- Home

- »

- Advanced Interior Materials

- »

-

Indonesia Precast Concrete Market Size, Industry Report, 2019-2025GVR Report cover

![Indonesia Precast Concrete Market Size, Share & Trends Report]()

Indonesia Precast Concrete Market Size, Share & Trends Analysis Report By Product (Structural Building Components, Transportation), By End Use (Infrastructure, Non-Residential), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-124-5

- Number of Pages: 63

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Advanced Materials

Industry Insights

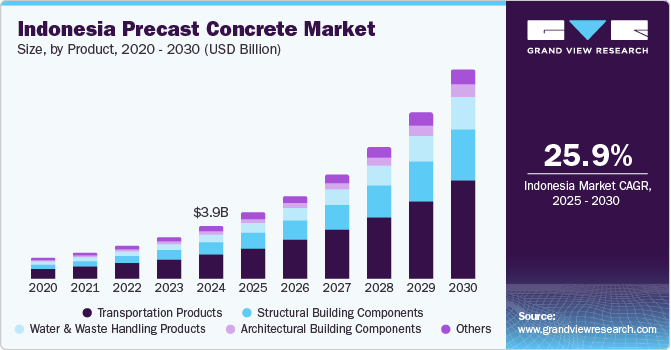

The Indonesia precast concrete market size was estimated at USD 915.0 million in 2018 and is expected to expand at a CAGR of 14.2% from 2019 to 2025. It is expected to be driven by increasing prominence of offsite construction in Indonesia, coupled with growing awareness regarding the advantages of the product.

The precast concrete products are majorly sold through two channels to the supply contractors and the construction companies. Top construction companies own in-house production capacities and subsidiaries for the production of precast concrete. Thus, market participants are highly inclined toward integration across the supply chain.

The market is gaining greater significance owing to a slow recovery from the economic downturn. It is also expected to exhibit growth with a rise in non-residential and residential construction due to rising urbanization. This growth can be attributed to the increasing awareness amongst builders, architects, constructors, and end-users regarding the advantages of using precast concrete.

The rising popularity of prefab construction is anticipated to generate high demand for cement, which in turn is likely to result in extensive mining activities causing environmental issues. The stringent government regulations are expected to hamper the production of cement on large scale.

With few established companies integrated across the value chain controlling the major market share, competitive rivalry is expected to below. The suppliers strive to attain long term supply contracts with the buyers, thereby intensifying market rivalry. The players scoring these contracts gain a competitive edge over the other players.

The precast concrete construction technology is one of the most promising solutions to deal with the rising demand for housing and infrastructure construction. However, the industry faces several challenges including lack of standardization, testing and certification facilities, non-availability of technology, tools and equipment, and limited knowledge which is expected to limit the growth.

The Indonesia precast concrete market has witnessed the presence of a large number of suppliers resulting in low switching costs. The market is expected to put pricing pressure on the suppliers owing to the intense competition, thereby diminishing their bargaining power. This is expected to lead to the adoption of a cost leadership strategy by the suppliers to gain a competitive edge over other players.

Product Insights

Structural building components are expected to exhibit a significant CAGR of 13.4% from 2019 to 2025. This growth can be attributed to an increasing number of hotels, malls, and hospitals coupled with growing industrialization in the country. An increase in the construction of residential and commercial buildings is expected to drive the demand for pillars, columns, and joints which is further expected to drive the segment.

Rising demand for affordable housing on account of the rapidly growing middle-class population in the country is anticipated to drive the demand for architectural building components over the forecast period. The demand for these components is anticipated to witness growth over the forecast period owing to the rising government initiatives to support affordable housing.

Transportation products are predicted to witness the fastest growth from 2019 to 2025 and are estimated to reach USD 1.36 billion by 2025. Increased expenditure in the construction sector by the government of Indonesia to improve the connectivity among the regions is anticipated to be one of the key drivers for this product segment.

The demand for precast tanks for the storage of clean and waste-water is likely to grow with increasing residential, commercial, and infrastructure construction activities. The ease in installation and maintenance of the precast concrete products, such as pipes, tanks, and others is estimated to further propel the demand for water and waste handling products over the forecast period.

End-Use Insights

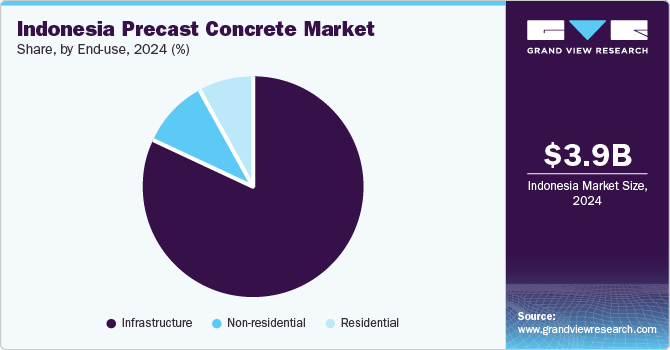

The demand from the residential construction industry in Indonesia is anticipated to witness an upward trend, at a CAGR of 16.7% over the forecast period. This growth is expected to be driven by rising population, substantial infrastructural investments, and rapid urbanization which are anticipated to influence the demand in the residential sector.

The rising need for the utilization of space for the housing sector is likely to influence the demand for multi-story apartments, and thus, is expected to support the market growth. Introduction of new construction materials and the need for reducing the construction time is further anticipated to increase the utilization of precast materials.

The non-residential construction segment is expected to be driven by substantial infrastructural investments, urban development, and penetration of multinational companies in the country. Also, the well-established tourism sector in the country is anticipated to encourage construction activities in the non-residential sector.

The infrastructure segment accounted for the largest market share of 82.0% in 2018 and is anticipated to upscale on account of increasing investments in infrastructure development. The strong growth is expected to be driven by lower project delays in the construction sector coupled with robust investments in commercial and infrastructure construction.

Multi-year investment and development plans by the government of Indonesia, including the Five-year Infrastructure Development Plan (2016-2020), to improve domestic infrastructure are anticipated to spur participation of the private sector. This, in turn, is expected to boost the demand for precast concrete over the forecast period.

Indonesia Precast Concrete Market Share Insights

Major market players are involved in technological innovations for developing new products to consolidate their market presence. Rising consumer demand and a shift in consumer preference toward high-quality products are projected to open up growth avenues for the new entrants over the forecast period.

Key players are heavily investing in R&D activities focused on the manufacturing of products that are suitable for various conditions at an affordable price. Increasing consumer demand and a shift in consumer preference toward high-quality products are projected to open up growth avenues for the new entrants over the forecast period.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million and CAGR from 2019 to 2025

Country scope

Indonesia

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the Indonesia precast concrete market report based on product and end use:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Structural Building Components

-

Girder

-

Slab

-

Pile

-

-

Architectural Building Components

-

Transportation

-

Girder

-

Slab

-

Pile

-

Others

-

-

Water & Waste Handling Products

-

Girder

-

Slab

-

Pile

-

Others

-

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2014 - 2025)

-

Residential

-

Housing

-

Apartment

-

-

Non-residential

-

Hospital

-

Shopping Malls

-

Industrial

-

Others

-

-

Infrastructure

-

Roadways

-

Bridges

-

Railways

-

Other Mass Transportation

-

Others

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."