corporation was granted a De Novo request from the U.S. Food and Drug Administration (FDA) to market its novel Sofia 2 SARS Antigen+ FIA. It is the first rapid antigen test approved by the FDA for COVID-19 and can be used only on prescription basis in point-of-care settings. This approval is expected to help Quidel Corporation stay competitive in the market and attain a higher share in the market.

End-use Insights

Based on end-use, the hospitals segment dominated the market in 2023 with a revenue share of 32.94%. Hospitals and clinics are primary care settings for the diagnosis and treatment of medical conditions. A major part of the wide-ranging population relies on these long-standing facilities for the diagnosis, treatment, and management of diseases. Furthermore, constant changes in the healthcare industry have led to a rise in the need for hospitals with improved diagnostic services. Increased global healthcare spending has also contributed to the segment growth significantly.

The clinical laboratories segment is anticipated to grow at the fastest CAGR over the forecast period. The growth of the diagnostic laboratories segment can mainly be attributed to advantages such as fast results (~3-4 hours), higher sensitivity, specificity, scalability, and cost-effectiveness, and the testing of various types of samples. Increasing inclination toward diagnostic laboratories for gaining fast and cost-effective testing services is expected to be a primary factor driving the demand for immunoassay solutions, thus boosting segment growth.

Regional Insights

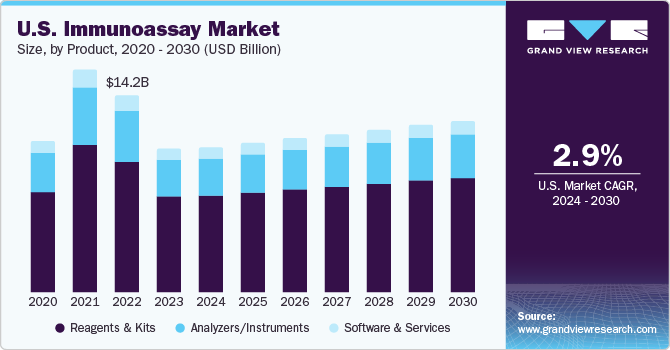

North America generated the highest revenue in 2023 with a 40.60% revenue share. The rise in demand for diagnostics related to chronic diseases and the increase in availability of technologically advanced diagnostic techniques are expected to propel market growth over the forecast period. Furthermore, in the U.S., there were 55.7 million people aged over 65 years in 2022 (~17% of the population in the country). Nearly 25% of this geriatric population suffers from cancer of which 30% are obese, creating an opportunity for local market players to boost their sales of diagnostic products for cancer, cardiology, endocrinology, infectious diseases, and other tests.

The Asia Pacific region is projected to witness the fastest CAGR over the forecast period. Unmet medical needs, positive economic growth, and increasing scientific research efforts are some of the primary growth drivers of market. In addition, an improved healthcare regulatory environment in high-growth nations is anticipated to draw in more foreign investors and encourage them to take the opportunities. Positive developments, such as government healthcare benefits, raised public knowledge, and a willingness to pay for advanced medical care, are anticipated to further fuel the market growth.

Product Insights

The reagents and kits segment contributed to the largest share of 66.16% in 2023. A significant market share can be attributed to the increased demand for immunoassay reagents and diagnostic kits, owing to the rising prevalence of infectious and autoimmune diseases. The approval and launch of novel immunoassay kits are expected to support segment growth. For instance, in February 2022, Agilent Technologies, Inc. introduced Dako SARS-CoV-2 lgG linked immunosorbent assay in the U.S. with plans to launch in other regions, such as Canada, Europe, Latin America, and some parts of Asia Pacific shortly.

The software and services segment is anticipated to register a significant CAGR from 2024 to 2030. This can be attributed to increased availability and high demand for cost-effective automated immunoassay systems in developing markets. For instance, in July 2023, Sysmex Corporation introduced a novel fully automated and high-speed chemiluminescence immunoassay system at the 2023 AACC exhibition. In addition, security software and Laboratory Information System (LIS) are available for immunoassay analyzers so that an administrator can set up user access levels and transfer data to other devices to enable easy transfer of data and healthcare cloud computing. These capabilities are anticipated to propel the segment growth during the forecast period.

Technology Insights

The enzyme immunoassays (EIA) segment held the largest market share of 63.39% in 2023, owing to their repeated usage in the detection of infectious and chronic diseases, food allergies, and drug abuse, among other applications. This method offers several advantages when compared to immunoelectrophoresis and immunodiffusion, including shortened assay duration, provision of quantitative outcomes, and need for a reduced quantity of antisera for analysis. Moreover, the increased research activities are expected to offer lucrative opportunities during the forecast period. For instance, researchers at the University of Central Florida are developing a screening method that is 300 times more successful in detecting a cancer biomarker than that of existing methods. This technique makes use of nanoparticles with platinum-rich shells and nickel-rich cores, which enhance the sensitivity of ELISA.

Rapid tests are also anticipated to witness significant growth over the study period. A rapid test, also known as lateral flow immunoassay, is used to detect the existence of the target analyte without utilizing specialized equipment. The rapid test technique has various applications such as in dengue and infections caused by Legionella, Salmonella, Campylobacter, Zika, and Listeria. Furthermore, the increasing availability of technologically advanced sandwich assays and the approval of various home-based immunoassays are expected to propel the market growth. For instance, in July 2023, SEKISUI Diagnostics, introduced the OSOM COVID-19 Antigen Home Test, a lateral flow immunoassay for diagnosis of SARS-CoV-2 virus.

Application Insights

Based on application, the infectious diseases testing segment held the largest market share of 36.39% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The rise in the prevalence of infectious diseases globally is also anticipated to boost market growth during the forecast period. As per the World Health Organization (WHO), in 2020, 241 million malaria cases were recorded across 85 malaria-endemic countries. Thus, the rising incidence of infectious diseases is expected to drive demand for immunoassays. Moreover, the launch and approval of new products in the field of infectious disease testing are further driving the market growth. For instance, in March 2021, Abbott received the FDA’s EUA for its new BinaxNOW COVID-19 Ag Card rapid test. This test is a lateral flow immunoassay designed for the detection of COVID-19.

The oncology segment is expected to witness rapid growth over the forecast period. The high prevalence of cancer worldwide is one of the major factors contributing to market growth over the forecast period. As per American Cancer Society estimates, in 2023, approximately 1.96 million new cancer cases were reported and around 609,820 individuals died due to cancer. Thus, efficient diagnostic tests for early detection and treatment of cancer are necessary. Owing to the aforementioned factors, immunoassays and analyzers are gaining popularity among market players, with a growing focus on new product development as well as launch of cost-efficient products in developing countries.

Specimen Insights

The blood specimen segment held the largest share of 43.11% in 2023 attributed to an increase in disease occurrence, which drives demand for different blood testing procedures, supporting segment growth. Furthermore, ongoing technical advancements are projected to boost market growth.In March 2022, CSL received clearance from the U.S. FDA for the Rika Plasma Donation System developed by Cell Technologies and Terumo Blood. This clearance accelerates the collection of plasma, consequently boosting the R&D of novel plasma-based medicines.

The urine specimen segment is anticipated to grow at the fastest CAGR over the forecast period. Urinalysis is a quick and easy method to analyze urine samples for infections and chronic disorders like urinary tract infections, diabetes, kidney disease, and others. Products such as BinaxNOW S. pneumoniae Antigen Card are lateral flow immunochromatographic assays that can detect C polysaccharide cell wall antigens, including all pneumococcal variants, in urine samples from patients diagnosed with pneumonia. Such tests are becoming increasingly popular owing to their advantages. Moreover, due to their ease of use, speedy results, and appropriateness for POC testing, Rapid Influenza Diagnostic Tests (RIDTs) are being widely utilized for the identification of influenza.

Key Companies & Market Share Insights

Companies are undertaking strategic initiatives such as product collaborations, geographic expansion, and strategic agreements for product portfolio expansion to maximize their market share. To sustain their presence in the market, industry players are further concentrating on collaborations, acquisitions and mergers, and product approval.

-

In March 2023, F. Hoffmann-La Roche Ltd. collaborated with Eli Lily and Company to support the development of Roche’s Elecsys Amyloid Plasma Panel (EAPP).

-

In February 2023, bioMérieux company received 510(k) clearance and the CLIA waiver for their BIOFIRE SPOTFIRE system and BIOFIRE SPOTFIRE respiratory panel.

-

In February 2022, bioMérieux launched VIDAS KUBE, a next-generation system for automated immunoassay testing. At the beginning of 2023, it was planned in selected countries and the rest of the world, extending gradually as of Q2.

Key Immunoassay Companies:

- Abbott

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- bioMérieux SA

- Quidel Corporation

- Sysmex Corporation

- Ortho Clinical Diagnostics

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

- Becton, Dickinson, and Company

- Thermo Fisher Scientific, Inc.

Immunoassay Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.88 billion

Revenue forecast in 2030

USD 34.47 billion

Growth rate

CAGR of 3.60% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, specimen, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Siemens Healthineers; bioMérieux SA; Abbott Laboratories; Danaher Corporation (Beckman Coulter); Quidel Corporation; Ortho Clinical Diagnostics; Sysmex Corporation; Bio-Rad Laboratories, Inc.; Becton, Dickinson, and Company; F. Hoffmann-La Roche AG; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immunoassay Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global immunoassay market based on product, specimen, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Kits

-

ELISA Reagents & Kits

-

Rapid Test Reagents & Kits

-

ELISPOT Reagents & Kits

-

Western Blot Reagents & Kits

-

Other Reagents & Kits

-

-

Analyzers/Instruments

-

Open Ended Systems

-

Closed Ended Systems

-

-

Software & Services

-

-

Specimen Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Saliva

-

Urine

-

Other Specimens

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Radioimmunoassay (RIA)

-

Enzyme Immunoassays (EIA)Rapid Test

-

Chemiluminescence Immunoassays (CLIA)

-

Fluorescence Immunoassays (FIA)

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Drug Monitoring

-

Oncology

-

Cardiology

-

Endocrinology

-

Infectious Disease Testing

-

Autoimmune Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Blood Banks

-

Clinical Laboratories

-

Pharmaceutical and Biotech Companies

-

Academic Research Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global immunoassay market size was estimated at USD 27.87 billion in 2023 and is expected to reach USD 27.88 billion in 2024.

b. The global immunoassay market is expected to grow at a compound annual growth rate of 3.60% from 2024 to 2030 to reach USD 34.47 billion by 2030.

b. North America dominated the immunoassay market with a share of 40.60% in 2023. Constant adoption of innovative techniques and the presence of developed healthcare infrastructure in the U.S. are factors fueling the immunoassay market in the U.S.

b. Some key players operating in the immunoassay market include Siemens Healthineers, BD (Becton, Dickinson & Company), BioMérieux SA, Abbott, F. Hoffmann-La Roche AG, Danaher , Ortho-clinical diagnostics, Sysmex Corporation, Thermo Fisher Scientific, Inc., and Quidel Corporation.

b. Key factors that are driving the immunoassay market growth include an increase in chronic & infectious diseases globally, a rise in the geriatric population prone to such chronic and infectious diseases, and high demand for portable and automated immunoassays.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."