- Home

- »

- Sensors & Controls

- »

-

Industrial Automation And Control Systems Market Report, 2030GVR Report cover

![Industrial Automation And Control Systems Market Size, Share & Trends Report]()

Industrial Automation And Control Systems Market Size, Share & Trends Analysis Report By Component Type (Industrial Robots, Control Valves), By Control System (DCS, PLC, SCADA), By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-130-6

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Semiconductors & Electronics

Report Overview

The global industrial automation and control systems market size was valued at USD 172.26 billion in 2022 and is anticipated to register at a compound annual growth rate (CAGR) of 10.5% from 2023 to 2030. The industrial sector has been evolving rapidly with the continual introduction of sophisticated technologies such as robotics, artificial intelligence, and more. Additionally, the automation enables swift operations of manufacturing and material handling with the use of intelligent manufacturing infrastructure. Industries are deploying industrial automation and control systems in an attempt to increase productivity and reduce labor costs. Moreover, with the advent of Industry 4.0, the manufacturing sector has been experiencing rapid adoption of new systems and augmented networking architectures, which is projected to provide significant opportunities for market growth.

The automation systems range from small independent units to numerous interlinked large-scale work cells spread across the factory floor. Every system is designed for a particular task, resulting in cost reduction, improved quality, improved operator safety, and enhanced production. Technologies including analytics, cloud, and mobility, are aiding organizations to attain their targets efficiently. In addition, the penetration of Internet of Things (IoT) in factory automation is driving the growth for smart manufacturing to embrace and adopt the advantages of internet connectivity. For instance, in May 2022, Emerson Electric Co. launched their new automation solution, TopWorx DX Partial Stroke Test with HART 7, which increases safety and automation by facilitating a discrete emergency shutdown valve.

Furthermore, factory automation is determined by technology growth, increasing economic and infrastructure opportunities, and rising demand for operational efficiency. Automation is expected to enhance countries and companies by introducing a new phase of economic growth. It is expected to significantly impact a wide range of businesses, shareholders, business models, and favorable government regulations to promote the adoption across industries worldwide. The automation sector is expected to witness a surge during the forecast period owing to the growing awareness on the usage of cloud computing platforms and technological progressions in semiconductors and electronic devices.The COVID-19 pandemic resulted in firm reliance on automation among important end-user businesses, reducing operational and other long-term economic impacts. As workforces were unable to function due to government-issued lockdowns, manufacturers had to adapt automated processes to avoid foreclosures. Market participants from around the world began automation in their processes up to some extent on their own or in way of partnerships. For instance, in March 2020, Epson Robots partnered with Air Automation Engineering (AEE) to provide technical support and service in the Midwest of the U.S.

Moreover, the upsurge in investment and ongoing development in the manufacturing sector is anticipated to propel the growth of the market in the coming years. Industries, including automotive, aerospace, and heavy engineering, are increasingly digitalizing and transforming their manufacturing process. Incorporating IIoT at manufacturing plants plays a vital role in connecting systems and devices with a network. Technologies, including AI, machine learning, cloud computing, and others are aiding new automation developments, which are anticipated to boost the market growth over the forecast period.

Component Type Insights

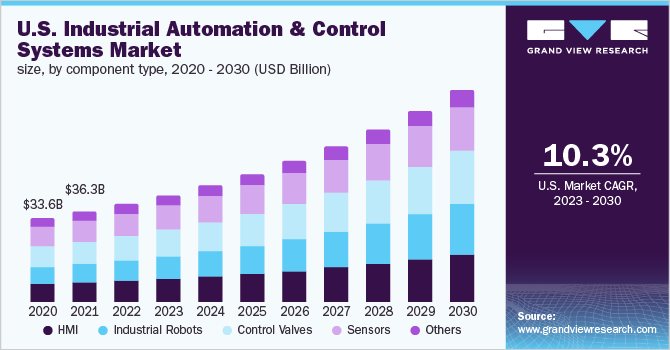

The industrial robots segment dominated the market and accounted for the largest revenue share of CAGR 12% over the forecast period from 2023 to 2030. This growth is a result of manufacturing companies’ extensive use of industrial robots and state-of-the-art machinery to optimize operations that require speed, strength, and accuracy. Industrial automation through robots reduces raw material waste, labor requirements, and energy usage and also ensures a smooth and continuous workflow in the manufacturing process, which is expected to drive segment growth.

The sensors component type segment recorded a significant revenue share of over 22% in 2022 owing to its use and need in automation and control system functioning and processes. Sensors are small in size and offer instant and accurate data and readings which are vital in automation processes. The different type of sensors includes temperature sensors, humidity sensors, torque sensors, and more. These sensors assist industrial automation robots in making the manufacturing process and operation smart and efficient, which is expected to fuel the market growth further.

Control System Insights

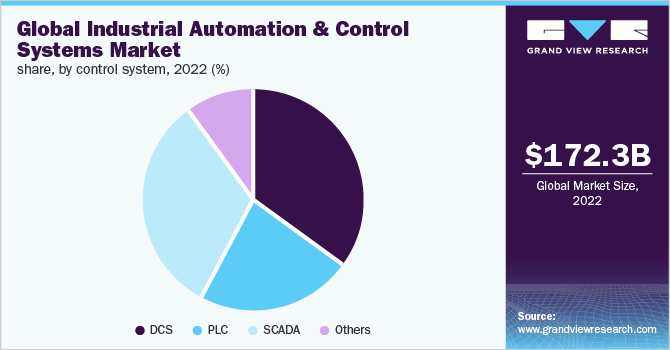

The distributed control systems (DCS) segment dominated the market and accounted for the largest revenue share of over 34% in 2022. As a result of the fast pace of adoption of IIOT preference of industrialists to deploy automated control systems, which is driving the market growth for DCS. Additionally, the advent of 5G and its adoption in the power generation sector is expected to boost the integration of IoT and DCS using 5G technology for better output efficiency.

The Supervisory Control and Data Acquisition (SCADA) control system segment are anticipated to grow at the highest CAGR of over 11% during the forecast period owing to the increase in adoption of industry 4.0. The SCADA control system is used across various industry verticals such as aerospace & defense, automotive, chemical, energy & utilities, manufacturing, and healthcare, among others due to its ability to gather data in real-time and feed it instantly to the controller systems. The growth in demand of manufacturers for smart and digitized production processes for increasing production efficiency is also expected to drive the segment growth further.

Vertical Insights

The healthcare segment is expected to dominate the market and accounted for the largest revenue share of around 11% over the forecast period owing to the consultation and services offered in order to treat patients’ health issues such as curative, palliative, rehabilitative, and curative. Automation and control improve operational costs, and supply chain errors, and improve customer center, which accounts for better care and treatment of patients. Automation has also enabled doctors to conduct surgeries remotely or with minimal human interference for added precision and safety, which is anticipated to drive the segment growth.

The manufacturing vertical segment recorded the largest market share of over 17% in 2022 owing to the ongoing trend of autonomous processes in factories and industries using automated processes and systems. The segment is anticipated to grow at a CAGR of over 10% over the forecast period from 2023 to 2030. Manufacturers are able to reduce process time and error rates in factory processes with automated systems. These systems are software or technology operated which allow little to no human intervention. This, in turn, is anticipated to boost the segment growth over the forecast period.

Regional Insights

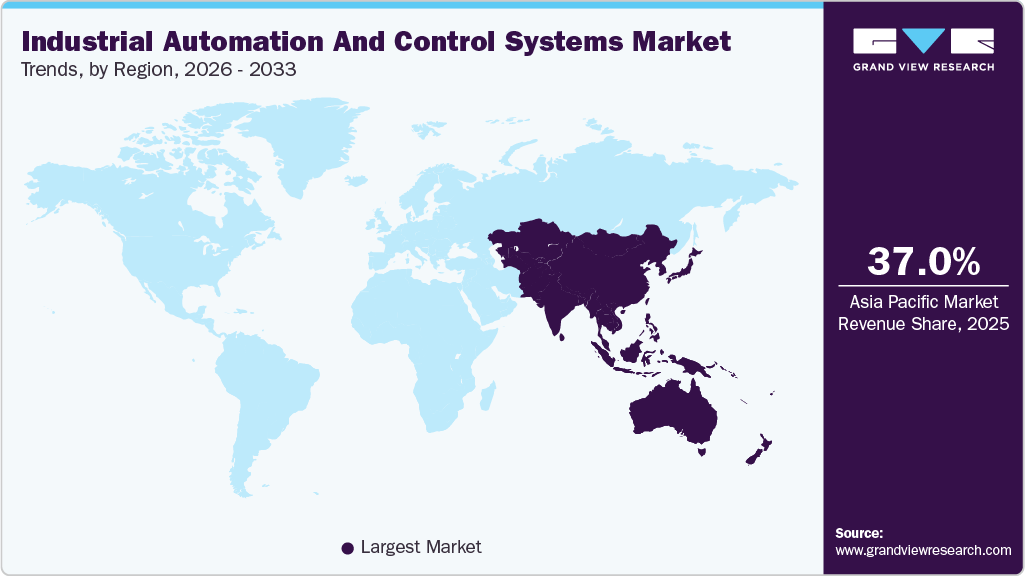

Asia Pacific region dominated the market and accounted for the largest revenue share of over 37% in 2022 and is expected to continue its dominance from 2023 to 2030. This strong growth is attributed to the presence of key market players and emerging companies in the region. Additionally, the growing demand for improved solutions to manage industrial plants in India and China is driving market growth in the region. The implementation of smart production facilities from conventional production facilities is a typical trend, and it assists in the general acceptance of industrial automation, which is driving the market growth further across the region.

North America is expected to grow at a CAGR of over 9% from 2023 to 2030. This significant growth is attributed to the manufacturing units in the region being driven to implement the latest technological advances and digital transformation abilities to make their business processes more efficient and effective due to a rapid increase in competition and increasing end-user requirements. For instance, in September 2022, ABB Ltd. expanded its manufacturing footprint across the U.S. with the help of investment in new EV charger stations in the region. This investment is expected to help ABB Ltd. E-mobility to meet the rising need and demand for electric vehicle chargers across the region. Industrial automation is also being adopted in many regional sectors such as automotive, healthcare, manufacturing, and more in the region, with significant companies placing industrial automation products on the market.

Key Companies & Market Share Insights

The competitive landscape highlights the industry dynamics reshaping the global market. Incumbent companies and new entrants anticipate organic and inorganic growth strategies, such as product launches, mergers & acquisitions, technological advancements, and geographical expansion, to remain pronounced in the forecast period. For instance,in April 2021, Accenture plc completed the acquisition of Pollux, an industrial automation solution provider. This acquisition is in line with Accenture plc’s aim to leverage Pollux’s experience and expertise in automation and robotics solutions.

Key companies are investing significant capital in joint ventures, research, and development in modern technologies. For instance, in March 2021, Suez, an American water-service company, and Schneider Electric partnered for the development of a joint venture to deliver innovative digital solutions for water cycle management. The joint venture is expected to combine SUEZ's technical expertise in the water business with EcoStruxure. Moreover, market players are expanding the capabilities of automation control systems to support their use in industries, such as transportation, mining and metal, and aerospace and defense. Some of the prominent players in the industrial automation and control systems market include:

-

ABB Ltd.

-

Emerson Electric Co.

-

Honeywell International, Inc.

-

Kawasaki Heavy Industries, Ltd.

-

Mitsubishi Electric Corporation

-

OMRON Corporation

-

Rockwell Automation, Inc.

-

Schneider Electric

-

Siemens AG

-

Yokogawa Electric Corporation

Industrial Automation And Control Systems Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 187.80 billion

Revenue forecast in 2030

USD 377.25 billion

Growth rate

CAGR of 10.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component type, control system, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Brazil; Mexico

Key companies profiled

ABB Ltd.; Emerson Electric Co.; Honeywell International, Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation; Rockwell Automation, Inc.; Schneider Electric; Siemens AG; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Automation And Control Systems Market Segmentation

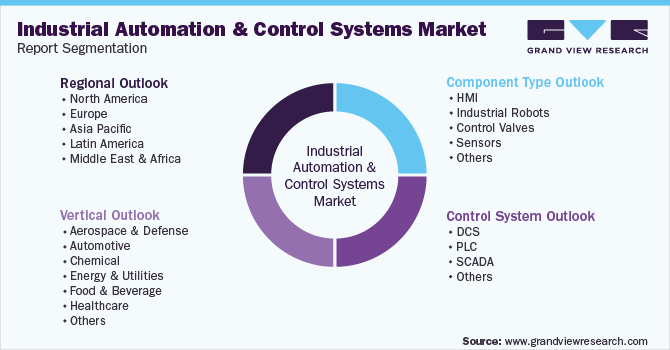

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest market trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial automation and control systems market report based on component type, control systems, vertical, and region:

-

Component Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

HMI

-

Industrial Robots

-

Control Valves

-

Sensors

-

Others

-

-

Control System Outlook (Revenue, USD Billion, 2018 - 2030)

-

DCS

-

PLC

-

SCADA

-

Others

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Chemical

-

Energy & Utilities

-

Food & Beverage

-

Healthcare

-

Manufacturing

-

Mining & Metal

-

Oil & Gas

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global industrial automation & control systems market size was estimated at USD 172.26 billion in 2022 and is expected to reach 187.80 billion in 2023.

b. The global industrial automation & control systems market is expected to grow at a compound annual growth rate of 10.5% from 2023 to 2030 to reach USD 377.25 billion by 2030.

b. Asia Pacific dominated the industrial automation & control systems market with a share of 37.7% in 2022. This is attributable to the increasing demand for better solutions to manage industrial plants in countries such as China, India, and South Korea; as well as the presence of the key market players and emerging companies in the region.

b. Some key players operating in the industrial automation & control systems market include ABB; Emerson Electric Co.; Honeywell International Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation; Rockwell Automation, Inc.; Schneider Electric; Siemens; and Yokogawa Electric Corporation.

b. Key factors that are driving the industrial automation & control systems market growth include the rising demand for mass/bulk production in the manufacturing sector and increasing adoption of industrial robots for automation of production.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."